Buy Now

Time and Attendance Software Market

Time and Attendance Software Market Size, Share, Growth & Industry Analysis, By Component (Software, Service), By Deployment (On-premises, Cloud-based, Hybrid), By Organization (Large Enterprises, Small and Medium Enterprises), By Vertical, and Regional Analysis, 2025-2032

Pages: 120 | Base Year: 2024 | Release: June 2025 | Author: Ashim L.

Market Definition

The market covers a broad range of solutions and services designed to support workforce management across various industries. This market includes software platforms, support services, and integrated tools that enable organizations to track employee hours, attendance, scheduling, and compliance.

The market also includes multiple deployment models, such as on-premises, cloud-based, and hybrid systems, catering to diverse IT infrastructure preferences. This report presents an overview of the primary growth drivers, supported by a regional analysis and regulatory frameworks expected to impact the market development over the forecast period.

Time and Attendance Software Market Overview

The global time and attendance software market size was valued at USD 4.53 billion in 2024 and is projected to grow from USD 4.85 billion in 2025 to USD 8.75 billion by 2032, exhibiting a CAGR of 8.32% during the forecast period.

The growth of the market is driven by the increasing adoption of digital workforce management solutions across industries. Organizations are focusing on improving operational efficiency and reducing manual errors in employee time tracking. The rise of remote and hybrid work models is fueling the demand for cloud-based and mobile-accessible attendance systems.

Major companies operating in the time and attendance software industry are Intuit Inc., Oracle, Bamboo HR LLC., SAP SE, Synel, Deltek, Inc., UKG Inc., Epicor Software Corporation, Paychex Inc., TimeClock Plus, LLC, ADP, Inc., Zebra Technologies Corp., Deputechnologies Pty Ltd., Workday, Inc., and Dayforce.

Advancements in technologies such as biometrics, AI, and IoT are enhancing the accuracy and automation of timekeeping processes. They enable real-time data collection, prevent time theft through identity verification, and support seamless integration with other HR and payroll systems.

As a result, businesses are increasingly adopting time and attendance software to upgrade workforce management, improve productivity, and ensure compliance with labor regulations effectively.

- In June 2024, Digital HRMS launched a new module called "Advances" and introduced multiple feature updates across Leave and Attendance, Recruitment, Performance Management System (PMS), Learning Management System (LMS), Confirmation Assessment, Policy Documents, and Reports & Analytics modules. The Advances module enables employees to request and manage expense advances while allowing administrators to monitor and approve requests.

Key Highlights:

Key Highlights:

- The time and attendance software industry size was valued at USD 4.53 billion in 2024.

- The market is projected to grow at a CAGR of 8.32% from 2025 to 2032.

