buyNow

Healthcare Informatics Market

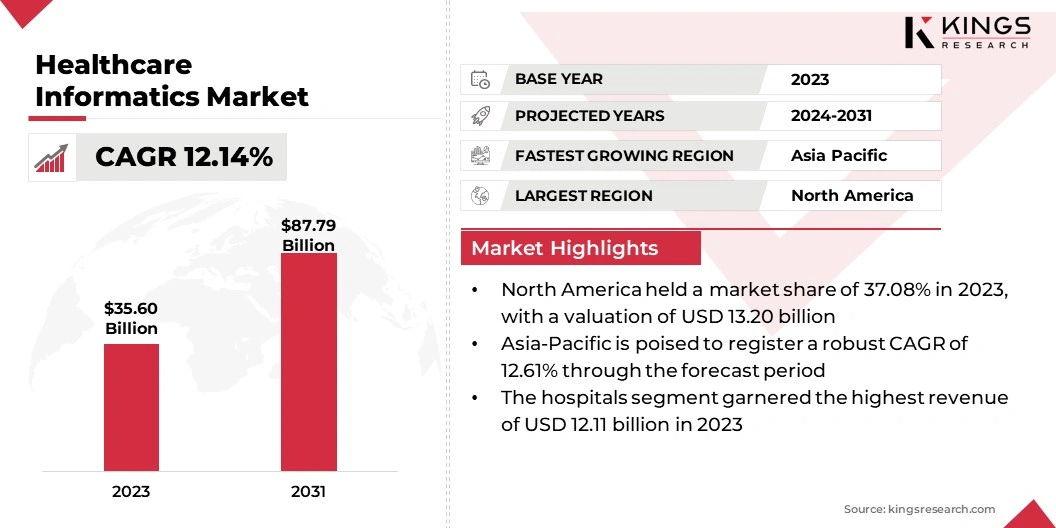

Healthcare Informatics Market Size, Share, Growth & Industry Analysis, By Type (Nursing Informatics, Pathology Informatics, Pharmacy Informatics, Others), By Application (Renal Diseases, Oncology, Cardiology, Gynecology, Others), By End-User (Hospitals, Specialty Clinics, Pharmacies, Research Labs, Others), and Regional Analysis, 2024-2031

pages: 120 | baseYear: 2023 | release: July 2024 | author: Saket A.

Healthcare Informatics Market Size

The global healthcare informatics market size was valued at USD 35.60 billion in 2023 and is projected to grow from USD 39.36 billion in 2024 to USD 87.79 billion by 2031, exhibiting a CAGR of 12.14% during the forecast period. Rising use of telemedicine and increasing demand for integrated healthcare systems are driving the growth of the market.

In the scope of work, the report includes solutions offered by companies such Johnson & Johnson Services, Inc., Altera Digital Health Inc., Medtronic, Koninklijke Philips N.V., Veradigm LLC, Change Healthcare, Oracle, Greenway Health, LLC, Oracle, OSP, and others.

The integration of artificial intelligence (AI) in healthcare informatics is revolutionizing data analysis and decision support systems. AI algorithms, particularly machine learning and deep learning, are being employed to analyze vast amounts of healthcare data, providing insights that were previously unattainable. These technologies enable the identification of patterns and trends in patient data, leading to more accurate diagnoses and personalized treatment plans.

- For instance, in March 2023, Genomic Vision launched FiberSmart, an AI-based technology designed to automate detection and quantification of fluorescent signals on combed DNA molecules. Leveraging advanced AI, FiberSmart visualizes, detects, and analyzes DNA replication kinetics up to three times more accurately and ten times faster than previous solutions.

Major factor contributing to this integration is the exponential growth of healthcare data, which necessitates advanced tools for effective management and analysis. Additionally, the shift toward value-based care, which emphasizes outcomes and efficiency, propels the adoption of AI in healthcare informatics. AI-powered solutions are improving clinical workflows while also reducing operational costs and minimizing human error.

