Buy Now

SCADA in Water and Wastewater Management Market

SCADA in Water and Wastewater Management Market Size, Share, Growth & Industry Analysis, By Component (Software, Hardware), By End-User (Residential, Industrial), and Regional Analysis, 2025-2032

Pages: 140 | Base Year: 2024 | Release: June 2025 | Author: Antriksh P.

Market Definition

The market refers to the global industry and economic activities related to the use of the Supervisory Control and Data Acquisition (SCADA) system used to monitor and control water treatment and wastewater treatment processes. SCADA collects real-time data from sensors and equipment in water and wastewater facilities.

It ensures safe, efficient, and reliable management of water resources by providing timely information, alarms, and control commands. The report identifies the principal factors contributing to market expansion and analyzes the competitive landscape influencing its growth.

SCADA in Water and Wastewater Management Market Overview

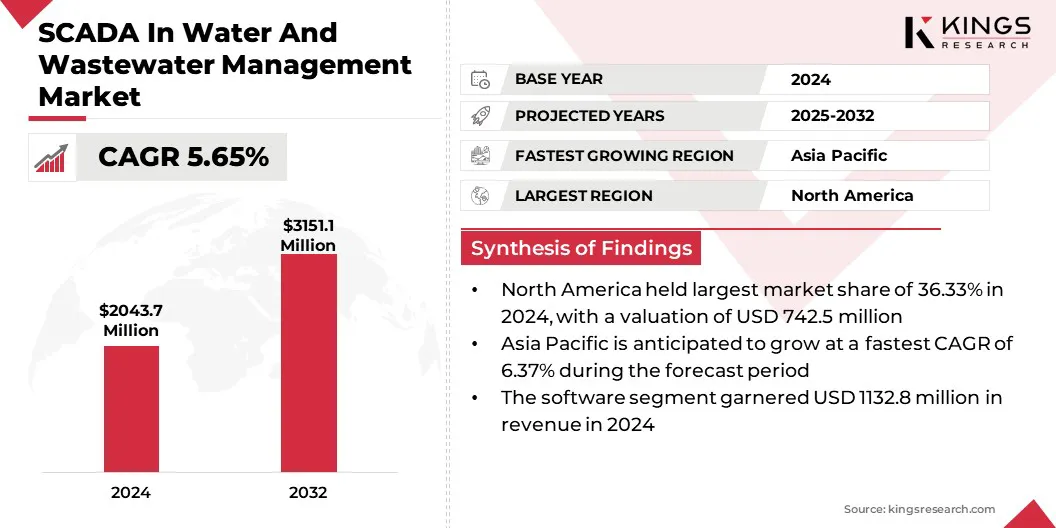

The global SCADA in water and wastewater management market size was valued at USD 2,043.7 million in 2024, estimated to be valued at USD 2,144.3 million in 2025 and reach USD 3,151.1 million by 2032, growing at a CAGR of 5.65% from 2025 to 2032.

Digital transformation in utilities is driving the adoption of smart technologies like SCADA systems for real-time monitoring, automation, and data analytics. This technology enhances operational efficiency, reduces water loss, and supports sustainable water and wastewater management practices globally.

Major companies operating in the SCADA in water and wastewater management industry are Ovarro, PSI Software SE, Eaton, Emerson Electric Co., General Electric Company, Hitachi, Ltd., Honeywell International Inc., Rockwell Automation Inc., Yokogawa Ltd., ABB, Schneider Electric, Alliance Water Resources, ecava, SJE Inc., and Drexel Group.

The market is witnessing steady growth, driven by increasing urbanization, the need for efficient resource management, and government initiatives promoting smart infrastructure. SCADA systems enable real-time monitoring, automation, and control of critical operations, improving service reliability and reducing losses.

These technologies support decision-making, enhance efficiency, and ensure compliance. Growing demand for sustainable solutions and digital transformation in utility management further strengthens the market's relevance and expansion.

- In February 2025, the Ministry of Housing and Urban Affairs in India empowered urban staff under AMRUT and Smart Cities Missions by integrating SCADA in 1,700+ water and sewerage projects, enhancing city planning and sustainability. Over 57,000 functionaries have been trained, including women and youth, strengthening inclusive urban governance and infrastructure management.

Key Highlights

Key Highlights

- The SCADA in water and wastewater management industry size was valued at USD 2,043.7 million in 2024.

- The market is projected to grow at a CAGR of 5.65% from 2025 to 2032.

- North America held a market share of 36.33% in 2024, with a valuation of USD 742.5 million.

- The software segment garnered USD 1,132.8 million in revenue in 2024.

- The residential segment is expected to reach USD 1,588.0 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.37% during the forecast period.

Market Driver

Digital Transformation in Utilities

The SCADA in water and wastewater management market is witnessing significant growth due to the digital transformation of utility services, especially in water and wastewater applications. Utilities are rapidly adopting smart technologies such as SCADA systems, IoT-enabled sensors, and cloud-based platforms to gain real-time visibility into operations.

This helps with quicker decision-making, predictive maintenance, and efficient resource allocation. It also helps utilities meet compliance and sustainability targets by minimizing water loss and optimizing treatment processes. As infrastructure modernizes, digital tools are becoming essential for resilient and data-driven utility management.

- In August 2024, ABB integrated its AquaMaster4 Mobile Comms flowmeter with the Topkapi SCADA software, enhancing real-time water management and conservation. This advancement supports sustainability goals by enabling accurate data transmission, efficient flow monitoring, and leak detection. The integration strengthens ABB’s position in delivering smart water solutions for global utilities.

