buyNow

Commercial Kitchen Appliances Market

Commercial Kitchen Appliances Market Size, Share, Growth & Industry Analysis, By Product Type (Cooking Appliances, Refrigeration Equipment, Food Preparation Appliances, Others), By End-users (Full-service Restaurants, Quick-service Restaurants, Hotels and Resorts, Others), and Regional Analysis, 2024-2031

pages: 120 | baseYear: 2023 | release: December 2024 | author: Saket A.

Commercial Kitchen Appliances Market Size

The global commercial kitchen appliances market size was valued at USD 103.67 billion in 2023 and is projected to grow from USD 108.68 billion in 2024 to USD 158.55 billion by 2031, exhibiting a CAGR of 5.54% during the forecast period.

The expansion of the foodservice industry, including restaurants, cafes, and cloud kitchens, is a significant driver of the market. The surge in consumer preferences for dining out and online food delivery has compelled businesses to invest in efficient and durable kitchen equipment. This trend is particularly prominent in urban areas, where convenience and diverse food offerings have become crucial to capturing a large market share.

In the scope of work, the report includes products offered by companies such as Electrolux AB, Middleby Corporation, ITW Food Equipment Group, Ali Group Worldwide, Haier Inc., Welbilt, Inc., Samsung, LG Electronics, Fujimak Corporation, Hoshizaki Corporation, and others.

Moreover, rising disposable incomes in developing economies have encouraged greater spending on dining experiences, contributing to the growth of the commercial kitchen appliances market.

- The Organization for Economic Co-operation and Development (OECD) reports a significant increase in real household income per capita, which grew by 0.9% in the first quarter of 2024, compared to a 0.3% rise in the previous quarter. During the same period, real GDP per capita experienced a modest growth of 0.3%.

Consumers are increasingly exploring diverse cuisines, prompting food establishments to expand their offerings and invest in state-of-the-art kitchen equipment.

Commercial kitchen appliances refer to specialized equipment and tools designed for use in professional foodservice environments, such as restaurants, hotels, catering businesses, and institutional kitchens. These appliances are engineered to handle high-volume food preparation, cooking, storage, and cleaning efficiently and reliably.

They include a wide range of equipment, such as ovens, refrigerators, fryers, dishwashers, mixers, and grills, among others. Built to meet rigorous industry standards, commercial kitchen appliances are typically more durable, powerful, and feature-rich than their residential counterparts, offering advanced functionalities to optimize workflow, ensure food safety, and support the unique demands of large-scale operations.

.webp)

Analyst’s Review

Advancements in technology are revolutionizing the commercial kitchen appliances market, fostering significant growth and modernization. Manufacturers are increasingly incorporating smart features, energy-efficient designs, and automation into their products to meet the evolving demands of the foodservice sector.

Equipment equipped with IoT capabilities allows for real-time monitoring, predictive maintenance, and enhanced operational efficiency, minimizing downtime and reducing costs.

- In October 2024, Chinese kitchen appliance brand Fotile introduced its innovative "Smart Fridge" during the Happiness Insights Conference. This advanced appliance features a large language model (LLM) named "Healthy Cooking GPT," which leverages artificial intelligence (AI) to simplify healthy meal preparation. By inputting personal details and health preferences, users can create a personalized profile, enabling the AI assistant to recommend tailored dishes that align with their dietary needs.

By adopting cutting-edge technologies, food service providers can optimize their processes, improve customer satisfaction, and remain competitive in a rapidly evolving market.

Automation has become a game-changer, with appliances such as programmable ovens, automated fryers, and self-cleaning systems streamlining kitchen operations and ensuring consistency in food quality. Additionally, energy-efficient technologies are gaining traction, addressing sustainability goals and lowering operating expenses.

Commercial Kitchen Appliances Market Growth Factors

Urbanization has led to evolving consumer lifestyles, with increased preference for ready-to-eat meals and dining out. This shift has resulted in a growing number of foodservice establishments in urban centers, driving the growth of the commercial kitchen appliances market. Businesses catering to urban populations are adopting compact, multifunctional appliances to optimize limited kitchen spaces.

With the global trend toward urban living showing no signs of slowing, the demand for innovative commercial kitchen solutions is expected to grow, addressing the unique challenges and opportunities of densely populated areas. The rapid expansion of restaurants and the foodservice industry has significantly influenced the demand for commercial kitchen appliances.

