buyNow

Autonomous Farm Equipment Market

Autonomous Farm Equipment Market Size, Share, Growth & Industry Analysis, By Offering (Hardware, Software, Services), By Equipment Type (Tractors, Harvesters, Seed Planters, Sprayers & Other), By Technology (Remote Sensing, GPS, IoT, Others), By Automation Type and Regional Analysis, 2024-2031

pages: 120 | baseYear: 2023 | release: September 2024 | author: Ashim L.

Autonomous Farm Equipment Market Size

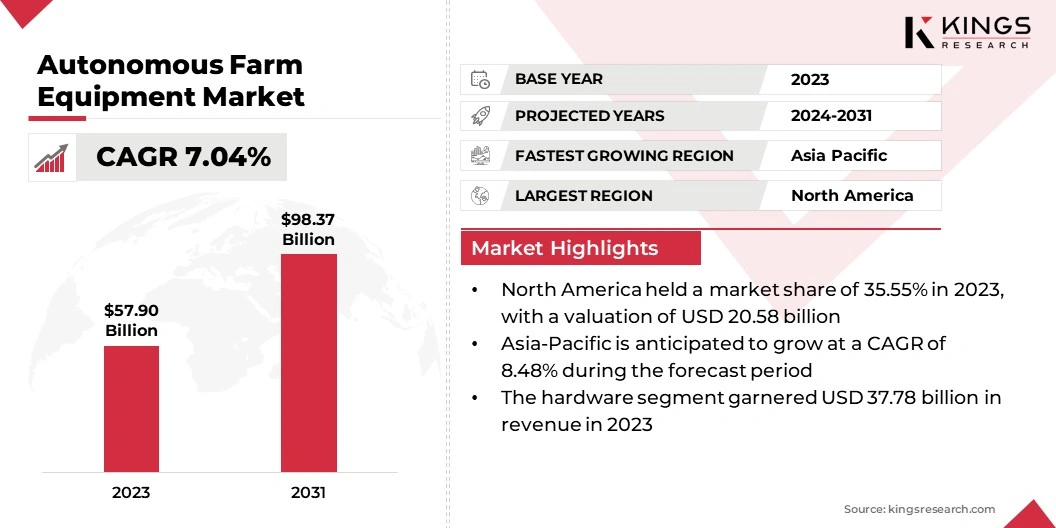

The global Autonomous Farm Equipment Market size was valued at USD 57.90 billion in 2023 and is projected to grow from USD 61.10 billion in 2024 to USD 98.37 billion by 2031, exhibiting a CAGR of 7.04% during the forecast period. The market is driven by the increasing demand for efficiency, precision, and cost reduction in agricultural practices.

It is further supported by technological advancements in AI, IoT, and GPS systems. In the scope of work, the report includes products and solutions offered by companies such as Autonomous Tractor Corporation, Bear Flag Robotics., Escorts Kubota Limited, Monarch Tractor, Raven Industries, Inc., Trimble Inc., CLAAS KGaA mbH, CNH Industrial N.V., HEXAGON, YANMAR HOLDINGS CO., LTD., and others.

The autonomous farm equipment market is primarily driven by the increasing demand for sustainable agriculture and the need to enhance crop productivity while minimizing labor costs. The rising global population and subsequent food demand are encouraging farmers to adopt advanced technologies that offer precision and efficiency in farm operations.

- The Food and Agriculture Organization (FAO) of the United Nations estimated that farmers will need to produce 70% more food by 2050 to feed a global population of 9.1 billion. As climate change impacts agricultural supply chains, AI and other technologies will become crucial to meet this demand. A World Economic Forum report published in 2024 further emphasizes the role of ‘Fourth Industrial Revolution’ technologies, urging for public-private partnerships to enable scalability.

Government initiatives promoting the use of automation in agriculture, coupled with the availability of high-precision GPS systems and advanced sensors, are fueling market growth. Additionally, labor shortages in rural areas and the high cost of skilled labor are encouraging the adoption of autonomous machinery, which reduces dependence on manual labor and optimizes resource use.

The market encompasses a range of technologically advanced machinery designed to perform agricultural tasks with minimal human intervention. These machines, such as autonomous tractors, harvesters, and drones, are integrated with AI, machine learning, and IoT capabilities and deliver better operational efficiency.

North America currently holds a significant share of the market as the region is characterized by a high adoption rate of advanced farming technologies and supportive government policies. Asia-Pacific is another region that is expected to witness considerable growth due to increasing investments in precision farming and technological advancements.

The market is a segment of the agricultural machinery industry that involves equipment capable of operating independently without human intervention. This market includes a variety of equipment types, such as driverless tractors, robotic harvesters, automated irrigation systems, and UAVs (unmanned aerial vehicles) or drones.

These machines are equipped with sensors, GPS, and AI capabilities that enable real-time decision-making, navigation, and data collection. The purpose of this equipment is to enhance farm productivity, reduce labor costs, and optimize the use of resources by minimizing human error. This market is closely linked to technological advancements in agriculture, with a focus on sustainability and efficiency.

