Buy Now

Nanosilica Market

Nanosilica Market Size, Share, Growth & Industry Analysis, By Product (P-type, S-Type, Others), By Application (Rubber, Healthcare, Coatings, Plastics, Electronics, Others), and Regional Analysis, 2024-2031

Pages: 170 | Base Year: 2023 | Release: April 2025 | Author: Sunanda G.

Market Definition

The market encompasses the production, formulation, and application of silica nanoparticles, which are engineered through sol-gel, flame synthesis, and precipitation processes to achieve precise particle size and surface characteristics.

These ultrafine silica particles enhance mechanical strength, thermal stability, and rheological properties in coatings, adhesives, and composites. Their high surface area and reactivity make them integral to reinforcing rubber in tire manufacturing, improving cement durability, and enhancing drug delivery in pharmaceuticals.

Nanosilica Market Overview

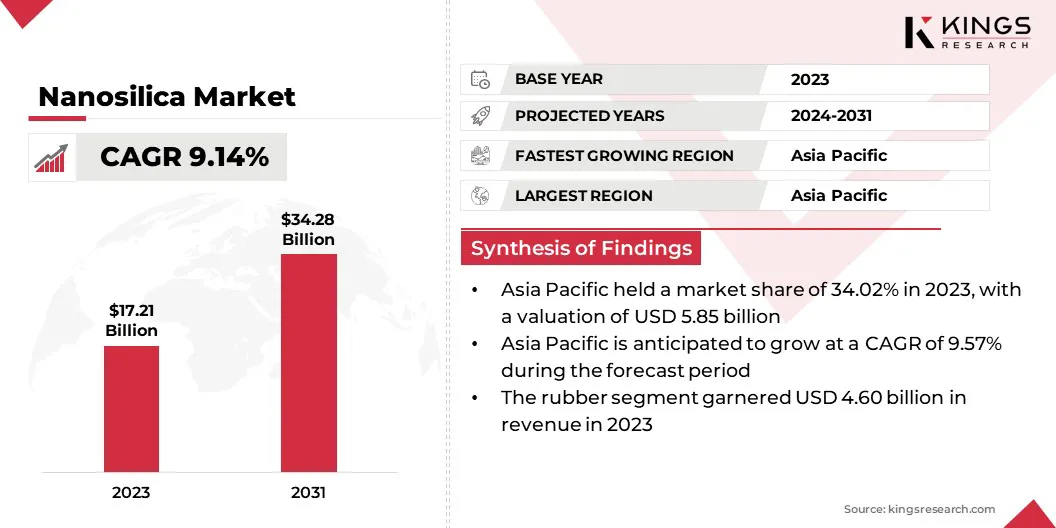

The global nanosilica market size was valued at USD 17.21 billion in 2023 and is projected to grow from USD 18.58 billion in 2024 to USD 34.28 billion by 2031, exhibiting a CAGR of 9.14% during the forecast period. Market growth is driven by its rising use in high-performance polymer composites, enhancing mechanical properties and thermal stability.

Growing adoption in pharmaceuticals and biomedical applications further boosts this demand, as it improves drug delivery efficiency and biocompatibility. Additionally, increasing focus on sustainable and eco-friendly materials is accelerating its integration across multiple industries.

Major companies operating in the nanosilica industry are Evonik, Cabot Corporation, BSB Nanotechnology, BIONANOKOREA CO., LTD., nanoComposix, Wacker Chemie AG, Master Bond Inc., Normet, Antenchem, Vitro Minerals Inc., HiQ-Nano S.r.l., XETEX, NYACOL Nano Technologies Inc., SkySpring Nanomaterials, Inc., Cenate, and others.

The market is witnessing significant growth due to its ability to enhance the mechanical and chemical properties of coatings and adhesives. Its benefits, including improved scratch resistance, rheology control, and anti-corrosion characteristics have made it indespensible in industrial coatings, protective films, and high-performance adhesives.

The growing demand for durable surfaces across industries such as construction, aerospace, and consumer goods is bolstering market expansion.

Key Highlights:

- The nanosilica industry size was recorded at USD 17.21 billion in 2023.