Healthcare informatics is an interdisciplinary field that leverages information technology to manage and analyze healthcare data, with the aim of improving patient outcomes and healthcare delivery. It encompasses various types, including clinical informatics, which focuses on patient care data; public health informatics, which deals with population health data; and bioinformatics, which involves the use of computational tools to analyze biological data.

The applications of healthcare informatics are extensive and encompass a variety of domains, including electronic health records (EHRs), telemedicine, clinical decision support systems, and health information exchanges. These applications facilitate better data management, enhance communication among healthcare providers, and support evidence-based decision-making.

End-users of healthcare informatics include hospitals, clinics, research institutions, public health organizations, and insurance companies. By integrating healthcare informatics, these entities streamline operations, reduce costs, and improve the quality of care provided to patients. The ability to utilize and analyze large datasets allows for advancements in personalized medicine, population health management, and the overall efficiency of healthcare systems.

Analyst’s Review

Key industry players are investing heavily in research and development to advance their informatics solutions. They are integrating cutting-edge technologies such as AI and blockchain to offer more robust and secure systems. Furthermore, these companies are focusing on strategic partnerships and collaborations with healthcare providers, technology firms, and research institutions to expand their product offerings and market reach.

Healthcare informatics market landscape is reshaped by the increasing demand for advanced healthcare IT solutions, spurred by the rising adoption of electronic health records and telemedicine.

Companies are responding to regulatory changes and healthcare reforms by developing compliant and user-friendly solutions that meet the evolving needs of healthcare professionals and patients. The imperatives for key players include enhancing data interoperability, ensuring data privacy and security, and providing scalable solutions that adapt to the dynamic healthcare environment.

Healthcare Informatics Market Growth Factors

Increasing healthcare expenditure is a significant factor supporting the expansion of the healthcare informatics market. As healthcare costs continue to rise globally, there is a growing need for efficient solutions that manage these expenses while improving patient care. Healthcare informatics plays a crucial role in addressing this need by streamlining administrative processes, reducing redundant tests, and enabling more accurate diagnoses and treatments.

- For instance, in 2023, according to the Centers for Medicare and Medicaid Services (CMS), national healthcare spending is anticipated to increase at an average annual rate of 5.7% from 2020 to 2027 By 2027, this spending is expected to reach nearly USD 6 trillion.

The integration of informatics systems helps healthcare providers to optimize resource allocation, thereby reducing operational costs. Moreover, the implementation of electronic health records (EHRs) and other informatics tools lead to substantial savings by minimizing paperwork, reducing errors, and enhancing coordination among different healthcare departments.

The need to manage healthcare costs effectively is compelling hospitals and clinics to adopt advanced informatics solutions, which improve efficiency and enhance the quality of care provided. Additionally, the rise in chronic diseases and an aging population necessitates more efficient healthcare delivery models, thereby boosting the demand for informatics solutions.

Health data interoperability presents a major challenge to the development of the healthcare informatics market. It refers to the ability of different IT systems and software applications to communicate, exchange, and use health information effectively. Despite advancements in healthcare technology, achieving seamless interoperability remains a complex issue due to the diverse range of systems and standards used across healthcare facilities.

The lack of interoperability has led to fragmented patient data, miscommunication among healthcare providers, and inefficiencies in care delivery. This challenge is compounded by stringent regulatory requirements and the need to protect patient privacy. To mitigate this challenge, healthcare organizations are increasingly adopting standardized protocols and frameworks, such as HL7 and FHIR, to facilitate better data exchange.

Additionally, there is a notable shift toward the use of cloud-based solutions and blockchain technology, which offer more secure and efficient ways to share and manage health data. By prioritizing interoperability, healthcare providers ensure that critical patient information is accessible across different platforms, leading to improved care coordination, better patient outcomes, and more streamlined healthcare processes.

