buyNow

5G Chipset Market

5G Chipset Market Size, Share, Growth & Industry Analysis, By Type (Modem Chips, Application-Specific Integrated Circuits, Radio Frequency Integrated Circuit, Millimeter Wave Technology Chips, Others), By Frequency, By Deployment, By End-Use Industry, and Regional Analysis, 2025-2032

pages: 160 | baseYear: 2024 | release: July 2025 | author: Sharmishtha M.

Market Definition

A 5G chipset is a set of integrated circuits that empowers devices such as smartphones, routers, laptops, autonomous vehicles, and IoT equipment to connect seamlessly to 5G networks, delivering significantly faster data speeds, ultra-low latency, and enhanced network reliability.

The market includes the design, development, manufacturing, and distribution of these chipsets, supporting a wide range of applications across consumer electronics, industrial automation, smart cities, healthcare, and automotive sectors. .

5G Chipset Market Overview

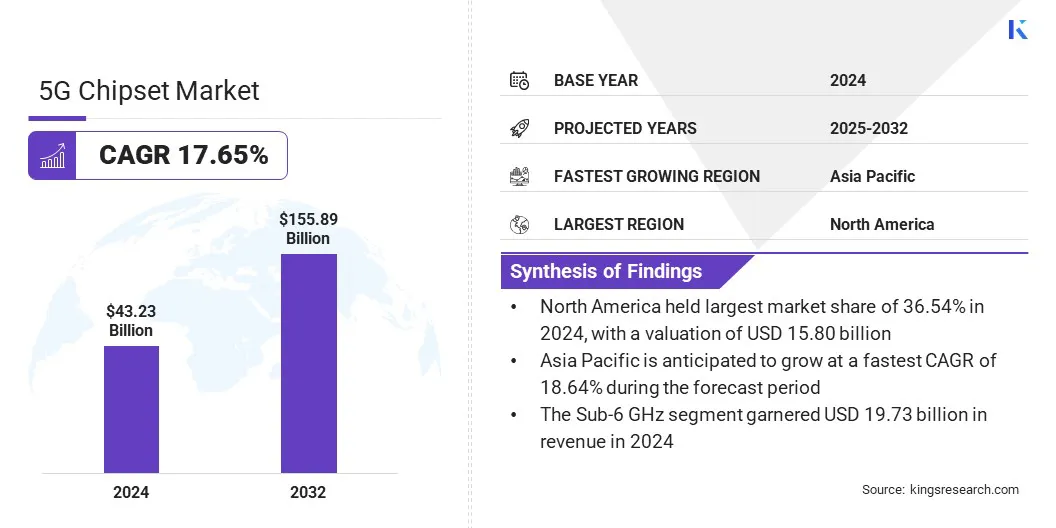

Global 5G chipset market size was valued at USD 43.23 billion in 2024, which is estimated to be valued at USD 49.95 billion in 2025 and reach USD 155.89 billion by 2032, growing at a CAGR of 17.65% from 2025 to 2032.

The growth of the market is driven by the expansion of the 5G ecosystem, with increasing participation from OEM and ODM device makers. Their innovations are boosting demand for 5G-enabled modules in CPEs, mobile routers, industrial devices, and connected infrastructure.

Key Highlights:

- The 5G chipset industry size was recorded at USD 43.23 billion in 2024.

- The market is projected to grow at a CAGR of 17.65% from 2025 to 2032.

- North America held a market share of 36.54% in 2024, with a valuation of USD 15.80 billion.

- The modem chips segment garnered USD 14.80 billion in revenue in 2024.

- The 24-39 GHz segment is expected to reach USD 67.31 billion by 2032.

- The smartphones segment held a market of 36.55% in 2024.

- The healthcare segment is anticipated to have a CAGR of 19.21% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 18.64% during the forecast period.

Major companies operating in the 5G chipset market are Huawei Technologies Co., Ltd., MediaTek, Intel Corporation, Samsung, Infineon Technologies AG, Qualcomm Technologies, Inc., Qorvo, Inc, Murata Manufacturing Co., Ltd., MACOM, Analog Devices, Inc., Anokiwave, Inc, GCT Semiconductor Holding Inc., Apple Inc., Sivers Semiconductors AB, and UNISOC Technologies Co., Ltd..

