Buy Now

Pressure Control Equipment Market

Pressure Control Equipment Market Size, Share, Growth & Industry Analysis, By Type (Coiled Tubing Pressure Control Equipment, Wireline Pressure Control Equipment), By Component (Valves, Control Heads, Wellhead Equipment, Adapter Flanges), By End-use Industry (Oil & Gas), and Regional Analysis, 2025-2032

Pages: 170 | Base Year: 2024 | Release: June 2025 | Author: Versha V.

Market Definition

The market covers a range of solutions used to maintain wellbore pressure during various operations across industries. This market includes wireline and coiled tubing pressure control systems, supporting both onshore and offshore applications. It spans key components such as valves, control heads, wellhead equipment, adapter flanges, and other associated hardware.

The report outlines the primary drivers of the market, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the market trajectory.

Pressure Control Equipment Market Overview

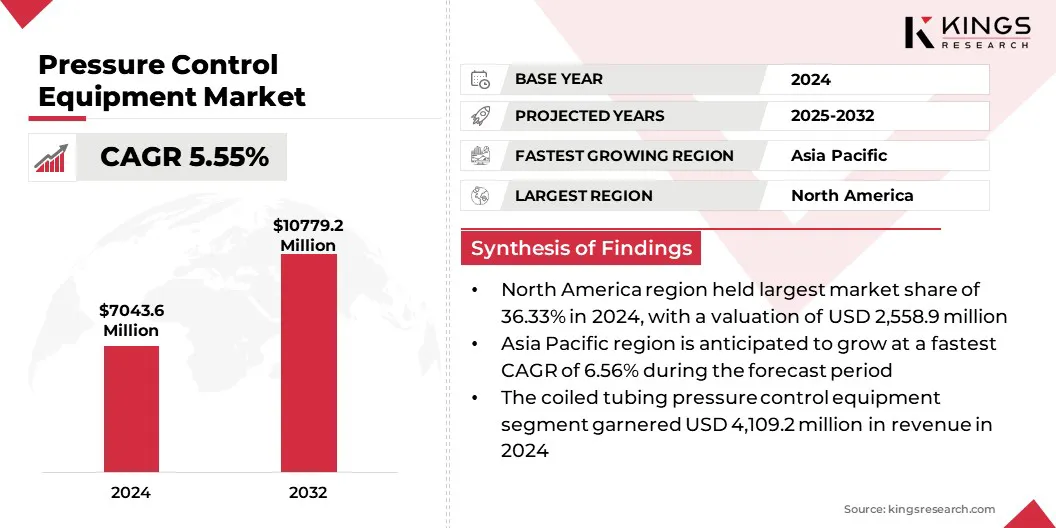

The global pressure control equipment market size was valued at USD 7,043.6 million in 2024 and is projected to grow from USD 7,387.8 million in 2025 to USD 10,779.2 million by 2032, exhibiting a CAGR of 5.55% during the forecast period.

This growth is attributed to the increasing demand from the oil & gas industry, where maintaining wellbore pressure is critical for safe & efficient drilling and production. Rising exploration and production activities, particularly in offshore and Deepwater fields, are fueling the need for advanced pressure control systems

Major companies operating in the pressure control equipment industry are Emerson Electric Co., TIS Manufacturing, The Weir Group PLC, IKM, Baker Hughes Company, Hunting PLC, Halliburton, SLB, Brace Tool Inc., Control Flow, Inc., Weatherford, Integrated Equipment, TechnipFMC plc, NXL Technologies, and NOV.

Technological advancements such as automated control systems and real-time monitoring are enhancing equipment reliability and operational efficiency. Growing industrialization and infrastructure development in emerging economies are also supporting market expansion by increasing the demand for robust pressure management solutions.

- In March 2025, SLB launched EWC electric well control technologies that reduce capital and operational expenses while enhancing safety in drilling operations. These new technologies replace traditional hydraulic systems with simplified electric power systems, offering real-time data insights and continuous on-demand power under all operating conditions.

Key Highlights:

- The pressure control equipment market size was valued at USD 7,043.6 million in 2024.

- The market is projected to grow at a CAGR of 5.55% from 2025 to 2032.

- North America held a market share of 36.33% in 2024, with a valuation of USD 2,558.9 million.

- The coiled tubing pressure control equipment segment garnered USD 4,109.2 million in revenue in 2024.

- The valves segment is expected to reach USD 4,086.4 million by 2032.

- The oil & gas segment is expected to reach USD 4,386.6 million by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 6.56% during the forecast period.

Market Driver

Increased Use of Ring Valves in Industrial Gas Cylinders

The market is driven by the increasing use of ring valves in industrial gas cylinders. These valves play a critical role in maintaining controlled pressure levels and ensuring leak-proof sealing in high-pressure gas applications.

The demand for reliable pressure control mechanisms has intensified as industries such as manufacturing, medical, and energy sectors expand their use of industrial gases.

Ring valves enhance operational safety and extend equipment lifespan, which makes them essential for safe handling and storage of compressed gases. This growing reliance on ring valves directly supports the need for advanced pressure control systems across multiple end-use sectors.

- In April 2025, Rotarex launched a new Ring Valve for industrial gas cylinders to improve safety, efficiency, and ease of use in gas handling. The valve features an ergonomic quarter-turn ring handle for quick operation, integrated safety mechanisms including an automatic outlet detection system and excess flow limiter, and a two-stage opening to prevent pressure surges.

Market Challenge

High Cost of Advanced Technologies and Materials

A significant challenge in the pressure control equipment market is the high cost associated with advanced technologies and materials. Developing equipment that can withstand extreme pressures and harsh environments requires investment in specialized alloys, precision manufacturing, and rigorous testing.

