Buy Now

Bioplastic Packaging Market

Bioplastic Packaging Market Size, Share, Growth & Industry Analysis, By Material Type (Biodegradable, Non-biodegradable), By Packaging Type (Flexible, Rigid), By End-use Industry (Consumer Goods, Food & Beverages, Cosmetic & Personal Care, Pharmaceuticals, Others), and Regional Analysis, 2024-2031

Pages: 160 | Base Year: 2023 | Release: May 2025 | Author: Versha V.

Market Definition

The market refers to the global industry focused on producing, distributing, and selling packaging materials made from biodegradable or bio-based plastics. These materials are used as sustainable alternatives to traditional petroleum-based plastics in various sectors, including food, beverages, cosmetics, and consumer goods.

It encompasses rigid and flexible packaging formats across diverse applications. The report outlines the primary drivers of market growth, along with an in-depth analysis of emerging trends and evolving regulatory frameworks shaping the industry's trajectory.

Bioplastic Packaging Market Overview

The global bioplastic packaging market size was valued at USD 17.45 billion in 2023 and is projected to grow from USD 19.85 billion in 2024 to USD 57.64 billion by 2031, exhibiting a CAGR of 16.45% during the forecast period.

Rising demand for safe compostable packaging in the food and beverage sector is driving growth in the bioplastic market. Innovations like multi-layer barrier coatings and mono-material film extrusion improve recyclability regulatory compliance and performance, supporting sustainability and operational efficiency.

Major companies operating in the bioplastic packaging industry are NatureWorks LLC., Novamont S.p.A, TotalEnergies Corbion bv, BASF, Green Dot Bioplastics Inc, Avantium, PTT MCC Biochem Co., Ltd., Arkema, Braskem, Plantic, TIPA LTD, Amcor Group, Danimer Scientific, Futerro, and Mitsubishi Chemical Group Corporation.

The market is driven by rising environmental concerns over plastic pollution, prompting industries to adopt sustainable alternatives. Companies are replacing fossil-based plastics with bio-based, recyclable, and compostable materials to reduce ecological impact.

The growing focus on circular economy practices is supporting the use of recycled and compostable polylactic acid (PLA), to meet regulatory requirements and maintain production efficiency.

This shift is strengthening demand for high-performance, low-impact packaging solutions that align with global sustainability objectives and reduce the environmental footprint of conventional packaging.

- In May 2023, TotalEnergies Corbion and Coexpan introduced a PLA- based cup made from recycled PLA, available in white and transparent variants, achieving production speeds comparable to conventional plastics via Form-Fill-Sea (FFS) technology. In collaboration with Innotech, the initiative supports sustainable packaging goals through continuous innovation, reducing environmental impact and addressing growing industry demands for low-footprint, bio-based packaging solutions.

Key Highlights:

- The bioplastic packaging industry size was recorded at USD 17.45 billion in 2023.

- The market is projected to grow at a CAGR of 16.45% from 2024 to 2031.

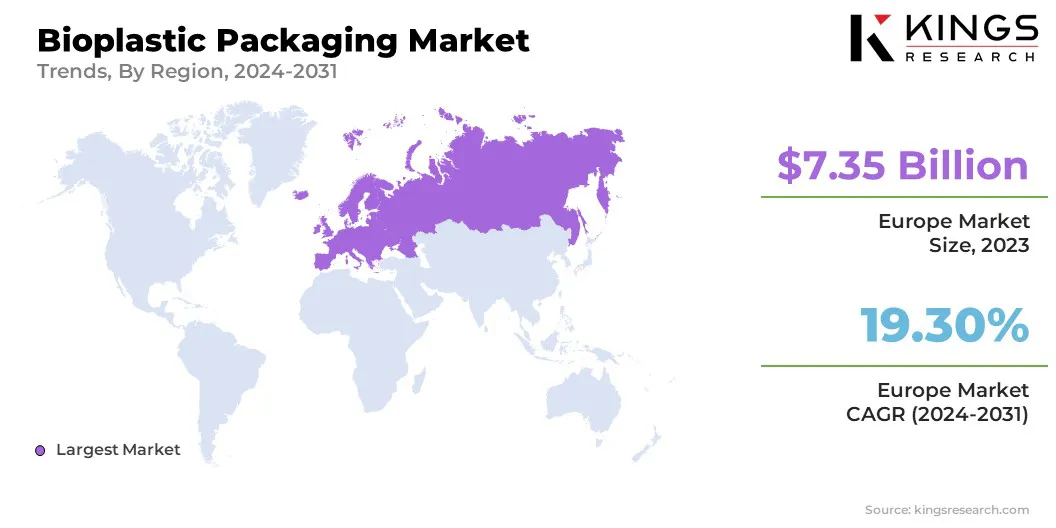

- Europe held a market share of 42.12% in 2023, with a valuation of USD 7.35 billion.

