Buy Now

OTR Tire Market

OTR Tire Market Size, Share, Growth & Industry Analysis, By Type (Radial, Bias, Solid), By Material (Rubber Compound, Reinforcing, Others,), By Vehicle (Earthmovers, Heavy Duty Trucks, Loaders & Dozers, Tractors, Forklift, Others), By Industry (Construction, Agriculture, Mining, Industrial) and Regional Analysis, 2025-2032

Pages: 180 | Base Year: 2024 | Release: May 2025 | Author: Sunanda G.

Market Definition

The market covers the production and use of heavy-duty tires designed for vehicles operating on rough terrain, including mining trucks, loaders, and construction machinery. These tires are built through precision processes involving multi-layer rubber compounds, strong bead construction, and reinforced sidewalls for durability.

Common applications include mining, agriculture, industrial handling, and infrastructure development. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

OTR Tire Market Overview

The global OTR tire market size was valued at USD 5.21 billion in 2024 and is projected to grow from USD 5.46 billion in 2025 to USD 7.87 billion by 2032, exhibiting a CAGR of 5.22% during the forecast period.

The growth of the market is influenced by rising agricultural mechanization in developing regions, where demand for tractors and harvesters continues to grow. Additionally, advancements in tire design, such as improved tread patterns and durable rubber compounds are enhancing performance and longevity, making them more valuable across off-road applications.

Major companies operating in the OTR tire industry are Bridgestone Corporation, Michelin, The Goodyear Tire & Rubber Company, Continental AG, Yokohama Rubber Company, Pirelli & C. S.p.A., Sumitomo Rubber Industries Ltd., Toyo Tire Corporation, Hankook Tire & Technology Co., Ltd., Apollo Tyres Ltd., MRF Limited, Balkrishna Industries Limited (BKT), Trelleborg AB, Qingdao Rhino Tyre Co., Ltd., and Prometeon Tyre Group S.R.L.

Rapid urbanization and increasing investment in infrastructure projects globally is driving of the growth of market. Projects involving roads, bridges, tunnels, and commercial developments rely on heavy construction machinery, which depends on OTR tires for performance and safety.

Governments in emerging economies are prioritizing transport infrastructure, increasing demand for robust tire solutions that can handle challenging terrain and long-duty cycles.

- In March 2024, Goodyear introduced the RL-5K OTR tire, designed for heavy-duty loaders and wheel dozers. This tire offers enhanced durability and performance, catering to demanding operations in construction and mining sectors.

Key Highlights

- The OTR tire market size was valued at USD 5.21 billion in 2024.

- The market is projected to grow at a CAGR of 5.22% from 2025 to 2032.

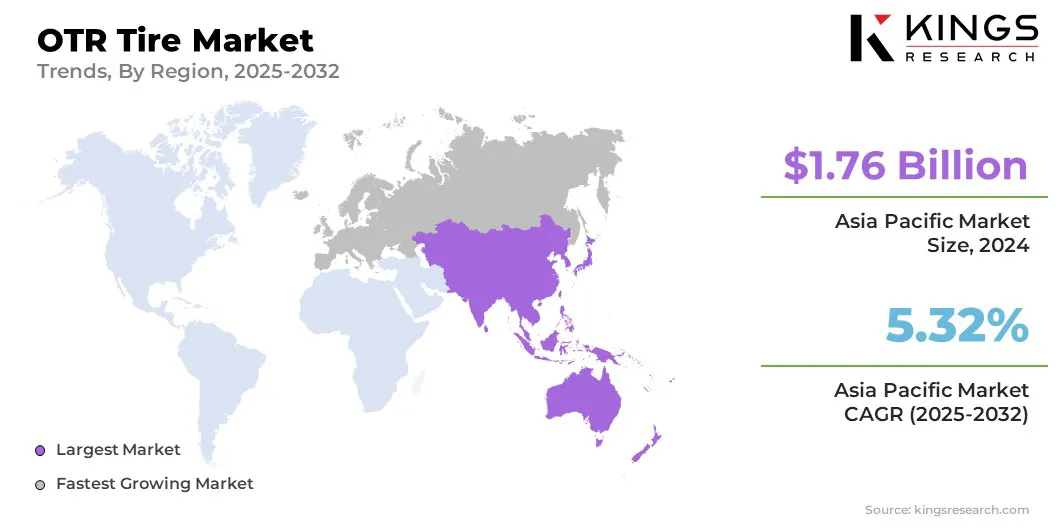

- Asia Pacific held a market share of 33.82% in 2024, with a valuation of USD 1.76 billion.

- The radial segment garnered USD 2.20 billion in revenue in 2024.