The market is experiencing rapid growth, driven by increasing demand for high-speed, low-latency connectivity across sectors such as telecommunications, automotive, industrial automation, and aviation. These chipsets are crucial in enabling devices to access next-generation 5G networks, supporting enhanced mobile broadband, ultra-reliable communication, and massive IoT deployment.

Ongoing advancements in semiconductor technologies, rising investments in 5G infrastructure, and the global shift towards digitalization are further fueling market expansion, making 5G chipsets a vital component of the evolving digital ecosystem.

- In June 2025, Gogo and GCT Semiconductor achieved a breakthrough in the market by successfully completing the first 5G end-to-end call for air-to-ground connectivity. This milestone validates the performance of Gogo’s 5G Aircard system and highlights the growing role of advanced chipsets in enabling high-speed, reliable in-flight broadband for business aviation across North America.

Market Driver

Expansion of the 5G Ecosystem

The growth of the 5G chipset market is driven by the expanding ecosystem of original equipment manufacturers (OEMs) and original design manufacturers (ODMs), that are actively developing a wide range of 5G-compatible devices. This includes consumer premises equipment (CPEs), mobile routers, ruggedized phones, industrial IoT systems, and other smart connectivity solutions.

As businesses and consumers demand faster, more reliable wireless connectivity, the manufacturers are scaling production and innovation. The integration of 5G chipsets across diverse applications is crucial in accelerating adoption and driving sustained market expansion globally.

- In August 2024, GCT Semiconductor signed an MoU with Samsung to accelerate the development of 4G/5G chipsets and modules and strengthen its global ecosystem. The collaboration aims to enhance adoption by device makers, support wireless operators worldwide, and expand advanced connectivity solutions for critical applications such as public safety and industrial IoT.

Market Challenge

High Development Costs

A major challenge in the 5G chipset market is the high development cost involved in designing and manufacturing advanced chipsets. This includes significant investment in research and development, testing, and infrastructure to meet evolving performance standards.

To address this, companies are forming strategic partnerships, leveraging shared R&D capabilities, and exploring cost-efficient semiconductor manufacturing techniques. Additionally, government incentives and funding programs aimed at boosting local chip production are helping to ease financial burdens and accelerate innovation in the 5G chipset ecosystem.

Market Trend

Integration of AI Capabilities

A key trend witnessed in the 5G chipset market is the integration of on-device AI capabilities, which is transforming user experiences across applications. Modern 5G chipsets now feature built-in AI engines that enhance photography through real-time image processing, optimize gaming by reducing latency and improving graphics, and boost productivity with intelligent task management.

AI integration is enabling faster, more efficient operations directly on the device, reducing dependence on cloud processing and paving the way for smarter, more responsive mobile and connected experiences.

- In February 2025, Qualcomm introduced the Snapdragon 6 Gen 4 Mobile Platform, with a next-generation 5G chipset designed to deliver enhanced performance, improved battery life, and ultra-fast connectivity. The platform strengthens Qualcomm’s position in the market with its upgraded CPU, GPU, and AI capabilities and brings premium experiences such as advanced gaming, seamless productivity, and high-quality multimedia to mid-tier smartphones globally.

5G Chipset Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Modem Chips, Application-Specific Integrated Circuits, Radio Frequency Integrated Circuit, Millimeter Wave Technology Chips, Others |

|

By Frequency |

Sub-6 GHz, 24-39 GHz, Above 39 GHz |

|

By Deployment |

Smartphones, Connected Vehicles, Connected Devices, Broadband Access Gateway Devices, Others |

|

By End-Use Industry |

Manufacturing, Energy & Utilities, Media & Entertainment, Healthcare, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Modem Chips, Application-Specific Integrated Circuits, Radio Frequency Integrated Circuit, Millimeter Wave Technology Chips, and Others): The modem chips segment earned USD 14.80 billion in 2024 due to rising integration of 5G modems in smartphones, laptops, and IoT devices to support ultra-fast data connectivity.

- By Frequency (Sub-6 GHz, 24-39 GHz, and Above 39 GHz): The sub-6 GHz segment held 45.65% of the market in 2024, due to its wider coverage, lower latency, and compatibility with existing infrastructure across developed and developing regions.

- By Deployment (Smartphones, Connected Vehicles, Connected Devices, Broadband Access Gateway Devices, and Others): The smartphones segment is projected to reach USD 51.39 billion by 2032, owing to mass adoption of 5G phones, falling chipset costs, and growing demand for high-speed mobile internet.

