enquireNow

Breast Lesion Localization Market

Breast Lesion Localization Market Size, Share, Growth & Industry Analysis, By Type (Wire Localization, Radioisotope Localization, Magnetic Seed Localization, Electromagnetic Localization), By Usage (Breast Biopsy, Breast Conservation), By End User (Hospitals & Clinics, Diagnostic Centers, Ambulatory Surgical Centers), and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: August 2025 | author: Versha V.

Market Definition

Breast lesion localization involves techniques used to accurately identify and mark abnormal breast tissue prior to surgical removal or biopsy. These procedures support surgeons in precisely targeting non-palpable lesions, improving surgical accuracy and preserving healthy tissue.

The market includes a range of localization methods such as wire, radioisotope, magnetic seed, and electromagnetic systems tailored for diagnostic and therapeutic interventions. Applications span breast cancer diagnosis, breast-conserving surgeries, and image-guided biopsies across hospitals, ambulatory surgical centers, and diagnostic clinics.

Breast Lesion Localization Market Overview

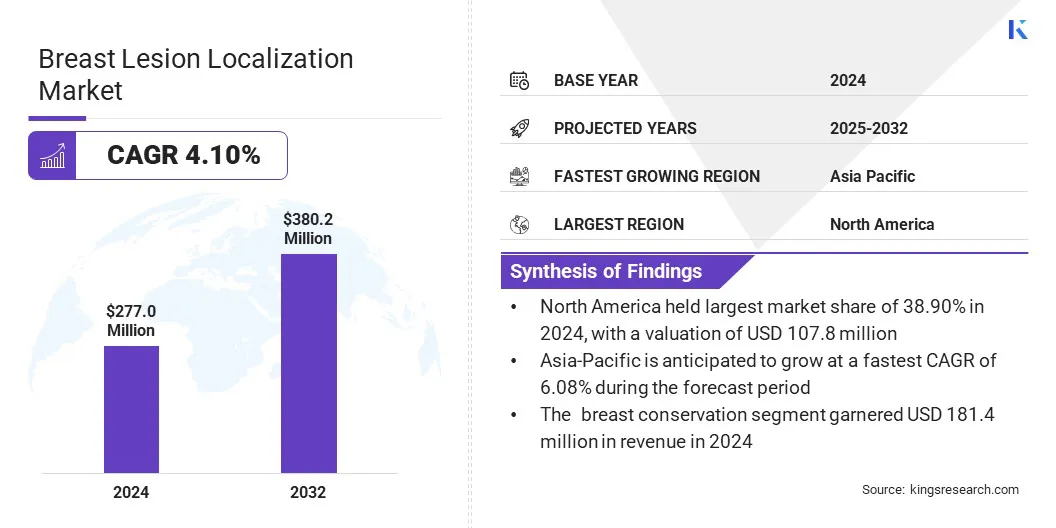

The global breast lesion localization market size was valued at USD 277 million in 2024 and is projected to grow from USD 286.9 million in 2025 to USD 380.2 million by 2032, exhibiting a CAGR of 4.10% during the forecast period. This growth is attributed to the rising incidence of breast cancer and the increasing preference for minimally invasive and breast-conserving surgical procedures.

According to an IARC study, breast cancer is expected to affect 1 in 20 women globally, with annual cases rising to 3.2 million and deaths to 1.1 million by 2050. The burden is expected to be greatest in countries with a low Human Development Index (HDI). Advancements in image-guided localization techniques, such as magnetic seed and electromagnetic systems, are supporting improved surgical precision and patient outcomes.

Key Highlights

- The breast lesion localization industry size was valued at USD 277 million in 2024.

- The market is projected to grow at a CAGR of 4.10% from 2025 to 2032.

- North America held a market share of 38.90% in 2024, valued at USD 107.8 million.

- The wire localization segment garnered USD 99.2 million in revenue in 2024.

- The breast conservation (Lumpectomy) segment is expected to reach USD 255.2 million by 2032.

- The ambulatory surgical centers segment is anticipated to witness the fastest CAGR of 7.25% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.08% through the projection period.

