buyNow

Cosmetic Implants Market

Cosmetic Implants Market Size, Share, Growth & Industry Analysis, By Application (Dental Implants, Breast Implants, Facial Implants, Penile Implants, Calf Implants, Buttock Implants, Others), By Material Type (Silicone Implants, Polymers, Biological Implants, Others), By End-User, and Regional Analysis, 2024-2031

pages: 120 | baseYear: 2023 | release: August 2024 | author: Omkar R.

Cosmetic Implants Market Size

The global Cosmetic Implants Market size was valued at USD 10.41 billion in 2023 and is projected to grow from USD 11.35 billion in 2024 to USD 21.19 billion by 2031, exhibiting a CAGR of 9.33% during the forecast period. Growth of the market is being driven by the increasing prevalence of advanced surgical techniques, which offer improved outcomes and faster recovery times.

Additionally, the aging population seeking aesthetic enhancements to maintain a youthful appearance is contributing to market growth. The expansion of medical tourism, offering cost-effective cosmetic procedures in emerging markets, is also boosting the demand for cosmetic implants globally.

In the scope of work, the report includes products offered by companies such as 3M, AllerganAesthetics, POLYTECH Health & Aesthetics GmbH, Dentsply Sirona, GCA Aesthetics, Henry Schein, Inc., Implantech, Johnson & Johnson, Sientra Inc., ZimVie Inc., and others.

The cosmetic implants market is experiencing robust growth, driven by increasing consumer demand for aesthetic enhancements and the availability of advanced implant technologies. Innovations in materials and techniques are improving safety, effectiveness, and patient satisfaction, leading to higher adoption rates.

In addition, the growing trend of minimally invasive procedures and personalized cosmetic solutions is further propelling market expansion. The rise in aesthetic surgeries, fueled by social media influence and consumer sentiment favoring self-improvement, is a key driver, as more individuals seek surgical interventions to enhance their appearance.

- The Aesthetic Society, a leading authority on aesthetic plastic surgery, released its annual Aesthetic Plastic Surgery National Databank report for 2023, highlighting significant trends in this field. The data showed a 2.9% increase in total surgical procedures from 2022 to 2023, contributing to a notable 10.2% overall growth in surgical procedures from 2019 to 2023. This surge indicates a continued demand for aesthetic plastic surgery.

This growing demand is expected to continue driving market growth over the forecast period.

Cosmetic implants are medical devices used to enhance or alter the appearance of various body parts for aesthetic purposes. Typically made from materials like silicone, saline, or other biocompatible substances, these implants are designed to achieve specific cosmetic outcomes, such as breast augmentation, facial contouring, or body sculpting.

The implants are surgically placed to improve physical appearance, address anatomical concerns, or restore volume lost due to aging or other factors. They are available in various shapes, sizes, and types, often tailored to meet the needs and preferences of individuals. Advances in implant technology and materials continue to enhance their safety, effectiveness, and natural appearance.

Analyst’s Review

The growth of the cosmetic implant market over the forecast period is expected to be primarily driven by the rising demand for implants, the advent of new and innovative technologies, and growing awareness about aesthetic appearance.

- The Aesthetic Society's April 2022 Aesthetic Plastic Surgery Statistics report highlighted that 148,000 women had their implants removed and replaced, underscoring the ongoing consumer engagement and demand in this sector.

Key players in the cosmetic implants market are capitalizing on growth opportunities by innovating and expanding their product offerings.

- For instance, in October 2023, GC Aesthetics, a well-established brand in breast aesthetics, and Bimini Health Tech, a leader in healthcare solutions, formed a strategic joint venture. This partnership aims to revolutionize breast reconstruction on a global scale by integrating advanced technologies and innovative approaches.

Such collaborations enable companies to leverage their expertise and resources to enhance market growth, meet evolving consumer needs, and stay competitive in the rapidly evolving cosmetic implant market.

Cosmetic Implants Market Growth Factors

Advancements in implant materials are driving market growth by meeting the increasing consumer demand for safer, more effective cosmetic solutions. As these materials offer improved durability and a more natural appearance, they enhance patient satisfaction, which leads to a rise in repeat procedures and positive word-of-mouth referrals. This boosts the overall market adoption and expands the customer base.

