enquireNow

B2B Digital Payment Market

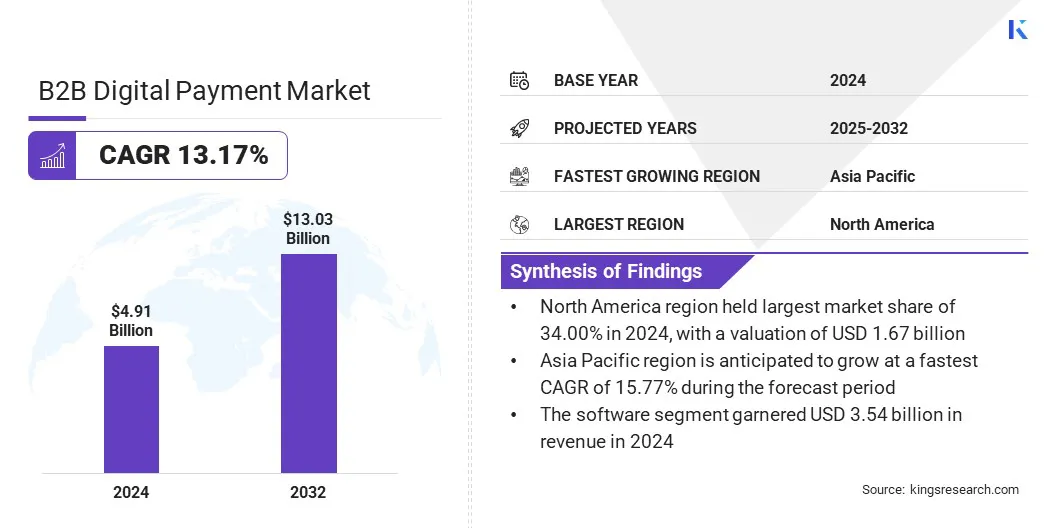

B2B Digital Payment Market Size, Share, Growth & Industry Analysis, By Offering (Software, Services), By Transaction Type (Domestic Payments, Cross-Border Payments), By Payment Method (Cards, Digital Wallets), By Industry, and Regional Analysis, 2025-2032

pages: 200 | baseYear: 2024 | release: August 2025 | author: Versha V.

Market Definition

B2B digital payments refer to electronic transactions between businesses for goods or services. They streamline operations by automating payment processes and reducing reliance on manual workflows. The market includes software for payment infrastructure, billing and accounting management, and security with compliance and fraud prevention features, along with professional and managed services.

It serves industries such as the BFSI, retail and e-commerce, manufacturing, and healthcare, enabling domestic and cross-border transactions through digital wallets, cards, and other methods.

B2B Digital Payment Market Overview

The global B2B digital payment market size was valued at USD 4.91 billion in 2024 and is projected to grow from USD 5.48 billion in 2025 to USD 13.03 billion by 2032, exhibiting a CAGR of 13.17%during the forecast period.

This growth is attributed to the growing demand for B2B invoice management and payment platforms that streamline complex financial workflows and reduce manual processing. AI-powered advancements in B2B digital payment systems are transforming the management of transactions by businesses through automation, real-time analytics, and intelligent fraud detection.

Key Highlights

- The B2B digital payment industry was valued at USD 4.91 billion in 2024.

- The market is projected to grow at a CAGR of 13.17% from 2025 to 2032.

- North America held a share of 34.00% in 2024, with a valuation of USD 1.67 billion.

- The software segment garnered USD 3.54 billion in revenue in 2024.

- The domestic payments segment is expected to reach USD 7.76 billion by 2032.

- The cards segment is projected to generate a revenue of USD 5.38 billion by 2032.

- The BFSI segment is estimated to record a valuation of USD 3.38 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 15.77% over the forecast period.

