Buy Now

Aerospace 3D Printing Market

Aerospace 3D Printing Market Size, Share, Growth & Industry Analysis, By Technology (Fused Deposition Modeling, Selective Laser Sintering, Stereolithography), By Offering (Printers, Materials, Software), By Platform (Commercial Aircraft, Military Aircraft), By Application, By End Use and Regional Analysis, 2025-2032

Pages: 180 | Base Year: 2024 | Release: June 2025 | Author: Versha V.

Market Definition

The market comprises the use of additive manufacturing technologies for producing complex and lightweight components used in aviation, defense, and space sectors. The scope includes 3D printers, advanced materials such as metal alloys and high-performance polymers, and supporting design and simulation software.

The market covers the development and production of engine components, structural elements, and interior assemblies that offer enhanced efficiency, reduced lead times, and supply chain flexibility. The report examines industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Aerospace 3D Printing Market Overview

The global aerospace 3D printing market size was valued at USD 3.67 billion in 2024 and is projected to grow from USD 4.41 billion in 2025 to USD 19.26 billion by 2032, exhibiting a significant CAGR of 23.44% during the forecast period. Expansion of metal 3D printing in aerospace for manufacturing durable, lightweight, high-performance parts for aircraft and space mission applications.

Major companies operating in the aerospace 3D printing industry are Stratasys, Dassault Systèmes, GoEngineer, Proto Labs, UnionTech, Ricoh., INTAMSYS Technology Co. Ltd., Metamorph 3D Print Services. ,3DGence, IamRapid, AMFG, RX SOLUTIONS, Airframe Designs., Goodfish Group Ltd., CRP TECHNOLOGY S.r.l., and others.

Increasing demand for lightweight components to enhance fuel efficiency is accelerating the adoption of additive manufacturing in the aerospace sector. 3D printing enables the production of complex, weight-optimized parts that reduce fuel consumption and improve overall aircraft performance.

This shift toward efficiency and cost reduction is driving the growth of the market across commercial, defense, and space applications.

Key Highlights:

- The aerospace 3D printing market size was recorded at USD 3.67 billion in 2024.

- The market is projected to grow at a CAGR of 23.44% from 2025 to 2032.

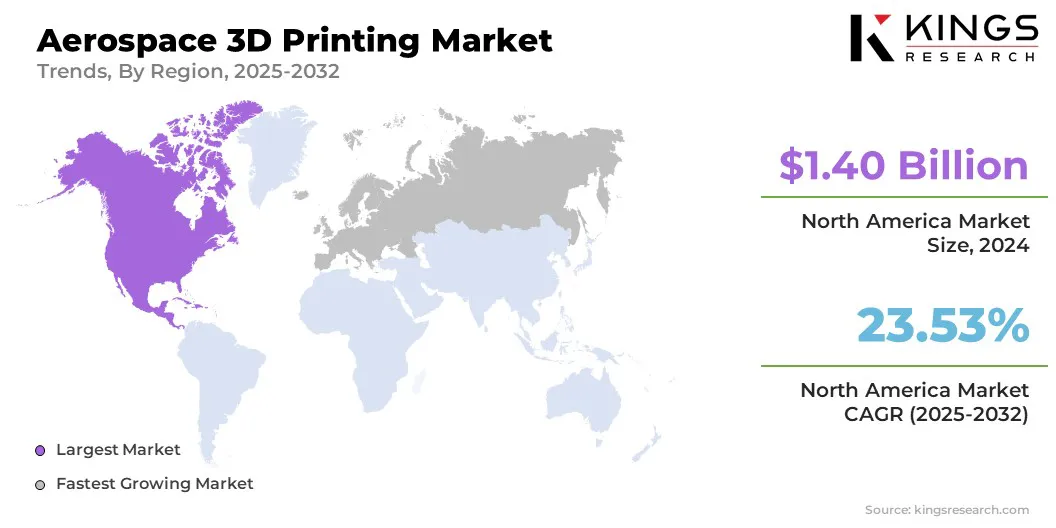

- North America held a market share of 38.10% in 2024, with a valuation of USD 1.40 billion.

- The selective laser sintering (SLS) segment garnered USD 0.98 billion in revenue in 2024.