- The non-biodegradable segment garnered USD 9.50 billion in revenue in 2023.

- The flexible segment is expected to reach USD 35.80 billion by 2031.

- The food & beverages segment is anticipated to witness the fastest CAGR of 18.86% during the forecast period

- North America is anticipated to grow at a CAGR of 15.85% during the forecast period.

Market Driver

"Expansion of the Food and Beverage Sector"

The bioplastic packaging market is experiencing growth driven by rising demand from the food and beverage industry for safe, compostable solutions. Manufacturers are increasingly adopting bio-based materials that ensure product safety to support circular economy goals.

Innovative compostable polymers offer both performance and environmental advantages, making them essential for compliance with evolving regulations. This is driving increased adoption of bioplastic packaging across the food and beverage sector, supporting market expansion through regulatory compliance and sustainable product innovation.

- In September 2023, Mitsubishi Chemical Group integrated its bio-based compostable polymer, BioPBS, into EN TEA's redesigned teabag pouches. Used in the sealant layer and zipper, BioPBS provides strong heat sealability and flexibility. The teabag pouches, including barrier layers and teabags, will use compostable materials, offering a fully sustainable packaging solution to meet the growing consumer demand for eco-friendly products.

Market Challenge

"Scalability Issues for Large-Scale Production and Supply"

Scalability issues for large-scale production and supply are a significant challenge in the bioplastic packaging market. Limited manufacturing capacity, high setup costs, and dependency on agricultural feedstocks restrict the ability to meet growing global demand.

Companies are addressing this by investing in expanded production facilities, forming strategic partnerships, and leveraging technological advancements to optimize biopolymer processing.

Key players are also localizing supply chains and securing long-term raw material sources to ensure consistent input availability. These initiatives aim to enhance production efficiency, reduce costs, and improve the commercial viability of bioplastics for widespread use across various packaging applications.

Market Trend

"Technological Advancements in the Packaging Industry"

Technological advancements in the bioplastic packaging market are enabling the creation of mono-material film solutions that enhance recyclability without compromising functionality. These innovations streamline manufacturing processes, reduce material complexity, and align with evolving regulatory standards.

By improving compatibility with recycling systems, such technologies support sustainability goals while maintaining the performance required for diverse applications, including food and consumer goods.

The focus is shifting toward efficient material use and integration of advanced printing and barrier solutions within single-material structures for greater environmental and operational efficiency.

- In May 2024, Toray Industries, Dow Inc., Comexi, Sakata Inx, and SGK Japan jointly developed a surface printing mono-material film packaging technology. It supports a low-carbon, circular economy and designed for food and daily-use products to addresses recyclability challenges in flexible films.

Bioplastic Packaging Market Report Snapshot

|

Segmentation |

Details |

|

By Material Type |

Biodegradable, Non-biodegradable |

|

By Packaging Type |

Flexible, Rigid |

|

By End-use Industry |

Consumer Goods, Food & Beverages, Cosmetic & Personal Care, Pharmaceuticals, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Material Type (Biodegradable, Non-biodegradable): The non-biodegradable segment earned USD 9.50 billion in 2023 due to its widespread use in durable packaging applications and well-established production infrastructure supporting large-scale demand.

- By Packaging Type (Flexible, Rigid): The flexible segment held 58.98% of the market in 2023, due to its lightweight nature, cost-efficiency, and versatility across various end-use industries, particularly in food and beverage packaging.

- By End-use Industry (Consumer Goods, Food & Beverages, Cosmetic & Personal Care, and Pharmaceuticals): The food & beverages segment is projected to reach USD 28.45 billion by 2031, due to rising consumer demand for sustainable packaging and increasing regulatory pressure to reduce single-use plastics in food-related applications.

Bioplastic Packaging Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Europe bioplastic packaging market share stood at around 42.12% in 2023 in the global market, with a valuation of USD 7.35 billion. Europe's dominance in the bioplastic packaging market is driven by its strong focus on innovation and early adoption of advanced bio-based materials.

