enquireNow

Well Intervention Market

Well Intervention Market Size, Share, Growth & Industry Analysis, By Service (Logging and Bottomhole Survey, Tubing/Packer Failure and Repair, Stimulation, Remedial Cementing, Zonal Isolation), By Type (Light Intervention, Medium Intervention, Heavy Intervention), By Application (Onshore, Offshore), and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: August 2025 | author: Versha V.

Market Definition

Well intervention refers to operations conducted on oil or gas wells during or after production to enhance, restore, or manage performance. These include corrective, diagnostic, and maintenance activities such as mechanical repairs, stimulation, logging, cleaning, plug setting, and equipment replacement without drilling a new well. Applied in both onshore and offshore settings, well intervention addresses declining production, mechanical issues, reservoir access, and flow assurance.

Well Intervention Market Overview

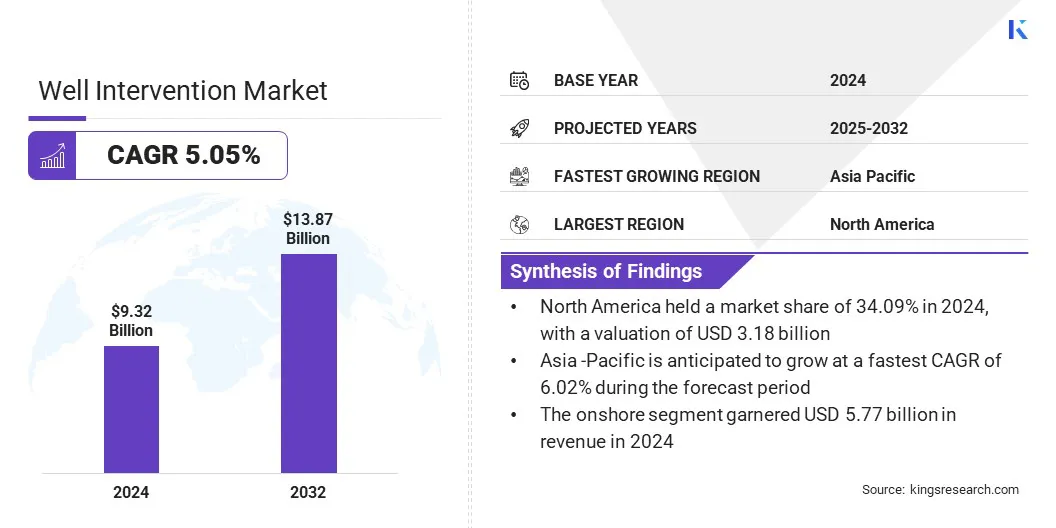

The global well intervention market size was valued at USD 9.32 billion in 2024 and is projected to grow from USD 9.77 billion in 2025 to USD 13.87 billion by 2032, exhibiting a CAGR of 5.05% during the forecast period.

This growth is driven by rising liquid fuel demand, which highlight the need for maintaining and enhancing production from existing oil and gas wells. Furthermore, the growing number of aging wells that require repair, re-completions, and other intervention activities to sustain output is contributing significantly to market expansion.

Key Highlights:

- The well intervention industry size was recorded at USD 9.32 billion in 2024.

- The market is projected to grow at a CAGR of 5.05% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 3.18 billion.

- The logging and bottomhole survey segment garnered USD 1.17 billion in revenue in 2024.

- The light intervention segment is expected to reach USD 5.79 billion by 2032.

- The onshore segment is anticipated to witness the fastest CAGR of 61.92% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.02% through the projection period.

Major companies operating in the well intervention market are Halliburton Energy Services, Inc, SLB, Baker Hughes Company, Weatherford, Patterson-UTI, Archer, AJ Lucas Group, Welltec A/S, Trican, Helix Energy, Hunting PLC, TAQA KSA, AKOFS Offshore, Expro Group, and Superior Energy Services.

The market is witnessing significant growth, mainly due to advancements in electric well control (EWC) technologies that are replacing traditional hydraulic systems. These systems streamline control architectures by eliminating complex hydraulic networks and introducing electrically powered actuators and telemetry-enabled controls.

EWC solutions enhance operational safety, reduce capital and maintenance costs, and support faster response times during critical drilling operations. This technological shift is enabling more reliable and cost-effective well interventions, leading to widespread adoption across offshore and onshore fields.