- The market is projected to grow at a CAGR of 9.14% from 2024 to 2031.

- Asia Pacific held a share of 34.02% in 2023, valued at USD 5.85 billion.

- The P-type segment garnered USD 6.62 billion in revenue in 2023.

- The plastics segment is poised to grow at a CAGR of 9.43% through the projection period.

- Europe is anticipated to grow at a CAGR of 9.16% during the forecast period.

Market Driver

"Growing Integration in Pharmaceutical and Biomedical Applications"

The increasing use of nanosilica in pharmaceuticals is fueling the growth of the nanosilica market. Its ability to enhance drug solubility, improve bioavailability, and enable controlled drug delivery makes it as a valuable excipient in pharmaceutical formulations. Research institutions and biotechnology firms are exploring nanosilica-based carriers for targeted drug delivery and improved therapeutic outcomes.

- A study by the National Library of Medicine in June 2023, highlights that silica nanoparticles serve as an effective carrier for chloramphenicol in topical drug formulations. Findings suggest that this approach enables a reduction in drug concentration, minimizing side effects while optimizing therapeutic outcomes. The incorporation of nanosilica enhances the safety profile of chloramphenicol and facilitates the development of a controlled-release formulation. Compared to commercially available alternatives, nanosilica-based drug delivery demonstrates significantly improved antimicrobial activity, reinforcing its potential for advanced pharmaceutical applications.

Market Challenge

"High Production Costs and Scalability Issues"

The nanosilica market faces a significant challenge due to high production costs and scalability limitations, which hinder widespread adoption across various industries. The complexity of synthesis processes, energy-intensive manufacturing, and stringent purity requirements contribute to elevated costs, making large-scale production economically challenging.

To address this, companies are investing in advanced production technologies, including one-step synthesis methods and automated manufacturing systems, to enhance efficiency and reduce costs.

Strategic partnerships with research institutions and material science firms are driving process innovations, enabling scalable production while maintaining quality and performance standards for commercial applications.

Market Trend

"Surging Adoption of Nanosilica for Sustainable Solutions"

The nanosilica market is experiencing growth due to the increasing shift toward sustainable materials. Industries are seeking alternatives that reduce carbon footprints while maintaining high-performance characteristics.

The ability of nanosilica to enhance material durability, improve resource efficiency, and minimize environmental impact has positioned it as a preferred choice for green technologies. Government policies promoting eco-friendly materials in manufacturing, construction, and industrial applications are further supporting market expansion.

- In January 2025, Evonik launched Smart Effects, a new business line integrating its Silica and Silanes divisions to develop advanced eco-friendly solutions. This initiative leverages expertise in molecular silane chemistry and silica particle design to deliver tailored eco-friendly solutions. In the tire industry, the combination of silica and silanes has been instrumental in producing fuel-efficient and safer green tires, reducing carbon footprints. Additionally, Smart Effects supports the electronics sector’s green transition by providing high-purity silica based nanoparticles and silanes for lithium-ion batteries, semiconductors, and display technologies.

Nanosilica Market Report Snapshot

|

Segmentation |

Details |

|

By Product |

P-type, S-Type, Others |

|

By Application |

Rubber, Healthcare, Coatings, Plastics, Electronics, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Product (P-type, S-Type, and Others): The P-type segment earned USD 6.62 billion in 2023 due to its high surface area and superior adsorption properties, making it essential for applications in coatings, adhesives, catalysts, and biomedical formulations where enhanced performance and stability are required.

- By Application (Rubber, Healthcare, Coatings, Plastics, Electronics, and Others): The plastics segment is set to grow at a CAGR of 9.43% through the forecast period, largely attributed to its ability to enhance mechanical strength, thermal stability, and barrier properties, leading to increased adoption in high-performance polymer composites for automotive, packaging, and electronics applications.

Nanosilica Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

The North America nanosilica market share stood at around 34.02% in 2023, valued at USD 5.85 billion. This growth is stimulated by the region's expanding electronics industry, particularly in countries such as China, Japan, South Korea, and Taiwan.

