buyNow

Intelligent Process Automation Market

Intelligent Process Automation Market Size, Share, Growth & Industry Analysis, By Component (Solution, Services), By Technology (Machine Learning, Natural Language Processing, Virtual Agents, Computer vision), By Deployment (Cloud-based, On-premises), By Application, By Vertical, and Regional Analysis, 2025-2032

pages: 210 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Intelligent process automation (IPA) uses artificial intelligence, machine learning, robotic process automation, and analytics to simplify and improve complex enterprise operations. The IPA market includes components such as software, services, and platforms, and involves technologies such as natural language processing, cognitive agents, low-code tools, and computer vision.

It automates rule-based and repetitive tasks, minimizes manual effort, and enables employees to focus on higher-value activities. Businesses implement IPA across finance, HR, supply chain, customer service, and compliance functions to accelerate workflows, reduce operational costs, and improve service quality across industries such as BFSI, healthcare, retail, and manufacturing.

Intelligent Process Automation Market Overview

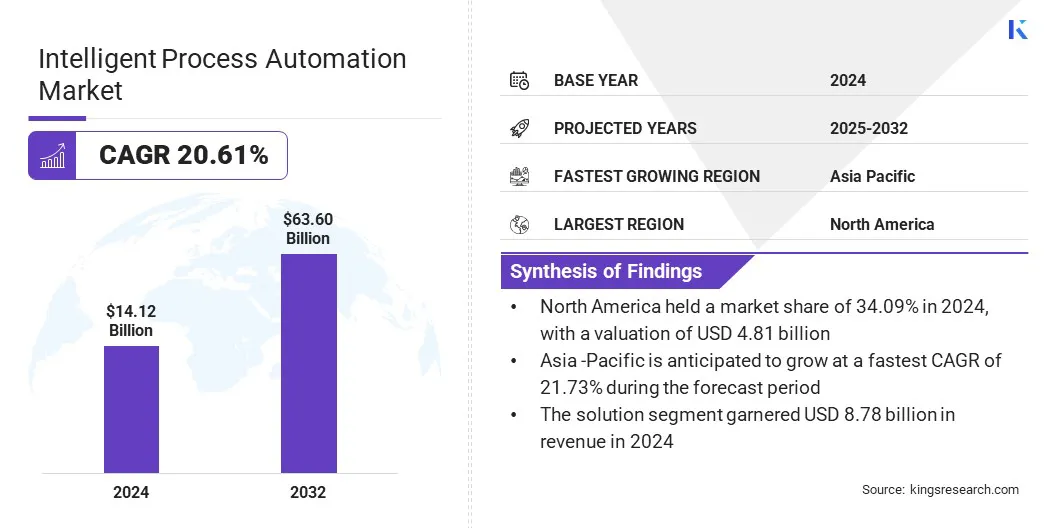

The global intelligent process automation market size was valued at USD 14.12 billion in 2024 and is projected to grow from USD 16.96 billion in 2025 to USD 63.60 billion by 2032, exhibiting a CAGR of 20.61% during the forecast period.

This growth is attributed to government-led cost-saving initiatives that encourage public institutions to automate routine functions and modernize outdated systems to improve efficiency. The market is also advancing as organizations shift toward hyperautomation to streamline administrative and operational workflows.

Key Highlights:

- The intelligent process automation industry size was valued at USD 14.12 billion in 2024.

- The market is projected to grow at a CAGR of 20.61% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 4.81 billion.

- The solution segment garnered USD 8.78 billion in revenue in 2024.

- The machine learning segment is expected to reach USD 17.88 billion by 2032.

- The cloud-based segment is anticipated to register the fastest CAGR of 20.97% during the forecast period.

- The IT operations segment garnered USD 4.22 billion in revenue in 2024

- The BFSI held a market share of 23.13% in 2024

- The market in Asia Pacific is anticipated to grow at a CAGR of 21.73% over the forecast period.

Major companies operating in the intelligent process automation market are Atos SE, IBM Corporation, Genpact, HCL Technologies Limited, Pegasystems Inc, Blue Prism Limited, Capgemini, CGI Inc, NICE, Cognizant, Infobip Ltd., Accenture, Infosys Limited, TATA Consultancy Services Limited, and Mahindra & Mahindra Ltd.

Government initiatives focused on AI-driven automation are enhancing operational efficiency and productivity within public services by reducing manual workloads and streamlining routine tasks. These positive outcomes are prompting the adoption of process automation across public and private sectors.