Healthcare Informatics Market Trends

The increasing focus on population health management (PHM) initiatives is a key trend boosting the demand for healthcare informatics solutions. PHM aims to improve the health outcomes of a group of individuals by monitoring and identifying individual patients within that group, emphasizing preventive care and the management of chronic diseases.

Informatics solutions are integral to PHM initiatives, as they provide the tools required to collect, analyze, and act upon large datasets related to population health. These tools enable healthcare providers to identify at-risk populations, track health outcomes, and implement targeted interventions.

The growing emphasis on value-based care, which focuses on improving health outcomes rather than the volume of services provided, fuels the demand for informatics solutions. By leveraging data analytics, predictive modeling, and electronic health records, healthcare organizations gain deeper insights into population health trends and develop more effective care strategies.

Segmentation Analysis

The global market is segmented based on type, application, end-user, and geography.

By Type

Based on type, the market is categorized into nursing informatics, pathology informatics, pharmacy informatics, and others. The pharmacy informatics segment captured the largest healthcare informatics market share of 43.25% in 2023, largely attributed to the growing adoption of advanced informatics solutions in pharmacies to enhance medication management and patient safety.

The integration of pharmacy informatics systems allows for the efficient handling of vast amounts of data related to drug interactions, patient medication histories, and inventory management. This leads to significant reductions in medication errors, improved adherence to treatment protocols, and better patient outcomes.

Additionally, the increasing complexity of medication regimens, especially for chronic diseases, necessitates robust informatics solutions to streamline the prescription process, monitor patient compliance, and provide real-time decision support to pharmacists. The widespread usage of telemedicine and the growing emphasis on precision medicine are leading to increased demand for pharmacy informatics.

- For instance, in 2022, Rock Health reported that telemedicine had achieved widespread adoption, surpassing 80%. It has emerged as the preferred method for prescription care and treating minor illnesses, reflecting a significant shift in patient preferences toward convenient and accessible healthcare services.

By leveraging data analytics and machine learning, pharmacy informatics solutions predict patient responses to medications and optimize therapy plans. Moreover, regulatory requirements for accurate and transparent medication documentation prompt pharmacies to adopt these advanced systems, thereby contributing to the expansion of the segment.

By Application

Based on application, the healthcare informatics market is classified into renal diseases, oncology, cardiology, gynecology, and others. The oncology segment is poised to record a staggering CAGR of 12.84% through the forecast period. This notable expansion is mainly attributable to the increasing prevalence of cancer worldwide, highlighting the need for more effective and efficient management and treatment solutions.

- For instance, according to WHO, in 2022, there were approximately 20 million new cancer cases globally, resulting in 9.7 million deaths. Lung cancer led with 2.5 million cases (12.4% of total), followed by female breast cancer (2.3 million cases, 11.6%), colorectal cancer (1.9 million cases, 9.6%), prostate cancer (1.5 million cases, 7.3%), and stomach cancer (970,000 cases, 4.9%).

Healthcare informatics plays a crucial role in oncology by enabling the integration and analysis of vast amounts of patient data, including genetic information, treatment histories, and outcomes. This data-driven approach facilitates personalized treatment plans, early detection, and improved patient monitoring, which are essential for effective cancer care.

Additionally, advancements in genomic research and precision medicine are boosting the adoption of informatics solutions in oncology, as these innovations enable the identification of specific biomarkers and the customization of treatments to individual patients. The growing emphasis on value-based care, which focuses on patient outcomes and cost-effectiveness, further supports the adoption of informatics in oncology.

By End-User

Based on end-user, the market is divided into hospitals, specialty clinics, pharmacies, research labs, and others. The hospitals segment led the healthcare informatics market in 2023, reaching a valuation of USD 12.11 billion, mainly propelled by the increasing adoption of advanced healthcare informatics solutions to improve patient care and operational efficiency.

Hospitals represent the largest end-users of healthcare informatics systems, leveraging electronic health records (EHRs), clinical decision support systems, and telemedicine platforms to enhance patient outcomes and streamline workflows.