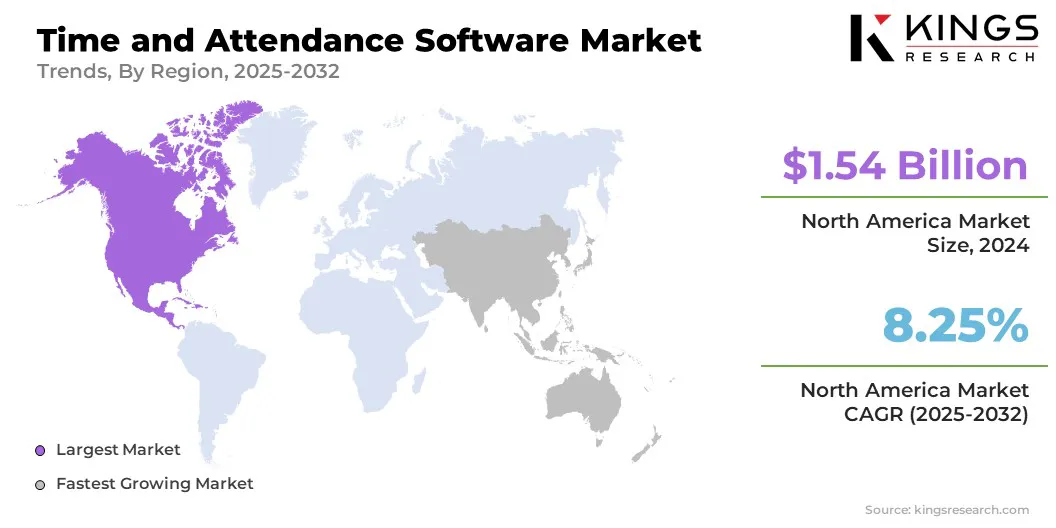

- North America held a market share of 34.07% in 2024, with a valuation of USD 1.54 billion.

- The software segment garnered USD 2.81 billion in revenue in 2024.

- The on-premises segment is expected to reach USD 3.65 billion by 2032.

- The large enterprises segment is expected to reach USD 4.89 billion by 2032.

- The retail segment is expected to reach USD 1.95 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 9.23% during the forecast period.

Market Driver

Rising Demand for Workforce Automation

The time and attendance software market is driven by the rising demand for workforce automation. Organizations across industries are increasingly adopting digital tools to streamline HR operations and eliminate manual tracking of employee attendance. Automated systems help reduce administrative workload, minimize errors in timekeeping, and improve overall efficiency.

These solutions enable real-time visibility into employee work patterns, support accurate payroll processing, and allow for better workforce planning. As businesses scale and adopt hybrid and distributed models, the need for flexible automated attendance management systems continues to grow, reinforcing demand in the market.

- In October 2023, Empeon announced the beta release of its Scheduling solution, a new addition to its enterprise-grade Human Capital Management (HCM) platform for health systems. The solution aims to optimize healthcare workforce management by simplifying shift scheduling and ensuring compliance with evolving regulations such as CMS minimum staffing standards.

Market Challenge

Ensuring Data Security and Privacy

A major challenge in the time and attendance software market is ensuring data security and privacy. These systems collect sensitive employee information, including biometric and location data, which makes them prime targets for cyberattacks and unauthorized access. Failure to protect this data can lead to legal penalties and loss of employee trust.

To address this, companies are adopting strong cybersecurity measures like encryption, multi-factor authentication, and regular audits. Compliance with data protection laws such as GDPR and CCPA is also helping companies secure systems and strengthen user confidence.

Market Trend

Integrating Geotagging Features

A key trend in the time and attendance software market is the increasing integration of geotagging features into workforce management systems. These location-based technologies enable employers to accurately track employees’ clock-in and out locations, ensuring greater accountability for remote, mobile, and field-based teams.

By defining virtual boundaries, geofencing restricts attendance actions to specific locations and reduces instances of time fraud. This trend is increasingly being adopted by industries such as construction, logistics, and retail, where field-based operations are prevalent and location accuracy is critical for operational efficiency and compliance.

- In April 2025, Patriot Software launched a new geotagging feature within its time and attendance software, Patriot Time. The feature provides employers with map-based visibility of where employees clock in and out. By offering precise location data, the geotagging feature enhances accountability, supports compliance, and promotes transparency between employers and employees.

Time and Attendance Software Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Software, Service |

|

By Deployment |

On-premises, Cloud-based, Hybrid |

|

By Organization |

Large Enterprises, Small and Medium Enterprises |

|

By Vertical |

Retail, IT & Telecommunications, Education, BFSI, Manufacturing, Healthcare, Government, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Component (Software, and Service): The software segment earned USD 2.81 billion in 2024, due to increased demand for automated tracking systems and scalable workforce management solutions.

- By Deployment (On-premises, Cloud-based, and Hybrid): The on-premises segment held 42.13% of the market in 2024, due to strong adoption among organizations with strict data security and compliance requirements.

- By Organization (Large Enterprises, and Small and Medium Enterprises): The large enterprises segment is projected to reach USD 89 billion by 2032, owing to higher investments in digital infrastructure and the need for advanced integration capabilities.

