Buy Now

Drone Sensor Market

Drone Sensor Market Size, Share, Growth & Industry Analysis, By Sensor Type (Inertial Sensors, Image Sensors, Pressure Sensors, Others), By Drone Type (Fixed-wing Drones, Rotary-wing Drones, Hybrid Drones, Nano and Micro Drones), By Application, By End-use Industry, and Regional Analysis, 2024-2031

Pages: 220 | Base Year: 2023 | Release: May 2025 | Author: Versha V.

Market Definition

The market encompasses the landscape of sensor technologies integrated into unmanned aerial systems across commercial, industrial, and defense sectors. It includes hardware, software, and systems used for data collection, navigation, imaging, and environmental monitoring.

The market covers a wide range of applications, including agriculture, surveillance, mapping, inspection, and logistics, and involves a diverse ecosystem of manufacturers, system integrators, and solution providers. The report offers a thorough assessment of the key driving factors, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Drone Sensor Market Overview

The global drone sensor market size was valued at USD 1,432.9 million in 2023 and is projected to grow from USD 1,693.5 million in 2024 to USD 5,474.0 million by 2031, exhibiting a CAGR of 18.25% during the forecast period.

The market is growing steadily due to the increasing use of drones across industries such as defense, infrastructure, and environmental monitoring. Moreover, the rising demand for high-precision data collection is driving the need for advanced sensors like thermal, LiDAR, and multispectral, thereby accelerating market growth.

Major companies operating in the drone sensor industry are Mapix technologies Ltd, Teledyne FLIR LLC, Honeywell International Inc., Trimble Inc., Robert Bosch Stiftung GmbH, TDK Corporation, Ouster Inc., Movella Inc, SICK AG, Analog Devices, Inc., Quantum-Systems GmbH, HBK, Inc, RIEGL LASER MEASUREMENT SYSTEMS GMBH, TE Connectivity, and AeroVironment, Inc.

The expanding use of drones in agriculture is a key driver in the global market, as they enable precision farming by delivering real-time insights into crop health, soil conditions, and irrigation needs. Additionally, growing government initiatives and investments in drone technology for public safety, disaster response, and environmental monitoring are accelerating the adoption of sensor-equipped drones across various sectors.

- In November 2024, the Indian government launched the Namo Drone Didi scheme to empower women-led Self-Help Groups (SHGs) by providing 15,000 drones for agricultural use. The initiative offers up to 80% subsidy and pilot training, enabling SHGs to rent drone services to farmers for fertilizer and pesticide application, to increase farmer income and promote the modernization of agricultural practices.

Key Highlights

- The drone sensor market size was valued at USD 1,432.9 million in 2023.

- The market is projected to grow at a CAGR of 18.25% from 2024 to 2031.

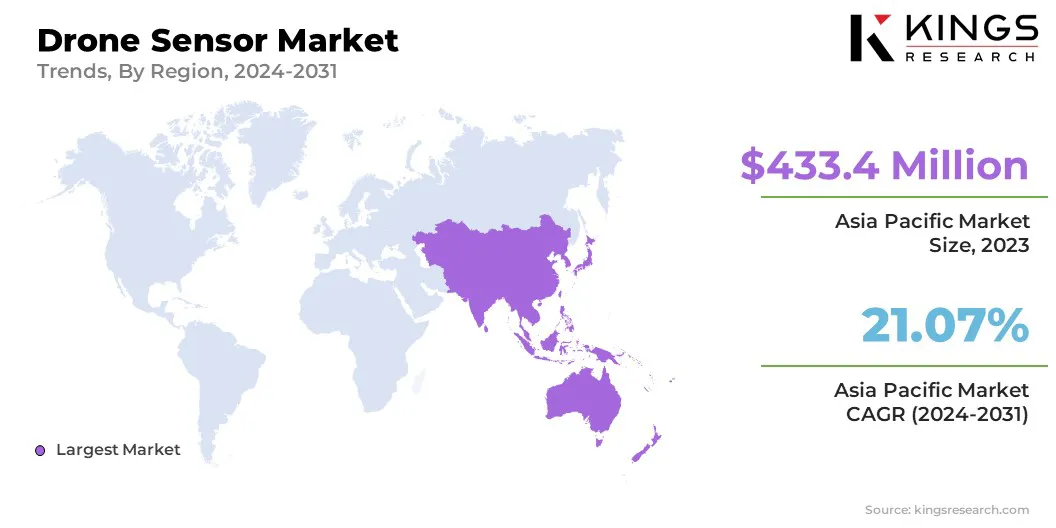

- Asia Pacific held a market share of 30.25% in 2023, with a valuation of USD 433.4 million.

- The image sensors segment garnered USD 281.8 million in revenue in 2023.