The integration of these systems enables hospitals to manage vast amounts of patient data more effectively, leading to improved diagnostic accuracy, reduced medical errors, and better treatment planning. Additionally, the growing demand for value-based care, which emphasizes patient outcomes and cost-effectiveness, prompts hospitals to invest in informatics solutions that optimize resource utilization and reduce healthcare costs.

The shift toward interoperability and data sharing among healthcare providers further leads to the widespread adoption of informatics in hospitals, facilitating seamless communication and coordination of care. Furthermore, regulatory requirements for quality reporting and patient safety standards necessitate the implementation of robust informatics systems in hospitals, thereby fueling the expansion of the segment.

Healthcare Informatics Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America healthcare informatics market share stood around 37.08% in 2023 in the global market, with a valuation of USD 13.20 billion, largely due to the region's advanced healthcare infrastructure and significant investments in healthcare IT. The U.S. and Canada have been at the forefront of adopting innovative healthcare informatics solutions, supported by strong government initiatives and regulatory frameworks aimed at improving healthcare quality and patient safety.

The widespread implementation of electronic health records (EHRs) and the adoption of telemedicine and remote patient monitoring technologies have been pivotal in enhancing healthcare delivery across North America.

Additionally, the presence of leading healthcare informatics companies and research institutions in the region fosters continuous advancements and innovations in the field. The focus on value-based care and the increasing prevalence of chronic diseases fuel the demand for advanced informatics solutions that improve patient outcomes and reduce healthcare costs.

Asia-Pacific is poised to grow at a robust CAGR of 12.61% in the forthcoming years, augmented by rapid advancements in healthcare infrastructure and increasing adoption of healthcare informatics solutions across the region. Countries such as China, India, and Japan are investing heavily in digital health technologies to address the challenges associated with providing quality healthcare to their large and diverse populations.

The growing prevalence of chronic diseases and an aging population in the region necessitate the implementation of efficient healthcare management systems, thereby propelling the demand for informatics solutions. Additionally, government initiatives that promote the adoption of electronic health records (EHRs) and telemedicine are contributing significantly to regional market growth.

The expansion of healthcare access in rural and underserved areas through mobile health technologies boosts the adoption of informatics solutions. Moreover, the increasing penetration of internet and smartphone usage facilitates the implementation of digital health platforms, thereby enhancing patient engagement and remote monitoring capabilities.

Competitive Landscape

The global Healthcare Informatics Market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Healthcare Informatics Market

- Johnson & Johnson Services, Inc.

- Altera Digital Health Inc.

- Medtronic

- Koninklijke Philips N.V.

- Veradigm LLC

- Change Healthcare

- Oracle

- Greenway Health, LLC

- Oracle

- OSP

Key Industry Developments

- May 2024 (Launch): athenahealth launched athenaOne for Women’s Health and athenaOne for Urgent Care, targeting specialty medical practices. These solutions integrate essential electronic health record and practice management features with customized workflows, aiming to reduce burnout and enhance the EHR experience in specialty care, according to the cloud-based company.

- April 2024 (Partnership): Greenway Health announced a strategic partnership with AI assistant and clinical documentation firm Nabla. This collaboration has led to the development of Greenway Clinical Assist, a solution that integrates Nabla’s ambient AI technology with Greenway’s Prime Suite and Intergy EHR solutions to enhance practitioner support.

- April 2024 (Collaboration): Veradigm announced a strategic collaboration with Vim to enhance point-of-care integration for EHR platforms and payers, extebding beyond existing Veradigm's EHR footprint. By deploying Veradigm Payer Insights, this partnership aims to bridge payer-provider gaps, thereby improving patient care coordination and outcomes.

The global Healthcare Informatics Market is segmented as:

By Type

- Nursing Informatics

- Pathology Informatics

- Pharmacy Informatics

- Others

By Application

- Renal Diseases

- Oncology

- Cardiology

- Gynecology

- Others

By End-User

- Hospitals

- Specialty Clinics

- Pharmacies

- Research Labs

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

freqAskQues