Major companies operating in the B2B digital payment market are Visa Inc., Mastercard, PayPal, Stripe, Inc., American Express Company, FIS, Fiserv, Inc., Paytm, Juspay Technologies, Airwallex, Rapyd Financial Network Ltd., TTMFS Singapore Pte Ltd, Coupa Software Inc., Payoneer Inc., and Veem.

Market growth is propelled by the growing use of virtual cards that enhance working capital management. These solutions enable businesses to extend payment cycles, optimize cash flow, and control transaction timing.

They improve spending visibility, reduce fraud risk, and simplify reconciliation. As demand for flexible, secure payment tools rises, virtual cards are strengthening financial operations while supporting broader digital transformation.

- In November 2023, Taulia collaborated with Mastercard to introduce Taulia Virtual Cards, a B2B payment solution for improving working capital efficiency. It optimizes cash flow and addresses payment uncertainties through smooth integration with SAP ERP platforms, including SAP S/4HANA.

Market Driver

Growing Demand for B2B Invoice Management and Payment Platforms

The B2B digital payment market is experiencing growth, mainly due to the rising demand for B2B invoice management and payment platforms. Businesses are replacing manual processes with automated systems that improve accuracy and reduce payment delays. These platforms streamline invoicing, reconciliation, and settlement by offering real-time visibility into transaction status and cash flow.

Integration with accounting and enterprise resource planning systems allows for faster approvals, error reduction, and improved compliance. Increasing transaction volumes are highlighting the need for centralized, secure, and scalable invoice-to-pay solutions, contributing significantly to market growth.

- In September 2024, Easebuzz partnered with NPCI Bharat BillPay Ltd. (NBBL) to launch a B2B invoice management and payments platform at the Global Fintech Festival 2024. The collaboration aimed at simplifying business payments by enabling interoperability within the ecosystem. The platform offers features such as invoice lifecycle management, integrated financing, and multi-mode payment options, addressing pain points across the FMCG, textiles, and pharmaceutical sectors.

Market Challenge

Security and Fraud Risks in B2B Digital Payment Transactions

A major challenge impeding the expansion of the B2B digital payment market is the growing risk of fraud and data breaches across high-value transactions. Businesses face threats such as phishing, account takeovers, and unauthorized access, which undermine trust in digital platforms. These risks delay adoption among enterprises seeking secure, compliant payment environments.

To address this challenge, providers are integrating multi-factor authentication, encryption, and AI-driven fraud detection tools. Additionally, they are strengthening compliance frameworks and investing in real-time monitoring systems to ensure transaction integrity and data security.

Market Trend

AI-Powered Advancements in B2B Digital Payment Systems

The B2B digital payment market is experiencing a notable shift toward the integration of artificial intelligence across transaction platforms. AI supports automation in invoice validation, fraud detection, payment reconciliation, and credit risk analysis. It enables real-time monitoring of payment activities and flags anomalies to reduce financial risks.

Businesses are using AI to enhance workflow accuracy, shorten processing cycles, and manage large volumes of transactions with minimal manual input. This shift is reshaping enterprise payment operations by improving operational efficiency, ensuring better compliance, and strengthening data-driven decision-making across global B2B networks.

- In April 2025, onPhase partnered with Bottomline to embed access to the Paymode digital payments network into its AI-powered accounts payable solution. The partnership aimed at streamlining invoice-to-payment workflows by enabling finance teams to eliminate paper checks, reduce fraud risks, and manage payments through a single platform.

B2B Digital Payment Market Report Snapshot

|

Segmentation |

Details |

|

By Offering |

Software(Payment Infrastructure, Billing and Accounting Management , Security, Compliance & Fraud Prevention), Services (Professional Services, Managed Services) |

|

By Transaction Type |

Domestic Payments, Cross-Border Payments |

|

By Payment Method |

Cards (Credit Cards, Debit Cards, Virtual Cards), Digital Wallets, Others |

|

By Industry |

BFSI, Retail & E-Commerce, Manufacturing, Healthcare, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe |

|

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Offering (Software and Services ): The software segment earned USD 3.54 billion in 2024, due to the growing demand for automated payment infrastructure and integrated accounting solutions.