These factors increase the overall cost of pressure control systems, which can limit adoption, especially among smaller operators or in price-sensitive markets.

Manufacturers are focusing on optimizing designs for cost-efficiency without compromising safety and performance. They are also exploring modular components and scalable solutions to provide more flexible and affordable options to a wider range of customers.

Market Trend

Accurate Control for High-precision Manufacturing

The market is registering the trend of accurate control for high-precision manufacturing. Industries such as semiconductors, aerospace, and pharmaceuticals demand tighter process tolerances, intensifying the need for pressure control systems that offer precise and consistent output.

These applications require stable pressure management to avoid defects, ensure product quality, and maintain safety standards. Manufacturers are responding by developing advanced pressure regulators and control systems with high responsiveness, fine-tuning capabilities, and minimal pressure fluctuation, increasing the adoption of pressure control equipment.

- In May 2024, Emerson launched the AVENTICS Series 625 Sentronic proportional pressure control valves to deliver highly accurate electronic pressure control with less than 0.5% deviation. The valves provide flexible control for sophisticated pneumatic applications and include data acquisition software for quick startup, monitoring, and control directly from a PC.

Pressure Control Equipment Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Coiled Tubing Pressure Control Equipment, Wireline Pressure Control Equipment |

|

By Component |

Valves, Control Heads, Wellhead Equipment, Adapter Flanges, Others |

|

By End Use Industry |

Oil & Gas, Chemicals & Petrochemicals, Energy & Utilities, Manufacturing, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Coiled Tubing Pressure Control Equipment, Wireline Pressure Control Equipment): The coiled tubing pressure control equipment segment earned USD 4,109.2 million in 2024, due to its widespread use in well intervention and maintenance operations across high-pressure environments.

- By Component (Valves, Control Heads, Wellhead Equipment, and Adapter Flanges): The valves segment held 38.33% share of the market in 2024, due to their critical role in pressure regulation and flow control during drilling & completion activities.

- By End Use Industry (Oil & Gas, Chemicals & Petrochemicals, Energy & Utilities, and Manufacturing): The oil & gas segment is projected to reach USD 4,386.6 million by 2032, owing to sustained exploration & production activities and increasing investments in offshore drilling projects.

Pressure Control Equipment Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 36.33% share of the pressure control equipment market in 2024, with a valuation of USD 2,558.9 million. This dominance is attributed to the region’s high drilling and well intervention activity, especially in the U.S.

The presence of established oilfield service providers, strong shale gas development, and consistent investments in upstream operations have supported the steady demand for pressure control systems. Additionally, regulatory emphasis on well integrity and worker safety has encouraged the adoption of advanced equipment across exploration and production sites.

- In January 2024, Halliburton Company launched Reservoir Xaminer, a wireline formation testing service designed to deliver precise formation pressure measurements and representative reservoir fluid samples more quickly. The service features dual quartz pressure sensors, real-time monitoring, larger dual probes, and high-strength straddle packers, enabling faster and more accurate formation testing while providing four times the data compared to other tools in the same operation.

The pressure control equipment industry in Asia Pacific is poised to grow at a significant CAGR of 6.56% over the forecast period. This growth is attributed to the rising energy demand, increasing exploration projects, and expanding industrial infrastructure in China, India, and Southeast Asia.

Regional governments are investing in domestic oil & gas production to reduce import dependence, boosting the demand for pressure control systems. The growing presence of global oilfield service companies and rising offshore development projects have further strengthened market prospects in the region.

Regulatory Frameworks

- In the U.S., pressure control equipment used in oil & gas operations is regulated by the Occupational Safety and Health Administration (OSHA) and the Bureau of Safety and Environmental Enforcement (BSEE). The OSHA enforces safety standards under CFR 29, which includes regulations on well control and equipment safety during drilling and servicing operations.

- In Japan, pressure control systems must comply with the High Pressure Gas Safety Act, overseen by the Ministry of Economy, Trade and Industry (METI). The act governs the design, installation, and periodic inspection of pressure equipment to prevent industrial accidents related to high-pressure gas operations.

Competitive Landscape

Key players in the pressure control equipment market are competing through strategic initiatives to strengthen their market position. Companies are focusing on technological advancements to offer more efficient & durable pressure control systems suited for high-pressure and high-temperature environments.

Strategic partnerships and long-term service agreements are being leveraged to secure recurring business from large oilfield operators. Mergers and acquisitions are also common, aimed at expanding geographic reach and enhancing product portfolios. Many players are investing in R&D to develop smart pressure control solutions that integrate real-time monitoring and automation.

Expansion into emerging markets is another key focus, with localized manufacturing and service capabilities enabling faster response times and cost advantages.

- In February 2025, Rotarex introduced the D655, a pneumatic high-pressure hydrogen valve designed for tube trailers and Multiple Element Gas Containers (MEGCs). The D655 supports remote control functionality and operates at pressures up to 500 bar. It features tightness of <10⁻³ mbar.l/sec, a securely retained soft seat, and a design that prevents particle shedding.

List of Key Companies in Pressure Control Equipment Market:

- Emerson Electric Co.

- TIS Manufacturing

- The Weir Group PLC

- IKM

- Baker Hughes Company

- Hunting PLC

- Halliburton

- SLB

- Brace Tool Inc.

- Control Flow, Inc.

- Weatherford

- Integrated Equipment

- TechnipFMC plc

- NXL Technologies

- NOV

Recent Developments (Product Launch)

- In August 2024, Helios Technologies, Inc. launched the FPJP electro-proportional flow control valve through its operating company Sun Hydraulics. The new cartridge valve delivers a high flow rate of 114 gpm (431 L/min) at pressures up to 5000 psi (350 bar). It features Sun’s floating style construction to prevent internal binding and is compatible with the XMD Series valve driver co-developed with Enovation Controls.