- The rubber Compound segment is expected to reach USD 3.15 billion by 2032.

- The earthmovers segment secured the largest revenue share of 29.90% in 2024.

- The agriculture is poised for a robust CAGR of 5.74% through the forecast period.

- Europe is anticipated to grow at a CAGR of 5.60% during the forecast period.

Market Driver

Agricultural Mechanization in Developing Regions

Increased innovations in agricultural practice in Asia-Pacific, Latin America, and parts of Africa has positively impacted the growth of market. Farmers are adopting advanced machinery like tractors, harvesters, and sprayers that require specialized OTR tires with deep tread designs for traction and soil protection.

As food production scales up to support population growth, demand for agricultural equipment and compatible OTR tires is expected to grow consistently during the forecast period.

- In February 2024, MAXAM Tire launched the AGILXTRA I-3 implement tire series with VF (Very High Flexion) technology. Designed for agricultural applications, these tires allow for higher speeds and heavier loads without excessive soil compaction, improving efficiency and sustainability in farming practices.

Market Challenge

High Cost of Raw Materials

A major challenge affecting the growth of the OTR tire market is the high and fluctuating cost of raw materials like natural rubber, synthetic rubber, and carbon black. These materials significantly impact overall production costs, especially for large, heavy-duty tires.

To manage this challenge, companies are actively investing in R&D to develop alternative materials including sustainable rubber blends and silica-based compounds. Manufacturers are also improving production efficiency through automation and lean manufacturing techniques.

Additionally, many are entering long-term supply contracts to stabilize procurement costs and reduce exposure to market volatility, helping maintain competitive pricing without compromising product quality.

Market Trend

Technological Advancements in Tire Design

Innovations in tread patterns, sidewall construction, and compound formulations have enhanced the performance and lifespan of OTR tires. These technological improvements support the expansion of market by offering value-added features such as reduced rolling resistance, better load distribution, and improved heat dissipation.

Tire manufacturers are investing in R&D to develop solutions tailored to extreme operational conditions, making their products more attractive to industries seeking efficiency and durability.

- In February 2025, Michelin introduced the e.Primacy All Season tire to address the changing needs of efficiency-focused drivers. Featuring the GreenPower Compound, this tire is engineered to lower energy consumption in daily driving while offering extended mileage performance. It also incorporates Piano Acoustic Technology, with an intelligently optimized tread pattern that helps minimize road noise, ensuring a quieter driving experience throughout the tire's lifespan.

OTR Tire Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Radial, Bias |

|

By Material |

Rubber Compound, Reinforcing, Others |

|

By Vehicle |

Earthmovers, Heavy Duty Trucks, Loaders & Dozers, Tractors, Forklift, Others |

|

By Industry |

Construction, Agriculture, Mining, Industrial, Port |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Radial, Bias, Solid): The radial segment earned USD 2.20 billion in 2024 due to its superior durability, lower heat generation, and longer tread life, which reduce operating costs and increase efficiency in heavy-duty applications.

- By Material (Rubber Compound, Reinforcing, Others): The rubber compound segment held 40.47% of the market in 2024, due to its critical role in enhancing durability, traction, and performance under extreme operating conditions.

- By Vehicle (Earthmovers, Heavy Duty Trucks, Loaders & Dozers, Tractors, Forklift, Others): The earthmovers segment is projected to reach USD 2.36 billion by 2032, owing to its extensive use in large-scale mining and infrastructure projects.

- By Industry (Construction, Agriculture, Mining, Industrial, Port): The agriculture segment is poised for significant growth at a CAGR of 5.74% through the forecast period, attributed to the high and consistent demand for tractors and harvesters in large-scale farming operations.

OTR Tire Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia Pacific OTR tire market share stood around 33.82% in 2024 in the global market, with a valuation of USD 1.76 billion. Asia Pacific is witnessing rapid development in highways, airports, rail corridors, and industrial zones. Major economies in the region are investing in public infrastructure through long-term development plans.

This is driving increased demand for heavy equipment such as excavators, dumpers, and loaders, directly increasing the need for high-performance OTR tires that can support continuous and high-load operations on rough surfaces. Moreover, Asia Pacific has a high concentration of open-pit mining projects, especially for coal, iron ore, and bauxite.

These operations require large fleets of haul trucks and earthmoving equipment that run in harsh terrain and extreme weather. As mining activity expands to meet regional and export demand, the replacement rate of OTR tires rises, boosting growth in both the OEM and aftermarket segments.

- In December 2024, JK Tyre & Industries launched a new range of OTR tires designed for challenging terrains, targeting heavy-duty machinery in the mining sector. These tires are engineered to deliver robust performance, enhanced durability, and improved efficiency, setting new standards in tire technology for the industry.

