enquireNow

Polycarbonate Sheets Market

Polycarbonate Sheets Market Size, Share, Growth & Industry Analysis, By Product Type (Solid Polycarbonate, Multiwall Polycarbonate, Corrugated Polycarbonate), By End-Use Industry (Building & Construction, Electrical & Electronics, Automotive & Transportation, Aerospace & Defense), and Regional Analysis, 2025-2032

pages: 140 | baseYear: 2024 | release: August 2025 | author: Versha V.

Market Definition

Polycarbonate sheets are lightweight, impact-resistant thermoplastic panels known for their high transparency, durability, and UV protection. The market includes solid, multiwall, and corrugated sheet variants used across construction, automotive, electrical, and signage sectors. Applications span residential, commercial, and industrial sectors across global infrastructure and product engineering.

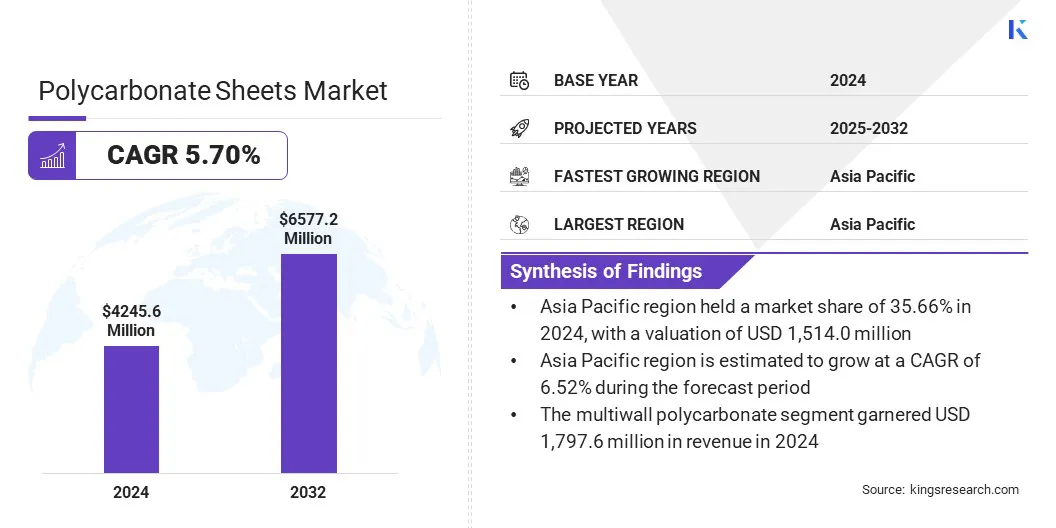

The global polycarbonate sheets market size was valued at USD 4,245.6 million in 2024 and is projected to grow from USD 4,461.9 million in 2025 to USD 6,577.2 million by 2032, exhibiting a CAGR of 5.70% during the forecast period. Market growth is attributed to rising adoption in construction and advancements in multiwall sheets.

Key Highlights

- The polycarbonate sheets industry size was USD 4,245.6 million in 2024.

- The market is projected to grow at a CAGR of 5.70% from 2025 to 2032.

- Asia Pacific held a share of 35.66% in 2024, valued at USD 1,514.0 million.

- The multiwall polycarbonate segment garnered USD 1,797.6 million in revenue in 2024.

- The building & construction segment is expected to reach USD 2,436.3 million by 2032.

- North America is anticipated to grow at a CAGR of 6.06% over the forecast period.

Major companies operating in the global polycarbonate sheets market are 3A Composites GmbH, Brett Martin, Palram Industries Ltd., Arla Plast, Tilara Polyplast Private Limited, ASIATIC PANEL, UVPLASTIC Material Technology CO., LTD., Hebei Unique Plastics Manufacturer Co., Ltd, Covestro AG, TEIJIN LIMITED, Suzhou Omay Optical Materials Co., Ltd., Excelite, Plaskolite, GALLINA, and Işık Plastik.

Polycarbonate Sheets Market Report Scope

|

Segmentation |

Details |

|

By Product Type |

Solid Polycarbonate, Multiwall Polycarbonate, Corrugated Polycarbonate |

|

By End-Use Industry |

Building & Construction, Electrical & Electronics, Automotive & Transportation, Aerospace & Defense |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Polycarbonate Sheets Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific polycarbonate sheets market share stood at 35.66% in 2024, valued at USD 1,514.0 million. This dominance is attributed to extensive infrastructure development in countries such as China, India, and those in Southeast Asia, where governments are investing significantly in transportation networks, smart cities, and urban utilities.

These projects require high-performance building materials and polycarbonate sheets are preferred for their strength, lightweight, and weather resistance. This sustained investment in public infrastructure continues to support strong demand, reinforcing Asia Pacific’s leading market position.

- In March 2025, India’s Ministry of Housing and Urban Affairs (MoHUA) reported that over 93% of 8,000+ smart city projects had been completed under the Smart Cities Mission, supported by approximately USD 5.8 billion in funding.

