Buy Now

Train Dispatching Market

Train Dispatching Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services), By Type (Centralized Train Dispatching (CTC), Automated Train Dispatching, Manual Train Dispatching), By Deployment Mode (On-Premise, Cloud-Based), By Application, and Regional Analysis, 2024-2031

Pages: 200 | Base Year: 2023 | Release: March 2025 | Author: Versha V.

Market Definition

The train dispatching market encompasses the development, deployment, and management of systems and solutions designed to coordinate train movements across railway networks.

This market includes various segments such as software platforms for train scheduling and monitoring, hardware solutions like signaling systems and control centers, and services for system integration, maintenance, and support.

Key applications span passenger rail services, freight transportation, and metro networks, with solutions tailored to improve operational efficiency, enhance safety, and ensure optimal resource utilization.

Train Dispatching Market Overview

The global train dispatching market size was valued at USD 952.3 million in 2023 and is projected to grow from USD 1014.3 million in 2024 to USD 1672.2 million by 2031, exhibiting a CAGR of 7.40% during the forecast period. This market is registering significant growth, driven by the increasing demand for efficient and reliable railway operations.

With rising global urbanization and population growth, there is a greater need for well-managed rail networks to support passenger and freight transportation. The adoption of automation, AI-powered scheduling, and predictive analytics is enhancing operational efficiency by reducing delays and optimizing train movements.

Governments and private railway operators are heavily investing in rail infrastructure modernization, including the implementation of cloud-based solutions, IoT-enabled systems, and GPS tracking to improve real-time monitoring and communication.

Major companies operating in the global train dispatching industry are Hitachi, Ltd., Siemens AG, Motorola Solutions, Inc., Alstom SA, Wabtec Corporation, ABB Group, Professional Software Associates, Inc., Tracsis plc., Rio Grande Pacific Corporation, TranSystems Corporation, Toshiba Corporation, Thales S.A., Indra Sistemas S.A., Knorr-Bremse AG, and Fujitsu Limited.

The expansion of high-speed rail projects, particularly in emerging economies, is further accelerating market growth, as these projects require advanced dispatching systems to ensure seamless operations.

Additionally, the increasing focus on sustainability and energy efficiency is encouraging the adoption of smart railway management solutions, driving the demand for advanced train dispatching technologies. The market continues to expand with innovations that enhance safety, reduce costs, and improve overall service quality as digital transformation reshapes the railway industry.

Key Highlights:

- The global train dispatching market size was valued at USD 952.3 million in 2023.

- The market is projected to grow at a CAGR of 7.40% from 2024 to 2031.

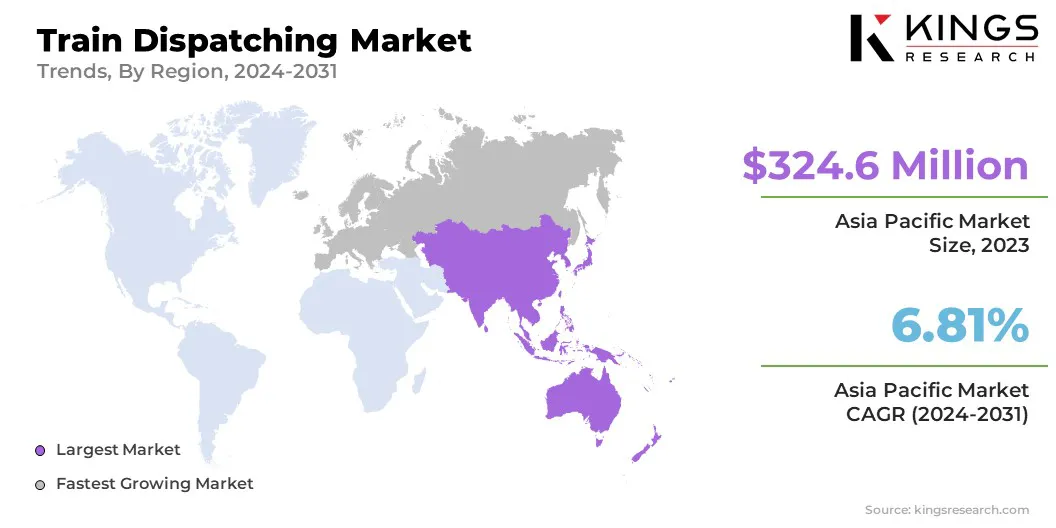

- Asia Pacific held a market share of 34.09% in 2023, with a valuation of USD 324.6 million.