Market Challenge

Data Management Issues

Data management is a significant challenge in the SCADA in water and wastewater management market, as large volumes of real-time data from sensors and control systems demand robust storage, processing, and analysis. Without effective data handling, utilities may face inefficiencies and delayed decision-making.

A viable solution is integrating cloud-based platforms and advanced analytics tools, which enable scalable data storage, real-time processing, and actionable insights. These technologies enhance operational visibility and support predictive maintenance, improving overall system performance.

Market Trend

International Collaboration

International collaborations have emerged as a key trend in the SCADA in water and wastewater management market, with involvement from international aid agencies and governments. These collaborations are driving the adoption of SCADA systems in regions with limited resources, enabling the modernization of critical water infrastructure.

Grant aid projects reflect a broader global commitment to sustainable water management. Such collaborations bring financial support and technical expertise, facilitating knowledge transfer and capacity building in smart utility operations.

- In February 2025, the Japan International Cooperation Agency (JICA) agreed with Jordan to improve water supply services in the Ma’an Governorate through SCADA system installation and facility rehabilitation. This project aims to enhance water management efficiency, aligning with SDG 6 for clean water and sanitation.

SCADA in Water and Wastewater Management Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Software [HMI (Human-Machine Interface) Software, Historian Software, Reporting and Analytics Software, Communication Software, Others], Hardware [RTUs (Remote Terminal Units), PLCs (Programmable Logic Controllers), Sensors and Actuators, Others] |

|

By End-User |

Residential, Industrial |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Component (Software and Hardware): The software segment earned USD 1,132.8 million in 2024, driven by the increasing adoption of advanced SCADA platforms and growing demand for real-time monitoring in water management systems.

- By End-User (Residential and Industrial): The residential segment held 52.65% of the market in 2024 due to rising urbanization and increased investments in smart water infrastructure for household water supply and wastewater treatment.

SCADA in Water and Wastewater Management Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America SCADA in water and wastewater management market share stood at 36.33% in 2024 in the global market, with a valuation of USD 742.5 million. North America dominates the market due to its advanced infrastructure, high technology adoption, and strong regulatory frameworks promoting water conservation. The region’s utilities invest in smart water solutions to address aging infrastructure and meet environmental standards.

The North America SCADA in water and wastewater management market share stood at 36.33% in 2024 in the global market, with a valuation of USD 742.5 million. North America dominates the market due to its advanced infrastructure, high technology adoption, and strong regulatory frameworks promoting water conservation. The region’s utilities invest in smart water solutions to address aging infrastructure and meet environmental standards.

Additionally, the presence of major SCADA system providers and continuous innovation in IoT and automation technologies fuel market growth. Government subsidies and growing awareness about sustainable water management further strengthen North America’s leadership.

The Asia Pacific SCADA in water and wastewater management industry is poised for significant growth at a CAGR of 6.37% over the forecast period. It is the fastest-growing market for SCADA in water and wastewater management, driven by rapid urbanization, industrial growth, and increasing water demand.

Countries like China, India, and Southeast Asia are prioritizing investments in smart water infrastructure to tackle water scarcity and improve water management efficiency. The adoption of advanced technologies, such as IoT, AI, and big data analytics, integrated with SCADA systems is accelerating. Additionally, supportive government policies and rising awareness of sustainable water management practices contribute to the region’s market expansion.

Regulatory Frameworks

- In India, the Water (Prevention and Control of Pollution) Act of 1974, amended in 1988 and 2003, regulates water pollution control, while the 1977 Cess Act levies charges on industrial water use to fund pollution prevention efforts.

- In the U.S., the Clean Water Act (CWA) provides a regulatory framework for controlling pollutant discharges into surface waters and sets quality standards to protect and maintain the nation’s water resources.

- In the EU, the recast Drinking Water Directive (DWD) ensures access to safe and high-quality drinking water to protect public health. It mandates member states to improve water access, especially for vulnerable groups, reflecting the European Citizens' Initiative 'Right2Water' and social rights principles.

Competitive Landscape

Companies in the SCADA in water and wastewater management industry are investing in advanced automation technologies, integrating AI, IoT, and real-time data analytics to optimize operations and enhance sustainability. They focus on developing centralized control systems that improve accuracy, maintenance, and resource efficiency.

Additionally, firms prioritize reducing energy consumption and carbon footprints while ensuring regulatory compliance and cybersecurity. Collaborations with technology providers and engineering consultants are common to deploy scalable and smart infrastructure solutions that address growing water management challenges.

- In Dec 2024, TAQA Water Solutions awarded a USD 25.9 million project to Electro Mechanical Company for a Siemens-based SCADA system across Abu Dhabi’s water infrastructure. This AI-driven upgrade enhances operational efficiency, reduces carbon emissions by 13%, cuts maintenance costs by 12%, and improves wastewater treatment capacity by 20%. This supports sustainability and advanced real-time monitoring across 43 treatment plants and 260 pumping stations.

List of Key Companies in SCADA in Water and Wastewater Management Market:

- Ovarro

- PSI Software SE

- Eaton

- Emerson Electric Co.

- General Electric Company

- Hitachi, Ltd.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Yokogawa Ltd.

- ABB

- Schneider Electric

- Alliance Water Resources

- ecava

- SJE Inc

- Drexel Group

Recent Developments (Launch)

- In September 2024, Schneider Electric introduced a transformative approach to SCADA systems in the water and wastewater management sector by integrating edge computing and artificial intelligence (AI). This development enables real-time data analysis and decision-making at the operational level, enhancing system response and efficiency. By processing data locally, facilities can reduce latency, minimize downtime, and optimize maintenance schedules. This innovation represents a significant advancement in digitalizing water management infrastructure, offering a cost-effective solution that modernizes legacy systems without complete overhauls.