- The rotary-wing drones segment is expected to reach USD 2,793.9 million by 2031.

- The navigation & collision avoidance segment is expected to reach USD 1,495.5 million by 2031.

- The defense & security segment is expected to reach USD 1,429.8 million by 2031.

- The market in North America is anticipated to grow at a CAGR of 16.48% during the forecast period.

Market Driver

Rising Demand for Advanced Sensors in Drones to Enhance Safety and Operational Reliability

The market is driven by the growing focus on safety across various industrial sectors. Drones equipped with specialized sensors, including gas detectors, thermal sensors, and multi-spectral imaging systems, are increasingly being adopted for tasks that involve hazardous environments or high-risk operations.

These sensors significantly enhance safety by providing real-time data that helps operators identify potential dangers, such as the presence of combustible gases before they escalate into critical issues. In industries like oil and gas, mining, and power generation, where environmental and operational risks are heightened, the ability to monitor and respond to safety threats in real time is essential.

As companies continue to focus on risk mitigation and worker protection, the demand for drones with advanced safety sensors is set to grow, driving the market's evolution.

- In October 2024, Flyability launched a new flammable gas sensor for its Elios 3 drone in partnership with NevadaNano. The sensor provides real-time warnings of combustible gases in confined spaces, enhancing safety during industrial inspections. It detects over 14 types of gases with high precision and is designed for use in sectors such as oil and gas, power generation, sewers, and mining.

Market Challenge

Data Security and Privacy Concerns

A key challenge in the drone sensor market is ensuring secure and private data handling, especially as drones are increasingly used in sensitive fields like defense, agriculture, and infrastructure inspection.

Drones often collect large volumes of real-time data, including high-resolution images, videos, and environmental readings, which can contain valuable or confidential information. As these data sets are transmitted wirelessly, they are vulnerable to cyber threats such as hacking, data breaches, and unauthorized access.

To address these concerns, solutions such as encrypted data transmission, secure cloud storage, and robust cybersecurity protocols are being implemented. Additionally, advancements in blockchain technology and AI-based security measures are further enhancing the protection of sensitive data.

Market Trend

Integration of Multi-Sensor Systems in Drone Technology for Enhanced Data Collection and Situational Awareness

A key trend in the market is the integration of multi-sensor systems, combining technologies such as LiDAR, thermal, and RGB sensors into compact drone systems. This integration allows for more comprehensive data collection and enhanced situational awareness, enabling drones to capture a wide array of information in a single flight.

LiDAR provides highly accurate topographic data, thermal sensors offer insights into temperature variations for infrastructure or environmental monitoring, and RGB sensors deliver detailed visual imagery.

By merging these sensors, drones can perform complex tasks more efficiently, offering a broader scope of analysis in industries such as agriculture, infrastructure inspection, and environmental monitoring. As demand for more versatile and powerful drone systems increases, this trend of multi-sensor payload integration is poised to drive further growth in the market.

- In February 2025, 3D TARGET and Sentera Sensors & Drones formed a strategic partnership to expand 3D TARGET's product portfolio. The collaboration focuses on integrating multispectral, thermal, and RGB sensors, optimizing processes and increasing efficiency for drone applications across various sectors.

Drone Sensor Market Report Snapshot

|

Segmentation |

Details |

|

By Sensor Type |

Inertial Sensors, Image Sensors, Pressure Sensors, Position Sensors, Ultrasonic Sensors, LiDAR Sensors, Infrared Sensors, Thermal Sensors, Proximity Sensors, Multispectral & Hyperspectral Sensors |

|

By Drone Type |

Fixed-wing Drones, Rotary-wing Drones, Hybrid Drones, Nano and Micro Drones |

|

By Application |

Navigation & Collision Avoidance, Data Acquisition & Transmission, Motion Detection, Air Pressure Measurement, Thermal Detection, Environmental Monitoring |

|

By End-use Industry |

Agriculture, Defense & Security, Environmental & Weather Monitoring, Media & Entertainment, Energy & Utilities, Construction & Mining, Oil & Gas, Logistics & Warehousing, Disaster Management & Search-and-Rescue, Smart Cities & Infrastructure |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Sensor Type (Inertial Sensors, Image Sensors, Pressure Sensors, Position Sensors, Ultrasonic Sensors, LiDAR Sensors, Infrared Sensors, Thermal Sensors, Proximity Sensors, and Multispectral & Hyperspectral Sensors): The image sensors segment earned USD 281.8 million in 2023 due to the growing demand for high-resolution imaging in surveillance, mapping, and precision agriculture.

- By Drone Type (Fixed-wing Drones, Rotary-wing Drones, Hybrid Drones, Nano and Micro Drones): The rotary-wing drones segment held 49.37% of the market in 2023, due to their ability to hover, take off vertically, and operate effectively in confined or complex environments.