- By End-Use Industry (Manufacturing, Energy & Utilities, Media & Entertainment, Healthcare, and Others): The healthcare segment is anticipated to have a CAGR of 19.21% during the forecast period, driven by 5G-enabled remote surgeries, real-time patient monitoring, and enhanced telemedicine capabilities.

5G Chipset Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America 5G chipset market share stood at 36.54% in 2024 in the global market, with a valuation of USD 15.80 billion. North America’s dominance in the market is attributed to the technological advancements, presence of key players, and early deployment of 5G infrastructure.

- According to 5G Americas, the region is expected to have approximately 420 million 5G users, highlighting massive adoption across consumer and enterprise segments.

The region also benefits from high smartphone penetration, robust R&D investments, and increasing adoption of 5G-enabled applications across sectors such as automotive, healthcare, and industrial automation. Additionally, supportive government initiatives and growing demand for high-speed connectivity in both urban and rural areas continue to fuel market growth and maintain North America’s leadership position.

Asia Pacific 5G chipset industry is poised for significant growth at a robust CAGR of 18.64% over the forecast period. Asia Pacific is the fastest growing region in the market, driven by large-scale adoption of 5G technology across countries like China, India, South Korea, and Japan.

- According to a March 2025 report by the Indian Ministry of Communications, over 250 million mobile subscribers in the country are using 5G services, supported by the installation of 46,900 thousands 5G Base Transceiver Stations (BTSs) nationwide.

The region benefits from strong government support, rapid urbanization, a booming smartphone user base, and rising demand for smart devices and industrial automation. Additionally, significant investments in telecom infrastructure, a growing base of local chipset manufacturers, and strategic public-private partnerships are accelerating 5G deployment, making Asia Pacific a key hub for innovation and market expansion in the global 5G ecosystem.

Regulatory Frameworks

- In India, spectrum allocation is overseen by the Department of Telecommunications (DoT) through auctions, with key 5G bands like 3300–3670 MHz and 700 MHz driving nationwide connectivity expansion.

- In the U.S., spectrum management is overseen by the Federal Communications Commission (FCC), which conducts auctions for licensed mid-band and mmWave bands to support the expansion of 5G connectivity nationwide.

- In the EU, privacy compliance is governed by the General Data Protection Regulation (GDPR), ensuring strict data protection standards for handling user information on connected 5G devices across member states.

Competitive Landscape

Companies in the 5G chipset industry are actively investing in research and development to enhance chip performance, reduce power consumption, and enable seamless connectivity across devices. They are forming strategic alliances, expanding manufacturing capabilities, and accelerating product rollouts to meet rising global demand.

Many are also focusing on AI integration, energy efficiency, and certification processes to ensure compliance with regional regulations. These efforts aim to strengthen market presence, support next-gen applications, and drive innovation in the evolving 5G ecosystem.

- In June 2025, GCT Semiconductor reached a major milestone by delivering its latest 5G chipsets and modules to lead customers, including Airspan Networks and Orbic North America. These deliveries, focused on mid-tier 5G applications, signal the start of broader evaluations, with plans to scale sampling efforts and refine performance in response to customer feedback and evolving production requirements.

Key Companies in 5G Chipset Market:

- Huawei Technologies Co., Ltd.

- MediaTek

- Intel Corporation

- Samsung

- Infineon Technologies AG

- Qualcomm Technologies, Inc.

- Qorvo, Inc

- Murata Manufacturing Co., Ltd.

- MACOM

- Analog Devices, Inc.

- Anokiwave, Inc

- GCT Semiconductor Holding Inc.

- Apple Inc.

- Sivers Semiconductors AB

- UNISOC Technologies Co., Ltd.

Recent Developments (Product Launches)

- In November 2023, MediaTek unveiled the Dimensity 8300 chipset, developed to enhance performance in premium 5G smartphone performance. Built on a 4nm process, the chip integrates generative AI, adaptive gaming, and ultra-fast 5G connectivity. It promises flagship-grade efficiency, powerful multitasking, and superior user experiences across gaming, photography, and productivity applications without compromising energy use.

- In February 2023, Qualcomm launched the Snapdragon X75, the first 5G Advanced-ready Modem-RF System. The system features AI-optimized 5G performance, advanced spectrum management, and a unified mmWave-sub6 architecture.

freqAskQues