Market Definition

The market encompasses the evaluation of product performance, primarily across the healthcare, pharmaceutical, and cosmetics industries. It involves a range of services and methodologies designed to determine whether products meet regulatory standards and deliver the intended outcomes.

This market comprises research laboratories and specialized testing firms that assess product effectiveness under real-world conditions to ensure reliability and compliance.

The report offers a thorough assessment of the main factors driving market expansion, along with detailed regional analysis and the competitive landscape influencing industry dynamics.

Efficacy Testing Market Overview

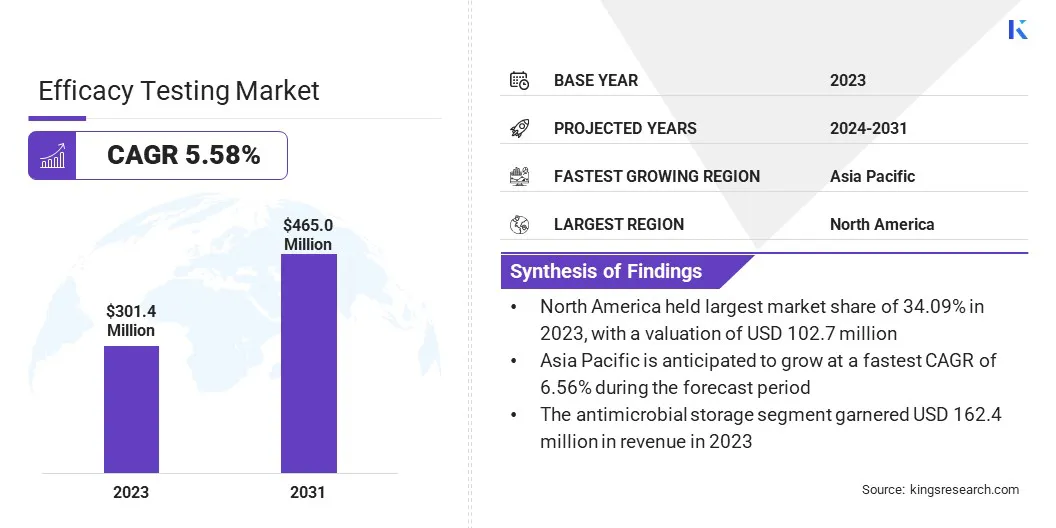

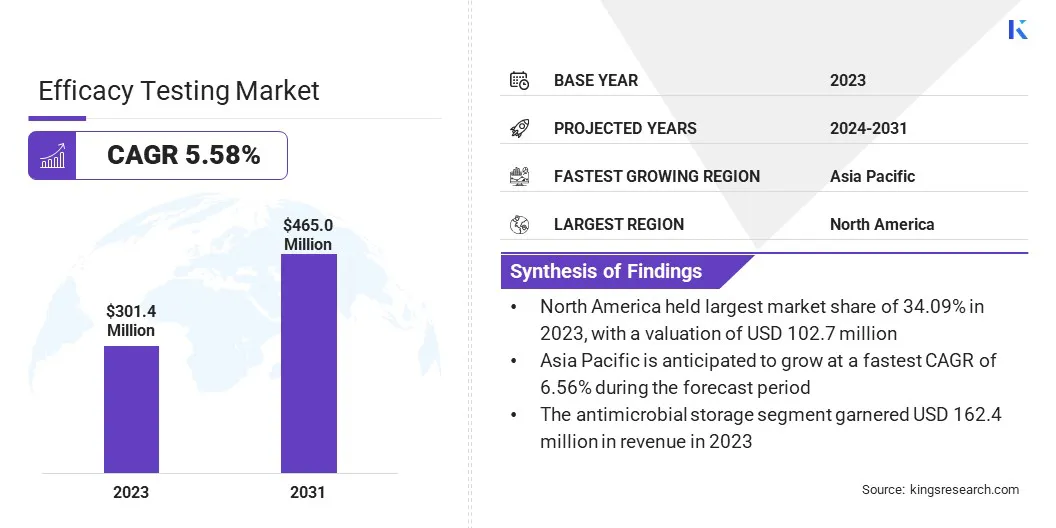

The global efficacy testing market size was valued at USD 301.4 million in 2023 and is projected to grow from USD 318.0 million in 2024 to USD 465.0 million by 2031, exhibiting a CAGR of 5.58% during the forecast period.

Market growth is fueled by the rising demand for safe and effective products in industries such as healthcare, pharmaceuticals, and cosmetics. Growing consumer awareness regarding product reliability, coupled with increasingly stringent regulatory requirements, is driving companies to prioritize comprehensive efficacy testing.

