enquireNow

Bioconcrete Market

Bioconcrete Market Size, Share, Growth & Industry Analysis, By Form (Intrinsic, Capsule-Based, Vascular), By Application (Residential, Commercial, Industrial, Infrastructure), and Regional Analysis, 2025-2032

pages: 120 | baseYear: 2024 | release: August 2025 | author: Antriksh P.

Market Definition

Bioconcrete is a self-healing construction material that incorporates bacteria or other agents to naturally repair cracks upon contact with moisture and oxygen. It enhances the durability and lifespan of structures while reducing maintenance needs.

The market encompasses the development, production, and application across residential, commercial, and infrastructure projects, with rising use in bridges, tunnels, marine structures, and high-rise buildings to improve integrity and promote sustainable construction.

Bioconcrete Market Overview

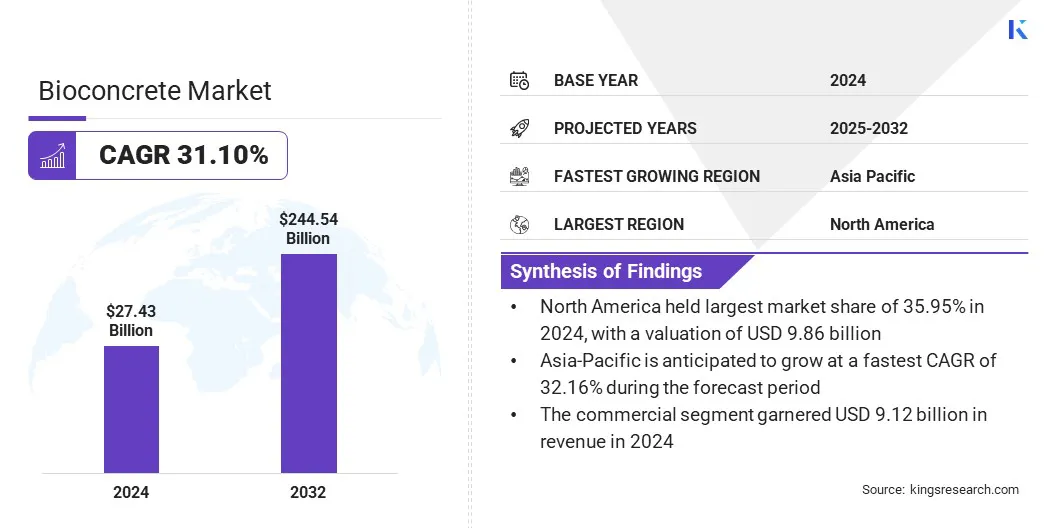

The global bioconcrete market size was valued at USD 27.43 billion in 2024 and is projected to grow from USD 35.48 billion in 2025 to USD 244.54 billion by 2032, exhibiting a CAGR of 31.10% during the forecast period.

This growth is fueled by the rising demand for sustainable and durable materials, along with the integration of microbial and enzymatic technologies that are transforming construction. These innovations are enhancing self-healing efficiency and expanding applications across infrastructure, marine, and high-performance building projects.

Key Highlights:

- The bioconcrete industry was recorded at USD 27.43 billion in 2024.

- The market is projected to grow at a CAGR of 31.10% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 9.86 billion.

- The capsule-based segment garnered USD 10.59 billion in revenue in 2024.

- The infrastructure segment is anticipated to witness the fastest CAGR of 31.47% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 32.16% through the projection period.

Major companies operating in the bioconcrete market are ACCIONA, Biomason, Akzo Nobel N.V., Basilisk, BASF SE, Breedon Group plc, Prometheus Materials, Inc, Xypex Chemical Corporation, Cemex S.A.B DE C.V., HOLCIM, Sika AG, UltraTech Cement Ltd., Wacker Chemie AG, Corbion, and Kryton International Inc..

Advancements in cost-effective large-scale production methods offer significant growth opportunity. High manufacturing costs are limiting widespread adoption, particularly in cost-sensitive construction sectors. Processe improvements, including optimizing bacterial cultivation, improving material sourcing, and streamlining curing techniques, can significantly reduce overall expenses.