Additionally, the reduced risk of complications and better results contribute to higher consumer confidence, encouraging more individuals to opt for cosmetic implants. Manufacturers leveraging these innovations are gaining a competitive advantage, which is further expanding the market.

Key players in the cosmetic implants market are actively addressing challenges associated with increasing regulatory scrutiny and safety concerns by investing in advanced research and development. They are focusing on improving implant materials and technologies to enhance durability and minimize complications.

For instance, companies are integrating cutting-edge innovations, such as more natural-looking and biocompatible materials, into their products. Additionally, these players are working closely with regulatory bodies to ensure compliance with stringent standards and expedite the approval process, which is expected to further fuel the market expansion in coming years.

Cosmetic Implants Industry Trends

The trend of minimally invasive cosmetic procedures is gaining significant momentum, driven by patient preferences for quicker recovery times, reduced surgical risks, and minimal scarring. This shift is encouraging the development of advanced implant techniques and tools designed to achieve the desired aesthetic outcomes with less invasive methods.

Innovations such as smaller incisions, improved imaging technologies, and the use of cutting-edge materials are enabling these procedures to be performed with greater precision and efficiency. As a result, more patients are opting for these less invasive options, which is boosting the demand for cosmetic implants and contributing to market growth.

Another trend of personalized cosmetic solutions is also driving market growth by catering to the rising demand for individualized care. As patients seek implants that perfectly match their unique body shapes and preferences, the adoption of advanced 3D printing and imaging technologies is enabling the creation of bespoke implants. Thus, the power of customization enhances patient satisfaction and outcomes, leading to higher demand for these tailored solutions.

- In July 2024, ZimVie Inc., a global life sciences leader in the dental market, announced the release of its RealGUIDE 5.4 software. The update became available in all markets where RealGUIDE was sold, enhancing ZimVie’s existing RealGUIDE software suite for treatment planning and implant restoration.

Surgeons and manufacturers offering personalized implants are gaining a competitive advantage, attracting more clients and increasing market share.

Segmentation Analysis

The global market has been segmented on the basis of application, material type, end-user, and geography.

By Application

Based on application, the cosmetic implants market has been categorized into dental implants, breast implants, facial implants, penile implants, calf implants, buttock implants, others. The breast implants segment garnered the highest revenue of USD 5.49 billion in 2023, driven by increasing demand for breast augmentation and reconstruction procedures.

- In March 2024, GC Aesthetics, a designer, manufacturer, and distributor of breast implants and medical devices for the global aesthetics industry, introduced the FixNip NRI, a specialized nipple implant designed for women who have undergone breast reconstruction surgeries. This new product aims to improve patient outcomes, further driving growth in the segment.

Additionally, the rising awareness of breast reconstruction options among women undergoing mastectomy and the influence of media and celebrity culture are further driving growth of the breast implants segment.

By Material Type

Based on material type, the market has been categorized into silicone implants, polymers, biological implants, and others. The silicone implants segment captured the largest market share of 64.09% in 2023. Advances in silicone gel technology have produced implants that offer improved safety profiles, enhanced aesthetics, and a more natural feel, leading to higher patient satisfaction.

The segment is also benefiting from rising consumer awareness about the advantages of silicone implants over other materials, such as saline. Additionally, the growing number of product approvals and the introduction of innovative silicone implants by key players are further propelling the segment's growth in the cosmetic implants market.

By End User

Based on end user, the market has been categorized into hospitals, specialty clinics, ambulatory surgical centers, and cosmetic surgery centers. Among these, the specialty clinics segment is expected to command the highest revenue of USD 8.29 billion by 2031. These clinics offer specialized services with advanced technologies and highly trained professionals, attracting patients seeking tailored cosmetic solutions.

The segment's growth is further supported by the rise in medical tourism, where patients prefer specialty clinics for their expertise and cost-effective treatments. Additionally, the growing emphasis on patient-centered care and post-operative support provided by these clinics is boosting their popularity, which is increasing the number of procedures performed in this segment, thereby driving market growth.

