enquireNow

Human Augmentation Market

Human Augmentation Market Size, Share, Growth & Industry Analysis, By Technology (Wearable Robotics, Neurotechnology, Extended Reality Systems, Advanced Materials & Nanotech), By Augmentation Type (Physical Enhancement, Sensory Enhancement, Cognitive Enhancement, Biological Enhancement), By Device, By Application, and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: August 2025 | author: Sunanda G.

Market Definition

Human augmentation refers to the enhancement of human physical or cognitive abilities through the use of advanced technologies such as wearable exoskeletons, neural interfaces, and robotics. It focuses on improving strength, endurance, precision, or mental processing through technology integration.

The market serves sectors such as healthcare rehabilitation, industrial manufacturing, defense, and consumer wellness. Applications include mobility assistance, workplace injury reduction, training simulations, and cognitive support to boost productivity and improve quality of life.

Human Augmentation Market Overview

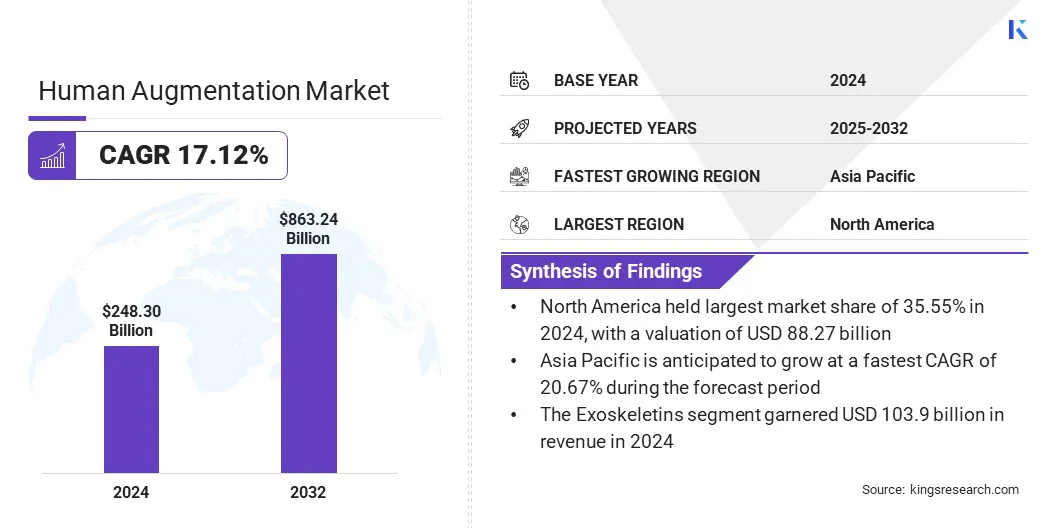

The global human augmentation market size was valued at USD 248.30 billion in 2024 and is projected to grow from USD 285.51 billion in 2025 to USD 863.24 billion by 2032, exhibiting a CAGR of 17.12% during the forecast period.

Market growth is driven by advances in neurotechnology and brain–computer interfaces, which enable direct communication between the brain and external devices, improving control and functionality. Additionally, the integration of soft robotics combined with AI-powered exoskeletons is enhancing mobility by offering adaptive support for rehabilitation, physical assistance, and performance enhancement across various applications.

Key Highlights

- The human augmentation industry size was valued at USD 248.30 billion in 2024.

- The market is projected to grow at a CAGR of 17.12% from 2025 to 2032.

- North America held a share of 35.55% in 2024, valued at USD 88.27 billion.

- The wearable robotics segment garnered USD 93.63 billion in revenue in 2024.

- The physical enhancement segment is expected to reach USD 314.57 billion by 2032.

- The exoskeletons segment secured the largest revenue share of 41.52% in 2024.

- The defense & tactical operations segment is set to grow at a CAGR of 20.47% through the forecast period.

- Asia Pacific is anticipated to grow at a robust CAGR of 20.67% through the projection period.

Major companies operating in the human augmentation market are Ekso Bionics, Lifeward, Inc., B-Temia, CYBERDYNE INC., Paradromics, Wandercraft, Neurable, MindMaze Group SA, OpenBCI, Roam Robotics, Palladyne AI Corp., Precision Neuroscience Corporation, HaptX Inc., NeuroPace, Inc., and Kernel.

Increasing adoption of exoskeletons and wearable robotics is fueling market growth across the industrial, medical, and military sectors. These technologies improve strength, endurance, and mobility, helping workers perform physically demanding tasks more safely and efficiently.

In medical rehabilitation, wearable devices assist patients in regaining movement and independence following injury or illness. Military applications focus on enhancing soldier performance and reducing fatigue during extended operations. Rising emphasis on occupational safety and productivity is accelerating the deployment of augmentation solutions in manufacturing and logistics.

- In April 2024, the U.S. Bureau of Labor Statistics reported that workplace injuries in physically demanding industries declined by 8% compared to 2023. This decrease is associated with increased use of assistive technologies, particularly wearable robotics and exoskeletons, in the manufacturing and logistics sectors to improve occupational safety.