- In March 2025, SLB introduced the EWC portfolio of electric well control technologies to enhance safety and reduce drilling costs. Replacing traditional hydraulic well control components, the electric-powered system offers real-time data insights and continuous on-demand power, lowering capital and operational expenditures while improving reliability and meeting evolving safety and redundancy standards.

Market Driver

Rising Demand for Liquid Fuel

The growth of the well intervention market is propelled by the rising liquid fuel demand from expanding transportation, industrial, and commercial sectors. Producers are increasingly focusing on maintaining and enhancing output from existing wells to meet consumption needs without the higher cost and risk of new drilling.

This is boosting the adoption of well intervention techniques that restore productivity, extend field life, and ensure a reliable supply, enabling energy companies to respond effectively to evolving global fuel demand.

- According to the U.S. Energy Information Administration (EIA), global consumption of liquid fuels is expected to rise by 0.8 million barrels per day in 2025 and by 1.1 million barrels per day in 2026. This growth is highlighting the increasing need to maintain and enhance output from existing oil and gas wells to meet growing energy demand.

Market Challenge

Operating in Harsh Offshore and Deepwater Environments

A key challenge impeding the progress of the well intervention market is operating in harsh offshore and deepwater environments. Extreme pressure, high temperatures, and complex well trajectories in these locations increase risks and reduce efficiency.

Equipment must withstand corrosive fluids and difficult access, increasing service costs and extending timelines. Many operators postpone intervention or reduce their scope due to technical and financial constraints.

To address this challenge, market players are developing advanced intervention technologies with higher pressure and temperature ratings, corrosion-resistant materials, and improved downhole tool reliability. Companies are also investing in remotely operated and autonomous intervention systems to enhance safety and reduce reliance on manual operations.

Strategic partnerships and field trials are enabling customized solutions tailored to extreme environments. These efforts are helping operators improve access, reduce risks, and optimize performance in technically demanding offshore wells.

Market Trend

Digitalization and Real-Time Monitoring

A key trend influencing the well intervention market is the integration of digital diagnostics and real-time monitoring tools to enhance precision and efficiency. Operators are deploying advanced wireline logging services that deliver continuous downhole insights, enabling faster identification of reservoir conditions and production issues.

These digital capabilities support data-driven decision-making and streamline intervention planning. This trend prompts the development of responsive intervention platforms that improve field performance, reduce delays, and enhance safety in offshore and subsea operations.

- In December 2024, Halliburton introduced the Intelli suite, a set of diagnostic wireline logging services designed for well intervention. This initiative aims to improve downhole insights and support production optimization through customized intervention strategies. The package includes IntelliSat, IntelliFlow, IntelliGuard, and IntelliScope, offering reservoir analysis, operational efficiency, and extended asset life.

Well Intervention Market Report Snapshot

|

Segmentation |

Details |

|

By Service |

Logging And Bottomhole Survey, Tubing/Packer Failure and Repair, Stimulation, Remedial Cementing, Zonal Isolation, Sand Control, Artificial Lift, Fishing, Re-Perforation, Others |

|

By Type |

Light Intervention, Medium Intervention, Heavy Intervention |

|

By Application |

Onshore, Offshore |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Service (Logging and Bottomhole Survey, Tubing/Packer Failure and Repair, Stimulation, Remedial Cementing, Zonal Isolation, Sand Control, Artificial Lift, Fishing, Re-Perforation, and Others): The logging and bottomhole survey segment earned USD 1.17 billion in 2024, mainly due to the growing demand for real-time reservoir data to support optimized intervention strategies.

- By Type (Light Intervention, Medium Intervention, and Heavy Intervention): The light intervention segment held a share of 42.17% in 2024, primarily attributed to its cost-efficiency, rapid deployment, and reduced downtime in routine well servicing.

- By Application (Onshore and Offshore): The onshore segment is projected to reach USD 8.38 billion by 2032, owing to easier site accessibility, lower operational risk, and higher frequency of well intervention activities.

Well Intervention Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America well intervention market share stood at 34.09% in 2024, valued at USD 3.18 billion. This dominance is attributed to the adoption of specialized drilling and intervention technologies that enhance well efficiency across the region.

Regional players are leveraging performance-focused tools to reduce service complexity, support long-term production, and improve well integrity in high-demand areas. The deployment of advanced solutions that enable effective wellbore cleanup and recovery operations is propelling regional market expansion.