Cosmetic Implants Market Regional Analysis

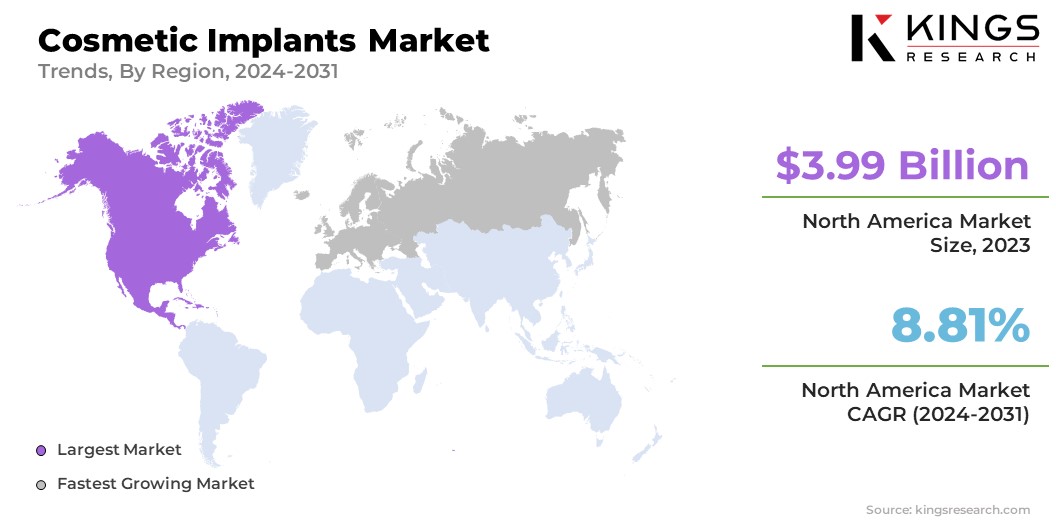

Based on region, the global market has been classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America cosmetic implants market share stood around 38.35% in 2023 in the global market, with a valuation of USD 3.99 billion, driven by the high demand for aesthetic procedures and the presence of advanced healthcare infrastructure in this region. The U.S., in particular, is a major contributor for this market, with a strong emphasis on cosmetic surgery and a growing acceptance of aesthetic enhancements.

- According to the 2023 ASPS Procedural Statistics released by the American Society of Plastic Surgeons, there was a 5% rise in plastic surgeries and a 7% increase in minimally invasive procedures compared to 2022. Notably, liposuction procedures reached 347,782, marking a 7% increase from 2022.

These trends highlight the country’s robust growth, further fueled by technological advancements, increasing disposable income, and social media influence.

Europe is anticipated to witness the fastest growth at a CAGR of 10.03% over the forecast period, driven by a strong demand for aesthetic procedures and a growing acceptance of cosmetic enhancements. Countries like Germany, France, and the UK are leading the market due to their well-established healthcare infrastructure and a high concentration of skilled plastic surgeons.

- In April 2024, GC Aesthetics (GCA), a leading designer, manufacturer, and distributor of breast implants and medical devices, announced the launch of the LUNA XT, a micro-textured anatomical breast implant. This is the first breast implant to be approved under the new European Medical Device Regulation (MDR), showcasing the region's advancements in implant technology and regulatory compliance.

The market's growth is further supported by increasing awareness about cosmetic procedures, rising disposable income, and a higher number of individuals seeking youthful appearances.

Competitive Landscape

The global cosmetic implants market report will provide valuable insights with a specialized emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Companies are implementing impactful strategic initiatives, such as expansion of services, investments in research and development (R&D), establishment of new service delivery centers, and optimization of their service delivery processes, which are likely to create new opportunities for market growth.

List of Key Companies in Cosmetic Implants Market

- 3M

- AllerganAesthetics

- POLYTECH Health & Aesthetics GmbH

- Dentsply Sirona

- GCA Aesthetics

- Henry Schein, Inc

- Implantech

- Johnson & Johnson

- Sientra Inc.

- ZimVie Inc.

Key Industry Development

June 2024 (Product Launch): BioHorizons released the Tapered Pro Conical, its first dental implant featuring a deep conical connection. This new implant reflects BioHorizons' commitment to developing innovative products to improve clinical performance and workflow efficiency.

The global cosmetic implants market has been segmented as follows:

By Application

- Dental Implants

- Breast Implants

- Facial Implants

- Penile Implants

- Calf Implants

- Buttock Implants

- Others

By Material Type

- Silicone Implants

- Polymers

- Biological Implants

- Others

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Cosmetic Surgery Centers

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America