The OTR tire industry in Europe is poised for significant growth at a robust CAGR of 5.60% over the forecast period. The expansion of wind farms, solar parks, and related infrastructure projects across Europe is creating demand for construction equipment suited to off-road terrain.

These projects typically take place in remote or uneven locations, requiring OTR tires that can support heavy lifting, transport, and ground leveling. This offers new market opportunities for OTR tire manufacturers supplying to energy contractors.

Furthermore, agricultural equipment in Europe is highly specialized, with a strong emphasis on precision and efficiency. The growth in smart farming practices is contributing to rising demand for high-performance agricultural tires that reduce soil compaction and increase field productivity.

Regulatory Frameworks

- The U.S. Environmental Protection Agency (EPA) enforces regulations on tire manufacturing related to emissions and waste management. The Occupational Safety and Health Administration (OSHA) sets workplace safety rules for equipment that use OTR tires, focusing on operational safety and tire handling. Additionally, the Department of Transportation (DOT) enforces tire performance and labeling requirements, ensuring tires meet standards for durability and traction, especially for off-road and industrial vehicles.

- Europe maintains strict regulatory frameworks emphasizing safety, environmental impact, and quality assurance. The European Tyre and Rim Technical Organisation (ETRTO) sets technical standards for OTR tires, covering dimensions, load capacities, and inflation pressures. The European Union's REACH Regulation restricts harmful chemicals in tire compounds, ensuring safer manufacturing processes.

- In China, the government enforces strict environmental laws through the Ministry of Ecology and Environment (MEE) that regulate emissions during tire production. The China Compulsory Certification (CCC) mark is mandatory for tires, including OTR tires, ensuring compliance with national quality and safety standards.

- Japan’s Ministry of Economy, Trade and Industry (METI) sets tire safety standards and mandates labeling requirements. The Japanese Industrial Standards (JIS) include detailed specifications for tire durability and performance, relevant to OTR applications. Environmental policies also encourage the use of eco-friendly materials and promote tire recycling programs.

Competitive Landscape

Market players in the OTR tire market are adopting strategies such as designing specialized tires tailored to specific applications, like quarry and mining operations and integrating proprietary technologies to enhance strength, heat resistance, and overall performance.

By offering multiple compound options to suit varied operational needs, companies are addressing the growing demand for durability and efficiency in harsh working environments. These advancements improve equipment uptime and reduce replacement cycles and operational costs, making them highly valuable to end-users.

- In March 2025, Bridgestone Americas unveiled the VRDU, the first aggregate tire engineered with the company's MASTERCORE technology. This innovation aims to enhance performance and durability in demanding applications. The Bridgestone MASTERCORE VRDU is specially crafted for use on rock surfaces. It comes in four advanced compounds, engineered to meet the specific demands of different quarry operations. Designed for dump trucks, this tire features advanced terrain technology aimed at enhancing operational efficiency.

List of Key Companies in OTR Tire Market:

- Bridgestone Corporation

- Michelin

- The Goodyear Tire & Rubber Company

- Continental AG

- Yokohama Rubber Company

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries Ltd.

- Toyo Tire Corporation

- Hankook Tire & Technology Co., Ltd.

- Apollo Tyres Ltd.

- MRF Limited

- Balkrishna Industries Limited (BKT)

- Trelleborg AB

- Qingdao Rhino Tyre Co., Ltd.

- Prometeon Tyre Group S.R.L.

Recent Developments (Partnerships/Expansion/Product Launches)

- In August 2024, Bridgestone announced an approximately USD 170 million investment to upgrade its Kitakyushu Plant in Fukuoka Prefecture, Japan. This enhancement focuses on producing OTR tires for mining and construction vehicles, aiming to ensure high quality and stable supply.

- In July 2024, BKT released the FL 695 steel-belted radial tire, designed to enhance performance in construction applications and agri-transport operations. The tire features a puncture-resistant compound for reliability in demanding operating conditions.

- In July 2024, Trelleborg Tires announced a partnership with John Deere to expand its presence in Brazil. Trelleborg's products is expected to be available at over 300 John Deere dealerships across the country, providing Brazilian farmers with access to a wide range of agricultural tires and after-sales services.

- In March 2024, Michelin introduced two new tire sizes, VF900/65R46 CFO and VF800/70R46 CFO, as part of an exclusive partnership with New Holland for the CR11 combined harvester. These tires feature Michelin's ULTRAFLEX technology, offering a 23% larger footprint and 7% reduced ground pressure, enhancing soil protection and fuel efficiency in large-scale farming operations.