The increasing investment in semiconductor fabrication plants and the demand for miniaturized electronic components are boosting the adoption of nanosilica in advanced electronic manufacturing. The region’s dominance in consumer electronics and electric vehicle (EV) battery production further propels this growth.

Moreover, the shift toward sustainable farming practices, supported by government policies and technological advancements, is fostering the adoption of nanosilica-based agrochemicals.

Research institutions and agricultural firms in the region are actively developing nanosilica-enhanced solutions to optimize yield and efficiency in food production, contributing to the regional market growth.

Europe nanosilica industry is set to grow at a robust CAGR of 9.16% over the forecast period. Europe’s shift toward energy transition and electrification is fueling the demand for high-purity nanosilica in battery technologies.

Companies in Germany, France, and Sweden are incorporating nanosilica in lithium-ion batteries and next-generation energy storage solutions to enhance thermal stability, energy density, and charge efficiency. The region’s commitment to reducing dependency on fossil fuels and promoting electric vehicle (EV) adoption is accelerating domestic market progress.

Furthermore, leading universities, nanotechnology research centers, and corporate R&D facilities in France, Germany, and the Netherlands are developing advanced nanosilica formulations tailored for high-performance materials, coatings, and biomedical applications.

The European Commission’s funding for nanotechnology research and sustainable materials is fostering regional market expansion, enabling new product development and the commercialization of nanosilica-based solutions.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) enforces the Toxic Substances Control Act (TSCA), which governs the manufacture, import, and processing of chemical substances, including nanomaterials like nanosilica. Manufacturers are required to submit pre-manufacture notices (PMNs) for new chemical substances, providing data on health and environmental effects. The EPA evaluates these submissions to determine if regulatory actions are necessary.

- The European Chemicals Agency (ECHA) implements the Registration, Evaluation, Authorisation, and Restriction of Chemicals (REACH) regulation. REACH mandates that companies manufacturing or importing over one tonne of chemicals annually register them with ECHA, including data on properties, uses, and safety. Since January 2020, additional provisions require detailed information on nanomaterials' characteristics and risks.

- China's Ministry of Ecology and Environment (MEE) regulates new chemical substances, including nanomaterials like nanosilica, under the Measures for the Environmental Management Registration of New Chemical Substances (MEE Order No. 12). Companies must register new nanomaterials and conduct environmental risk assessments prior to production or importation.

- Japan's Chemical Substances Control Law (CSCL) governs chemical substances, including nanomaterials. Manufacturers and importers of nanosilica are required to submit notifications and conduct safety evaluations. The Ministry of Economy, Trade and Industry (METI) ensures compliance and may request additional information if risks are identified.

Competitive Landscape

The nanosilica industry is characterized by market players focusing on technological innovations aimed at enhacing production efficiency and reducing costs. Advancements in synthesis techniques are enabling the large-scale production of high-purity nanosilica with improved performance characteristics, expanding its applications in energy storage, electronics, and advanced coatings.

By refining manufacturing methods and optimizing raw material utilization, companies are strengthening their market position while supporting next-generation technologies that leverage nanosilica’s unique properties.

- In March 2023, Australian startup Kinaltek introduced a groundbreaking one-step production process that converts standard silica powders into battery-grade nanosilicon at less than 5% of the cost of conventional methods. This enhances the potential for silicon nanoparticles in high-performance lithium-ion batteries.

List of Key Companies in Nanosilica Market:

- Evonik

- Cabot Corporation

- BSB Nanotechnology

- BIONANOKOREA CO., LTD.

- nanoComposix

- Wacker Chemie AG

- Master Bond Inc.

- Normet

- Antenchem

- Vitro Minerals Inc.

- HiQ-Nano S.r.l.

- XETEX

- NYACOL Nano Technologies Inc.

- SkySpring Nanomaterials, Inc.

- Cenate

Recent Developments (Expansion)

- In July 2024, Cenate successfully sacled its manufacturing process for silicon nano composites to the first commercial level. This milestone was achieved in collaboration with the Dynatec Group, whose primary production facility is adjacent to Cenate’s pilot site.