- The hardware segment garnered USD 410.3 million in revenue in 2023.

- The Centralized Train Dispatching (CTC) segment is expected to reach USD 827.8 million by 2031.

- The On-premise segment is expected to reach USD 1,040.8 million by 2031.

- The passenger rail dispatching segment is expected to reach USD 901.35 million by 2031.

- The market in Europe is anticipated to grow at a CAGR of 8.82% during the forecast period.

Market Driver

"Automation and Infrastructure Expansion Driving Growth"

The train dispatching market is registering significant growth, driven by the rising demand for automation and AI-powered solutions, as well as the expansion of railway infrastructure and high-speed rail projects.

Automation and AI-driven dispatching systems are playing a crucial role in optimizing train schedules, minimizing delays, and improving real-time decision-making as rail networks become more complex.

Advanced technologies such as Machine Learning (ML), predictive analytics, and AI-based traffic management enable dispatchers to analyze vast amounts of data, detect potential conflicts, and make proactive adjustments to train movements. This result in improved operational efficiency, reduced congestion, and enhanced passenger and freight service reliability.

The expansion of railway infrastructure and high-speed rail projects is another key factor fueling the market. Governments and private railway operators globally are making substantial investments in modernizing rail networks to accommodate increasing passenger and freight demands.

The development of high-speed rail corridors, urban metro systems, and freight rail expansions necessitates sophisticated train dispatching solutions capable of handling complex routing, high-frequency train movements, and seamless integration with signaling and control systems.

Smart railway initiatives and public-private partnerships are further accelerating infrastructure upgrades, leading to a growing need for digitalized and automated dispatching systems.

Market Challenge

"High Cost and Cybersecurity Challenges in the Train Dispatching Market"

The market faces significant challenges, including high implementation costs and cybersecurity risks associated with digitalization, both of which impact the adoption and efficiency of advanced dispatching systems.

High implementation costs pose a major barrier, as modern train dispatching solutions rely on sophisticated technologies such as AI, IoT, cloud computing, and automation. Upgrading legacy systems or integrating new digital dispatching platforms requires substantial investment in infrastructure, software, and workforce training.

Smaller railway operators, particularly in developing regions, may struggle with budget constraints, leading to slower adoption rates. Additionally, integrating new systems with existing rail infrastructure can be complex and costly, requiring specialized expertise and long-term planning.

A practical solution to this challenge is increased government funding, public-private partnerships, and phased implementation strategies. By gradually rolling out advanced dispatching technologies in stages, railway operators can manage costs more effectively while minimizing disruptions to daily operations.

Cybersecurity threats present another critical challenge as railway networks become more interconnected and reliant on digital communication systems. Modern dispatching platforms use cloud-based storage, real-time data exchange, and remote access capabilities, making them potential targets for cyberattacks, hacking attempts, and data breaches.

A cyberattack on a dispatching system can lead to service disruptions, compromised safety, and significant financial losses. The risk of cyber threats continues to grow as railway networks increasingly integrate 5G, IoT, and AI-driven automation. Thus, railway operators are implementing advanced cybersecurity measures such as multi-layered encryption, firewalls, intrusion detection systems, and AI-powered threat monitoring.

Market Trend

"Technological Advancements Transforming the Train Dispatching Market"

The market is evolving rapidly, driven by the increasing integration of IoT and cloud-based dispatching systems, as well as the shift toward Future Railway Mobile Communication System (FRMCS) and 5G-enabled communication.