Major companies operating in the breast lesion localization market are Hologic, Inc., IZI Medical Products, BPB MEDICA, BD, Cook, Merit Medical Systems, Biomedical Srl, Stryker, Argon Medical Devices, Sirius Medical Systems B.V., Vigeo srl, MEDAX S.R.L., STERYLAB S.r.l., LauraneMedical.com, and Medline Industries, LP.

The shift toward non-wire localization technologies and the rise of outpatient procedures in ambulatory surgical centers are driving market adoption. Advancements in localization devices and expanding diagnostic infrastructure in emerging markets further support market growth.

- In April 2025, GE HealthCare showcased its newest breast imaging technologies at the SBI Symposium. The showcase featured the Pristina Via system, which offers low-dose, zero-click DBT capture. GE HealthCare also showcased SmartMammo, an AI-based tool designed to streamline lesion localization and improve accuracy in dense breast tissue.

Market Driver

Growing Adoption of Breast-Conserving Surgeries

The growth of the breast lesion localization market is propelled by the increasing adoption of breast-conserving surgeries as a preferred treatment for early-stage breast cancer. This clinical shift prioritizes the removal of cancerous tissue while preserving as much healthy breast tissue as possible, creating strong demand for accurate, minimally invasive localization techniques.

Surgeons are moving away from traditional wire-based methods in favor of advanced alternatives such as magnetic seed and radar reflector systems, which offer improved precision, scheduling flexibility, and reduced patient discomfort.

This transition is further supported by evolving clinical guidelines, improved imaging capabilities, and heightened patient awareness of cosmetic outcomes and quality of life after surgery. Healthcare providers are expanding access to early detection and outpatient surgical options, driving increased demand for precise lesion localization.

Market Challenge

High Cost & Limited Accessibility of Advanced Localization Technologies

High cost and limited accessibility of advanced localization technologies pose significant challenges to the growth of the breast lesion localization market, particularly in low- and middle-income regions. Newer techniques such as magnetic seed and radar reflector systems require specialized equipment, advanced imaging support, and trained personnel, leading to higher procedural and capital costs.

These financial demands create barriers for smaller hospitals and outpatient centers. This leads to slower adoption and limited availability of clinically advanced treatment methods. Budget limitations and lack of reimbursement in certain regions further constrain procurement and integration of these technologies into standard surgical workflows.

To address these challenges, manufacturers are developing cost-effective, wire-free solutions that integrate easily with existing imaging systems. Streamlined device designs, clinician training programs, and value-based reimbursement models are helping reduce adoption barriers. Public health initiatives and pilot programs are also expanding access in underserved regions.

Market Trend

Shift Toward Wire-Free Localization Technologies

Advancements in wire-free localization technologies are transforming the breast lesion localization market by improving procedural efficiency, surgical accuracy, and patient experience.

Magnetic seed, radar reflector, and electromagnetic systems enable precise lesion marking without the constraints of same-day surgery scheduling, reducing workflow disruptions and minimizing patient discomfort. These technologies are supporting better cosmetic outcomes and lowering reoperation rates in breast-conserving surgeries.

The ability to place localization devices days in advance offers greater flexibility to surgical teams and radiologists, optimizing operating room utilization. Integration with advanced imaging and navigation systems enhances real-time surgical guidance and lesion targeting.

The shift toward minimally invasive and outpatient care models is leading to a growing preference for wire-free localization solutions. These innovations are setting a new standard in breast cancer surgery, combining precision, convenience, and clinical effectiveness.

Breast Lesion Localization Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Wire Localization, Radioisotope Localization (Radio Guided Occult-Lesion Localization (ROLL), Radioactive-Seed Localization (RSL)), Magnetic Seed Localization, Electromagnetic Localization, and Others |

|

By Usage |

Breast Biopsy, and Breast Conservation (Lumpectomy) |

|

By End User |

Hospitals & Clinics, Diagnostic Centers, Ambulatory Surgical Centers, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Wire Localization, Radioisotope Localization, Magnetic Seed Localization, Electromagnetic Localization, and Others): The wire localization segment earned USD 99.2 million in 2024 due to widespread clinical acceptance, cost-effectiveness, and established use in breast-conserving surgeries.

- By Usage (Breast Biopsy, and Breast Conservation (Lumpectomy)): The breast conservation held 65.50% of the market in 2024, due to the rising preference for tissue-preserving surgeries and improved cosmetic outcomes in early-stage breast cancer treatment.