- By Vertical (Retail, IT & Telecommunications, Education, BFSI, Manufacturing, Healthcare, Government, Others ): The retail segment is projected to reach USD 1.95 billion by 2032, owing to the growing reliance on shift-based labor and the need for real-time attendance monitoring.

Time and Attendance Software Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America time and attendance software market share stood at around 34.07% in 2024, with a valuation of USD 1.54 billion. This dominance is driven by the widespread adoption of advanced digital workforce solutions across industries. The presence of established software vendors, high labor compliance standards, and the early adoption of automation technologies is further driving the growth of the market.

The North America time and attendance software market share stood at around 34.07% in 2024, with a valuation of USD 1.54 billion. This dominance is driven by the widespread adoption of advanced digital workforce solutions across industries. The presence of established software vendors, high labor compliance standards, and the early adoption of automation technologies is further driving the growth of the market.

- In January 2024, Synel Americas launched XT Blu, a comprehensive rebranding and upgrade of its XactTime platform. The new cloud-based solution features an intuitive user interface and consolidated data on single screens for administrators and employees and utilizes advanced technologies such as cloud based solutions, for improved performance and security.

The time and attendance software industry in Asia Pacific is poised to grow at a significant CAGR of 9.23% over the forecast period. This growth is due to rapid industrialization, expanding service sectors, and growing awareness of workforce optimization tools.

SMEs and large organizations across countries like China, India, and Japan are increasingly adopting time and attendance solutions to streamline operations and ensure labor law compliance. Cloud adoption and digital transformation initiatives across the region are further accelerating market expansion.

Regulatory Frameworks

- In the U.S., the Fair Labor Standards Act (FLSA) governs timekeeping requirements and mandates the accurate tracking of employee work hours, overtime, and recordkeeping. Employers must ensure compliance with Department of Labor (DOL) guidelines for electronic time and attendance systems.

- In Europe, the Working Time Directive (2003/88/EC) requires employers to maintain accurate records of working hours, rest periods, and leave. Additionally, the General Data Protection Regulation (GDPR) governs how employee attendance data is collected, stored, and processed.

- In Japan, the Labor Standards Act mandates employers to maintain records of working hours, rest periods, and overtime. The Ministry of Health, Labour and Welfare has issued guidelines supporting the use of electronic time and attendance systems, provided they ensure accuracy and employee consent.

Competitive Landscape

Key players in the time and attendance software industry are investing in AI-driven analytics, real-time tracking, and cloud-native platforms to enhance product performance and user experience. Key players are expanding their solution portfolios through modular offerings that support mobile access, biometric integration, and advanced scheduling features.

Strategic collaborations with HR technology platforms and ERP providers are commonly employed to strengthen ecosystem compatibility. Companies are also pursuing vertical-specific customization to meet industry-specific standards and operational needs. Subscription-based pricing models and SaaS deployment are widely adopted to improve customer retention and operational flexibility.

- In October 2024, ADP acquired WorkForce Software, a leading provider of workforce management solutions for large global enterprises. WorkForce Software’s capabilities in time and attendance, scheduling, forecasting, and absence management will enhance ADP’s suite of solutions for over one million clients worldwide.

List of Key Companies in Time and Attendance Software Market:

- Intuit Inc.

- Oracle

- Bamboo HR LLC.

- SAP SE

- Synel

- Deltek, Inc.

- UKG Inc.

- Epicor Software Corporation

- Paychex Inc.

- TimeClock Plus, LLC

- ADP, Inc.

- Zebra Technologies Corp.

- Deputechnologies Pty Ltd.

- Workday, Inc.

- Dayforce

Recent Developments (Product Launch)

- In April 2025, AccuCloud launched a cloud-based time and attendance tracking and integration solution tailored for HCM and ERP software vendors. The scalable enterprise-grade platform offers durable time collection devices, a cloud-based middleware, and a web-based management portal. AccuCloud enables seamless integration with back-end systems, improving data collection and reducing operational costs.