Market Driver

Advances in Neurotechnology and Brain–Computer Interfaces

The human augmentation market is experiencing notable growth, fueled by advancements in neurotechnology that enhance human-machine integration. Innovations in neural implants, prosthetics, and cognitive enhancement tools aresupporting this expansion. Cutting-edge neurotechnologies enable new treatments for paralysis, stroke, and neurological disorders by restoring or enhancing brain function.

Brain–computer interfaces (BCIs) are improving communication between the nervous system and external devices, providing users with greater control and interaction. Additionally, BCIs are enhancing augmented and virtual reality experiences, making interfaces more intuitive and immersive. These innovations are expanding applications across healthcare, gaming, and assistive technology sectors.

- In April 2024, Blackrock Neurotech announced the NeuroPort User Switch, a modular, scalp‑mounted device designed to enable wireless brain‑computer interface signal acquisition with up to 256 channels. This product allows more flexible and mobile BCI signal collection in research and clinical settings. It enables seamless integration with existing NeuroPort systems for extended neurodata recording.

Market Challenge

High Costs and Complex Regulatory Approvals

A key challenge hampering the expansion of the human augmentation market is the substantial investment required for research and development of advanced devices. This challenge is further compounded by lengthy and complex regulatory approval processes, which increase time-to-market, raise costs, and restrict accessibility. Slow regulatory clearance delays product launches and constrains companies’ ability to scale solutions efficiently.

To address this challenge, market players are engaging in early regulatory consultations, streamlining clinical trial designs, and forming strategic partnerships to share development risks . Companies are also investing in modular technologies and phased commercialization approaches to improve affordability and accelerate market entry.

Market Trend

Integration of Soft Robotics with AI-Powered Exoskeletons

A key trend influencing the human augmentation market is the integration of soft robotics with AI-driven exoskeletons to enhance natural movement. These lightweight, flexible robotic suits reduce fatigue and improve mobility during physical tasks, while AI enables adaptive, user-specific assistance for greater comfort.

Applications are expanding in healthcare, industrial, and military sectors, particularly for rehabilitation and endurance support. Advances in materials and control algorithms are boosting the development of more intuitive and responsive systems, improving the quality of life and workforce productivity.

- In May 2025, German Bionic introduced Exia, its most advanced wearable and the first exoskeleton powered by Augmented AI. Designed for use in manufacturing, logistics, healthcare, and retail, Exia leverages an AI-native platform that interprets real-time context to adapt support for walking, lifting, bending, and carrying.

Human Augmentation Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Wearable Robotics, Neurotechnology, Extended Reality Systems, Advanced Materials & Nanotech |

|

By Augmentation Type |

Physical Enhancement, Sensory Enhancement, Cognitive Enhancement, Biological Enhancement |

|

By Device |

Exoskeletons, Smart Prosthetics & Orthotics, Sensory Implants & Wearables, Others |

|

By Application |

Medical & Rehabilitation, Industrial Productivity, Defense & Tactical Operations, Consumer & Recreational, Specialized Environments |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Technology (Wearable Robotics, Neurotechnology, Extended Reality Systems, and Advanced Materials & Nanotech): The wearable robotics segment earned USD 93.63 billion in 2024, mainly due to its expanding use in rehabilitation, industrial assistance, and military applications.

- By Augmentation Type (Physical Enhancement, Sensory Enhancement, Cognitive Enhancement, and Biological Enhancement): The physical enhancement segment held a share of 41.52% in 2024, fueled by rising adoption of advanced exoskeletons and prosthetics, which improve mobility, strength, and endurance across healthcare, industrial, and defense applications.

- By Device (Exoskeletons, Smart Prosthetics & Orthotics, Sensory Implants & Wearables, and Others): The exoskeletons segment is projected to reach USD 301.91 billion by 2032, owing to rising adoption in healthcare, industrial, and military sectors for enhancing mobility, reducing fatigue, and improving worker safety.

- By Application (Medical & Rehabilitation, Industrial Productivity, Defense & Tactical Operations, and Consumer & Recreational, and Specialized Environments): The defense & tactical operations segment is set to grow at a robust CAGR of 20.47% through the forecast period, largely attributed to sustained government investments in advanced exoskeletons, neurotechnology, and augmented reality systems to enhance soldier performance, mobility, and situational awareness in complex combat environments.

Human Augmentation Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America human augmentation market share stood at 35.55% in 2024, valued at USD 88.27 billion. This dominance is reinforced by the presence of leading technology developers in wearables, exoskeletons, AR/VR devices, and neurotechnology, including Ekso Bionics, Magic Leap, and Neuralink.

The regional market further benefits from advanced R&D facilities, a skilled workforce, and strong venture capital networks. This enables the rapid commercialization of high-performance human augmentation products and fuels regional market growth.

- In August 2024, Neuralink successfully completed its second device implantation to enable paralyzed individuals to operate digital devices through thought. The technology is being tested for applications in assisting people with spinal cord injuries. The first recipient has demonstrated the ability to play video games, browse the internet, post on social media, and control a laptop cursor through neural signals.

