Buy Now

Environmental Testing Market

Environmental Testing Market Size, Share, Growth & Industry Analysis, By Technology (Rapid, Conventional), By Sample (Wastewater/Effluent, Soil, Water, Air), By Target-tested (Chemical, Biological, Temperature, Particulate Matter, Moisture, Noise), By End Use, and Regional Analysis, 2025-2032

Pages: 160 | Base Year: 2024 | Release: June 2025 | Author: Versha V.

Market Definition

The market encompasses analytical services and technologies designed to detect, quantify, and monitor environmental pollutants to ensure regulatory compliance and safeguard public & ecological health. It includes instrumentation and services for testing air, water, soil, and waste across sectors such as industrial manufacturing, energy, agriculture, and construction.

Core technologies include chromatography, spectroscopy, and microbiological analysis, supported by advanced data management systems. The report examines critical driving factors, industry trends, regional developments, and regulatory frameworks impacting market growth through the forecast period.

Environmental Testing Market Overview

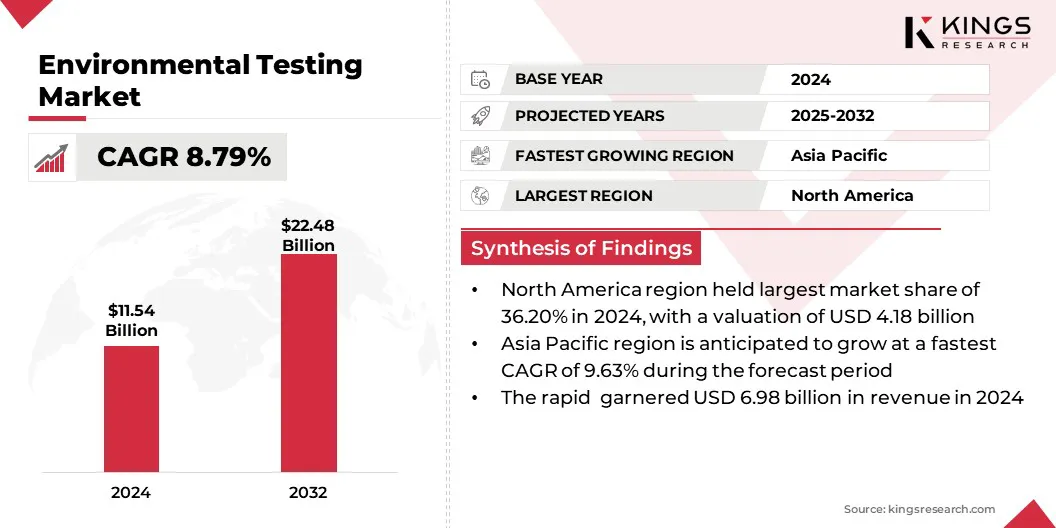

The global environmental testing market size was valued at USD 11.54 billion in 2024 and is projected to grow from USD 12.47 billion in 2025 to USD 22.48 billion by 2032, exhibiting a CAGR of 8.79% during the forecast period.

Rising pollution and stringent regulations drive the demand for advanced environmental testing, with innovations in sensor technology enabling precise, real-time contaminant monitoring and enhancing regulatory compliance.

Major companies operating in the environmental testing industry are SGS Société Générale de Surveillance SA., Bureau Veritas, Eurofins Scientific, Intertek Group Plc, TÜV SÜD, AsureQuality., ALS Mérieux NutriSciences Corporation, Microbac Laboratories, Inc., Symbio Labs., Envirolab Services Pty Ltd, R J Hill Laboratories Limited, Alex Stewart Agriculture, EMSL Analytical, Inc., and Envirosure Inc.

Global focus on sustainable development is driving the market. Governments and industries are increasingly implementing environmental assessment protocols to align with sustainability objectives.

Rising demand for accurate analysis of air, water, and soil quality is prompting the adoption of advanced testing technologies. This shift is strengthening compliance efforts and accelerating market expansion across multiple sectors.

Key Highlights:

- The environmental testing market size was valued at USD 11.54 billion in 2024.

- The market is projected to grow at a CAGR of 8.79% from 2025 to 2032.

- North America held a market share of 36.20% in 2024, with a valuation of USD 4.18 billion.

- The rapid segment garnered USD 6.98 billion in revenue in 2024.

- The wastewater/effluent segment is expected to reach USD 8.19 billion by 2032.

- The chemical segment secured the largest revenue share of 34.55% in 2024.

- The government segment is poised for a robust CAGR of 9.60% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 9.63% during the forecast period.

Market Driver

Rising Pollution Levels

Rising pollution levels across air, water, and soil are driving the market. Environmental testing enables the detection and analysis of contaminants, ensuring regulatory compliance and public health safety.

Additionally, increased industrial emissions, urban waste discharge, and agricultural runoff are accelerating the demand for reliable testing solutions. This growing need for pollution monitoring is expected to significantly support the market expansion in the coming years.

- In April 2025, the American Lung Association’s “State of the Air” report revealed that 156 million U.S. residents, 25 million more than the previous year live in areas with failing grades for ozone or particle pollution, largely due to worsening air quality caused by extreme heat and wildfires.

Market Challenge

High Costs and Limited Access to Technology

The environmental testing market is challenged by the high cost and limited accessibility of advanced testing technologies, particularly in developing regions. This restricts the widespread implementation of comprehensive environmental monitoring programs.

Manufacturers are focusing on the development of cost-effective, portable testing solutions without compromising analytical precision. Strategic collaborations with regional laboratories and government bodies are also being pursued to expand infrastructure and improve service reach.

These initiatives aim to democratize access to high-quality environmental testing and support global efforts toward sustainable environmental management.