- In February 2024, the National Restaurant Association projected that the foodservice industry will achieve USD 1 trillion in sales in 2024. Additionally, the industry is expected to expand its workforce by 200,000 jobs, bringing total employment in the industry to 15.7 million by the end of the year.

These establishments prioritize fast and efficient food preparation to cater to a high volume of customers within limited timeframes. Specialized equipment designed to support speed and consistency, such as high-capacity ovens, fryers, and grills, has become essential for food operations. The increasing presence of global restaurant chains in emerging markets has further accelerated investments in commercial kitchen solutions.

Commercial Kitchen Appliances Industry Trends

The shift toward modular and customizable kitchen designs is reshaping the commercial kitchen appliances market. Businesses are seeking tailored solutions that maximize space efficiency and adapt to specific operational needs. This trend is particularly relevant for urban food establishments, where space constraints are common.

Modular appliances offer flexibility in design, allowing establishments to reconfigure their kitchen layouts easily as their needs evolve. By investing in such solutions, businesses optimize workflow, reduce setup times, and enhance overall productivity. This preference for tailored kitchen solutions continues to contribute significantly to market growth.

The rise of online food delivery platforms has created robust demand for commercial kitchen appliances tailored to high-speed operations. Cloud kitchens, which exclusively cater to delivery services, have rapidly expanded, relying heavily on advanced equipment to meet large order volumes with efficiency.

- In November 2024, Skope Kitchens launched India's first Managed Kitchen-as-a-Service platform, designed to transform the USD 3 billion cloud kitchen industry. Skope distinguishes itself through its unique expansion model and comprehensive rethinking of kitchen operations.

Appliances designed for quick food preparation, consistent quality, and energy optimization are critical for these establishments.

Segmentation Analysis

The global market is segmented based on product type, end-users, and geography.

By Product Type

Based on product type, the market is segmented into cooking appliances, refrigeration equipment, and food preparation appliances. The cooking appliances segment is further categorized into ovens, fryers, grills, and others. The refrigeration equipment segment is further divided into refrigerators, freezers, and ice machines. The food preparation appliances segment is segmented into mixer grinders, food processors, hand blenders, and others.

The cooking appliances segment led the commercial kitchen appliances market in 2023, reaching a valuation of USD 43.28 billion. This is driven by their essential role in foodservice operations such as restaurants, hotels, catering services, and institutional kitchens.

Products such as ovens, fryers, and grills are crucial for preparing a wide variety of dishes efficiently and consistently. The growing demand for fast-casual dining, along with an increase in the number of foodservice establishments globally, directly contributes to the dominance of cooking appliances in the market.

By End-Users

Based on end-users, the market is classified into full-service restaurants, quick-service restaurants, hotels and resorts, and others. The quick-service restaurants segment is poised for significant growth at a robust CAGR of 6.70% through the forecast period fueled by the increasing global demand for fast, convenient, and affordable dining options.

QSRs require specialized kitchen equipment designed for high-volume cooking, fast food preparation, and quick turnaround times. With the rise of delivery services and takeout, QSRs are focusing on efficiency and speed, making the need for innovative cooking and food storage equipment more critical.

Additionally, the increasing popularity of fast-casual dining options and the shift in consumer preferences toward convenience-based food options are driving the expansion of the quick-service restaurants segment.

