enquireNow

Breathable Films Market

Breathable Films Market Size, Share, Growth & Industry Analysis, By Material Type (Polyethylene, Polypropylene, Polyurethane, Polyester, Others), By Film Type (Microporous Films, Monolithic Films), By End-Use Industry (Hygiene & Personal Care, Medical & Healthcare, Food Packaging, Others), and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: August 2025 | author: Versha V.

Market Definition

Breathable films are specialized thin polymer sheets made from polyethylene, polypropylene, or polyurethane that are engineered with microporous or monolithic structures to allow water vapor transmission while preventing the penetration of liquids, dust, and microorganisms.

These films are widely used in hygiene products, medical gowns, and drapes. They are also employed in protective clothing, construction membranes, and specialized packaging to ensure comfort, moisture control, and barrier protection.

Breathable Films Market Overview

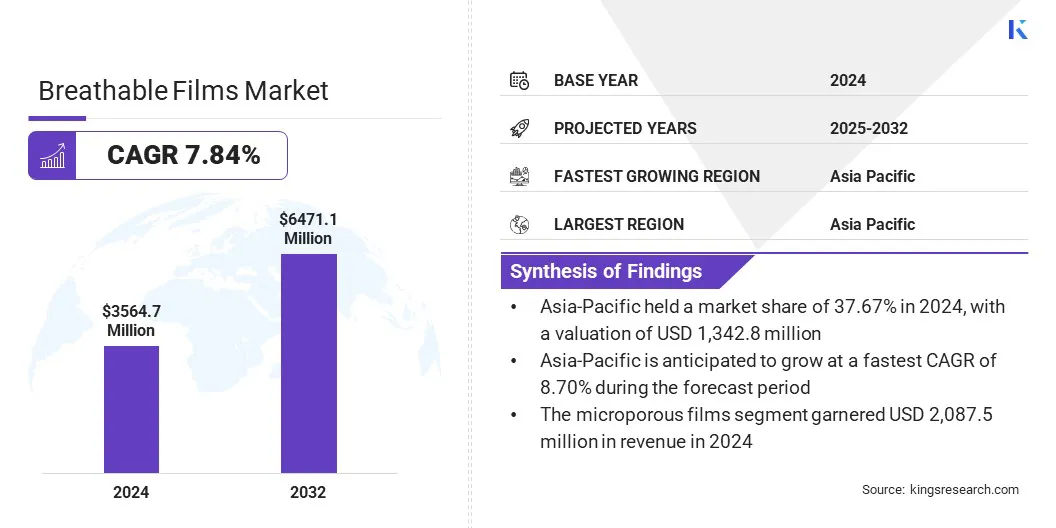

The global breathable films market size was valued at USD 3,564.7 million in 2024 and is projected to grow from USD 3,814.9 million in 2025 to USD 6,471.1 million by 2032, exhibiting a CAGR of 7.84% during the forecast period.

The market is driven by expansion of building and construction activities that increase the use of breathable films in roofing systems, wall wraps, and insulation layers to manage moisture and improve structural durability. The market is further expanding due to rising demand in hygiene and healthcare applications using breathable films in diapers, sanitary products, surgical drapes, and gowns to ensure comfort and liquid barrier performance.

Key Highlights:

- The breathable films industry size was recorded at USD 3,564.7 million in 2024.

- The market is projected to grow at a CAGR of 7.84% from 2025 to 2032.

- Asia Pacific held a market share of 37.67% in 2024, with a valuation of USD 1,342.8 million.

- The polyethylene segment garnered USD 1,342.1 million in revenue in 2024.

- The microporous films segment is expected to reach USD 3,979.7 million by 2032.

- The medical & healthcare segment is anticipated to witness the fastest CAGR of 9.75% over the forecast period.

- North America is anticipated to grow at a CAGR of 8.01% during the forecast period.

Major companies operating in the breathable films market are Arkema, Amcor plc, Exxon Mobil Corporation, Mitsui Chemicals, Inc., Nitto Denko Corporation, RKW Group, Dow, Toray Industries, Inc., Omya International AG, Kimberly-Clark Corporation, Cosmo Films, Daika Kogyo Co., Ltd., American Polyfilm, Inc., Rahil Foam Pvt. Ltd. and Trioworld Industrier AB.

