buyNow

Medical Sensors Market

Medical Sensors Market Size, Share, Growth & Industry Analysis, By Type (Pressure Sensors, Temperature Sensor, Image Sensors, Accelerometer, Biosensors, Flow Sensors, Squid Sensors), By Application (Diagnostic, Therapeutic, Monitoring, Wellness & Fitness), By End User (Hospitals, Home Care Settings), and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Medical sensors are used to detect, measure, and monitor physiological, biochemical, and physical parameters within the human body for medical purposes. The market focuses on the development, production, and utilization of sensor-based technologies for disease diagnosis, patient monitoring, and therapeutic management.

It includes a variety of sensor types such as biosensors, pressure sensors, temperature sensors, motion sensors, image sensors, and wearable sensors. These sensors are integrated into medical devices, diagnostic systems, and remote monitoring platforms to enable real-time health monitoring, early diagnosis, and personalized treatment.

Medical Sensors Market Overview

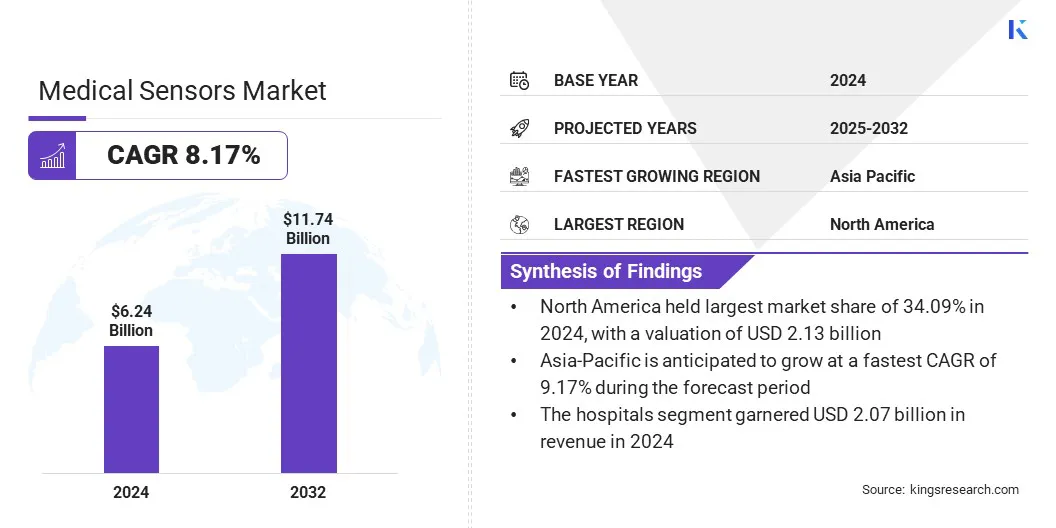

The global medical sensors market size was valued at USD 6.24 billion in 2024 and is projected to grow from USD 6.74 billion in 2025 to USD 11.74 billion by 2032, exhibiting a CAGR of 8.17% during the forecast period.

This growth is attributed to the increasing demand for advanced healthcare monitoring solutions across key applications such as wearable devices, remote patient monitoring, and telemedicine. The rising prevalence of chronic diseases like diabetes, cardiovascular disorders, and respiratory conditions is driving the need for accurate and real-time physiological data.

Major companies operating in the medical sensors industry are Medtronic, Honeywell International Inc., Sensirion AG, STMicroelectronics, Analog Devices, Inc., Koninklijke Philips N.V., TE Connectivity, Abbott Laboratories, amphenol-sensors.com, OMNIVISION, GE HealthCare, Masimo, Merit Medical Systems, Inc., Murata Manufacturing Co., Ltd., and Fujikura Ltd.

The expanding adoption of sensor miniaturization technologies and wireless connectivity is enabling more compact, efficient, and user-friendly medical sensors. Growing investments in research and development, supportive regulatory frameworks, and heightened awareness about early disease detection are fueling market expansion.

Ongoing innovations in sensor accuracy, integration with artificial intelligence, and increasing collaborations between medical device manufacturers and technology firms, are accelerating market development.

- In March 2025, researchers at the University of Turku developed a new method to create highly accurate sensors for continuous health monitoring. They used single-wall carbon nanotubes to improve the detection of low-concentration substances, advancing personalized healthcare. This advancement enhances sensor sensitivity and specificity for more reliable and precise monitoring of vital health markers.

Key Highlights

- The medical sensors industry size was valued at USD 6.24 billion in 2024.

- The market is projected to grow at a CAGR of 8.17% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 2.13 billion.

- The pressure sensors segment garnered USD 1.40 billion in revenue in 2024.

- The diagnostic segment is expected to reach USD 3.30 billion by 2032.

- The clinics segment is anticipated to witness the fastest CAGR of 8.47% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 9.17% through the projection period.