Scaling production without compromising quality will improve competitiveness with traditional concrete, promoting adoption by contractors, developers, and governments. Additionally, cost-efficient manufacturing can pave the way for wider use in infrastructure rehabilitation projects, affordable housing developments, and public works, ultimately positioning bioconcrete as both an economically and environmentally favorable solution in the global construction industry.

- In August 2024, ACCIONA announced plans to utilize over 48,000 tons of low-carbon concrete with type IIIA cement for constructing caissons in the Port of Cadiz container terminal expansion. This underscores the company's commitment to sustainable and environmentally responsible port infrastructure development.

Market Driver

Rising Demand for Sustainable and Durable Construction Materials

The rising demand for sustainable and durable construction materials is fueling the growth of the bioconcrete market. Urban expansion, environmental concerns, and the global shift toward net-zero carbon emissions have led to a strong preference for materials that reduce lifecycle costs and environmental impact.

Bioconcrete combines self-healing properties, enhanced structural resilience, and reduced maintenance requirements, addressing key market needs. It supports green building certifications, minimizes resource wastage, and extends infrastructure lifespan.

These advantages are prompting increased adoption in critical sectors such as transportation, water management, and large-scale infrastructure, supportng a shift toward more sustainable construction practices worldwide.

- In April 2023, ACCIONA and Orsted signed an MOU to co-develop cost-competitive, large-scale foundation solutions for offshore wind farms. The collaboration aims to leverage floating concrete platforms and sustainable materials such as bio-cement and bioconcrete, combining Orsted’s offshore wind expertise with ACCIONA’s capabilities in large-scale construction and concrete structures.

Market Challenge

High Initial Production Costs

High initial production costs present a major challenge to the progress of the bioconcrete market. The inclusion of specialized bacterial cultures, nutrient compounds, and controlled curing processes significantly increases manufacturing expenses compared to conventional concrete.

Additionally, limited large-scale production facilities and the need for advanced biotechnology infrastructure elevate costs, making the material less accessible in price-sensitive markets. This cost barrier restricts its adoption in low-budget projects and developing regions, despite its long-term economic and environmental benefits.

To address this challenge, market players are focusing on industry collaboration, process optimization, and investment in scalable manufacturing technologies. Improved production efficiency improves and economies of scale can reduce costs, enhancing market reach and competitiveness.

Furthermore, implementing automated manufacturing, optimizing bacterial strain cultivation, and expanding production capacity through strategic partnerships can significantly lower unit costs, enhancing affordability and accelerating adoption across diverse construction sectors.

Market Trend

Increasing Integration of Microbial and Enzymatic Technologies in Bioconcrete Production

The increasing integration of microbial and enzymatic technologies in bioconcrete production is significantly improving performance and durability. Advanced biotechnological approaches enable the use of specific bacterial strains and enzymes that function effectively in harsh environments and activate healing processes more efficiently. This integration enhances the speed and extent of crack sealing, ensuring structural longevity even in demanding conditions such as high salinity or extreme temperature fluctuations.

These innovations are fostering customized formulations for applications such as marine structures, tunnels, and high-rise buildings. This is expanding applications and strengthening market competitiveness.

- In July 2024, Researchers at the Fraunhofer Institute for Ceramic Technologies and Systems IKTS and the Fraunhofer Institute for Electron Beam and Plasma Technology FEP developed an eco-friendly, biologically induced method for producing biogenic construction materials under the “BioCarboBeton” project, enabling the permanent binding of carbon dioxide within the material.

Bioconcrete Market Report Snapshot

|

Segmentation |

Details |

|

By Form |

Intrinsic, Capsule-Based, Vascular |

|

By Application |

Residential, Commercial, Industrial, Infrastructure |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Form (Intrinsic, Capsule-Based, and Vascular): The capsule-based segment captured the largest share of 38.61% in 2024, primarily attributed to its ease of incorporation into concrete mixes, controlled bacterial activation, and higher reliability in achieving consistent self-healing performance across diverse construction applications.

- By Application (Residential, Commercial, Industrial, and Infrastructure): The infrastructure segment is poised to record a staggering CAGR of 31.47% through the forecast period, mainly due to rapid urbanization, substantial public infrastructure investments, and growing adoption of sustainable, long-lasting materials in bridges, highways, and water management systems.