Major companies operating in the efficacy testing industry are Intertek Group plc, SGS Société Générale de Surveillance SA, BASF, Eurofins Scientific, ALS, LGC Limited, Sotera Health Company, Microbac Laboratories, Inc., Charles River Laboratories, Labcorp, ICON plc, Piramal Pharma Limited, Lonza, WuXi AppTec, and Almac Group.

The growing trend toward personalized products, particularly in medicine and skincare, is creating a strong demand for more specialized efficacy testing. Additionally, advances in testing technologies, such as better clinical trials and improved laboratory techniques, are making it easier to measure product effectiveness.

- In June 2023, Sysmex Corporation launched a point-of-care testing system in Europe for the rapid detection of antimicrobial susceptibility. The system uses proprietary microfluidic technology to deliver results in 30 minutes, supporting faster diagnosis and proper antimicrobial use in primary care settings to help combat antimicrobial resistance (AMR).

Key Highlights

- The efficacy testing market size was valued at USD 301.4 million in 2023.

- The market is projected to grow at a CAGR of 5.58% from 2024 to 2031.

- North America held a market share of 34.09% in 2023, with a valuation of USD 102.7 million.

- The antimicrobial segment garnered USD 162.4 million in revenue in 2023.

- The pharmaceutical segment is expected to reach USD 186.2 million by 2031.

- Asia Pacific is anticipated to grow at a CAGR of 6.56% over the forecast period.

Market Driver

Increasing Demand for Personalized Medicine and Precision Diagnostics

The market is growing due to the increasing demand for personalized medicine and precision diagnostics. As medical treatments become increasingly tailored to individual patient profiles, there is a growing need to evaluate their efficacy across distinct population segments.

Personalized medicine focuses on using information about a patient’s genes, environment, and lifestyle to create treatments that are more effective. This has led to a higher demand for efficacy testing to ensure optimal results. Advancements in technology, including enhanced imaging systems, are facilitating the testing of personalized treatments.

The growing adoption of advanced diagnostic technologies, such as PET/CT systems or deep learning reconstruction tools, further supports this demand, as these innovations enable precise and accurate testing for personalized treatments. The market is adapting to meet the need for more precise and tailored testing solutions.

- In June 2024, GE HealthCare expanded its portfolio with the addition of three key innovations: the MINItrace Magni, a compact cyclotron enabling in-house production of PET tracers and radiometals; the Omni Legend 21 cm, a high-performance PET/CT system designed to meet increasing healthcare demands; and Clarify DL, a deep learning reconstruction technology offering enhanced imaging clarity and accuracy.

Market Challenge

Regulatory Hurdles and Compliance Requirements

A significant challenge hampering the expansion of the efficacy testing market is navigating the complex and evolving regulatory landscape. Regional disparities in regulatory requirements and efficacy testing guidelines pose significant challenges for companies seeking to ensure compliance across multiple international markets.

These regulations can lead to delayed approval process, higher testing costs, and uncertainty, particularly for innovative therapies such as personalized medicine. To address this challenge, industry players can focus on enhancing collaboration between regulatory bodies, pharmaceutical companies, and testing facilities. Streamlining communication and understanding across these groups can help align testing protocols with regulatory expectations.

Market Trend

Advancements in AI and Machine Learning

The market is witnessing a significant trend toward the integration of artificial intelligence (AI) and machine learning (ML) technologies. These advanced technologies are transforming conventional approaches to drug efficacy testing, particularly in clinical trials and early-stage drug development.

AI and ML enable more accurate and faster data analysis, helping researchers and clinicians to identify patterns and insights often missed by traditional methods. This increased efficiency improves the reliability of test results, thereby accelerating drug development and shortening time-to-market for new treatments.

As AI and ML continue to evolve, their significance in efficacy testing is expected to grow increasingly vital over time, supporting the development of safer and more effective therapies.

- In February 2025, Median Technologies' eyonis Lung Cancer Screening (LCS) achieved the primary endpoint in the RELIVE clinical trial, a crucial milestone for regulatory submissions. The AI/ML-based software, designed to enhance radiologists' diagnostic accuracy in analyzing low-dose computed tomography (LDCT) scans, showed a statistically significant improvement in lung cancer detection compared to radiologists alone.