The adoption of IoT and cloud-based technologies is transforming train dispatching by enabling real-time train tracking, predictive maintenance, and seamless communication between dispatch centers and railway operators.

Cloud-based platforms allow for centralized data management, improving operational efficiency and reducing system downtime. IoT-enabled sensors installed on trains and railway infrastructure provide continuous data streams, allowing dispatchers to monitor train conditions, detect anomalies, and optimize scheduling in real time.

Another significant trend shaping the train dispatching market is the transition toward FRMCS and 5G-enabled communication. FRMCS is emerging as the next-generation standard for railway communications as railway operators move away from legacy communication systems, providing greater flexibility, higher data transmission speeds, and enhanced interoperability.

The integration of 5G technology further enhances train dispatching by enabling faster data exchange, ultra-low latency communication, and improved connectivity across rail networks. This technological shift supports automation, remote monitoring, and advanced safety features, ensuring more efficient and secure train operations.

- In February 2024, Tracsis announced advancements in Computer Aided Dispatch (CAD) technology to enhance railroad dispatching operations across North America. The developments include the integration of digital track warrant systems, geofencing, and AI-driven automation to improve safety, efficiency, and operational awareness. Tracsis' cloud-based dispatching solutions aim to streamline train dispatching while ensuring seamless integration with third-party systems and Positive Train Control (PTC) networks.

Train Dispatching Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Hardware, Software, Services |

|

By Type |

Centralized Train Dispatching (CTC), Automated Train Dispatching, Manual Train Dispatching |

|

By Deployment Mode |

On-premise, Cloud-based |

|

By Application |

Passenger Rail Dispatching, Freight Rail Dispatching, High-speed Rail Dispatching |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia Pacific | |

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Component (Hardware, Software, Services): The hardware segment earned USD 410.3 million in 2023, due to the increasing adoption of advanced signalling and communication equipment in train dispatching systems.

- By Type (Centralized Train Dispatching (CTC), Automated Train Dispatching, Manual Train Dispatching): The Centralized Train Dispatching (CTC) segment held 52.34% share of the market in 2023, due to the growing need for real-time train coordination and efficient traffic management.

- By Deployment Mode (On-premise, Cloud-based): The on-premise segment is projected to reach USD 1,040.8 million by 2031, owing to the preference for secure, customized, and locally managed dispatching solutions.

- By Application (Passenger Rail Dispatching, Freight Rail Dispatching, High-speed Rail Dispatching): The passenger rail dispatching segment is projected to reach USD 901.35 million by 2031, owing to rising urbanization, increasing rail passenger traffic, and expanding metro & high-speed rail networks.

Train Dispatching Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

Asia Pacific accounted for a substantial train dispatching market share of 34.09% in 2023, with a valuation of USD 324.6 million. The region's dominance is driven by rapid urbanization, increasing investments in railway infrastructure, and the expansion of high-speed rail networks in countries such as China, India, and Japan.

Government initiatives aimed at modernizing railway operations, improving safety, and enhancing train scheduling efficiency are further propelling the market. The adoption of advanced train dispatching solutions, including AI-driven automation and IoT-enabled monitoring systems, is rising as railway operators focus on improving operational efficiency and reducing delays.

Additionally, the growing demand for metro and suburban rail services in densely populated cities is driving the need for robust train dispatching technologies, contributing to sustained market expansion.

- In October 2024, IVU Traffic Technologies AG announced its expansion into India with the implementation of its integrated IVU.rail software for the new Regional Rapid Transit System (RRTS). The software will support planning and scheduling for over 600 staff members, ensuring reliable and efficient railway operations.

The train dispatching industry in Europe is expected to register the fastest growth, with a projected CAGR of 8.82% over the forecast period. The region's growth is fueled by strong government investments in railway digitalization, the push for sustainable and energy-efficient rail transport, and the increasing adoption of Future Railway Mobile Communication System (FRMCS) & 5G-enabled dispatching technologies.