Moreover, the U.S. Department of Defense and Canadian Armed Forces have been early adopters of exoskeletons, augmented vision systems, and soldier performance enhancement tools. Ongoing programs such as the U.S. Army’s TALOS and ONYX exoskeleton initiatives ensure steady demand, while defense budgets in the region remain high, enabling continuous procurement and regular technology upgrades.

The Asia-Pacific human augmentation industry is estimated to grow at a significant CAGR of 20.67% over the forecast period. This growth is propelled by countries such as Japan, South Korea, and China, which host advanced robotics, AI research, and high-tech manufacturing hubs. These innovation ecosystems accelerate the development of wearable robotics, AR systems, and brain–computer interfaces, enabling rapid transition from research to commercialization.

- In December 2024, KAIST researchers developed the WalkON Suit F1, a front-wearing exoskeleton that can autonomously dock onto a wheelchair-bound user and assist them in walking, navigating stairs, and moving laterally at speeds of up to 3.2 km/h, marking a significant advancement in assistive wearable robotics.

There is increasing adoption of wearable devices and BCI solutions for rehabilitation and mobility recovery. Medical institutions are actively integrating technologies such as AI-powered augmentation to assist patients recovering from strokes or spinal injuries in regaining independence. This willingness to adopt new healthcare solutions, combined with rising healthcare budgets, continues to fuel consistent regional market expansion.

- In January 2025, WIRobotics from South Korea launched the WIM (We Innovate Mobility) exoskeleton, designed for seniors and rehabilitation patients. This lightweight device integrates with an AI-enabled app that analyzes gait and improves walking speed, endurance, and strength by up to 78%.

Regulatory Frameworks

- The U.S. Food and Drug Administration (FDA) regulates human augmentation devices under established medical device rules. High-risk implantables and innovative neurotechnologies typically require Investigational Device Exemptions (IDE) and Premarket Approval (PMA) or use expedited pathways such as Breakthrough Device designation.

- The European Union regulates human augmentation technologies through the Medical Device Regulation (MDR, Regulation (EU) 2017/745) and In Vitro Diagnostic Regulation (IVDR). Implantable devices fall into high-risk classes, requiring clinical evidence, Notified-Body assessments, and post-market surveillance. Since 1 August 2024, the Artificial Intelligence Act adds further obligations for AI-enabled medical systems deemed “high-risk,” including risk management, transparency, human oversight, and periodic monitoring.

- Japan regulates medical augmentation technologies through the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour and Welfare (MHLW) under the PMD Act. Devices are classified from Class I (low risk) to Class IV (high risk), requiring varying levels of approval. Japan also supports AI-based medical systems with post-market change management (IDATEN) processes and requires Quality Management System (QMS) compliance with ISO 13485 standards.

- China’s National Medical Products Administration (NMPA) classifies medical devices into risk-based tiers and oversees regulatory approvals. It has introduced a special “innovative device” review path. The NMPA also issues detailed guidance on AI-based medical software, including classification, clinical evaluation, lifecycle management, and quality control for Software as a Medical Device (SaMD) and Software in a Medical Device (SiMD).

Competitive Landscape

Major players operating in the human augmentation industry are adopting strategies such as investing in research and development, integrating advanced AI-powered motion systems, and focusing on ergonomic product design to strengthen their position.

Several companies are forming partnerships with technology providers and outdoor equipment brands to expand their reach and enhance product performance. These approaches help manufacturers deliver more adaptive, versatile, and user-friendly exoskeletons, meeting the growing demand for solutions that improve mobility and endurance in challenging environments.

- In January 2024, Hypershell introduced the Hypershell GoX and ProX at booth 55253 during the Las Vegas Venetian Expo. The Hypershell ProX, an all-terrain exoskeleton for running, hiking, and long-distance trekking, integrates advanced robotics, ergonomic design, and AI to enhance outdoor mobility. Its AI-powered motion engine anticipates and adapts to user movements, enabling smooth transitions across nine motion postures.

Key Companies in Human Augmentation Market:

- Ekso Bionics

- Lifeward, Inc.

- B-Temia

- CYBERDYNE INC.

- Paradromics

- Wandercraft

- Neurable

- MindMaze Group SA

- OpenBCI

- Roam Robotics

- Palladyne AI Corp.

- Precision Neuroscience Corporation

- HaptX Inc.

- NeuroPace, Inc.

- Kernel

Recent Developments (Product Launches/Regulatory Approval)

- In May 2025, Precision Neuroscience obtained clearance from the United States Food and Drug Administration (FDA) for its Layer 7 Cortical Interface, a brain–computer interface (BCI) technology featuring a thin-film design with 1,024 electrodes embedded in a flexible material to conform to the brain’s surface. The device is intended to help individuals with severe paralysis control digital devices through thought.

- In April 2024, Synchron launched a community-focused BCI registry to connect patients, caregivers, and clinicians, aiming to enhance understanding of BCI applications for individuals with limited mobility. Synchron’s BCI system interprets neural signals to explore new methods for restoring motor intent and enabling digital device control.

freqAskQues