buyNow

Autonomous Agents Market

Autonomous Agents Market Size, Share, Growth & Industry Analysis, By Component (Platform, Services), By Deployment Mode (Cloud-Based, On-Premise), By Organization Size (Large Enterprises, Small & Medium-Sized Enterprises (SMEs)), By End-use Industry (BFSI, Healthcare & Life Sciences, Manufacturing), and Regional Analysis, 2025-2032

pages: 210 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Autonomous agents are intelligent software systems that operate independently to perform tasks, make decisions, and interact with their environment without human input. The market includes AI-powered bots, multi-agent systems, robotic process automation tools, autonomous vehicles, and virtual assistants to streamline operations, enhance user experiences, and drive automation.

It also covers the development, deployment, and integration of these agents across manufacturing, logistics, financial services, healthcare, and smart infrastructure.

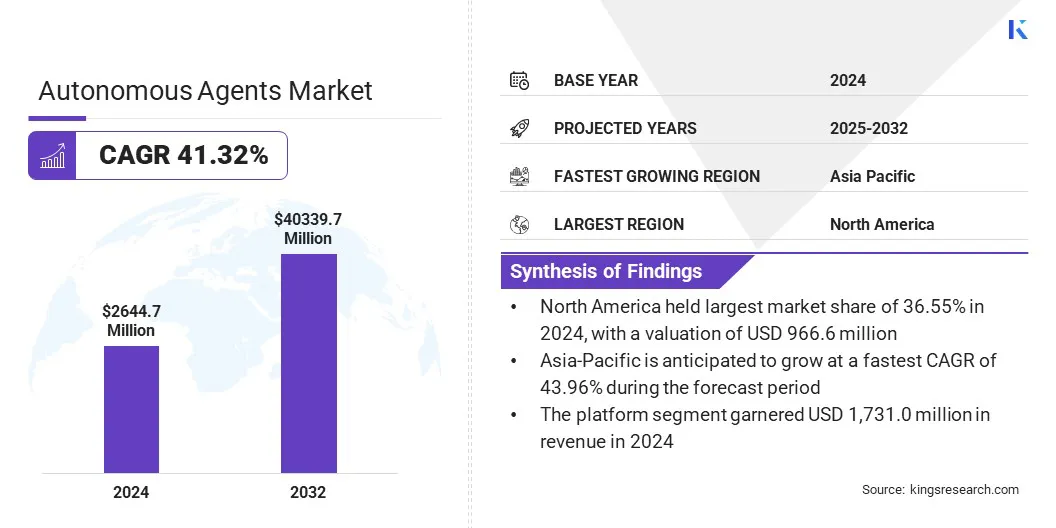

The global autonomous agents market size was valued at USD 2,644.7 million in 2024 and is projected to grow from USD 3,583.5 million in 2025 to USD 40,339.7 million by 2032, exhibiting a CAGR of 41.32% during the forecast period.

This growth is attributed to the increasing adoption of autonomous agents across manufacturing, finance, healthcare, and transportation sectors. Rising demand for intelligent automation, real-time decision-making, and adaptive systems is acceleratig their use in applications such as smart robotics, algorithmic trading, and autonomous vehicles.

Key Highlights

- The autonomous agents industry size was valued at USD 2,644.7 million in 2024.

- The market is projected to grow at a CAGR of 41.32% from 2025 to 2032.

- North America held a share of 36.55% in 2024, valued at USD 966.6 million.

- The platform segment garnered USD 1,731.0 million in revenue in 2024.

- The cloud-based segment is expected to reach USD 26,246.1 million by 2032.

- The small & medium-sized enterprises (SMEs) segment is anticipated to witness the fastest CAGR of 45.31% over the forecast period.

- The BFSI segment garnered USD 966.4 million in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 43.96% over the forecast period.

Major companies operating in the autonomous agents market are Microsoft, IBM, Salesforce, Inc., SAS Institute Inc., Amazon Web Services, Inc., SAP SE, C3.ai, Inc., Oracle, Fetch.ai., Aptiv, Google LLC, NVIDIA Corporation, Nuance Communications, Inc., ABB, and Leena AI Inc.

Autonomous Agents Market Report Scope

|

Segmentation |

Details |

|

By Component |

Platform, and Services |

|

By Deployment Mode |

Cloud-Based, and On-Premise |

|

By Organization Size |

Large Enterprises, and Small & Medium-Sized Enterprises (SMEs) |

|

By End-use Industry |

BFSI, Retail & E-Commerce, Healthcare & Life Sciences, IT & Telecommunications, Manufacturing, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Autonomous Agents Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America autonomous agents market share stood at 36.55% in 2024, valued at USD 966.6 million. This dominance is reinforced by the region’s strong innovation ecosystem, early adoption of autonomous technologies, and the presence of major AI and software companies driving platform development and deployment.

