Angiographic Catheters Market Size

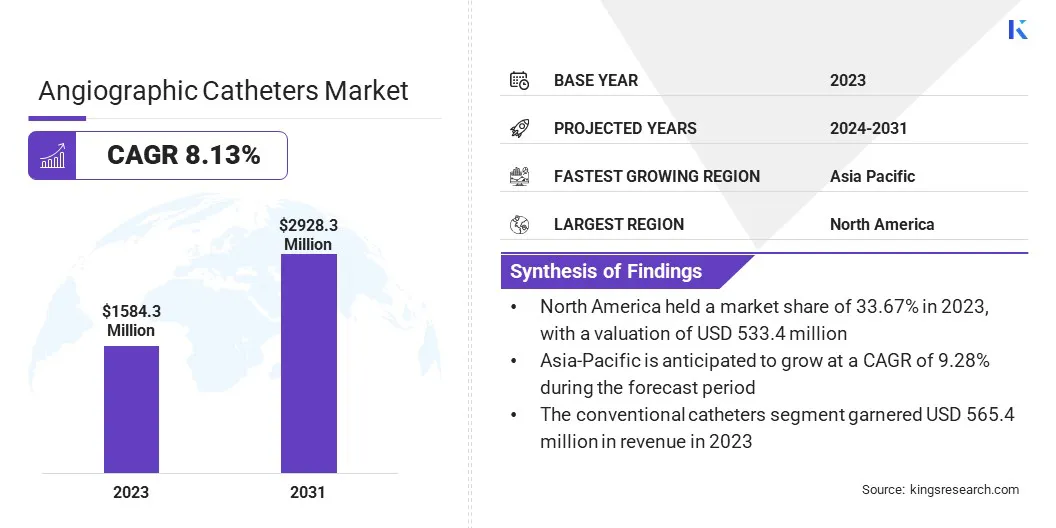

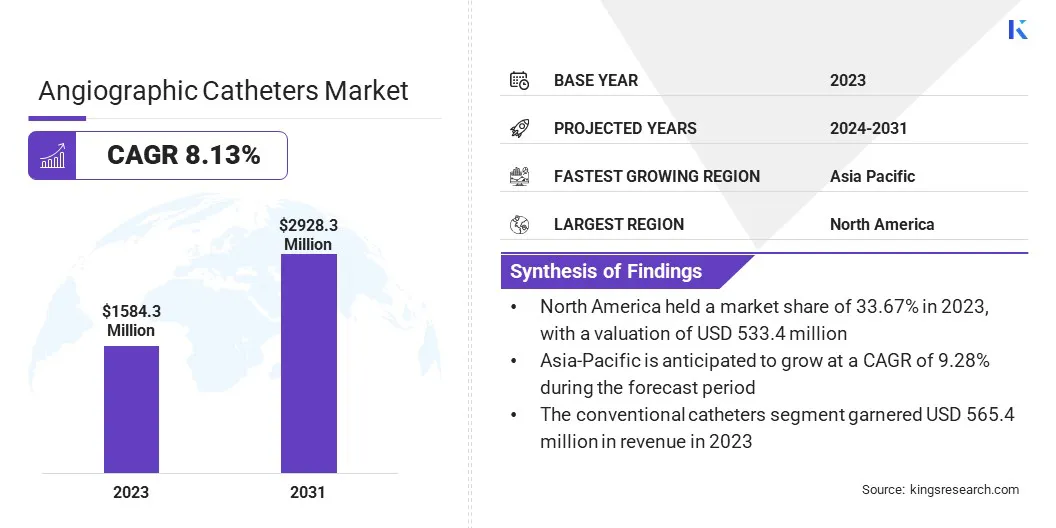

The global Angiographic Catheters Market size was valued at USD 1,584.3 million in 2023, and is projected to grow from USD 1,694.1 million in 2024 to USD 2,928.3 million by 2031, exhibiting a CAGR of 8.13% during the forecast period. In the scope of work, the report includes products offered by companies such as Alvimedica, AngioDynamics, B. Braun Medical Ltd, Becton, Dickinson and Company, Boston Scientific Corporation, Cardinal Health, Cook, Medtronic, Merit Medical Systems, TERUMO CORPORATION and others.

The expansion of the angiographic catheters market is driven by increasing incidences of cardiovascular diseases, ongoing technological advancements in catheter design, rising demand for minimally invasive procedures, and growing healthcare expenditures. The growth of the market is propelled by rising incidences of cardiovascular diseases and increasing geriatric populations.

Technological advancements in imaging techniques and catheter designs enhance diagnostic accuracy and procedural safety, thereby contributing to market growth. Additionally, growing awareness regarding early diagnosis and minimally invasive procedures boosts demand. Increased healthcare expenditure, particularly in emerging economies, facilitates the adoption of advanced medical devices.