- By End User (Hospitals & Clinics, Diagnostic Centers, Ambulatory Surgical Centers, and Others): The hospitals & clinics segment is projected to reach USD 230.8 million by 2032, owing to their high patient volume, advanced surgical infrastructure, and widespread adoption of localization technologies for breast cancer treatment.

Breast Lesion Localization Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America breast lesion localization market share stood at 38.90% in 2024, valued at USD 107.8 million. This dominance is attributed to the region’s advanced healthcare infrastructure, early implementation of breast cancer screening programs, and strong clinical adoption of wire-free localization technologies.

Furthermore, the presence of key medical device manufacturers, favorable reimbursement frameworks, and ongoing investment in surgical innovation is driving the widespread deployment of next-generation localization systems.

In 2024, the American Cancer Society estimates that 310,720 new cases of invasive breast cancer will be diagnosed among women in the U.S., with 16% occurring in those under the age of 50, highlighting the need for effective and accessible localization solutions. Moreover, growing preference for breast-conserving surgeries, integration of image-guided techniques, and high procedural volumes across specialized cancer centers further contribute to the expansion of the market.

Asia-Pacific is poised for a CAGR of 6.08% over the forecast period. This growth is propelled by rising breast cancer prevalence, expanding access to healthcare services, and the modernization of diagnostic and surgical capabilities across developing countries.

Regional governments are investing in early detection programs and breast screening initiatives, which are boosting procedural volumes. The increasing adoption of wire-free and image-guided localization techniques in urban medical centers, along with greater patient awareness and demand for breast-conserving surgeries, is further supporting market development.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) regulates breast lesion localization systems as Class II medical devices under the 510(k) premarket notification process. This framework requires manufacturers to demonstrate substantial equivalence to an existing approved device, ensuring safety and effectiveness while enabling relatively faster market access.

- In the European Union, breast lesion localization devices are regulated under the Medical Device Regulation (EU MDR 2017/745). This regulation mandates CE marking based on conformity assessments, clinical evaluations, post-market surveillance, and Unique Device Identification (UDI) to ensure consistent safety and performance across member states.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) oversees the approval of breast lesion localization systems under the Act on Securing Quality, Efficacy and Safety of Products. Devices are classified by risk level, with Class II or III systems requiring rigorous clinical and technical evaluations before receiving Shonin or Ninsho certification.

Competitive Landscape

Companies operating in the breast lesion localization industry are focusing on developing advanced, wire-free localization technologies that enhance surgical accuracy, patient comfort, and workflow efficiency.

Leading players are investing in non-radioactive, minimally invasive solutions such as magnetic seed and radar-based systems to meet the growing demand for breast-conserving procedures and reduce dependence on traditional wire localization.

They are also leveraging strategic partnerships with hospitals, cancer centers, and imaging technology providers to drive clinical adoption, streamline integration with existing systems, and expand market access across key regions.

Additionally, manufacturers are pursuing regulatory approvals, expanding product portfolios, and entering distribution agreements to strengthen their global footprint, especially in emerging healthcare markets where breast cancer incidence and screening rates are rising.

- In November 2024, GE HealthCare and RadNet’s DeepHealth announced a collaboration to integrate AI-powered SmartMammo software into the Senographe Pristina mammography system. The partnership aims to improve diagnostic accuracy and streamline breast imaging workflows.

Key Companies in Breast Lesion Localization Market:

- Hologic, Inc.

- IZI Medical Products

- BPB MEDICA

- BD

- Cook

- Merit Medical Systems

- Biomedical Srl

- Stryker

- Argon Medical Devices

- Sirius Medical Systems B.V.

- Vigeo srl

- MEDAX S.R.L.

- STERYLAB S.r.l.

- LauraneMedical.com.

- Medline Industries, LP.

- Theragenics Corporation

- ILUMARK GmbH

Recent Developments (Partnerships)

- In February 2025, Mammotome partnered with Sirius Medical to distribute the Sirius Pintuition System in the U.S. and Germany. This wire-free, non-radioactive technology enables real-time surgical navigation for precise tumor localization. The collaboration strengthens Mammotome’s breast surgery portfolio and expands access to advanced localization tools..

freqAskQues