enquireNow

Geochemical Services Market

Geochemical Services Market Size, Share, Growth & Industry Analysis, By Service Type (Sample Preparation, Fire Assay, Aqua Regia Digest, Mixed Acid Digest, Hydro-Geochemical Analysis, X-Ray Fluorescence, Others), By Service Mode (Laboratory-Based Services, On-Site/ In-Field Services), By End User, and Regional Analysis, 2022-2032

pages: 174 | baseYear: 2024 | release: August 2025 | author: Ashim L.

Market Definition

The market refers to the ecosystem of service providers that perform chemical and elemental analysis of soil, rock, water, sediment, and gas samples. It includes laboratory-based and field-based services that support decision-making across mineral exploration, oil and gas operations, environmental assessments, hydrology, and archaeological surveys.

The market scope covers sample collection, analytical testing, geochemical data interpretation, and site characterization using standardized protocols and instrumentation.

Geochemical Services Market Overview

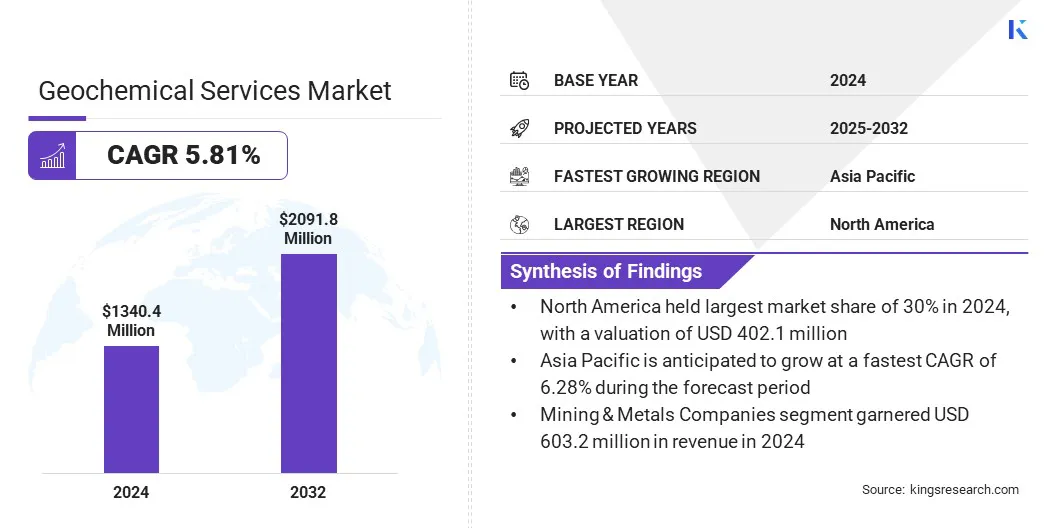

The global geochemical services market size was valued at USD 1,340.4 million in 2024 and is projected to grow from USD 1,409.0 million in 2025 to USD 2,091.8 million by 2032, exhibiting a CAGR of 5.81% during the forecast period.The market provides analytical solutions to determine the chemical and mineralogical composition of geological and environmental samples.

Services include sample preparation, laboratory assays, field analysis, and data interpretation, delivered under standardized quality frameworks. Market growth is driven by resource exploration demand, environmental regulations, and adoption of advanced analytical technologies for faster, more accurate subsurface characterization.

Key Highlights:

- The geochemical services industry size was recorded at USD 1,340.4 million in 2024.

- The market is projected to grow at a CAGR of 5.81% from 2025 to 2032.

- North America held a market share of 30% in 2024, with a valuation of USD 402.1 million.

- The fire assay service type segment garnered USD 281.5 million in revenue in 2024.

- The laboratory-based services segment is expected to reach USD 1,506.2 million by 2032.

- The engineering & consulting firms segment is anticipated to witness the fastest CAGR of 5.95% during the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 5.95% during the forecast period.

Major companies operating in the geochemical services market are Actlabs Group, ACZ Laboratories, AGAT Laboratories, ALS Limited, Bureau Veritas, Capital Limited, Cotecna Inspection SA, Eurofins Scientific, FLSmidth A/S, Fugro, Geochemic Ltd, Geolabs Limited, Intertek Group plc, Saudi Aramco, SGS Société Générale de Surveillance SA., and others.

The market is expanding due to rising mineral exploration activity globally. Increased demand for critical minerals such as lithium, cobalt, and rare earth elements is driving the adoption of advanced analysis techniques for resource identification and extraction.

- For instance, according to Geoscience Australia, the total mineral exploration expenditure in Australia amounted to USD 3.95 billion, with USD 208.5 million directed to cobalt and nickel in the country.