Analyst’s Review

Manufacturers in the autonomous farm equipment market are focusing on innovation and collaboration to strengthen their competitive position. They are investing in research and development to introduce new products, such as AI-powered tractors and robotic harvesters, that offer greater efficiency and cost savings. Companies are also forming partnerships with technology firms to enhance the integration of IoT and machine learning capabilities in their equipment.

- For instance, in March 2024, John Deere, Ag Leader Technology, and Kinze Manufacturing announced their collaboration to streamline the integration of their technology and equipment for farmers. This agreement would allow seamless integration of agronomic data from Kinze and Ag Leader products into the John Deere Operations Center. The companies also has settled existing litigation, with John Deere licensing planting technology to Ag Leader and Kinze, providing access to SureSpeed and True Speed technologies.

To capitalize on the growing demand, manufacturers are recommended to consider expanding their product portfolios to include more affordable options for small and medium-sized farms. Additionally, investing in customer education and training programs will help increase market penetration. Strengthening after-sales service and support networks will also be crucial for maintaining customer loyalty and driving long-term growth.

Autonomous Farm Equipment Market Growth Factors

The market is experiencing growth due to the increasing adoption of precision farming techniques. Farmers are recognizing the value of technology-driven solutions that enhance efficiency, reduce waste, and improve crop yields. Autonomous equipment, such as self-driving tractors and robotic harvesters, are playing a crucial role in optimizing field operations by enabling precise application of fertilizers and pesticides.

These technologies are reducing reliance on manual labor and minimizing human error, thereby driving productivity gains. The integration of AI, machine learning, and IoT is allowing for real-time decision-making, which is helping farmers adapt to the changing environmental conditions and resource availability, further boosting market expansion.

A major challenge in the autonomous farm equipment market is the high initial cost of investment, which is limiting product adoption among small- and medium-sized farms. Many farmers are hesitant to invest in expensive autonomous machinery due to concerns about return on investment and the financial risks involved. Overcoming this challenge requires favorable financing options, such as leasing models and government subsidies, to lower the entry barriers.

Increasing awareness and demonstrating the long-term benefits of autonomous equipment, including reduced labor costs and improved yields, are also crucial. Collaboration between technology providers, governments, and agricultural cooperatives help facilitate access and training, encouraging wider adoption of these technologies.

- For instance, in February 2024, Agtonomy introduced its Smart Farm Task Ecosystem, a new platform that autonomously connects self-driving tractors with farm tools to enhance efficiency and sustainability. The ecosystem combines Agtonomy's TeleFarmer software with hardware solutions such as Smart Toolbar, Smart Take-Off, Smart Sprayers, and Smart Implement Sensors, enabling farmers to remotely plan and execute tasks across various crop plantations using advanced computing and AI technologies, in partnership with equipment manufacturers.

Autonomous Farm Equipment Market Trends

The market is witnessing a trend of increased integration of artificial intelligence (AI) and machine learning in farming machinery. Manufacturers are embedding AI algorithms into equipment, such as autonomous tractors, drones, and harvesters, to enable real-time data analysis and decision-making.

- The AI4AI initiative launched by the World Economic Forum, aims at the integration of AI in agriculture that has received support from public sector initiatives. The initiative aims to advance digital agriculture through public-private partnerships, targeting an impact on 1 million farmers worldwide by 2027.

Such developments are helping farmers optimize crop management practices by predicting weather patterns, detecting plant diseases, and managing resource use more efficiently. AI-driven automation is enhancing the precision of farming operations, reducing waste, and lowering costs. This trend is being supported by advancements in connectivity, including 5G networks, which provide the necessary infrastructure for real-time communication between various farm devices and systems.

Another significant trend in the autonomous farm equipment market is the growing adoption of electric-powered machinery. Farmers are increasingly focusing on sustainability and seeking alternatives to traditional fuel-based equipment to reduce carbon emissions as well as operational costs. Electric-powered autonomous equipment, such as electric tractors and robotic weeders, is also gaining traction due to its lower maintenance costs and quieter operations.

Additionally, these machines are being designed to operate with renewable energy sources such as solar power, further supporting the approach of eco-friendly farming. Governments and regulatory bodies are promoting this shift through incentives and subsidies, which are accelerating the transition from conventional to electric-powered autonomous farm equipment.

Segmentation Analysis

The global market is segmented based on offering, equipment type, technology, automation type, and geography.

By Offering

Based on offering, the market is categorized into hardware, software, and services. The hardware segment led the autonomous farm equipment market in 2023, reaching the valuation of USD 37.78 billion. This segment of the market is expanding due to the increasing demand for advanced machinery that incorporates automation technology.

