buyNow

3D Food Printing Market

3D Food Printing Market Size, Share, Growth & Industry Analysis, By Ingredient Type (Dough, Fruits & Vegetables, Others), By Printer Technology (Extrusion-Based Printing, Selective Sintering, Others), By Application (Bakery & Confectionery, Meat & Seafood), By End User, and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

3D food printing refers to the use of additive manufacturing technology to create edible products by layering food-grade materials based on digital models. This approach enables precise customization of shapes, textures, and nutritional content. It supports innovation in personalized nutrition, creative food presentation, and sustainable production practices by reducing waste and streamlining ingredient use.

3D Food Printing Market Overview

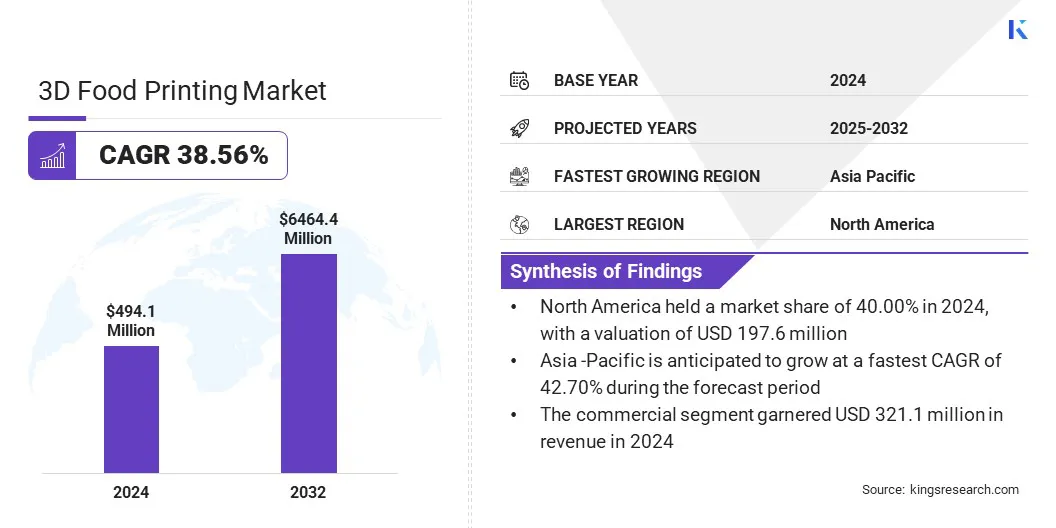

The 3D food printing market size was valued at USD 494.1 million in 2024 and is projected to grow from USD 659.3 million in 2025 to USD 6,464.4 million by 2032, exhibiting a CAGR of 38.56% during the forecast period. The market is driven by the rising demand for customized dining solutions which is prompting the use of 3D food printing for personalized meals.

Additionally, the shift toward industrial-scale production is driving the market by enabling manufacturers to use high-throughput printers for efficient, consistent, and large-volume production of alternative protein foods.

Key Highlights:

- The 3D food printing industry size was recorded at USD 494.1 million in 2024.

- The market is projected to grow at a CAGR of 38.56% from 2025 to 2032.

- North America held a market share of 40.00% in 2024, with a valuation of USD 197.6 million.

- The dough segment garnered USD 172.9 million in revenue in 2024.

- The extrusion-based printing segment is expected to reach USD 4,258.1 million by 2032.

- The nutritional meals segment is anticipated to grow at a CAGR of 41.73% over the forecast period.

- The commercial segment held a market share of 65.00% in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 42.70% through the projection period.

Major companies operating in the 3D food printing market are byFlow, NATURAL MACHINES, Redefine Meat Ltd., Cocoa Press, Novameat, Steakholder Foods, Dovetailed, Wiiboox, FELIXprinters, Changxing Shiyin Technology Co., Ltd, Cocuus, and Zmorph.

Increasing focus on food waste reduction drives the adoption of 3D food printing as a sustainable solution. 3D food printing supports sustainable food production by optimizing resource use, reducing waste, and incorporating eco-friendly ingredients like plant-based proteins. This shift is enabling food manufacturers to explore innovative production methods that minimize waste and enhance resource efficiency.