Countries are leading the shift toward automated and cloud-based dispatching systems, improving real-time communication and optimizing train traffic management. The European Union's (EU) focus on reducing carbon emissions and enhancing railway interoperability across member states is also driving the demand for modern train dispatching solutions.

The adoption of centralized and automated train dispatching systems is expected to accelerate as high-speed rail expansion and cross-border railway projects continue to grow, solidifying Europe's position as the fastest-growing regional market.

Regulatory Framework

- In the U.S., the Federal Railroad Administration (FRA) regulates train dispatching under the U.S. Department of Transportation. It sets safety standards, operational guidelines, and technological requirements for dispatching systems to ensure efficient and secure railway operations.

- In Europe, the European Union Agency for Railways (ERA) oversees train dispatching regulations to ensure interoperability and safety across member states. The European Rail Traffic Management System (ERTMS) standardizes dispatching protocols, signaling, and communication to improve cross-border rail efficiency.

- In China, the National Railway Administration (NRA) regulates train dispatching under the Ministry of Transport. The country has adopted advanced digital dispatching systems and high-speed rail scheduling technologies to manage one of the world's largest rail networks.

- In Japan, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT), along with the Japan Railway Construction, Transport and Technology Agency (JRTT), regulates train dispatching. Japan's system focuses on high-speed rail safety, precision scheduling, and real-time monitoring to maintain punctuality.

- In India, the Ministry of Railways and the Railway Board oversee train dispatching through Indian Railways. The country is modernizing its dispatching infrastructure with Centralized Traffic Control (CTC) and automated signaling systems to enhance rail network efficiency and safety.

Competitive Landscape:

The global train dispatching market is characterized by a large number of participants. Continuous technological advancements, strategic collaborations, and increasing investments in automation and digital solutions drive competition.

Market players focus on developing AI-powered dispatching systems, cloud-based platforms, and IoT-integrated solutions to enhance operational efficiency and ensure real-time train tracking and scheduling.

Companies expand their geographic presence by securing government contracts, partnering with railway operators, and integrating their dispatching technologies into existing rail infrastructures.

The growing demand for high-speed rail and freight transport solutions accelerates innovation, leading to investments in predictive analytics, ML algorithms, and automated control systems.

Additionally, the increasing adoption of smart transportation solutions and sustainability initiatives encourages market participants to develop energy-efficient and environmentally friendly dispatching technologies. Market players continuously enhance their solutions to improve safety, reduce operational costs, and optimize railway network performance.

Competition remains intense as digital transformation reshapes the industry, with companies striving to offer scalable, secure, and high-performance dispatching solutions to meet the growing global demand.

- In March 2024, Frequentis and Swiss Federal Railways (SBB) announced their collaboration for the delivery and implementation of a next-generation rail communication system. The partnership focuses on replacing SBB’s existing dispatcher communication system with the IMS Service BTA platform, enhancing coordination between train control centers, staff, and emergency teams.

List of Key Companies in Train Dispatching Market:

- Hitachi, Ltd.

- Siemens AG

- Motorola Solutions, Inc.

- Alstom SA

- Wabtec Corporation

- ABB Group

- Professional Software Associates, Inc.

- Tracsis plc.

- Rio Grande Pacific Corporation

- TranSystems Corporation

- Toshiba Corporation

- Thales S.A.

- Indra Sistemas S.A.

- Knorr-Bremse AG

- Fujitsu Limited

Recent Developments (Partnerships/Collaborations)

- In June 2024, Tracsis and Rio Grande Pacific Corporation (RGPC) announced their collaboration to enhance railroad dispatching operations. RGPC utilizes Tracsis’ cloud-hosted dispatching system to streamline its rail operations while providing dispatching services for other railroads. The partnership focuses on improving efficiency, reliability, and scalability in railroad dispatching by enabling seamless integration and operational flexibility.

- In March 2024, Siemens Mobility expanded its partnership with Metrolinx to provide track, signal, and right-of-way maintenance for Toronto’s Central Region. This contract enhances system reliability using digital tools and infrastructure performance data.