- By Application (Navigation & Collision Avoidance, Data Acquisition & Transmission, Motion Detection, Air Pressure Measurement, Thermal Detection, Environmental Monitoring): The navigation & collision avoidance segment is projected to reach USD 1,495.5 million by 2031, owing to the rising need for autonomous flight capabilities and enhanced safety in both commercial and defense operations.

- By End-use Industry (Agriculture, Defense & Security, Environmental & Weather Monitoring, Media & Entertainment, Energy & Utilities, Construction & Mining, Oil & Gas, Logistics & Warehousing, Disaster Management & Search-and-Rescue, Smart Cities & Infrastructure): The defense & security segment is projected to reach USD 1,429.8 million by 2031, owing to increased military spending on unmanned systems for surveillance, reconnaissance, and threat detection.

Drone Sensor Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific accounted for 30.25% share of the drone sensor market in 2023, with a valuation of USD 433.4 million. This dominance is primarily driven by strong demand from countries such as China, Japan, and India.

China, in particular, has a large and mature drone manufacturing ecosystem, with major players investing heavily in sensor innovations for applications ranging from agricultural spraying to urban logistics. Japan’s precision agriculture and infrastructure inspection sectors also make significant contributions, fueled by its aging workforce and need for automation.

In India, expanding defense modernization programs and commercial drone deployments for mapping and surveying have further supported regional growth. The integration of AI-enabled sensors further enhances operational efficiency and data accuracy, reinforcing the region’s leadership in the global market.

- In March 2025, Dryad Networks expanded into Australia and New Zealand to enhance early wildfire detection capabilities using AI-driven technologies. The company opened a regional office in Macquarie Park, New South Wales, to work closely with emergency services and industry stakeholders. As part of the expansion, Dryad introduced its Silvaguard autonomous drone, designed to suppress fires using acoustic waves, and partnered with Indigenous Industries Australia, Thinxtra, Indicium Dynamics, and Direct Safety to accelerate regional deployment.

The market in North America is expected to register fastest growth in the market, with a projected CAGR of 16.48% over the forecast period. This growth is being driven by the United States’ expanding investments in defense and aerospace technologies, particularly in deploying sensor-equipped drones for tactical surveillance, border security, and disaster response operations.

These initiatives are significantly increasing the demand for advanced sensing solutions. The region also benefits from strong research and development efforts, especially in autonomous navigation and enhanced sensing capabilities.

Additionally, the growing application of drones in sectors such as oil & gas pipeline monitoring and wildfire management is further boosting the need for sophisticated sensor technologies.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) is the primary regulatory authority for drones or Unmanned Aircraft Systems (UAS). The FAA oversees various aspects of drone operation, including registration, pilot certification, and operational restrictions.

- In Europe, the primary regulatory authority for drone operations is the European Union Aviation Safety Agency (EASA). EASA sets regulations for drones and related equipment, and ensures safe and standardized drone operations across EU countries.

Competitive Landscape

The drone sensor market is characterized by companies using clear strategies to strengthen their position across both commercial and defense sectors. Many are developing their own sensor technologies and combining them with software platforms to offer complete solutions for specific uses like farming, energy inspection, and security surveillance.

A common approach is to combine different types of sensors such as visual, thermal, and distance-measuring into one system to improve accuracy and performance. Leading players are focusing on modular sensor architectures that support rapid customization based on mission requirements. This flexibility allows deployment across diverse drone platforms without significant reengineering.

- In March 2025, Drone Forge and Airbus signed a Letter of Intent (LOI) to collaborate on the deployment and operational integration of the Flexrotor uncrewed aerial system. The partnership aimed to commercialize the Flexrotor across the commercial, government, and defense sectors, focusing on tactical operations and mission-specific sensor integration.

List of Key Companies in Drone Sensor Market:

- Mapix technologies Ltd

- Teledyne FLIR LLC

- Honeywell International Inc.

- Trimble Inc.

- Robert Bosch Stiftung GmbH

- TDK Corporation

- Ouster Inc.

- Movella Inc

- SICK AG

- Analog Devices, Inc.

- Quantum-Systems GmbH

- HBK, Inc

- RIEGL LASER MEASUREMENT SYSTEMS GMBH

- TE Connectivity

- AeroVironment, Inc.

Recent Developments (Partnership)

- In October 2024, ZenaTech, Inc. and Spider Vision Sensors Ltd. established a partnership to manufacture drone sensors and components, including LiDAR, thermal, infrared, and multi-spectral sensors. The collaboration aims to ensure ZenaDrone’s compliance with the US National Defense Authorization Act (NDAA) to secure more US military contracts.