- According to the UN Environment Programme’s Food Waste Index Report 2024, more than 30% of food produced globally is lost or wasted each year. This growing concern is accelerating the adoption of 3D food printing as a sustainable solution to help achieve Sustainable Development Goal (SDG) 12.3. The technology is increasingly being integrated to align with both consumer and regulatory expectations focused on waste reduction and sustainability.

Market Driver

Rising Demand for Customized Dining Solutions

The growing demand for personalized dining experiences is a key driver of the 3D food printing market. Consumers are increasingly seeking convenience, dietary customization, and visually unique meals, prompting food service providers to adopt innovative technologies that meet these expectations.

3D food printing enables precise control over ingredients, portion sizes, and nutritional composition, making it suitable for tailored meal production. Additionally, the expansion of premium dining and experiential food shift is supporting the integration of food printing solutions across restaurants, hospitality, and institutional catering.

- According to the U.S. Department of Agriculture Economic Research Service, food spending in the U.S. reached USD 2.57 trillion in 2023, averaging USD 7,672 per person. The 12.0% increase in food-away-from-home spending highlights rising consumer demand for innovative and customizable dining experiences.

Market Challenge

Limited availability of printable food materials

A key challenge in the 3D food printing market is the limited availability of printable food materials suitable for consistent and high-quality output. The technology relies on a narrow range of ingredients, such as purees, pastes, and gels, which restricts the variety, texture, and complexity of printable food items.

This limitation is constraining product innovation and broader culinary applications. Moreover, the lack of standardized input formulations and material compatibility across different printer models is further impeding scalability and commercial adoption across the food industry.

To address this challenge, market players are developing a broader range of food-safe, printable materials using alternative proteins, plant-based ingredients, and upcycled food waste. They are working with food scientists to create stable, high-viscosity formulations that support consistent texture and quality during printing.

Manufacturers are also focusing on standardizing input materials to ensure compatibility across various printer models. Additionally, players are introducing modular cartridge systems to streamline material handling and enable the production of more diverse and visually appealing food items at scale.

Market Trend

Shift Toward Industrial-Scale Production

A key trend in the 3D food printing market is the transition toward industrial-scale production capabilities using high-throughput 3D printers. Manufacturers are increasingly introducing systems that allow continuous printing of customized meat and seafood alternatives with precise control over texture, structure, and composition.

This trend prompts companies to invest in multi-nozzle extrusion technologies that support mass customization and consistent output at commercial volumes. These innovations are transforming the market by making it viable for mainstream retail and foodservice applications and enabling large-scale distribution of personalized and sustainable food products.

- In January 2024, Revo Foods launched the Food Fabricator X2, the world’s first industrial-scale 3D food printer designed for high-volume production of customized meat and seafood alternatives.

3D Food Printing Market Report Snapshot

|

Segmentation |

Details |

|

By Ingredient Type |

Dough, Fruits & Vegetables, Dairy Products, Proteins, Carbohydrates, Others |

|

By Printer Technology |

Extrusion-Based Printing, Selective Sintering, Inkjet Printing, Binder Jetting |

|

By Application |

Bakery & Confectionery, Meat & Seafood, Nutritional Meals, Restaurants & Gourmet Dishes, Others |

|

By End User |

Government, Commercial, Residential |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Ingredient Type (Dough, Fruits & Vegetables, Dairy Products, Proteins, Carbohydrates, and Others): The dough segment earned USD 172.9 million in 2024 due to its widespread use in bakery applications and ease of extrusion.

- By Printer Technology (Extrusion-Based Printing, Selective Sintering, Inkjet Printing, and Binder Jetting): The extrusion-based printing segment held 60.00% of the market in 2024, due to its compatibility with diverse food materials and cost-effective operation.

- By Application (Bakery & Confectionery, Meat & Seafood, Nutritional Meals, and Restaurants & Gourmet Dishes): The bakery & confectionery segment is projected to reach USD 2,335.4 million by 2032, owing to rising demand for customizable, visually appealing edible products.

- By End User (Government, Commercial, and Residential): The commercial segment is anticipated to grow at a CAGR of 39.41% over the forecast period, due to increasing adoption by restaurants, food startups, and catering businesses seeking differentiation.