- The printers segment is expected to reach USD 8.01 billion by 2032.

- The commercial aircraft segment secured the largest revenue share of 44.20% in 2024.

- The engine components segment is poised for a robust CAGR of 26.48% through the forecast period.

- The OEMs segment garnered USD 2.62 billion in revenue in 2024.

- Europe is anticipated to grow at a CAGR of 25.96% during the forecast period.

Market Driver

Expansion of Metal 3D Printing in Aerospace Component Manufacturing

Expansion of metal 3D printing technologies for durable aerospace parts is driving the growth of the market. The ability to produce high-strength, heat-resistant components using advanced metal powders is enabling more efficient and reliable aircraft manufacturing.

This capability is supporting the industry's shift toward precision-engineered, performance-optimized parts, facilitating the adoption of 3D printing across aerospace applications.

- In April 2025, UltiMaker highlighted the role of 3D printing in the aerospace industry, driving innovation in design, prototyping, and production of components. This cutting-edge additive manufacturing technology allows the fabrication of lightweight and complex parts that conventional manufacturing techniques can not produce efficiently.

Market Challenge

Cost Barriers and Regulatory Challenges

The aerospace 3D printing market faces challenges related to the high capital expenditure associated with advanced printing equipment and specialized materials. This financial barrier limits adoption, particularly among smaller players.

Additionally, stringent regulatory standards demand rigorous certification processes for 3D-printed components, which increases development timelines and complexity. To remedy this and gain more market share, manufacturers are investing in cost-effective printing technologies and collaborating with certification bodies to streamline approval procedures.

Efforts to develop standardized materials and testing protocols are also underway to facilitate faster integration of 3D-printed parts into aerospace systems.

Market Trend

Expansion of Additive Manufacturing for Manufacturing Space Mission Components

The market is characterized by the expansion of additive manufacturing applications in space-related projects. There is a growing focus on adopting 3D printing to produce complex, lightweight components specifically for space missions.

This trend demonstrates increased reliance on innovative manufacturing techniques to improve design flexibility and shorten production timelines within the aerospace sector.

- In September 2024, the European Space Agency (ESA) and Airbus successfully printed their first metal product on the International Space Station, representing a significant breakthrough in crew autonomy for future long-duration exploration missions. This milestone enables astronauts to produce critical parts on-site using 3D printing technology, particularly during extended space travel.

Aerospace 3D Printing Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Fused Deposition Modeling (FDM)), Selective Laser Sintering (SLS), Stereolithography (SLA), Direct Metal Laser Sintering (DMLS), Electron Beam Melting (EBM) |

|

By Offering |

Printers, Materials, Software, Services |

|

By Platform |

Commercial Aircraft, Military Aircraft, UAVs (Drones), Spacecraft |

|

By Application |

Engine Components, Structural Components, Spacecraft Components, Tooling, Prototyping |

|

By End Use |

OEMs, MRO |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Technology (Fused Deposition Modeling (FDM), Selective Laser Sintering (SLS), Stereolithography (SLA), Direct Metal Laser Sintering (DMLS), and Electron Beam Melting (EBM)): The selective laser sintering (SLS) segment earned USD 0.98 billion in 2024 due to its ability to produce high-strength, lightweight, and complex components with excellent mechanical properties and reduced lead times at par with stringent performance and safety requirements of the aerospace industry.

- By Offering (Printers, Materials, Software, and Services): The printers segment held 38.70% of the market in 2024 mainly because aerospace manufacturers are prioritizing investment in advanced 3D printing hardware that enables rapid prototyping, customization, and in-house production of complex parts with high precision and reliability.

- By Platform (Commercial Aircraft, Military Aircraft, UAVs (Drones), and Spacecraft): The commercial aircraft segment is projected to reach USD 8.27 billion by 2032, owing to the high demand for lightweight, fuel-efficient, and cost-effective components that enhance performance and reduce manufacturing lead times in commercial aviation.

- By Application (Engine Components, Structural Components, Spacecraft Components, Tooling, and Prototyping): The Engine Components segment earned USD 1.23 billion in 2024 due to the critical need for lightweight, high-performance, and complex parts that improve engine efficiency and durability while reducing production time and costs.