The region actively invests in research and development of high-performance bioplastics with enhanced functional properties, such as superior gas barriers and mechanical strength.

This focus on innovation and sustainability is driving Europe’s continued leadership in the global bioplastic packaging market, enabling the region to meet increasing demand while advancing environmental standards.

- In December 2024, Avantium N.V. noted the EU’s approval of the Packaging and Packaging Waste Regulation (PPWR), which highlights the importance of biobased plastics like Avantium’s Polyethylene Furanoate (releaf) in meeting circular economy objectives. Releaf is fully biobased and recyclable, offering excellent gas barrier properties and mechanical strength, enabling thinner packaging, longer shelf life, lower material use, and reduced CO₂ emissions.

North America bioplastic packaging industry is poised for significant growth at a robust CAGR of 15.85% over the forecast period. Government incentives are significantly accelerating the growth of the bioplastic packaging market in North America.

Federal and state-level programs offer tax credits, grants, and subsidies to companies investing in bio-based materials and sustainable manufacturing practices. These incentives reduce capital expenditure barriers, encouraging the expansion of bioplastic production facilities and R&D efforts. Supportive policies, such as green procurement standards and funding for composting infrastructure, further drive adoption.

As a result, businesses are increasingly aligning their operations with regulatory frameworks that favor environmentally responsible packaging solutions. As a result, these factors are driving increased adoption of environmentally responsible packaging solutions across the North American bioplastic packaging market.

Regulatory Framework

- In the US, the bioplastic packaging market is regulated by the Food and Drug Administration (FDA) for food-contact safety under the Federal Food, Drug, and Cosmetic Act, and by the Federal Trade Commission (FTC), which oversees environmental marketing claims such as biodegradable or compostable.

- In India, the Ministry of Environment, Forest and Climate Change (MoEFCC) oversees plastic waste management, including bioplastics, through the Plastic Waste Management Rules, 2021, enforcing bans on certain single-use plastics and Extended Producer Responsibility.

Competitive Landscape

The bioplastic packaging industry is characterized by a large number of participants, including both established corporations and rising organizations. Key players in the bioplastic packaging market are actively pursuing strategic initiatives to strengthen their market position.

Companies are engaging in mergers and acquisitions to expand capabilities and geographic reach while forming partnerships to accelerate innovation. New product launches and investments in advanced bioplastic technologies are also central to their growth strategies.

These actions reflect a competitive landscape where market participants are focused on scaling operations and responding to increasing global demand for sustainable packaging solutions.

- In March 2024, PTT MCC Biochem and Nordic Bioproducts Group formed a strategic partnership to advance next-generation bioplastics using AaltoCell Technology. The collaboration focuses on enhancing the performance, heat resistance, and home compostability of BioPBS combined with cellulosic fibers, targeting single-use applications like coffee capsules and cutlery to meet the growing demand for high-performance, eco-friendly packaging solutions.

List of Key Companies in Bioplastic Packaging Market:

- NatureWorks LLC.

- Novamont S.p.A

- TotalEnergies Corbion bv

- BASF

- Green Dot Bioplastics Inc

- Avantium

- PTT MCC Biochem Co., Ltd.

- Arkema

- Braskem

- Plantic

- TIPA LTD

- Amcor Group

- Danimer Scientific

- Futerro

- Mitsubishi Chemical Group Corporation

Recent Developments (M&A/Partnerships/New Product Launch)

- In November 2024, Walki and Lactips established a strategic partnership to create fully biodegradable, plastic-free food packaging. This collaboration focuses on using Lactips’ casein-based polymer, derived from milk processing. The packaging created under this partnership is designed to be both biodegradable and compatible with existing paper recycling systems.

- In April 2024, Amcor and Kimberly-Clark launched new packaging for Huggies Eco Protect diapers in Peru, featuring 30% post-consumer recycled content. Developed to support circular economy goals, the packaging uses recycled plastic film as raw material while maintaining product performance and visual quality, offering a more sustainable solution for hypoallergenic diapers made with certified plant-based fibers.

- In October 2023, Danimer Scientific Inc., in collaboration with BIOLO and Bolthouse Farms, launched home compostable packaging for fresh produce using Nodax, a polyhydroxyalkanoate (PHA) biopolymer. As a 100% biodegradable material derived from renewable resources, PHA reinforces the role of bioplastic packaging in reducing plastic waste.