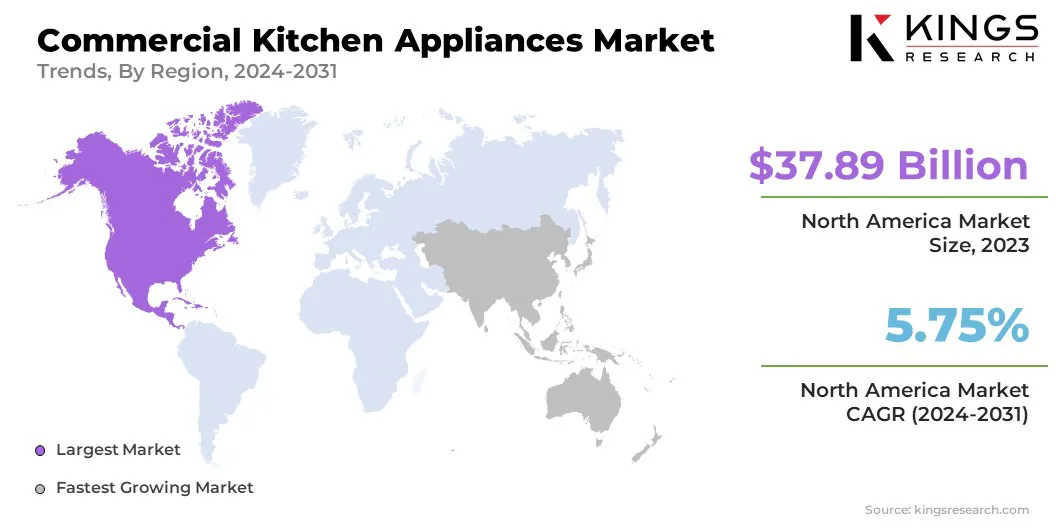

Commercial Kitchen Appliances Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, Middle East and AAfrica and Latin America.

North America accounted for 36.55% share of the commercial kitchen appliances market in 2023, with a valuation of USD 37.89 billion. The demand for commercial kitchen appliances is primarily driven by the growing number of restaurants, hotels, and foodservice establishments in the U.S. and Canada.

- According to the Restaurants Canada Organization, the foodservice industry in Canada is forecasted to witness a 4.9% increase in revenue in 2024 from 2023, reflecting the growing consumer preference for dining out and the subsequent need for efficient kitchen solutions to meet operational demands.

Additionally, the increasing focus on energy-efficient and high-performance kitchen equipment is contributing to the market growth. The rise in the adoption of advanced technologies such as smart appliances and automation in commercial kitchens is also a key factor driving the market in North America.

The well-established foodservice industry in the region and high consumer demand for convenience and innovation in food preparation equipment are expected to continue supporting the market's dominance.

The market in Asia Pacific is poised for significant growth at a robust CAGR of 6.20% over the forecast period. This is attributed to rapid urbanization, changing lifestyles, and the growing number of restaurants, cafés, and hotels in countries such as China, India, and Japan. The increasing middle-class population and rising disposable incomes in these countries are driving the demand for modern and efficient kitchen appliances in the foodservice sector.

- According to the Asian Development Bank, urbanization in the region is expected to add around 1.1 billion people to cities by 2040, further fueling the demand for advanced foodservice infrastructure and appliances to cater to the evolving consumer preferences and higher consumption patterns in urban areas.

Additionally, the growing trend of fast food and quick-service restaurants in urban areas is contributing to the market’s rapid expansion in the region. The APAC market is also seeing significant investments in the hospitality and foodservice industries, which are expected to further boost the demand for commercial kitchen appliances.

Competitive Landscape

The commercial kitchen appliances market report will provide valuable insights with an emphasis on the fragmented nature of the market. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, could create new opportunities for the market growth.

List of Key Companies in Commercial Kitchen Appliances Market

- Electrolux AB

- Middleby Corporation

- ITW Food Equipment Group

- Ali Group Worldwide

- Haier Inc.

- Welbilt, Inc.

- Samsung

- LG Electronics

- Fujimak Corporation

- Hoshizaki Corporation

Key Industry Developments

- September 2024 (Launch) – Electrolux Professional introduced the NeoBlue Touch, an energy and water-efficient undercounter dishwasher designed for commercial kitchens. This innovative model emphasizes sustainability while maintaining high performance in cleaning capabilities. The NeoBlue Touch features advanced technology that optimizes water and energy consumption, making it an eco-friendly choice for businesses.

- February 2023 (Launch) – Midea showcased its latest innovations at The NAFEM Show 2023, the premier event for food service equipment and supplies. The company introduced its highly advanced FlashChef High Speed Oven, Scan&Go Microwave, and commercial induction cooktops series, which are designed to effectively address the diverse needs of the food service industry.

The global commercial kitchen appliances market has been segmented as:

By Product Type

- Cooking Appliances

- Ovens

- Fryers

- Grills

- Others

- Refrigeration Equipment

- Refrigerators

- Freezers

- Ice Machines

- Food Preparation Appliances

- Mixer Grinders

- Food Processors

- Hand Blenders

- Others

By End-users

- Full-service Restaurants

- Quick-service Restaurants

- Hotels and Resorts

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

freqAskQues