Market Driver

Growing Adoption of Remote Patient Monitoring & Telemedicine

The growth of the medical sensors market is propelled by the expanding adoption of remote patient monitoring and telemedicine, which enable continuous and real-time health tracking. Increasing demand to reduce hospital visits, lower healthcare costs, and improve outcomes, particularly for chronic disease management fuels product adoption.

Advancements in medical sensor technologies, wireless communication, and digital health platforms facilitate the monitoring of vital signs, glucose levels, and respiratory parameters, from home or remote locations.

Telehealth acceptance and the demand for accurate and reliable medical sensors has witnessed high growth in the post-COVID era. This shift encourages healthcare providers to enhance patient engagement, enable timely interventions, and utilize data-driven decision-making while offering patients greater convenience and personalized care.

- In April 2024, Philips partnered with smartQare to integrate advanced wearable biosensors with clinical monitoring platforms to enhance continuous patient monitoring in and outside hospitals. The partnership aims to improve data flow between sensors and systems, reduce clinical workload, and shorten patient hospital stays by providing seamless, easy-to-use remote monitoring solutions.

Market Challenge

Complexities in Integration with Healthcare Information Systems

Integration issues pose significant obstacles to the widespread adoption of medical sensors, particularly in diverse clinical environments. Variations in data standards, communication protocols, and interoperability among electronic health record (EHR) systems make seamless data exchange and real-time monitoring challenging.

Incompatibility issues and fragmented healthcare IT infrastructures complicate the aggregation and analysis of sensor data, limiting its clinical utility. These barriers delay implementation, reduce workflow efficiency, and hinder timely decision-making among healthcare providers.

To overcome these issues, stakeholders are working on developing universal data standards and interoperable platforms. Collaboration between sensor manufacturers, healthcare providers, and IT vendors aims to streamline integration processes. Moreover, the adoption of cloud-based solutions and middleware technologies is facilitating smoother data flow, enhancing clinical workflows, and improving patient care outcomes.

Market Trend

Advancements in Sensor Technology

Advancements in sensor technology are transforming the medical sensors market by enabling more precise, miniaturized, and multifunctional devices that support a wide range of healthcare applications. Innovations in microelectromechanical systems (MEMS), nanotechnology, and advanced bio-sensing materials allow real-time monitoring of physiological and biochemical parameters with improved accuracy and patient comfort.

Emerging sensor designs now integrate wireless communication, energy-efficient operation, and compatibility with digital health platforms, facilitating seamless data collection, analysis, and remote monitoring. These capabilities allow healthcare providers to track multiple health indicators simultaneously, enabling proactive disease management and personalized care strategies.

Developments in sensor fabrication, such as multi-analyte detection and flexible, wearable formats, are expanding clinical utility while improving scalability and cost-efficiency. As these technologies advance, they are strengthening the role of medical sensors in preventive care, chronic disease management, and population health monitoring, while supporting the shift toward data-driven and patient-centric healthcare models.

- In October 2024, STMicroelectronics launched the ST1VAFE3BX biosensing chip for healthcare wearables. The compact chip combines biopotential sensing, motion tracking, and AI with low power use, supporting longer battery life. This innovation is set to advance the capabilities and efficiency of next-generation wearable health devices.

Medical Sensors Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Pressure Sensors, Temperature Sensors, Image Sensors, Accelerometer, Biosensors, Flow Sensors, Squid Sensors, and Others |

|

By Application |

Diagnostic, Therapeutic, Monitoring, Wellness & Fitness, and Others |

|

By End User |

Hospitals, Clinics, Home Care Settings, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Pressure Sensors, Temperature Sensors, Image Sensors, Accelerometer, Biosensors, Flow Sensors, Squid Sensors, and Others): The pressure sensors segment earned USD 1.40 billion in 2024, due to their widespread use in critical applications such as blood pressure monitoring, respiratory devices, and invasive medical procedures that require precise pressure measurements.

- By Application (Diagnostic, Therapeutic, Monitoring, Wellness & Fitness, and Others): The diagnostic segment held a share of 28.08% in 2024, attributed to the growing demand for early disease detection, advanced imaging technologies, and non-invasive diagnostic tools. This is enabled by high-precision medical sensors.

- By End User (Hospitals, Clinics, Home Care Settings, and Others): The hospitals segment is projected to reach USD 3.87 billion by 2032, owing to the increasing adoption of advanced sensor-based medical devices for continuous patient monitoring, surgical procedures, and comprehensive diagnostic services within hospital settings.

Medical Sensors Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America medical sensors market share stood at 34.09% in 2024, valued at USD 2.13 billion. This dominance is attributed to the presence of a well-established healthcare infrastructure, high adoption of advanced medical technologies, and substantial investments in research and development across the region.