3D Food Printing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America 3D food printing market accounted for a share of 40.00% in 2024, with a valuation of USD 197.6 million. This dominance is attributed to the strong regulatory framework and early commercialization of 3D-printed food products in the region.

The market in the region is witnessing growth due to the introduction of plant-based meat and seafood alternatives produced through advanced 3D printing technologies. Regulatory approvals for food-grade materials are facilitating mass production and speeding up the shift from experimental prototypes to commercially available products.

Moreover, the presence of key market players diversifying their product portfolios with new formulations that cater to a wide range of consumer preferences. Manufacturers in the region are prioritizing the development of scalable and production-ready solutions to speed up commercialization, thereby fueling market expansion in the region.

- In April 2024, Steakholder Foods launched its SHMeat and SHFish blends in the U.S. using advanced 3D printing technologies, following GRAS approval. The company is expanding its presence in North America by commercializing plant-based meat and seafood alternatives and developing additional 3D-printable product lines.

The Asia Pacific 3D food printing industry is set to grow at a robust CAGR of 42.70% over the forecast period. This growth is attributed to the increasing investment in research and development across the region to advance alternative protein technologies integrated with 3D food printing.

The market is registering significant growth as companies in the region are developing cultivated seafood products using additive manufacturing and cell cultivation techniques. The regional support through cross-border public funding is accelerating technological innovation while promoting the commercialization of sustainable food solutions in the region.

Additionally, the market is expanding due to strategic collaborations between food tech firms and national innovation agencies that are facilitating pilot production of high-value, 3D-printed meat and seafood alternatives. These developments are accelerating the transition toward sustainable food systems, thereby fueling the market growth in the region.

- In November 2024, UMAMI Bioworks and Steakholder Foods collaborated under the Singapore-Israel Industrial R&D (SIIRD) grant to scale the production of 3D-printed cultivated fish fillets. The collaboration aims to develop high-value seafood alternatives by combining 3D printing with cell cultivation technologies. Ongoing commercialization efforts are supported through Singapore’s National Additive Manufacturing Innovation Cluster (NAMIC).

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) oversees 3D-printed food safety, ingredient approvals, labeling, and manufacturing standards. It ensures that printed food products meet existing food safety regulations under the Federal Food, Drug, and Cosmetic Act. FDA also monitors emerging technologies and evaluates food contact materials used in 3D printing equipment.

- In China, the National Medical Products Administration (NMPA) regulates 3D-printed food primarily through oversight of food additives, safety compliance, and manufacturing practices. The agency ensures that novel foods and technologies comply with national food safety standards.

- In India, the Food Safety and Standards Authority of India (FSSAI) regulates 3D-printed food under the Food Safety and Standards Act. It monitors ingredient safety, hygiene protocols, and labeling accuracy. FSSAI develops guidelines to address innovations in food manufacturing, including edible inks and print-ready materials used in personalized nutrition applications.

Competitive Landscape

Major players in the 3D food printing industry are expanding into new regional markets by establishing strategic partnerships with local food producers. Market players are supplying proprietary 3D printing hardware along with compatible plant-based printing materials to support localized production. Additionally, players are focusing on commercialization by leveraging established distribution networks to drive adoption and scale up the availability of 3D-printed meat alternatives.

- In December 2024, Steakholder Foods signed an MoU with Taiwan-based Vegefarm Co. Ltd. to supply its MX200 3D printer and plant-based premixes, supported by Taiwan’s ITRI. The partnership aims to adapt and commercialize 3D-printed meat alternatives in the Asia Pacific, leveraging Vegefarm’s distribution network.

List of Key Companies in 3D Food Printing Market:

- byFlow

- NATURAL MACHINES

- Redefine Meat Ltd.

- Cocoa Press

- Novameat

- Steakholder Foods

- Dovetailed

- Wiiboox

- FELIXprinters

- Changxing Shiyin Technology Co., Ltd

- Cocuus

- Zmorph

Recent Developments (Product Launch)

- In October 2024, Revo Foods opened the world’s largest 3D food printing facility in Vienna, the Taste Factory, to scale production of mycoprotein-based alternatives using its proprietary 3D Structuring technology, marking a pivotal step toward mainstream commercialization of 3D-printed food.

freqAskQues