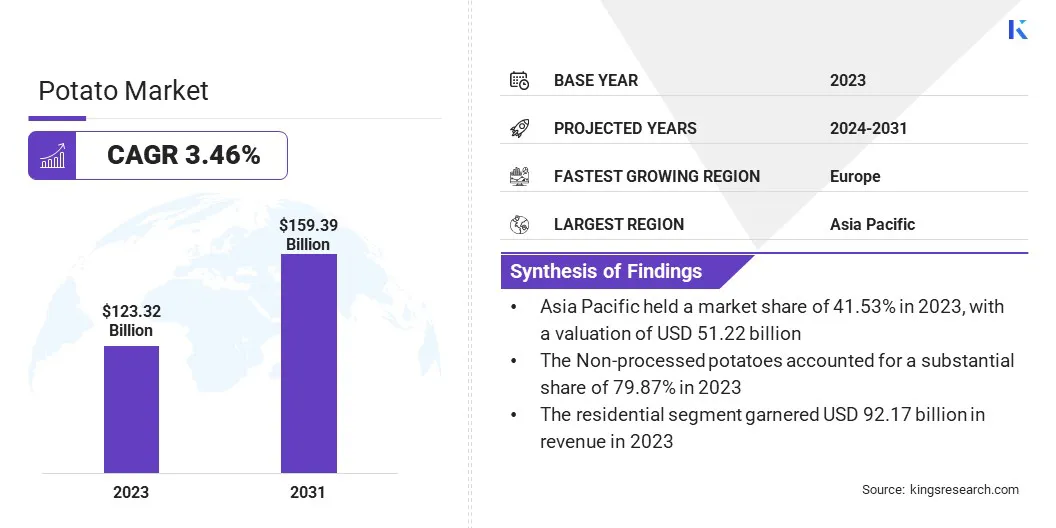

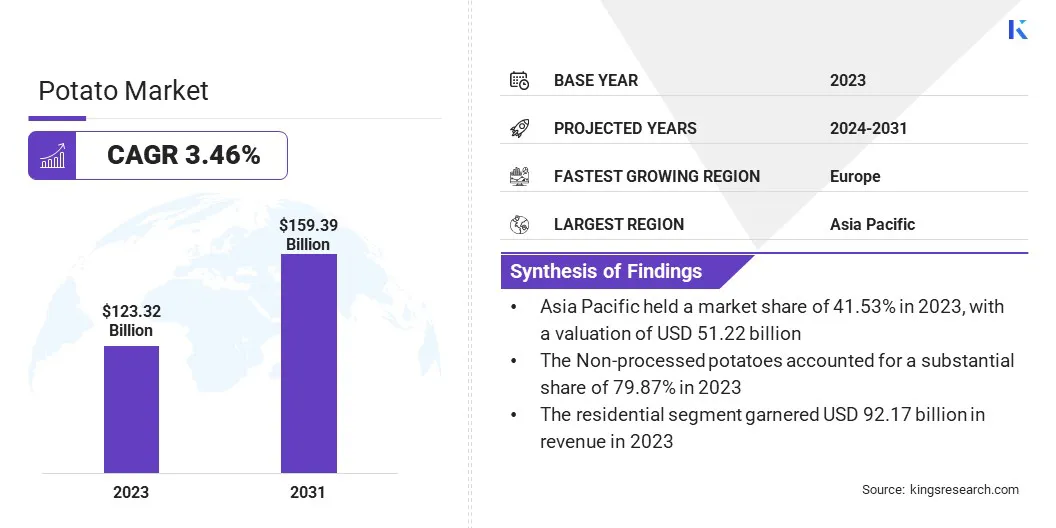

Potato Market Size

The global Potato Market size was valued at USD 123.32 billion in 2023 and is projected to reach USD 159.39 billion by 2031, growing at a CAGR of 3.46% from 2024 to 2031. In the scope of work, the report includes products offered by companies such as McCain Foods Limited, Lamb Weston, Inc., J.R. Simplot Company, Farm Frites, PepsiCo, The Kraft Heinz Company, Cavendish Farms Corporation, Aviko, Pizzoli S.p.A, Albert Bartlett & Sons (Airdrie) Limited and Others.

The global potato market is witnessing steady growth, driven by rising demand for convenience foods, increasing adoption of potato-based snacks, and expanding applications in the food processing industry. Despite challenges such as fluctuating weather conditions affecting production and distribution, the market is expected to maintain a positive growth trajectory over the forecast period. One notable trend is the shift toward sustainable agricultural practices, which is significantly benefiting the potato market outlook.