Moreover, service providers in the region are consolidating capabilities through strategic acquisitions to strengthen their intervention portfolios and improve delivery in mature fields. These efforts are helping operators extend asset life, manage operational risks in both conventional and unconventional basins, and support sustained production and efficiency, contributing to regional market expansion.

- In February 2024, Expro acquired UK-based Coretrax to expand its well construction and intervention capabilities. The deal aims to strengthen Expro’s technology portfolio and regional presence in Europe, the Middle East, and the Americas.

The Asia-Pacific well intervention industry is set to grow at a CAGR of 6.02% over the forecast period. This growth is attributed to structured well intervention programs aimed at enhancing production from mature offshore fields.

Regional operators are increasing output by executing scheduled intervention activities that improve field performance and ensure production continuity. Furthermore, the domestic market is expanding due to strategic asset acquisitions that provide direct control over the planning and execution of intervention operations.

Market participants are adopting late-life asset management strategies that support long-term resource recovery. Operators are prioritizing production optimization and reserve utilization to extend asset life and improve operational outcomes. These factors are contributing to the continued growth of the regional market.

- In July 2025, EnQuest acquired Harbour Energy’s Vietnam assets and assumed operatorship of the Chim Sao and Dua fields. Subsequent well intervention activities boosted production, and the company plans to continue these programs alongside late-life field management to enhance asset value.

Regulatory Frameworks

- In the U.S., the Bureau of Safety and Environmental Enforcement (BSEE) regulates offshore well intervention activities in U.S. federal waters. It oversees safety protocols, equipment standards, blowout preventer (BOP) performance, well integrity, and environmental protection. BSEE ensures that all well interventions comply with rigorous operational and emergency response requirements to prevent accidents.

- In the UK, the North Sea Transition Authority (NSTA) regulates well intervention activities. NSTA ensures that interventions maintain safe production, extend field life, and meet emissions and abandonment regulations, supporting the UK’s offshore energy and decarbonization strategy.

- In China, the Ministry of Natural Resources (MNR) oversees oil and gas well intervention activities related to resource management, safety compliance, and environmental standards. The MNR ensures that all interventions in onshore and offshore wells align with national regulations on reservoir management, drilling integrity, and pollution control under strict state supervision.

- In India, the Directorate General of Hydrocarbons (DGH) governs well intervention operations across the upstream oil and gas sectors. It enforces technical standards, well integrity norms, and safety protocols. DGH monitors real-time data during interventions, ensures adherence to contractual obligations under PSCs, and guides operators on maintaining productivity and environmental sustainability.

Competitive Landscape

Major players in the well intervention industry are increasingly focusing on digitalization to streamline operations across the intervention lifecycle. They are integrating AI-powered platforms to enhance planning accuracy, optimize real-time execution, and improve post-job analysis. They are also deploying cloud-based platforms that facilitate remote monitoring, real-time data sharing, and end-to-end procedural tracking.

Additionally, market players are enhancing data integration and automation to align intervention services with evolving performance, compliance, and cost-efficiency goals in both onshore and offshore operations.

- In August 2025, SLB acquired Stimline Digital AS, a key well intervention software company. Stimline’s IDEX platform enables AI-driven planning, execution, and post-job analysis of well interventions. The acquisition enhances SLB’s digital ecosystem, offering operators intelligent, vendor-agnostic workflows that improve consistency, efficiency, and performance across mature oil and gas fields.

Key Companies in Well Intervention Market:

- Halliburton Energy Services, Inc

- SLB

- Baker Hughes Company

- Weatherford

- Patterson-UTI

- Archer

- AJ Lucas Group

- Welltec A/S

- Trican

- Helix Energy

- Hunting PLC

- TAQA KSA

- AKOFS Offshore

- Expro Group

- Superior Energy Services

Recent Developments (M&A/Partnerships/Agreements/ Product Launch)

- In September 2024, Halliburton introduced its Clear portfolio of electromechanical well intervention technologies at Gastech 2024 in Houston. The portfolio features ClearTrac wireline tractors, ClearCut pipe cutters, and ClearShift valve shifters, designed for high-angle and horizontal wells. These tools incorporate surface readout telemetry and electromechanical drives to enhance downhole access and operational efficiency in well completions and interventions.

- In August 2024, Helix Energy Solutions Group secured three-year contracts with Petrobras to deliver riser-based well intervention services offshore Brazil using two specialized vessels. The contracts support production enhancement and decommissioning in mature fields, highlighting the importance of integrated subsea capabilities in optimizing oil and gas assets

freqAskQues