Bioconcrete Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America bioconcrete market accounted for a share of 35.95%, valued at USD 9.86 billion in 2024. This dominance is reinforced by infrastructure modernization, rising adoption of sustainable construction practices, and supportive regulatory frameworks. The region’s focus on extending the lifespan of critical assets such as bridges, tunnels, and marine structures has accelerated the adoption of self-healing materials.

Strong R&D investments, coupled with the presence of advanced biotechnology and construction industries, further strengthen this position. Additionally, government-backed sustainability programs and green building certifications continue to promote bioconcrete over conventional alternatives.

- In August 2023, Prometheus Materials reported exceptional ASTM C423 sound-absorption test results for its bio-cement and bio-concrete technology, reinforcing its position in zero-carbon building solutions that outperform traditional portland cement in both sustainability and performance.

The Asia-Pacific bioconcrete industry is projected to grow at the highest CAGR of 32.16% in the forthcoming years. This growth is mainly fueled by rapid urbanization, large-scale infrastructure development, and increasing government initiatives promoting sustainable construction. Countries in the region are investing heavily in transportation networks, water management systems, and coastal protection projects, creating significant opportunities for bioconcrete adoption.

The rising need to combat environmental degradation and enhance the resilience of structures against harsh weather conditions further supports regional market growth. Moreover, the relatively low penetration of self-healing materials presents untapped potential for both domestic and international suppliers.

Regulatory Frameworks

- In the European Union, the Construction Products Regulation (EU) No 305/2011 regulates the harmonized marketing of construction products. It ensures that bioconcrete used in EU construction projects meets uniform safety, environmental, and performance standards.

- In the U.S., the Environmental Protection Agency’s Clean Air Act monitors emissions from cement and concrete production. It promotes the use of low-carbon materials such as bioconcrete to reduce air pollutants and greenhouse gas emissions in construction activities.

- In India, the Bureau of Indian Standards IS 456:2000 oversees plain and reinforced concrete usage. It provides structural guidelines that bioconcrete formulations must meet for safe and durable construction practices.

- In Australia, the National Construction Code (NCC) regulates building and construction material standards. It supports the integration of innovative materials such as bioconcrete, ensuring compliance with safety, sustainability, and performance benchmarks.

- In Canada, the Canadian Standards Association CSA A23.1/A23.2 monitors concrete materials and methods of construction. It establishes testing, quality control, and durability criteria that are directly applicable to bioconcrete adoption.

Competitive Landscape

Key players in the bioconcrete industry are adopting strategic measures to strengthen market presence and accelerate product adoption. Many companies are investing in advanced R&D to enhance self-healing efficiency, reduce production costs, and expand application scope. Strategic collaborations with construction firms, research institutions, and infrastructure developers are enabling faster commercialization and project-specific innovations.

Expansion into high-growth regions, supported by localized manufacturing facilities, is reducing supply chain costs and improving responsiveness. Companies are aligning with sustainability goals by meeting stringent environmental regulations, securing green building certifications, and offering climate-specific solutions. These efforts, supported by continuous technological innovation and market diversification, are critical for sustaining competitiveness and ensuring long-term growth.

- In April 2025, Sika invested in Giatec Scientific Inc., aimed at enhancing its digital strategy to advance smart testing, AI-driven solutions, and sustainable concrete practices. The initiative aims to improve industry efficiency and reduce carbon footprint across the construction lifecycle.

Key Companies in Hydrogen Rocket Engine Market:

- ACCIONA

- Biomason

- Akzo Nobel N.V.

- Basilisk

- BASF SE

- Breedon Group plc

- Prometheus Materials, Inc

- Xypex Chemical Corporation

- Cemex S.A.B DE C.V.

- HOLCIM

- Sika AG

- UltraTech Cement Ltd.

- Wacker Chemie AG

- Corbion

- Kryton International Inc.

Recent Developments (Partnerships)

- In September 2023, Biomason partnered with GXN to advance its Biocement technology for sustainable concrete production. The collaboration intends to develop a high-performance binder that reduces carbon emissions and supports the scaling of eco-friendly solutions for diverse construction applications.

freqAskQues