This segment is driven by the ongoing development and deployment of high-tech equipment. The growth is also fueled by the need for more efficient, precise, and reliable agricultural tools. Innovations in sensors, robotics, and communication technologies are enhancing the functionality of autonomous equipment. As farms increasingly adopt these technologies to improve productivity and reduce operational costs, the hardware segment is anticipated to grow, aided by advancements and increasing investments in cutting-edge agricultural machinery.

By Equipment Type

Based on equipment type, the market is classified into tractors, harvesters, seed planters, sprayers, tillage equipment, and other equipment. The tractors segment is poised for significant growth at a CAGR of 8.13% over the forecast period from 2024 to 2031.

This expansion is attributed to the rising adoption of autonomous tractors that reduce labor costs and increase efficiency in field operations. Farmers are increasingly investing in smart tractors equipped with AI and GPS technologies to perform tasks, such as plowing, planting, and tilling, autonomously.

The need for higher productivity and reduced human intervention, especially in large-scale farming, is driving the demand for autonomous tractors. Furthermore, manufacturers are focusing on developing electric and hybrid tractors, offering eco-friendly and cost-efficient alternatives to traditional diesel-powered equipment.

By Technology

Based on technology, the market is segmented into remote sensing, GPS, IoT, and others. The GPS segment secured the largest autonomous farm equipment market share of 35.29% in 2023. The expansion of this segment is driven by the growing need for precise location-based data in autonomous farming operations.

GPS technology is crucial for navigation and positioning, enabling accurate operations without human intervention. It supports real-time mapping, field analysis, and monitoring, which enhances productivity and reduces errors in planting, spraying, and harvesting. The increasing integration of GPS with other technologies, such as IoT and AI, is further boosting its adoption. Additionally, improvements in satellite accuracy and connectivity are making GPS systems more reliable and affordable for farmers globally.

Autonomous Farm Equipment Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

North America autonomous farm equipment market share stood around 35.55% in 2023 in the global market, with a valuation of USD 20.58 billion. This dominance is driven by the early adoption of advanced agricultural technologies and significant investments in automation by farmers in the region.

The presence of key players, along with supportive government policies and subsidies encouraging technological adoption in agriculture, is also contributing to market growth. Moreover, the region's well-established digital infrastructure and high degree of awareness among farmers regarding the benefits of autonomous equipment are supporting its widespread use. Increasing demand for sustainable farming practices and the need to address labor shortages in rural areas are further accelerating market expansion in North America.

Asia-Pacific is also expected to grow at the fastest CAGR of 8.48% over the forecast period. This rapid growth can be attributed to the increasing agricultural activities and rising investments in modernizing farming practices across countries such as China, India, and Japan.

The region's large population and high demand for food are pushing farmers to adopt advanced technologies to improve productivity and efficiency. Government initiatives and subsidies to promote smart agriculture are also encouraging the adoption of autonomous equipment. Additionally, the increasing availability of affordable automation solutions and growing awareness about their benefits are fueling market growth in the Asia-Pacific region.

Competitive Landscape

The global autonomous farm equipment market report provides valuable insights with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies, such as partnerships, mergers and acquisitions, product innovations, and joint ventures, to expand their product portfolio and increase their market shares across different regions.

Expansion & investments are the major strategies adopted by companies in this sector. Industry players are investing extensively in R&D activities, building new manufacturing facilities, and supply chain optimization.

List of Key Companies in Autonomous Farm Equipment Market

- Autonomous Tractor Corporation

- Bear Flag Robotics.

- Escorts Kubota Limited

- Monarch Tractor

- Raven Industries, Inc.

- Trimble Inc.

- CLAAS KGaA mbH

- CNH Industrial N.V.

- HEXAGON

- YANMAR HOLDINGS CO., LTD.

Key Industry Developments

- May 2023 (Partnership): Monarch Tractor, the manufacturer of the MK-V electric, driver-optional tractor, announced a financial services agreement with CNH Industrial Capital America, LLC to expand its technology reach through the CNH Industrial’s dealer network. This agreement aimed to bring Monarch’s equipment to more farmers nationwide, supported by CNH Industrial Capital’s expertise in agricultural financing. Additionally, Monarch started producing the MK-V at Foxconn’s Ohio facility to meet the growing demand and fulfill backorders.

- March 2023 (Partnership): Raven Industries began the strategic integration of Augmenta, a machine vision company acquired by its parent, CNH Industrial. This integration expanded Raven's automated technologies by adding advanced Sense & Act capabilities for crop spraying, using real-time sensors and AI for precise application. Raven planned to incorporate Augmenta's technology into its portfolio, enhancing its precision agriculture offerings with vision-based variable rate application (VRA) solutions.

The global autonomous farm equipment market is segmented as below:

By Offering

- Hardware

- Software

- Services

By Equipment Type

- Tractors

- Harvesters

- Seed Planters

- Sprayers

- Tillage Equipment

- Other Equipment

By Technology

- Remote Sensing

- GPS

- IoT

- Others

By Automation Type

- Fully Autonomous

- Partially Autonomous

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- France

- UK

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

freqAskQues