Efficacy Testing Market Report Snapshot

|

Segmentation

|

Details

|

|

By Service Type

|

Antimicrobial, Disinfectant

|

|

By Application

|

Pharmaceutical, Cosmetics & Personal Care, Others

|

|

By Region

|

North America: U.S., Canada, Mexico

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific

|

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa

|

|

South America: Brazil, Argentina, Rest of South America

|

Market Segmentation

- By Service Type (Antimicrobial and Disinfectant): The antimicrobial segment earned USD 162.4 million in 2023 due to the increasing demand for infection prevention in healthcare settings and the growing awareness of antimicrobial resistance.

- By Application (Pharmaceutical, Cosmetics & Personal Care, and Others): The pharmaceutical segment held a share of 40.47% in 2023, attributed to the rising need for effective antimicrobial solutions to ensure the safety and efficacy of drug manufacturing processes.

Efficacy Testing Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America efficacy testing market accounted for a substantial share of 34.09% in 2023, with a valuation of USD 102.7 million. The region's dominance is largely attributed to its strong healthcare infrastructure, the presence of major pharmaceutical and biotechnology companies, and its leadership in adopting advanced diagnostic tools.

These include high-resolution imaging systems, next-generation sequencing (NGS), real-time PCR systems, and AI-driven analytics. These technologies are pivotal in enhancing the speed, accuracy, and sensitivity of efficacy testing, resulting in more reliable outcomes during clinical trials and drug development. This is supporting regional market expansion, driving innovations in efficacy testing, and improving patient care.

Asia Pacific efficacy testing industry is expected to register the fastest CAGR of 6.56% over the forecast period. This growth is bolstered by the rapid expansion of healthcare infrastructure, increased healthcare spending, and the growing demand for more accurate and efficient efficacy testing in emerging economies.

The increasing adoption of advanced diagnostic tools, particularly in countries such as China and India, has led to a rise in demand for tailored testing solutions. Moreover, the growing focus on precision medicine in the region boosts the need for sophisticated testing methods that can deliver high-quality results.

Regulatory Frameworks

- In the U.S., the primary regulatory authority for efficacy testing of various products is the Food and Drug Administration (FDA) for drugs, medical devices, and biologics, while the Environmental Protection Agency (EPA) monitors pesticide efficacy. The FDA focuses on ensuring the safety and effectiveness of these products before and after they are marketed, often through clinical trials and post-market surveillance.

- In Europe, the regulatory body for assessing the efficacy of medicines and disinfectants is the European Medicines Agency (EMA). The EMA conducts scientific evaluations and provides guidelines for the application and approval of medicinal products.

- In India, efficacy testing for pharmaceuticals and medical devices is overseen by the Central Drugs Standard Control Organisation (CDSCO), the National Regulatory Authority (NRA). CDSCO, under the Directorate General of Health Services (DGHS), Ministry of Health and Family Welfare, is responsible for ensuring the safety, efficacy, and quality of drugs, medical devices, and cosmetics.

Competitive Landscape

The efficacy testing market is characterized by numerous players adopting various strategies to strengthen their position. Key market players focus on expanding their service offerings by incorporating advanced testing technologies and methodologies to meet evolving industry needs.

Strategic partnerships and collaborations with research institutions, regulatory bodies, and other industry players are commonly used to enhance capabilities and expand market reach. Additionally, they players are focusing on geographic expansion to tap into new growth opportunities.

Investment in research and development are enabling the creation of more accurate and efficient testing solutions. Some players are also leveraging digital tools and automation to streamline testing processes, reducing time and costs while improving accuracy and scalability.

- In March 2025, HyCentA Research GmbH and AVL List GmbH collaborated through the ReMET project to develop groundbreaking measurement and testing technologies for hydrogen applications. The partnership focused on optimizing the performance, efficiency, and durability of electrolyzers, fuel cells, and hydrogen storage systems.

List of Key Companies in Efficacy Testing Market:

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- BASF

- Eurofins Scientific

- ALS

- LGC Limited

- Sotera Health Company

- Microbac Laboratories, Inc.

- Charles River Laboratories

- Labcorp

- ICON plc

- Piramal Pharma Limited

- Lonza

- WuXi AppTec

- Almac Group

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In April 2025, bioAffinity Technologies, Inc. implemented process optimizations for its noninvasive lung cancer test CyPath Lung, increasing data acquisition speed by 50% and reducing sample processing costs by 60%. The improvements maintain the test’s validated efficacy with 92% sensitivity, 87% specificity, and 88% accuracy while enhancing lab throughput and reducing unit costs to support broader market access and operational scalability.

- In December 2024, Roche received CE certification for the new and updated cobas 6800/8800 systems 2.0. The systems enhance laboratory efficiency, testing capabilities, and throughput, offering a unified user experience and enabling more flexible, resource-optimized testing for healthcare settings worldwide.