- By End-Use (OEMs, and MRO): The OEMs segment held 71.30% of the market in 2024, due to their direct involvement in integrating advanced additive manufacturing technologies to optimize production efficiency, reduce costs, and accelerate innovation in component manufacturing.

Aerospace 3D Printing Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America aerospace 3D printing market share stood at 38.10% in 2024 globally, with a valuation of USD 1.40 billion. The region dominates the market mainly due to early adoption of advanced additive manufacturing technologies across both defense and commercial sectors.

North America's robust investment in research and development and strong collaboration between government agencies and private companies, helps drive innovation and implementation of 3D printing solutions. These elements result in cost-efficient manufacturing, improved design adaptability, and shorter production cycles, reinforcing North America’s role as a market market.

- In October 2023, the Applied Science and Technology Research Organization of America reported that 3D printing is rapidly advancing within the U.S. defense sector. Boeing announced plans to begin testing a fully 3D-printed prototype of the main rotor system for its AH-64 Apache attack helicopter.

Europe is also expected to note a significant growth at a robust CAGR of 25.96% over the forecast period. This growth is driven by rising demand for custom components and on-demand production capabilities. The region’s aerospace manufacturers are using additive manufacturing to streamline prototyping and reduce time-to-market.

Additionally, increasing investments in advanced manufacturing technologies and a skilled workforce support the rapid integration of 3D printing across aerospace applications, positioning Europe as a rapidly growing region in the global market.

Regulatory Frameworks

- In the U.S., the Federal Aviation Administration (FAA) oversees the certification of aircraft components manufactured through additive manufacturing (AM). In accordance with 14 CFR Parts 21, 23, 25, and 33, all 3D-printed parts intended for civil aviation must comply with established airworthiness and safety requirements. The FAA also issues advisory circulars, such as AC 33.15-3, which offer technical guidance on the application of powder-bed fusion processes for engine components.

- In Europe, the European Union Aviation Safety Agency (EASA) is the central authority regulating civil aviation. It oversees the certification of aerospace components manufactured through additive manufacturing (AM), ensuring compliance with airworthiness requirements defined under Regulation (EU) 2018/1139 and relevant certification specifications, including CS-25 and CS-E. EASA also issues regulatory guidance and conducts research to support the qualification and approval of AM technologies in aerospace applications.

Competitive Landscape

The aerospace 3D printing market is experiencing dynamic growth, driven by continuous product launches and technological advancements across various sectors. Companies are introducing innovative 3D printing systems and materials tailored for aerospace applications, enhancing production efficiency and component performance.

These developments enable the manufacturing of complex, lightweight parts that meet stringent industry standards. The market's competitive landscape is characterized by ongoing innovation and strategic initiatives aimed at capturing emerging opportunities in the aerospace sector.

- In April 2025, Stratasys Ltd. introduced the Neo00+, the latest model in its stereolithography (SLA) 3D printer lineup. The Neo800+ delivers faster print speeds, higher part yield, and lower production costs. It also meets industry demands for large, precise, and consistently high-quality parts for wind tunnel testing, prototyping, and tooling applications.

List of Key Companies in Aerospace 3D Printing Market:

- Stratasys

- Dassault Systèmes

- GoEngineer

- Proto Labs

- UnionTech

- Ricoh.

- INTAMSYS Technology Co. Ltd.

- Metamorph 3D Print Services

- 3DGence

- IamRapid

- AMFG

- RX SOLUTIONS

- Airframe Designs

- Goodfish Group Ltd.

- CRP TECHNOLOGY S.r.l.

Recent Developments (Launches)

- In October 2024, the European Space Agency (ESA) awarded a USD 415,000 development contract to launch provider Dawn Aerospace under the Future Launcher Preparatory Program (FLPP). This contract supports Dawn Aerospace in developing additively manufactured (3D printed) combustion chambers for high-performance rocket engines with high combustion pressure.

- In March 2024, the Commonwealth Scientific and Industrial Research Organisation (CSIRO) reported that its Lab22 facility’s Nikon SLM-280 (Selective Laser Melting) printer can simultaneously produce multiple metals in a single continuous print. This technology is particularly suited for aerospace and space applications, where high performance and lightweight materials are essential, allowing engineers greater design freedom to consolidate parts, reduce weight and cost, and make strategic weight optimizations.