National geological mapping programs and private sector investments are accelerating exploration activity globally. Advancements in analytical instrumentation and automation are further improving testing precision and field-to-lab turnaround time.

Market Driver

Rising Global Demand for Critical Minerals Used in Clean Energy Technologies

The global geochemical services market is driven by structural shifts in critical mineral demand and growing supply-chain pressures. According to the IEA’s 2024–2025 assessment, project pipelines for minerals such as nickel, cobalt, and rare earths will keep pace with demand through 2035 under current policy settings.

However, copper and lithium are projected to face significant deficits. For copper, a 30% supply shortfall is expected due to declining ore grades, high capital intensity, and limited new discoveries. These factors are increasing the need for exploration activity, particularly in geochemically complex regions.

Moreover, export restrictions such as China’s 2024–2025 bans on key rare earths, tungsten, and semiconductor metals, and the Democratic Republic of the Congo’s temporary cobalt export suspension are creating geopolitical uncertainties.

The resulting supply concentration is increasing the need for countries to strengthen domestic supply chains to mitigate dependency risks. These factors are accelerating investment in advanced geochemical surveying and risk-informed resource mapping, thereby broadening the market for both laboratory-based and in-field geochemical services.

Market Challenge

High Costs Associated with Acquisition and Maintenance of Advanced Analytical Infrastructure

A major challenge in the geochemical services market is the high capital investment required for advanced analytical equipment and laboratory infrastructure. Smaller firms, constrained by limited resources, often struggle to attract experienced geochemists, creating a competitive imbalance that limits innovation and scalability. Limited access to cutting-edge tools also impacts data quality and service consistency.

Market participants are addressing this challenge by forming strategic partnerships with government agencies and industry bodies to expand service reach and standardize quality. Many are investing in joint testing centers and shared laboratory facilities to optimize infrastructure costs.

Companies are also implementing workforce development programs, including in-house technical training and skill certification, to ensure consistent analytical standards. Access to modern equipment is being enhanced through equipment leasing models, collaborative research projects, and technology-sharing agreements, enabling smaller players to compete effectively while meeting stringent client and regulatory requirements.

- For instance, the U.S. Geochemical Society offers capacity‑building grants of up to USD 3,000 to support geochemistry training initiatives. These focus on low and lower-middle income countries, funding activities such as summer schools, analytical workshops, field courses, and university‑level laboratory instruction. These grants are explicitly designed to fund analytical training and technical skill development. They also enable network building between universities, government agencies, and nascent service providers.

Market Trend

Growing Integration of AI and Machine Learning for Geochemical Data Modeling

The integration of artificial intelligence (AI) and machine learning (ML) into geochemical data modeling is enhancing the precision and efficiency of geoscientific analysis. These technologies enable advanced interpretation of large, multi-element datasets derived from soil, rock, water, and sediment samples.

ML algorithms are used to detect geochemical anomalies, predict mineralization zones, and model spatial distribution patterns with greater accuracy. These algorithms improve the reliability of exploratory targeting and its usage in environmental applications and AI-driven tools support rapid identification of contamination zones and risk areas.

The application of AI reduces manual interpretation time, accelerates decision-making, and supports more cost-effective exploration workflows. As a result, the adoption of AI and ML has become a strategic priority for geochemical service providers seeking to differentiate through data-driven insights and predictive modeling capabilities.

- The U.S. Geological Survey’s (USGS) according to their July 2025 press release are currently adopting artificial intelligence and machine learning across geochemical and environmental workflows. Its Environmental Health Program employs algorithms to map contaminant gradients, predict arsenic and PFAS concentrations in groundwater, and support rapid field-based pollutant assessments. In geoscience applications, AI tools aid in the prediction of mineral-rich zones and expedite exploratory targeting using vast geochemical datasets.

Geochemical Services Market Report Snapshot

|

Segmentation |

Details |

|

By Service Type |

Sample Preparation, Fire Assay, Aqua Regia Digest, Mixed Acid Digest, Hydro-Geochemical Analysis, X-Ray Fluorescence (XRF), Others |

|

By Service Mode |

Laboratory-Based Services, On-Site/ In-Field Services |

|

By End User |

Mining & Metals Companies, Oil & Gas Operators, Environmental Agencies, Research & Academic Institutions, Engineering & Consulting Firms, Government & NGOs |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Service Type (Sample Preparation, Fire Assay, Aqua Regia Digest, Mixed Acid Digest, Hydro-Geochemical Analysis, X-Ray Fluorescence (XRF), Others): The sample preparation segment earned USD 248.0 million in 2024 due to the growing volume of mineral and soil samples collected across exploration and environmental projects.