Increasing investments in automation across finance, healthcare, and logistics, along with supportive regulatory frameworks and funding for AI research, further support the integration of autonomous agents in commercial and enterprise applications.

The region’s focus on digital transformation, operational efficiency, and real time, data-driven decision making supports its leading position. Growing demand for intelligent automation, cloud infrastructure expansion, and continuous advancements in machine learning and natural language processing are further fueling regional market expansion.

- In November 2024, ThoughtSpot, a U.S.-based company, introduced Spotter, an autonomous AI-powered analytics agent designed to deliver proactive, conversational insights across enterprise environments. Spotter enables natural language interactions with structured data and integrates seamlessly with platforms such as Salesforce, ServiceNow, and other business applications.

The Asia-Pacific autonomous agents industry is set to grow at a CAGR of 43.96% over the forecast period. This growth is propelled by rapid digital transformation, rising automation demands across manufacturing and service sectors, and the increasing adoption of AI technologies.

The region’s expanding tech ecosystem, coupled with strong investment in robotics, smart infrastructure, and industrial IoT, is boosting the deployment of autonomous agents across various high-growth markets. Government initiatives supporting AI innovation, digital skill development, and automation in public services are further aiding domestic market expansion.

Moreover, the growing demand for cost-efficient, cloud-based solutions and increased focus on improving operational efficiency are accelerating adoption among small and medium-sized enterprises. A surge in AI-focused startups, expanding research collaborations, and emphasis on technological self-reliance are positioning Asia-Pacific as a major region for autonomous agent advancements.

Autonomous Agents Market Overview

The growing emphasis on operational efficiency, personalized user experiences, and scalable AI solutions is fueling market expansion. Additionally, advancements in machine learning, natural language processing, multi-agent frameworks, and integration with IoT ecosystems, along with expanding investments in digital transformation initiatives, are fostering market development.

- In October 2024, Microsoft introduced a new set of autonomous agents within Copilot Studio and Dynamics 365, aimed at streamlining business operations through intelligent automation. These prebuilt AI agents handle tasks such as lead management, vendor communication, finance reconciliation, and customer service, while allowing users to create custom agents with no coding required through the Copilot Studio public preview.

Market Driver

Increasing Demand for Automation Across Industries

The growth of the autonomous agents market is fueled by the increasing demand for automation across industries focused on enhancing efficiency, reducing operational costs, and minimizing reliance on manual processes.

Businesses are adopting autonomous agents to handle repetitive and time-sensitive tasks, enable real-time decision-making, and maintain consistent performance across large-scale operations. Manufacturing, logistics, finance, and telecommunications are adopting these technologies to improve accuracy, streamline workflows, and respond swiftly to changing conditions.

This transition is further supported by persistent labor shortages, rising workforce costs, and the expanding need to process real-time data. The rising focus on digital transformation and the shift toward intelligent, self-adaptive systems are prompting organizations to invest in advanced automation tools, accelerating the deployment of autonomous agents across global markets.

- In September 2024, ReliaQuest launched an autonomous, self-learning AI agent for security operations within its GreyMatter platform. The agent automates threat detection, investigation, and response, improving speed and accuracy while reducing manual workload across Tier 1 and Tier 2 tasks.

Market Challenge

Data Bias and Ethical Considerations

Data bias and ethical considerations present significant challenges to the growth of the autonomous agents market, particularly in high-stakes sectors such as finance, healthcare, and public services.

Autonomous agents trained on skewed or non-representative datasets can produce biased or discriminatory outcomes, affecting trust and performance. Ethical concerns surrounding accountability, decision transparency, and the delegation of sensitive tasks to machines further limit the adoption and regulatory compliance. The limited explainability of AI systems raises concerns about their reliability and appropriate use.

To overcome these challenges, developers are focusing on building transparent, explainable models, along with fairness-aware machine learning practices. Regulatory bodies and industry leaders are establishing ethical guidelines and compliance frameworks to ensure responsible development and use.

Cross-sector collaboration, diverse data sourcing, and human-in-the-loop systems are being implemented to minimize bias, enhance oversight, and foster public trust in autonomous agent technologies.

Market Trend

Advancements in Artificial Intelligence and Machine Learning

Advancements in artificial intelligence and machine learning are influencing the autonomous agents market by enabling greater adaptability, real-time decision-making, and task automation across dynamic environments.