- In 2025, the Central Digital and Data Office identified over 140 AI use-cases in the UK central government to reduce administrative workload. Some applications save up to 40% of time in tasks like drafting policy documents. This initiative is streamlining operations and improving productivity in public services, contributing to the increasing demand for IPA solutions.

Market Driver

Government-led Cost-saving Initiatives

Government-led cost-saving initiatives are driving the adoption of IPA across public services. Government agencies are prioritizing automation to reduce manual workloads, lower operational costs, and streamline service delivery.

Departments are modernizing outdated systems and processes that slow down operations and consume excess resources. Governments are collaborating with private technology providers and agencies to adopt automation tools tailored to the specific needs of the public sector, further supporting the market growth.

- In 2025, the UK government estimated over USD 51.15 billion in unrealized savings annually through digitization and AI-driven automation. This potential for significant cost reduction is encouraging public and private sectors to adopt IPA to optimize operations, reduce waste, and enhance service delivery.

Market Challenge

High Implementation Costs

High implementation costs are limiting the adoption of IPA among small and mid-sized enterprises. These organizations often face budget constraints that make it difficult to invest in IPA infrastructure, training, and integration with existing systems.

Smaller firms maintain a cautious approach and focus their resources on core operational activities rather than adopting advanced automation. Additionally, the perceived complexity of deployment is further discouraging the adoption of IPA.

Market players are introducing flexible pricing models, including subscription-based and modular solutions, to reduce upfront costs for small and mid-sized enterprises. Vendors are also offering low-code and no-code platforms that simplify deployment and minimize the need for specialized IT skills. These efforts aim to make IPA more accessible and scalable and enable smaller firms to adopt automation gradually without major financial strain.

Market Trend

Shift toward Hyperautomation

The shift toward hyperautomation is accelerating as organizations aim to automate entire workflows across front and back office operations. This trend involves integrating multiple technologies including robotic process automation, artificial intelligence, and advanced analytics, to create connected and intelligent systems that can operate with minimal human intervention. Enterprises are moving beyond task-based automation to embrace end-to-end process optimization and enable greater operational agility & responsiveness.

- In June 2024, ABB launched OmniCore, a next-generation robotics control platform designed to enhance IPA through improved speed, precision, and system integration. The platform supports the integration of AI, sensors, cloud, and edge computing, enabling more autonomous and advanced robotic applications.

Intelligent Process Automation Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Solution, Services |

|

By Technology |

Machine Learning, Natural Language Processing, Virtual Agents, Computer vision, Others |

|

By Deployment |

Cloud-based, On-premises |

|

By Application |

IT Operations, Business Process Automation, Application Management, Content Management, Security Management, Others |

|

By Vertical |

BFSI, Healthcare, Retail, IT & Telecommunications, Media & Entertainment, Manufacturing, Energy & Utility, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Component (Solution, and Services): The solution segment earned USD 8.78 billion in 2024, due to the rising demand for integrated automation platforms that streamline enterprise workflows.

- By Technology (Machine Learning, Natural Language Processing, Virtual Agents, and Computer vision): The machine learning segment held 28.08% share of the market in 2024, due to its growing use in predictive analytics and decision-making processes.

- By Deployment (Cloud-based, and On-premises): The on-premises segment is projected to reach USD 37.51 billion by 2032, propelled by greater control, customization, and data security requirements in regulated industries.

- By Application (IT Operations, Business Process Automation, Application Management, Content Management, Security Management and Others): The IT operations segment earned USD 4.22 billion in 2024, owing to the increased adoption of automation for system monitoring and incident management.

- By Vertical (BFSI, Healthcare, Retail, IT & Telecommunications, Media & Entertainment, Manufacturing, Energy & Utility and Others): The media & entertainment segment is anticipated to register the fastest CAGR of 20.76% during the forecast period, due to the rising use of automation in content personalization and digital workflow optimization.

Intelligent Process Automation Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America intelligent process automation market share stood at around 34.09% in 2024, with a valuation of USD 4.81 billion. This dominance is attributed to the growing integration of AI and robotic process automation technologies across business operations in the region.

Market players in the region are expanding their automation capabilities through acquisitions that consolidate expertise and enhance service offerings across industries such as manufacturing, energy, logistics, and financial services. The market is also benefiting from a strong base of technology consultants and solution providers supporting large-scale transformation initiatives within enterprises.