As consumers become increasingly conscious of environmental issues and seek healthier food options, there is a growing demand for organic and locally sourced produce, including potatoes. This trend has led to the increased adoption of eco-friendly farming methods, such as crop rotation, integrated pest management, and reduced chemical usage, resulting in higher-quality potatoes and improved yields.

Furthermore, the versatility of potatoes as a staple food ingredient has contributed to their significant popularity across various cuisines worldwide. From traditional dishes to innovative culinary creations, potatoes remain a key component in many diets, ensuring consistent demand in both developed and emerging markets. Additionally, the convenience and affordability of potatoes make them an attractive option for consumers seeking value and convenience without compromising on nutrition.

Analyst's Review

The global potato market is experiencing robust growth, fueled by shifting consumer preferences toward sustainability and healthy eating habits. With ongoing advancements in agricultural practices and continued innovation in potato cultivation techniques, the market is poised to expand further in the foreseeable future.

Market Definition

The potato market encompasses all aspects related to the production, distribution, and consumption of potatoes on a global scale. It includes various stakeholders such as farmers, distributors, retailers, and consumers, who play crucial roles in shaping market dynamics. The market is characterized by the cultivation of different potato varieties suited to diverse climates and growing conditions.

Additionally, it involves the trade of both fresh potatoes and processed potato products, catering to a wide range of consumer preferences and dietary needs. Factors influencing the global market growth include changing consumer trends, technological advancements in cultivation and processing, and shifts in supply and demand. Overall, the market serves as a vital component of the global food industry, providing nutritious and versatile food options to consumers worldwide.

Potato Market Dynamics

Evolving consumer preferences toward healthier and more convenient food options are driving the demand for potatoes, while simultaneous technological advancements in agricultural practices are revolutionizing potato cultivation. As consumers increasingly prioritize nutritious and versatile foods, potatoes are increasingly gaining popularity as a staple ingredient in various cuisines and meal preparations. This consumer shift is paralleled by advancements in precision farming techniques and improved storage methods, which enhance potato cultivation efficiency and productivity. Farmers are leveraging technologies such as GPS-guided tractors and drones to optimize inputs, reduce wastage, and maintain higher-quality yields.

Moreover, innovations in storage facilities ensure extended shelf life and reduced post-harvest losses. The synergy between changing consumer preferences and technological advancements underscores the resilience and adaptability of the potato market, positioning it to meet evolving consumer demands while driving sustainable growth in the agricultural sector.

Moreover, the expanding market for processed potato products, including frozen fries, chips, and dehydrated flakes, presents lucrative opportunities for market growth. Surging Consumer demand for convenience foods and snacking options continues to drive innovation and diversification within this segment.

The market faces dual challenges related to environmental sustainability and price volatility. Environmental concerns, such as soil degradation, water usage, and pesticide contamination, pose significant restraints on potato cultivation. Despite advancements in sustainable farming practices, mitigating these environmental impacts requires ongoing efforts and investments.

Moreover, the market contends with price volatility caused by fluctuations in input costs, market prices, and currency exchange rates. Price instability can adversely affect profitability and investment decisions, necessitating effective risk management strategies. Balancing environmental sustainability with economic viability presents a major challenge for industry stakeholders, highlighting the importance of implementing resilient and adaptive agricultural practices to ensure the long-term viability of the global market.

Segmentation Analysis

The global potato market is segmented based on application, type, product type, and geography.

By Application

Based on application, the market is categorized into residential, commercial, and industrial. The residential segment dominated the market, accounting for USD 92.17 billion in 2023. The dominance of the segment is indicative of several underlying factors such as potatoes being a staple food item in many households globally, which is contributing to sustained demand within the residential sector.

Additionally, the versatility of potatoes in various cuisines and meal preparations solidifies their position in residential kitchens. Moreover, the affordability and accessibility of potatoes make them a preferred choice for self-cooking, driving consistent consumption. Moreover, increasing health consciousness among consumers has led to the popularity of homemade, potato-based dishes perceived as healthier alternatives to processed foods.

By Type

Based on type, the market is bifurcated into organic and inorganic. Inorganic generated the highest revenue of USD 101.07 billion in 2023. The adoption of conventional farming methods, which are often associated with inorganic potato production, typically results in higher yields compared to organic methods. This higher output contributes to greater availability and accessibility of inorganic potatoes in the market.