The North America polycarbonate sheets industry is estimated to grow at a CAGR of 6.06% over the forecast period. This growth is propelled by rapid automotive production and a rising focus on lightweight materials, particularly in electric vehicle manufacturing.

Polycarbonate sheets are widely used in glazing systems, headlamp covers, and interior components due to their strength, impact resistance, and reduced weight. These applications support improved vehicle efficiency and occupant safety standards. The expanding EV ecosystem and emphasis on fuel economy are expected to further boost demand, positioning North America as the fastest-growing market for polycarbonate sheets.

Polycarbonate Sheets Market Overview

The increased use of polycarbonate sheets in windows, sunroofs, and interior components is fueling market growth due to their lightweight structure, durability, and optical clarity. These sheets reduce vehicle weight, enhance fuel efficiency, and meet stringent emission regulations while offering design flexibility for advanced vehicle interiors. Their ability to withstand impact and maintain performance under varying conditions positions them as a preferred material.

Market Driver

Rising Adoption in Construction Applications

The rising use of polycarbonate sheets in the construction sector is boosting market growth, supported by their extensive use in skylights, roofing systems, and wall panels. These sheets offer high impact resistance, thermal insulation, and long-term durability, which makes them suitable for both commercial and residential structures.

Additionally, their ability to transmit natural light while withstanding harsh environmental conditions enhances their appeal in modern architecture, reinforcing demand across infrastructure and real estate sectors.

- In February 2024, Miami-Dade County updated its Building Code Notice of Acceptance, mandating the use of vacuum-formed clear polycarbonate sheets with a minimum thickness of 0.093" or 0.118" for skylight domes.

Market Challenge

Raw Material Price Volatility

Fluctuating raw material costs present a significant challenge to the progress of the polycarbonate sheets market by increasing manufacturing expenses and disrupting pricing consistency. Price volatility in bisphenol A and other petrochemical inputs reduces profit margins and complicates budget forecasting for downstream industries. This pricing uncertainty weakens the market’s cost competitiveness compared to alternative materials in price-sensitive applications.

To address these challenges, producers are enhancing supply chain efficiency through backward integration and long-term sourcing strategies, helping stabilize operations and supporting sustained market performance .

Market Trend

Technological Advancements in Multiwall Sheets

Advancements in multiwall polycarbonate sheet technologies are emerging as a notable trend in the polycarbonate sheets market, marked by improved insulation performance and structural durability. These enhancements support efficient temperature regulation and greater load resistance, aligning with the growing demand for energy-efficient materials.

Their suitability for cold climates and controlled environments reflects a significant shift toward high-performance building solutions. This transition is reinforcing their use in climate-sensitive applications, shaping evolving material standards.

Market Segmentation

- By Product Type (Solid Polycarbonate, Multiwall Polycarbonate, and Corrugated Polycarbonate): The multiwall polycarbonate segment earned USD 1,797.6 million in 2024, due to its superior thermal insulation, high strength-to-weight ratio, and suitability for energy-efficient construction in diverse climate conditions.

- By End-Use Industry (Building & Construction, Electrical & Electronics, Automotive & Transportation, and Aerospace & Defense): The building & construction segment held a share of 37.45% in 2024, attributed to its extensive use in roofing, skylights, and facades, supported by the demand for durable, lightweight, and energy-efficient materials in modern infrastructure.

Regulatory Frameworks

- In India, the Bureau of Indian Standards (BIS) regulates the quality and safety of plastic and polymer-based products through specific Indian Standards (IS) codes. These include guidelines applicable to polycarbonate sheets used in construction, automotive, and electrical sectors.

- In the U.S., the Occupational Safety and Health Administration (OSHA) establishes safety regulations for the handling and processing of polycarbonate materials in industrial settings, including permissible exposure limits for chemicals used during production.

Competitive Landscape

The competitive landscape of the polycarbonate sheets industry is marked by strategic acquisitions and frequent product launches. Companies are expanding their portfolios to enhance application-specific offerings and meet evolving regulatory and performance standards.

New product developments focus on improved durability, UV resistance, and extended warranties, targeting infrastructure and automotive sectors. Acquisitions aim to strengthen global distribution networks and manufacturing capabilities, enabling faster market penetration and broader customer reach across key geographies.

Key Companies in Polycarbonate Sheets Market:

- 3A Composites GmbH

- Brett Martin

- Palram Industries Ltd.

- Arla Plast

- Tilara Polyplast Private Limited

- ASIATIC PANEL

- UVPLASTIC Material Technology CO., LTD.

- Hebei Unique Plastics Manufacturer Co., Ltd

- Covestro AG

- TEIJIN LIMITED

- Suzhou Omay Optical Materials Co., Ltd.

- Excelite

- Plaskolite

- GALLINA

- Işık Plastik.

Recent Developments (Product Launch)

- In June 2024, Teijin Limited reported the addition of a new production line for its Panlite polycarbonate resin sheets and films. The company invested in this new line to meet the growing demand for high-quality automotive interior parts and in-vehicle electronic components, such as displays and touch screens.

freqAskQues