The strong presence of leading medical device manufacturers, combined with the increasing demand for innovative diagnostic and monitoring solutions, is further driving market growth in the region. Additionally, favorable reimbursement policies and supportive government initiatives are encouraging the integration of sensor-based technologies into mainstream healthcare practices.

The region’s growing focus on personalized medicine, remote patient monitoring, and preventive healthcare is stimulating continuous product innovation and accelerating the adoption of medical sensors across various clinical applications.

- In August 2024, Injectsense, based in California, completed the first human implantation of its ultraminiaturized intraocular pressure sensor for glaucoma management. The tiny, wireless sensor enables continuous, real-time monitoring using a minimally invasive technique, paving the way for personalized treatment and improved patient care.

The Asia-Pacific medical sensors industry is set to grow at a CAGR of 9.17% over the forecast period. This growth is attributed to the rapid expansion of healthcare infrastructure, increasing healthcare awareness, and a growing focus on preventive health management across emerging economies in the region.

The region’s growing adoption of telemedicine, mobile health platforms, and wearable medical devices is further supporting market expansion. Government initiatives aimed at modernizing healthcare systems, encouraging digital health innovation, and improving access to quality care are fostering a favorable environment for sensor technology adoption.

Increasing partnerships between global medical device companies, local manufacturers, and research institutions are accelerating technological advancements and broadening the application scope of medical sensors in the region.

Regulatory Frameworks

- In the European Union, the Medical Device Regulation (MDR) (EU) 2017/745 governs medical sensors. It sets requirements for clinical evaluation, conformity assessment, and post-market monitoring to ensure patient safety and device performance.

- In the U.S., the Food and Drug Administration (FDA) regulates medical sensors as medical devices under the Federal Food, Drug, and Cosmetic Act (FD&C Act). It ensures safety, effectiveness, and quality through premarket approvals, clearances, and post-market surveillance.

- In China, the National Medical Products Administration (NMPA) regulates medical devices and medical sensors. It oversees the registration, approval, quality control, and safety monitoring of medical devices to ensure that they meet national standards and protect public health.

- In the United Kingdom, the Medical Devices Regulations 2002 (Statutory Instrument 2002/618) regulate medical devices, such as medical sensors. These regulations implement European Community Directives concerning medical devices, ensuring that these products meet essential safety and performance requirements before being placed on the market or put into service.

- In the International context, the International Organization for Standardization (ISO) 13485:2016 regulates quality management systems for medical devices. It specifies requirements to make sure that organizations consistently provide safe and effective medical devices that meet regulatory and customer standards.

Competitive Landscape

The medical sensors industry includes a diverse mix of well-established multinational corporations and emerging technology firms. Companies are actively expanding their product portfolios and market reach through ongoing technological innovation, diversification of sensor applications, and strategic partnerships.

Key players are heavily investing in research and development to enhance sensor accuracy, miniaturization, multi-parameter monitoring capabilities, and seamless integration with digital health platforms.

They are also developing advanced wearable, implantable, and non-invasive sensor technologies to address a broad range of diagnostic, therapeutic, and monitoring applications across various healthcare settings. Firms are partnering with healthcare providers, research institutions, and technology vendors to strengthen their distribution networks, support clinical validation, and accelerate global market expansion.

- In December 2024, Honeywell introduced a liquid flow sensing platform to improve accuracy in dosing liquid medications. The solution offers real-time, continuous measurement, enhancing medication delivery in medical fluid management, wearable drug delivery, and diagnostics.

List of Key Companies in Medical Sensors Market:

- Medtronic

- Honeywell International Inc.

- Sensirion AG

- STMicroelectronics

- Analog Devices, Inc.

- Koninklijke Philips N.V.

- TE Connectivity

- Abbott Laboratories

- amphenol-sensors.com

- OMNIVISION

- GE HealthCare

- Masimo

- Merit Medical Systems, Inc.

- Murata Manufacturing Co., Ltd.

- Fujikura Ltd.

Recent Developments (M&A/ Launch/Expansion)

- In May 2025, Abbott introduced the TactiFlex sensor-enabled ablation catheter in India for treating abnormal heart rhythms. The catheter features a flexible tip and contact force technology that helps doctorsrestore normal heart rhythm by guiding electrical currents. This advanced technology improves treatment accuracy and patient outcomes in cardiac care.

- In April 2024, Biolinq announced a USD 58 million funding round to advance its wearable biosensor technology for metabolic health. The capital will support a pivotal U.S. clinical trial and FDA approval process for their intradermal glucose sensor, which monitors glucose levels beneath the skin without needles or blood. This sensor is embedded in a forearm patch that provides users with real-time, easy-to-understand glucose readings.

- In November 2023, Millar acquired Sentron, a pressure and pH sensor manufacturer from the Netherlands. The acquisition aims to expand Millar’s sensor portfolio for medical and industrial applications, strengthening its position in the MEMS (Micro-Electro-Mechanical Systems) pressure sensor industry.