- By Service Mode (Laboratory-Based Services, On-Site/ In-Field Services): The laboratory-based services segment held 73% of the market in 2024, due to the higher accuracy, multi-element detection capability, and regulatory-grade quality assurance provided by centralized labs.

- By End User (Mining & Metals Companies, Oil & Gas Operators, Environmental Agencies, Research & Academic Institutions, Engineering & Consulting Firms, and Government & NGOs): The mining & metals companies segment is projected to reach USD 940.9 million by 2032, owing to the global push toward energy transition, which is increasing the demand for battery metals such as lithium, nickel, and cobalt.

Geochemical Services Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for approximately 30% of the global geochemical services market, valued at USD 402.1 million in 2024. The region’s dominance is supported by extensive mineral exploration across the U.S. and Canada, particularly for copper, gold, lithium, and rare earth elements. Government initiatives such as the USGS Earth MRI program and Canada's Critical Minerals Strategy are advancing geological mapping and resource assessment.

Additionally, strong regulatory frameworks, established laboratory infrastructure, and ongoing investments in battery metal supply chains contribute to stable market demand. Through the Critical Minerals Geoscience Data (CMGD) initiative, the Canadian government allocated USD 7.4 million for geoscience data access and mapping infrastructure.

Collaboration between public institutions and private explorers ensures that geochemical service providers remain integral to national mapping and exploration programs. Moreover, collaboration between public institutions and private exploration companies strengthens service utilization across mining and environmental sectors.

The Asia-Pacific Geochemical Services industry is projected to grow at a robust CAGR of 6.28% over the forecast period. This growth is driven by rapid industrialization, infrastructure expansion, and increased demand for critical minerals across China, India, and Southeast Asia.

Government initiatives such as India's National Mineral Exploration Policy and Australia’s critical minerals strategy are stimulating exploration activities. The region is also witnessing the adoption of portable geochemical analysis tools and advanced laboratory capabilities.

Rising investment in electric vehicle manufacturing and battery storage further fuels mineral demand. These factors position Asia-Pacific as the fastest-growing regional market with strong long-term potential.

Regulatory Frameworks

- In the U.S., geochemical service providers operate under regulatory standards defined by the Environmental Protection Agency (EPA) and the United States Geological Survey (USGS), particularly in environmental sampling and mineral assessment.

- In the European Union, directives such as the Water Framework Directive and the Soil Thematic Strategy guide sampling methodologies and quality assurance.

- In China, the Ministry of Natural Resources mandates nationwide geochemical mapping, governed by the Chinese Academy of Geological Sciences.

- In India, the Geological Survey of India leads mineral exploration and mandates geochemical baseline data as part of national mineral policy initiatives.

Competitive Landscape

The geochemical services industry comprises a mix of established industry leaders and emerging participants. Companies are increasingly investing in laboratory automation to improve efficiency and data accuracy. Market players are also expanding their geographic footprint, particularly in resource-rich regions, to capitalize on growing exploration and production activities.

The digitalization of data reporting platforms is enhancing client access to real-time analytical insights, enabling faster decision-making and stronger project outcomes. Leading firms are further strengthening their capabilities by integrating advanced techniques such as multi-element and isotopic analysis into their service portfolios.

- In July 2025, PetroStrat introduced a new geochemistry service that integrated inorganic and organic geochemical techniques to support subsurface interpretation. The offering aimed to enhance stratigraphic analysis by combining geochemical data with biostratigraphy and sedimentology.

Key Companies in Geochemical Services Market:

- Actlabs Group

- ACZ Laboratories

- AGAT Laboratories

- ALS Limited

- Bureau Veritas

- Capital Limited

- Cotecna Inspection SA

- Eurofins Scientific

- FLSmidth A/S

- Fugro

- Geochemic Ltd

- Geolabs Limited

- Intertek Group plc

- Saudi Aramco

- SGS Société Générale de Surveillance SA.

Recent Developments (M&A/Partnerships/Agreements/New Product Launch)

- In 2025, CSIRO launched LandScape+, an online tool that helped geologists interpret geochemical data using machine learning and high-resolution landform mapping. The tool integrated remotely sensed data to support exploration in remote and soil-covered regions, enabling faster and more cost-effective analysis of mineral potential. It aimed to simplify early-stage exploration, particularly for critical minerals like gold, lithium, and copper.

- In June 2025, Actlabs Val-d’Or received ISO/IEC 17025 accreditation, confirming its compliance with international standards for laboratory testing and calibration. This is expected to enhance the company's credibility and competitiveness in delivering precise, reliable, and globally recognized analytical results.

- In April 2025, Geolabs Limited relocated its Birmingham laboratory to Coleshill, North Warwickshire, expanding its Midlands operations. The new facility offers increased floor space, enabling a broader range of testing services.

freqAskQues