Firms are focusing on delivering end-to-end automation services, including design, implementation, and ongoing support. The region continues to attract strategic investments as businesses seek to improve operational efficiency and broaden automation coverage, thereby contributing to the regional market expansion.

- In October 2024, UST acquired the automation unit of Information Services Group (ISG) to strengthen its position in the intelligent automation market. The unit brings AI, RPA, and automation expertise with a global team and strong partnerships. This acquisition enhances UST’s ability to deliver end-to-end automation services, broaden its partner ecosystem, and support enterprise-scale transformation through IPA solutions.

The intelligent process automation industry in Asia Pacific is set to grow at a robust CAGR of 21.73% over the forecast period. This growth is attributed to the rising demand for industrial automation and the steady expansion of manufacturing activities across Asia Pacific.

Players in the region are investing in advanced automation, artificial intelligence, and machine learning technologies to improve operational control and streamline complex workflows. The market is also witnessing the adoption of data-driven tools for predictive maintenance and performance optimization in the automotive and industrial sectors.

Key players in the market are strengthening their regional presence by acquiring local automation providers with strong industry experience. These acquisitions help companies expand access to key economies within Asia Pacific and deliver tailored solutions across diverse industries, further fueling the regional market.

- In December 2024, Schaeffler AG acquired India-based Dhruva Automation & Controls to expand its presence in the market across Asia-Pacific. Dhruva specializes in smart industrial automation and software solutions, supporting a wide range of manufacturing sectors. The acquisition enhances Schaeffler’s capabilities in predictive maintenance, machine data analysis, and digital operations, while increasing access to key regional markets.

Regulatory Frameworks

- In the U.S., the Federal Trade Commission (FTC) oversees IPA in relation to consumer data, ensuring compliance with data privacy and protection laws. It regulates unfair or deceptive practices in AI-driven automation, monitors algorithmic transparency, and enforces standards for responsible data use in automated systems across finance, retail, and healthcare sectors.

- In China, the Cyberspace Administration of China (CAC) regulates the use of IPA technologies under China’s cybersecurity and data governance laws. It oversees algorithmic accountability, ethical AI deployment, and cross-border data flows in intelligent automation systems.

- In India, Ministry of Electronics and Information Technology (MeitY) governs the use of IPA solutions by setting standards for AI ethics, digital governance, and data protection. It oversees the deployment of intelligent automation across public and private sectors, promoting responsible innovation, interoperability, and compliance with India's evolving data privacy and IT frameworks under the Digital India initiative.

Competitive Landscape

Major players in the intelligent process automation industry are expanding their capabilities through strategic acquisitions to enhance their real-time automation offerings. They are integrating low-code platforms that support customization and agility across process-intensive industries. Providers are shifting focus toward cloud-native solutions to improve scalability, flexibility, and deployment speed.

Additionally, market players are broadening their reach into new regional markets and customer segments in mid-sized enterprises. These strategies reflect the growing emphasis on combining automation with enterprise software to deliver more comprehensive and efficient business solutions.

- In December 2024, Aptean acquired Germany-based JobRouter to strengthen its IPA capabilities. JobRouter’s cloud-native, low-code platform supports real-time automation of complex business processes across various industries. This acquisition enables Aptean to serve its global ERP customer base while expanding its footprint in the European IPA market and mid-sized enterprise segment.

Key Companies in Intelligent Process Automation Market:

- Atos SE

- IBM Corporation

- Genpact

- HCL Technologies Limited

- Pegasystems Inc

- Blue Prism Limited

- Capgemini

- CGI Inc

- NiCE

- Cognizant

- Infobip ltd.

- Accenture

- Infosys Limited

- TATA Consultancy Services Limited

- Mahindra&Mahindra Ltd.

Recent Developments (Product Launch)

- In May 2025, Validere launched Validere Intelligence, a suite of new automation and AI-powered features tailored for the energy industry. This launch aims to reduce manual processing, streamline compliance reporting, and improve decision-making.

- In March 2025, ABBYY launched AI Labs in the U.S., Hungary, and India to accelerate the development of purpose-built AI for intelligent document processing and process automation. These labs focus on creating advanced AI solutions by leveraging proprietary datasets, multimodal models, and domain expertise in OCR, machine learning, and NLP.

- In October 2024, Neutrinos launched its Intelligent Automation Platform tailored for the insurance industry, featuring over 60 pre-built automation assets. The platform integrates an omni-channel experience layer, low-code development, process automation, advanced decision making , and unified governance tools.

freqAskQues