Innovations in deep learning, reinforcement learning, and natural language processing are allowing autonomous agents to understand context, learn from interactions, and improve their performance with minimal human oversight. These technologies are expanding the scope of autonomous agents in autonomous driving, predictive maintenance, intelligent customer support, and algorithmic trading.

The integration of AI-powered models is enhancing agents' ability to process unstructured data, recognize patterns, and respond to complex stimuli with high accuracy. Additionally, the use of federated learning, edge AI, and self-supervised learning techniques is improving scalability, privacy, and processing speed, crucial for development in decentralized and real-time systems.

- In March 2025, Wipro launched new autonomous agent solutions for the healthcare industry using Salesforce’s Agentforce platform. These AI-powered agents are designed to automate provider onboarding, credential verification, and administrative workflows, helping healthcare organizations improve operational efficiency and enhance patient service delivery.

Market Segmentation

- By Component (Platform and Services): The platform segment earned USD 1,731.0 million in 2024, due to the growing demand for scalable AI-driven solutions that enable real time decision making and automation across industries.

- By Deployment Mode (Cloud-Based and On-Premise): The cloud-based segment held a share of 43.10% in 2024, fueled by the increasing adoption of flexible, scalable, and cost-efficient deployment models that support real time updates and remote accessibility for autonomous agent applications.

- By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises (SMEs)): The small & medium-sized enterprises (SMEs) segment is projected to reach USD 21,164.8 million by 2032, owing to the rising demand for affordable, cloud-based autonomous agent solutions that enhance operational efficiency and competitiveness without requiring extensive infrastructure investments.

- By End-use Industry (BFSI, Retail & E-Commerce, Healthcare & Life Sciences, IT & Telecommunications, Manufacturing, and Others): The healthcare & life sciences segment is anticipated to grow at a CAGR of 48.13% through the projection period, mainly propelled by the rising use of autonomous agents for diagnostics, virtual assistance, and workflow automation.

Regulatory Frameworks

- In the European Union, the Artificial Intelligence Act regulates autonomous agents through a risk-based framework that classifies high-risk AI. It requires transparency, human oversight, and conformity assessments to ensure safety, accountability, and alignment with fundamental rights.

- In the U.S., the Algorithmic Accountability Act regulates automated decision systems. It mandates impact assessments for AI systems, including autonomous agents used in critical sectors, to address risks related to privacy, bias, and discrimination.

Competitive Landscape

Major companies operating in the autonomous agents industry are striving to strengthen their market position through innovation in intelligent automation and adaptive decision-making capabilities. Key players are focused on developing AI-driven platforms, enhancing real time data processing, and offering scalable, cloud-based solutions tailored to industry-specific applications across finance, healthcare, manufacturing, and logistics.

Additionally, these companies are adopting strategic acquisitions, research collaborations, and regional expansion initiatives to diversify their offerings and meet evolving enterprise automation needs. This dynamic competitive environment fosters continuous advancement in autonomous agent technologies, with vendors emphasizing interoperability, explainability, and secure integration to differentiate their solutions in a rapidly evolving digital landscape.

- In September 2024, Salesforce partnered with IBM to deliver AI-powered autonomous agents that improve decision-making, productivity, and efficiency. The collaboration integrates Salesforce’s Agentforce with IBM’s watsonx Orchestrate and Granite models, enabling enterprises to automate multistep workflows across sales, service, HR, and finance while ensuring secure, compliant data integration.

List of Key Companies in Autonomous Agents Market:

- Microsoft

- IBM

- Salesforce, Inc.

- SAS Institute Inc.

- Amazon Web Services, Inc.

- SAP SE

- C3.ai, Inc.

- Oracle

- Fetch.ai.

- Aptiv

- Google LLC

- NVIDIA Corporation

- Nuance Communications, Inc.

- ABB

- Leena AI Inc.

Recent Developments (Product Launch)

- In February 2025, Zoho unveiled Zia Agents, a new autonomous agent platform featuring Agent Studio and Agent Marketplace. These solutions empower businesses to deploy task-specific digital agents such as those for sales, HR, IT help desk, and customer support across their suite of over 100 applications. It supports no-code/low-code custom agent development and broad distribution via a marketplace, while ensuring data privacy through Zoho’s secure, in‑house infrastructure.

- In September 2024, Salesforce, Inc. launched Agentforce, a new AI-powered digital labor platform that delivers autonomous agents within its ecosystem. These agents can analyze enterprise data, execute multi-step workflows, and take context-aware actions, enabling automation of tasks such as lead nurturing and case resolution across Salesforce and connected applications.

freqAskQues