Breathable Films Market Report Scope

|

Segmentation |

Details |

|

By Material Type |

Polyethylene, Polypropylene, Polyurethane, Polyester, Others |

|

By Film Type |

Microporous Films, Monolithic Films |

|

By End-Use Industry |

Hygiene & Personal Care, Medical & Healthcare, Food Packaging, Building & Construction, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Breathable Films Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for a market share of 37.67% in 2024, with a valuation of USD 1,342.8 billion. This dominance is driven by rapid capacity expansion of breathable film manufacturing facilities and increasing production efficiency by regional market players.

The market is witnessing growth as regional film manufacturers expand advanced production lines for BOPP, PET, and CPP films to support the rising demand from the packaging and personal care industries.

These developments are creating a steady supply base that enhances the availability of high-quality raw materials for breathable film production in the region, enabling manufacturers to scale output, reduce lead times, and capture growing demand across hygiene, medical, and packaging sectors.

- In May 2025, JPFL Films expanded its Nashik facility in Maharashtra, India, by adding new production lines for BOPP (Biaxially Oriented Polypropylene), PET (Polyethylene Terephthalate), and CPP (Cast Polypropylene) films. These high-performance film lines are aimed at enhancing efficiency and output, to strengthen the flexible packaging supply for food, personal care, and pharmaceutical applications across the Asia Pacific region.

North America is set to grow at a CAGR of 8.01% over the forecast period. This growth is attributed to the expansion of film manufacturing facilities and the production capabilities that are supporting medical, hygiene, and construction applications in the region. Players in the region are investing in advanced automated plants and sustainable operations to strengthen supply and meet rising demand, which is driving the expansion of the market.

Additionally, regional producers are improving the availability of specialized breathable films that enhance product performance and allow faster and more efficient delivery to customers. The market continues to benefit from expanded capacity and localized production as these factors ensure consistent supply and support wider use in medical, hygiene, and construction sectors, thereby driving market growth in the region.

- In June 2025, Pelsan Tekstil A.S. launched its first U.S. manufacturing facility in Goldsboro, North Carolina, to produce breathable polyethylene films for hygiene and medical applications. The new site, operated as Pelsan US, Inc., strengthens the company’s presence in North America and enhances supply capabilities through advanced automation and sustainable production practices.

Market Driver

Expansion of Building and Construction Activities

A major driver in the breathable films market is the expansion of building and construction activities driven by rapid urbanization and housing development. Builders and contractors are increasingly using breathable films in roofing systems, wall wraps, and insulation layers to manage moisture, improve energy efficiency, and protect structural integrity.

This growing focus on advanced building materials that provide vapor permeability while blocking water intrusion is prompting wider adoption of breathable films across residential, commercial, and infrastructure projects worldwide.

- In July 2025, the U.S. Census Bureau reported that building permits for new housing units reached a seasonally adjusted annual rate of 1,397,000. This steady level of residential construction activity is driving demand for advanced building materials, including breathable film used in roofing and wall wraps.

Market Challenge

High Production Costs of Advanced Films

A key challenge in the breathable films market is the high production costs associated with advanced film technologies. Manufacturing breathable films requires specialized raw materials, multilayer extrusion processes, and stringent quality control to achieve precise permeability and barrier properties.

These factors increase operational expenses and limit cost competitiveness compared to conventional films. Manufacturers with limited resources face difficulty in scaling production due to high capital investment, which hinders the adoption of breathable films.

To address this challenge, market players are increasingly investing in advanced manufacturing technologies, process automation, and material innovations to improve efficiency and reduce waste.

They are focusing on developing cost-effective formulations using thinner multilayer structures and recycled resins without compromising performance. Additionally, manufacturers are developing bio-based and sustainable raw materials to reduce costs and to meet the rising demand for eco‑friendly breathable films.

Market Trend

Expansion of Breathable Films into Nonwoven Composite Applications

A key trend in the breathable films market is the expansion of breathable films into nonwoven composite applications to enhance material functionality and diversify end-use. Producers are combining films with nonwoven substrates to create multi-layer structures that improve moisture control, durability, and barrier properties.