Market Trend

Advancements in Sensor Technology

Advances in sensor technology are enabling more precise, real-time monitoring of contaminants and pollutants. This technological evolution supports improved data accuracy and faster response times, aligning with stricter environmental regulations.

The trend reflects an industry shift toward high-resolution, automated testing solutions, enhancing decision-making in environmental risk assessment and regulatory compliance

- In February 2025, the National Aeronautics and Space Administration (NASA) introduced the Inexpensive Network Sensor Technology for Exploring Pollution (INSTEP), a network of compact, low-cost atmospheric sensors based on a design from the Hannigan Lab at the University of Colorado Boulder. These sensors measure trace gases, including CH₄, HCHO, CO, CO₂, NO₂, and O₃, using ML-enabled calibration to ensure accuracy.

Environmental Testing Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Rapid (Mass Spectrometer Testing, Molecular Spectroscopy Testing, Chromatography Testing, Acidity/Alkalinity Testing, Turbidity Testing, PCR Testing, Immunoassay Testing), Conventional (Culture Plate Method, Biological & Chemical Oxygen Demand (BOD & COD), Dissolved Oxygen Determination (DOD)) |

|

By Sample |

Wastewater/Effluent, Soil, Water, Air, Noise |

|

By Target-tested |

Chemical, Biological, Temperature, Particulate Matter, Moisture, Noise |

|

By End use |

Government, Industrial, Environment Testing Laboratories, Energy & Utilities, Agriculture |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Technology (Rapid, Conventional): The rapid segment earned USD 6.98 billion in 2024, due to the increasing demand for advanced, precise, and automated testing solutions to meet stringent regulatory standards and environmental monitoring needs.

- By Sample (Wastewater/Effluent, Soil, Water, Air and Noise): The wastewater/effluent segment held 35.38% share of the market in 2024, due to rising industrial discharge regulations and growing emphasis on water pollution control & sustainable wastewater management.

- By Target-tested (Chemical, Biological, Temperature, Particulate Matter, Moisture and Noise): The chemical segment is projected to reach USD 8.16 billion by 2032, owing to the increasing need to monitor and control hazardous chemical pollutants to ensure environmental safety and regulatory compliance.

- By End use (Government, Industrial, Environment Testing Laboratories, Energy & Utilities, Agriculture): The government segment earned USD 3.18 billion in 2024, due to stringent environmental regulations and enforcement mandates requiring extensive monitoring and compliance across various industries.

Environmental Testing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for 36.20% share of the environmental testing market in 2024, with a valuation of USD 4.18 billion. The market dominance is attributed to significant investments in research & development of advanced testing technologies.

Continuous innovation in analytical instruments, coupled with collaboration between government agencies, academic institutions, and private sector firms, has enhanced testing accuracy and efficiency. These advancements enable comprehensive monitoring and compliance, reinforcing the region’s leadership in delivering high-quality environmental testing solutions across diverse industries.

The environmental testing industry in Asia Pacific is poised for significant growth at a robust CAGR of 9.63% over the forecast period. This growth is attributed to substantial government investments in environmental infrastructure and technology. Strategic initiatives aimed at enhancing pollution control, water treatment, and waste management are driving the adoption of advanced testing solutions.

Coupled with increasing foreign direct investment and industrial expansion, these factors are accelerating market growth and establishing the region as a critical hub for environmental testing services.

Regulatory Frameworks

- In the U.S., the Environmental Protection Agency (EPA) governs environmental testing through regulations including the Clean Air Act, Clean Water Act, Resource Conservation and Recovery Act, and Safe Drinking Water Act. These laws establish stringent standards for monitoring air, water, hazardous waste, and drinking water to ensure environmental and public health protection.

- In China, the Environmental Protection Law of the People’s Republic of China serves as the fundamental legal framework governing environmental monitoring and testing activities. This law establishes the responsibilities of governmental bodies and enterprises in protecting the environment by setting clear requirements for the systematic monitoring, evaluation, and reporting of environmental quality. It mandates the implementation of standardized testing procedures to assess air, water, soil, and other environmental media, ensuring accurate data collection to support pollution control and environmental management efforts nationwide.

Competitive Landscape

The environmental testing market is registering intense competition through frequent product launches and strategic innovations. Companies are introducing advanced testing instruments and consumables to address emerging contaminants and regulatory requirements.

Increased R&D investments and collaborations are accelerating the development of reliable, accurate solutions. Market participants focus on enhancing functionality, cost efficiency, and customization to cater to diverse industry needs and regulatory standards, driving the market.

- For instance, in May 2025, Presto launched a comprehensive range of Environmental Test Chambers, featuring specialized test cabinets designed to evaluate product performance under diverse temperature conditions. These high-quality, space-efficient chambers address humidity, altitude, and temperature testing requirements, catering to laboratories with limited space.

List of Key Companies in Environmental Testing Market:

- SGS Société Générale de Surveillance SA.

- Bureau Veritas

- Eurofins Scientific

- Intertek Group Plc

- TÜV SÜD

- AsureQuality.

- ALS

- Mérieux NutriSciences Corporation

- Microbac Laboratories, Inc.

- Symbio Labs.

- Envirolab Services Pty Ltd

- R J Hill Laboratories Limited

- Alex Stewart Agriculture

- EMSL Analytical, Inc.

- Envirosure Inc.

Recent Developments (M&A)

- In January 2025, SGS Société Générale de Surveillance SA announced the acquisition of RTI Laboratories. This acquisition strengthens SGS’s material testing services by incorporating metallurgical testing, alloy chemistry, failure analysis, and paint & coating evaluations into its Midwest network.