Furthermore, supportive government initiatives and favorable reimbursement policies play crucial roles in fostering market expansion. The shift toward outpatient care and the development of specialized catheters for various vascular conditions further reshape market dynamics.

- According to the World Health Organization (WHO), non-communicable diseases (NCD) account for approximately 74% of global deaths as of 2023. Cardiovascular diseases alone contribute to roughly 44% of these NCD deaths. The need for angiographic catheters is likely to rise due to their pivotal role in the diagnosis and treatment of cardiovascular diseases.

The angiographic catheters market is experiencing significant growth due to ongoing technological advancements and increasing healthcare needs. The market comprises various types of catheters designed for specific diagnostic and therapeutic procedures. The Asia-Pacific region is witnessing rapid growth due to improving healthcare facilities and rising awareness.

Major players are focusing on product innovation and strategic collaborations to enhance their market presence. The market is characterized by rigorous regulatory standards that ensure safety and efficacy, resulting in continuous improvement in product quality and performance.

Angiographic catheters are medical devices used in angiography to visualize the vascular system. These catheters are thin, flexible tubes inserted into blood vessels to inject contrast media, enabling detailed imaging of arteries and veins. They play a critical role in diagnosing and treating cardiovascular diseases, including coronary artery disease and peripheral arterial disease.

The market includes various types of catheters, such as diagnostic, guiding, and microcatheters, each serving specific clinical purposes. The increasing demand for minimally invasive diagnostic procedures, coupled with advancements in catheter technology, contributes to market expansion.

Analyst’s Review

Manufacturers are emphasizing innovation and product development, with key players focusing on enhancing catheter design to improve procedural precision and patient comfort. There is a noticeable shift toward the introduction of advanced materials and coatings that enhance catheter flexibility and maneuverability during procedures.

Additionally, manufacturers are investing heavily in research aimed at integrating artificial intelligence and robotics into catheter systems to refine diagnostic accuracy and procedural efficiency.

- In 2023, Becton, Dickinson and Company invested approximately 6.4% of their revenue, totaling around USD 1,237 million, in research and development expenses.

To capitalize on these advancements, stakeholders are prioritizing collaboration with healthcare providers to integrate new technologies seamlessly into clinical practice. Moreover, enhancing regulatory compliance and ensuring robust post-market surveillance are essential for maintaining product quality and safety standards.

Adopting these strategies is anticipated to enable manufacturers to navigate competitive pressures and meet evolving healthcare demands effectively in the angiographic catheters market.

Angiographic Catheters Market Growth Factors

The increasing prevalence of cardiovascular diseases is a key factor propelling market development, fueled by sedentary lifestyles, poor dietary habits, and rising obesity rates, all of which contribute to increasing incidences of cardiovascular diseases globally. This trend is boosting the demand for angiographic procedures, as they are essential for accurate diagnosis and effective treatment planning.

Technological advancements in catheter design, such as improved flexibility and precision, are enhancing procedural outcomes. Additionally, the shift toward minimally invasive techniques is making angiography a preferred option, thereby propelling market growth. Healthcare providers are increasingly adopting these advanced catheters to offer better patient care and improve diagnostic accuracy.

The high cost associated with advanced catheters and related imaging systems presents a significant challenge hindering market development. This financial barrier limits access, especially in low-income regions. To overcome this challenge, manufacturers are focusing on cost-effective production methods and economies of scale to reduce prices.

Additionally, partnerships with government agencies and non-profit organizations help subsidize costs and improve accessibility. Implementing innovative financing options, such as leasing and instalment plans, further make these devices more affordable for healthcare providers.

Angiographic Catheters Market Trends

The increasing adoption of minimally invasive procedures is positively impacting the market. Healthcare providers are continuously seeking methods that reduce patient recovery time, minimize surgical risks, and lower healthcare costs. Minimally invasive angiographic procedures meet these needs by offering precise diagnostics with less trauma compared to traditional surgeries.

Advances in catheter technology, such as the development of microcatheters, are enabling more complex interventions to be performed with minimal incisions. This trend is leading to a higher demand for sophisticated angiographic catheters and expanding their application in various medical specialties, thereby significantly influencing the market.

The angiographic catheters market is experiencing continuous advancements in technology. Companies are actively developing catheters with improved functionalities, such as increased flexibility for navigating complex vasculature or enhanced tip designs for better visualization during procedures.

For instance, there is a growing focus on catheters with biocompatible coatings that minimize friction and improve manoeuvrability. This trend toward innovation is expected to propel market growth by offering physicians improved tools for minimally invasive procedures.