This is driving broader adoption of breathable films in hygiene, medical, construction, automotive, and agricultural sectors. These innovations are enabling manufacturers to extend the scope of applications and deliver solutions that meet varied industrial requirements.

- In April 2024, RKW Group showcased its range of nonwovens and specialty films, including the Aptra breathable film, at Techtextil 2024 in Mannheim, Germany. The company highlighted its hydroentangled spunbond nonwoven RKW HyJet, produced inline for the first time globally, designed for applications in personal care, automotive protection, insulation, and agriculture, along with other thermobonded nonwoven and laminate solutions.

Market Segmentation:

- By Material Type (Polyethylene, Polypropylene, Polyurethane, Polyester, and Others): The polyethylene segment earned USD 1,342.1 million in 2024 due to its wide availability, low cost, and extensive use in hygiene products, medical drapes, and construction.

- By Film Type (Microporous Films, and Monolithic Films): The microporous films segment held 58.56% of the market in 2024, due to their excellent breathability, moisture barrier properties, and strong adoption in diapers, sanitary products, and protective apparel.

- By End-Use Industry (Hygiene & Personal Care, Medical & Healthcare, Food Packaging, and Building & Construction): The hygiene & personal care segment is projected to reach USD 2,091.1 million by 2032, owing to the increasing consumption of disposable diapers, feminine hygiene products, and adult incontinence products worldwide.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates breathable films used in medical, healthcare, and hygiene products. It oversees material safety, biocompatibility, and performance to protect patients and consumers. It sets strict rules for films used in medical gowns, surgical drapes, diapers, and sanitary products to ensure compliance with the Federal Food, Drug, and Cosmetic Act.

- In the UK, the British Standards Institution (BSI) develops standards for breathable films in hygiene, healthcare, and construction. It publishes BS EN standards that define requirements for breathability, safety, and durability. These standards support compliance with UK safety laws for medical disposables and personal protective equipment.

- In China, the National Medical Products Administration (NMPA) regulates breathable films for medical and hygiene uses. It controls polymer composition, manufacturing quality, and labeling. It requires breathable films in healthcare disposables, medical apparel, and hygiene products to meet Chinese safety standards and testing protocols to protect users and ensure market compliance.

- In India, the Bureau of Indian Standards (BIS) sets standards for breathable films in hygiene, packaging, and construction. It defines product performance, moisture permeability, and polymer safety by issuing IS codes and certification schemes for breathable films used in medical disposables, sanitary products, and protective clothing sold in India.

Competitive Landscape

Market players in the breathable films industry are consolidating operations to expand expertise in material science and to improve film production capabilities. They are focusing on strengthening their positions in healthcare, hygiene, and consumer packaging applications by integrating resources and technologies.

Market players are working to enhance product development through broader research and innovation capabilities to meet evolving requirements for breathability and performance. Additionally, they are upgrading equipment, increasing plant capacities, and introducing new breathable film grades tailored for applications in hygiene, medical, construction, and apparel sectors.

- In April 2025, Amcor and Berry Global merged to create a packaging company with expanded material science and film production capabilities. This combination strengthens their positions in healthcare and consumer packaging, including breathable films used in hygiene and medical applications, and enhances innovation and global supply capabilities.

Key Companies in Breathable Films Market:

- Arkema

- Amcor plc

- Exxon Mobil Corporation

- Mitsui Chemicals, Inc

- Nitto Denko Corporation.

- RKW Group

- Dow

- TORAY INDUSTRIES, INC

- Omya International AG

- KIMBERLY-CLARK CORPORATION

- Cosmo Films

- Daika Kogyo Co.,Ltd.

- AMERICAN POLYFILM, INC.

- Rahil Foam Pvt. Ltd

- Trioworld Industrier AB

Recent Developments (Product Launch)

- In March 2025, SK Functional Polymer launched its LOTRYL 40MA05T copolymer designed to produce high-permeability breathable films used in membranes for housewrap and roofing underlayment applications. This enables adjustable moisture vapor transmission rates, improves process, and reduces costs by replacing copolyamide or copolyester.

freqAskQues