Additionally, inorganic potatoes often have a longer shelf life and are more resistant to pests and diseases due to the use of synthetic pesticides and fertilizers, thereby enhancing their marketability. Furthermore, the affordability of inorganic potatoes for consumers, as they are often produced on a larger scale with lower production costs compared to organic varieties is further supporting the growth. Moreover, the widespread adoption of inorganic farming practices by large-scale commercial potato growers consolidates the dominance of the inorganic segment in the market. However, growing consumer awareness and demand for organic products, driven by health and environmental concerns, is anticipated to increase the market share for organic potatoes over the forecast period.

By Product Type

Based on product type, the market is divided into processed and non-processed. Non-processed potatoes accounted for a substantial share of 79.87% in 2023. Non-processed potatoes encompass fresh produce, which serves as a foundational ingredient in various culinary applications, ranging from mashed potatoes to roasted dishes, thereby ensuring consistent demand.

Moreover, non-processed potatoes are perceived as healthier options compared to their processed counterparts, as they retain their natural nutritional content, including vitamins, minerals, and dietary fiber, appealing to health-conscious consumers. Additionally, the versatility of non-processed potatoes allows for diverse cooking methods and culinary innovations, catering to evolving consumer preferences and culinary trends.

Potato Market Regional Analysis

Based on region, the global market is classified into North America, Europe, Asia-Pacific, MEA, and Latin America.

The Asia Pacific Potato Market share stood around 41.53% in 2023 in the global market, with a valuation of USD 51.22 billion. This dominance can be attributed to several factors, including the region's large and diverse population with varied dietary preferences, which drives significant demand for staple foods such as potatoes.

Additionally, rapid urbanization and economic development in countries such as China and India are expanding the consumer base and increasing per capita consumption of potatoes. Furthermore, advancements in agricultural practices and technologies are enhancing potato yields and quality, thereby contributing to the overall regional market growth. With the largest market share and favorable growth prospects, Asia-Pacific is poised to maintain its leading position in the global potato market in the near future.

North America stands as the second-largest region in the global potato market, with a substantial value of USD 34.46 billion in 2023. This significant growth is mainly driven by several factors, including the region's established food processing industry and the widespread consumption of potato-based products. Furthermore, the surging popularity of fast food chains and casual dining establishments in North America drives demand for processed potato products such as fries and chips.

Additionally, the region's favorable climate conditions in potato-growing regions, coupled with advanced agricultural technologies, ensure consistent potato yields and quality. Moreover, increasing consumer awareness of the health benefits associated with potatoes, such as their high vitamin and mineral content, stimulates market growth. With its strong market presence and conducive business environment, North America is set to maintain its position as a key region in the global potato market.

Competitive Landscape

The global potato market study will provide valuable insight with an emphasis on the fragmented nature of the industry. Prominent players are focusing on several key business strategies such as partnerships, mergers and acquisitions, product innovations, and joint ventures to expand their product portfolio and increase their market shares across different regions. Manufacturers are adopting a range of strategic initiatives, including investments in R&D activities, the establishment of new manufacturing facilities, and supply chain optimization, to strengthen their market standing.

List of Key Companies in Potato Market

- McCain Foods Limited

- Lamb Weston, Inc.

- J.R. Simplot Company

- Farm Frites

- PepsiCo

- The Kraft Heinz Company

- Cavendish Farms Corporation

- Aviko

- Pizzoli S.p.A

- Albert Bartlett & Sons (Airdrie) Limited

Key Industry Developments

- September 2023 (Acquisition) - Agrico expanded its business segment by acquiring Royal ZAP's seed potato operations, aiming to meet growing demand. This move enhances synergy and organizational efficiency. It further supports Agrico's growth strategy amid decreasing seed potato acreage in Western Europe, ensuring its stability as a sector partner.

- August 2023 (Acquisition) - Tereos and Agristo signed a memorandum of understanding to establish a food processing venture at Tereos' former sugar factory site in France. Agristo plans to build a frozen potato product facility, involving an investment of €350 million. Production is expected to commence by the second half of 2027, offering new opportunities for local producers.

The Global Potato Market is Segmented as:

By Application

- Residential

- Commercial

- Industrial

By Type

By Product Type

By Region

- North America

- Europe

- France

- U.K.

- Spain

- Germany

- Italy

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia-Pacific

- Middle East & Africa

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America.