Segmentation Analysis

The global market is segmented based on product, end user, and geography.

By Product

Based on product, the market is categorized into scoring balloon catheters, conventional catheters, deb catheters, and cutting balloon catheters. The conventional catheters segment led the angiographic catheters market in 2023, reaching a valuation of USD 565.4 million.

Conventional catheters are versatile and widely used across various angiographic procedures, including coronary angiography and peripheral angiography. Their established reliability and familiarity among healthcare providers contribute significantly to their continued preference.

Moreover, advancements in materials and design have enhanced the flexibility and navigability of conventional catheters, leading to improved procedural outcomes and increased patient safety. Additionally, the increasing prevalence of cardiovascular diseases worldwide has bolstered the demand for diagnostic and interventional procedures, supporting the growth of the conventional catheters segment.

By End User

Based on end user, the market is classified into hospitals and clinics, ambulatory surgical centers (ASCs), and diagnostic centers. The hospitals and clinics segment is poised to witness significant growth at a CAGR of 8.66% through the forecast period (2024-2031).

Hospitals and clinics are the primary settings for angiographic procedures due to their advanced infrastructure, specialized medical expertise, and comprehensive patient care capabilities. These facilities are equipped with state-of-the-art imaging technologies and surgical suites necessary for performing complex angiographic interventions.

Additionally, the increasing incidence of cardiovascular diseases and the rising preference for minimally invasive procedures boost the demand for angiographic catheters in hospital settings. Moreover, hospitals' capacity to handle a wide range of medical conditions and emergencies supports the growth of the segment.

Angiographic Catheters Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia Pacific, MEA, and Latin America.

The North America angiographic catheters market accounted for a significant share of around 33.67% in 2023, with a valuation of USD 533.4 million. The region benefits from a well-established healthcare infrastructure and advanced medical technologies, leading to the widespread adoption of angiographic procedures.

High healthcare expenditure and robust research and development activities foster continuous innovation in catheter technologies, fostering regional market growth. Moreover, favorable reimbursement policies and a proactive regulatory environment ensure high standards of patient care and safety, thereby boosting regional market expansion.

Additionally, a growing aging population prone to cardiovascular diseases and a strong focus on healthcare quality and patient outcomes contribute to North America's prominent position in the angiographic catheters market.

- According to the Administration for Community Living's 2024 report, in the United States, more than 55 million people aged 65 or older constituted over 16% of the country's population. Projections indicated a significant increase in this demographic over the next thirty years. Globally, this demographic trend mirrored a shift where older adults outnumbered children and youth in many countries. Additionally, there has been an increase in life expectancy, with the number of individuals aged 85 and older more than doubling between 2022 and 2040. The rise in the geriatric population increases the incidences of cardiovascular diseases, thereby facilitating the growth of the market.

Asia-Pacific is poised to experience the fastest growth, depicting a robust CAGR of 9.28% through the estimated timeframe. The increasing healthcare investments and infrastructure development in countries such as China and India are expanding access to advanced medical technologies, including angiographic catheters.

Rising disposable incomes and improving healthcare awareness among the population are spurring the demand for diagnostic and therapeutic procedures, thereby boosting regional market growth. Additionally, a growing burden of cardiovascular diseases and favorable initiatives to improve healthcare access and affordability are further propelling domestic market expansion. The dynamic economic growth and demographic trends in Asia-Pacific make it a key region for angiographic catheters.

Competitive Landscape

The angiographic catheters market report will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions.

Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Angiographic Catheters Market

- Alvimedica

- AngioDynamics

- Braun Medical Ltd

- Becton, Dickinson and Company

- Boston Scientific Corporation

- Cardinal Health

- Cook

- Medtronic

- Merit Medical Systems

- TERUMO CORPORATION

Key Industry Developments

- February 2024 (Launch): BIOTRONIK launched the Micro Rx catheter, a new microcatheter, designed specifically to enhance guidewire support during PCI procedures. Manufactured by IMDS, this marks the fourth product from IMDS distributed by BIOTRONIK in the U.S.

- February 2024 (Expansion): Royal Philips, a major healthcare technology provider, announced that it had surpassed 1500 Cath Lab installations across India. This achievement aligns with their goals of improved healthcare outcomes and affordability. Moreover, Philips launched the OmniWire pressure wire, a first-of-its-kind technology for coronary interventions, and the Zenition 90 Motorized C-arm system for various surgical procedures.

The global angiographic catheters market is segmented as:

By Product

- Scoring Balloon Catheters

- Conventional Catheters

- DEB Catheters

- Cutting Balloon Catheters

By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers (ASCs)

- Diagnostic Centers

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America