- By Transaction Type (Domestic Payments and Cross-Border Payments): The domestic payments segment held a substantial share of 64.00% in 2024, fueled by the increased adoption of real-time payment systems and local transaction platforms.

- By Payment Method (Cards, Digital Wallets, and Others): The cards segment is projected to reach USD 5.38 billion by 2032, owing to the rising usage of virtual and corporate cards for controlled and traceable business spending.

- By Industry (BFSI, Retail & E-Commerce, Manufacturing, and Healthcare): The BFSI segment is projected to reach USD 3.38 billion by 2032, propelled by the rising need for secure, scalable, and compliant transaction systems across domestic and global networks.

B2B Digital Payment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America B2B digital payment market share stood at 34.00% in 2024, valued at USD 1.67 billion. This dominance is reinforced by the early integration of advanced payment technologies supported by a strong digital infrastructure.

Large enterprises are increasingly adopting automated systems to improve transaction speed, accuracy, and compliance. This is leading to the consistent demand for B2B digital payment solutions in BFSI, manufacturing, and retail sectors. North America continues to lead the market due to widespread adoption and mature digital systems.

The Asia-Pacific B2B digital payment industry is set to grow at a robust CAGR of 15.77% over the forecast period. This growth is supported by government initiatives promoting digital transactions across key economies across the region.

Regional programs are enhancing digital infrastructure and fostering financial inclusion for businesses, accelerating the adoption of digital payment systems among small and medium enterprises. The region is emerging as the fastest growing market for B2B digital payments due to the widespread implementation of these government-led initiatives.

- In August 2024, the Reserve Bank of India (RBI) launched two digital payment initiatives: Bharat BillPay for Business and UPI Circle at the Global Fintech Festival 2024. Developed by NPCI, these initiatives focused on streamlining B2B payments through ERP integration and improving delegate payment capabilities. Bharat BillPay for Business simplifies invoice and payment workflows by enabling purchase order creation, automated reminders, and assured settlements.

Regulatory Frameworks

- In the U.S., the B2B digital payment sector is regulated under the Electronic Fund Transfer Act (EFTA) and the Bank Secrecy Act (BSA), which govern transaction security, anti-money laundering, and fraud prevention.

- In India, the Payments and Settlements Systems Act, 2007, along with oversight by the Reserve Bank of India (RBI), ensures secure digital payment operations and mandates licensing for payment system providers.

Competitive Landscape

Key players in the B2B digital payment industry are actively forming strategic collaborations to expand service capabilities, improve platform integration, and enhance transaction security. These collaborations, often with fintech firms, banks, and enterprise software providers, aim to deliver more seamless payment experiences across industries.

Companies are focusing on integrating digital wallets, virtual cards, and real-time payment networks through joint ventures and API-based alliances. The market is characterized by continuous efforts to build interoperable ecosystems that support multi-currency transactions, ensure regulatory compliance, and support scalable infrastructure.

- In April 2025, HBX Group and FinPay launched the HBX Group eWallet, a B2B payment platform for the travel industry. The solution offers integrated financing, invoice access, and complete transaction traceability.

Key Companies in B2B Digital Payment Market:

- Visa Inc.

- Mastercard

- PayPal

- Stripe, Inc.

- American Express Company

- FIS

- Fiserv, Inc.

- Paytm

- Juspay Technologies

- Airwallex

- Rapyd Financial Network Ltd.

- TTMFS Singapore Pte Ltd

- Coupa Software Inc.

- Payoneer Inc.

- Veem

Recent Developments (Product Launch)

- In July 2025, Mastercard launched the global availability of Mastercard Receivables Manager and introduced Commercial Direct Payments to accelerate B2B payment automation. These solutions aim to enhance virtual card efficiency, security, and reconciliation for suppliers, offering fully automated straight-through processing.

freqAskQues