buyNow

Wireline Services Market

Wireline Services Market Size, Share, Growth & Industry Analysis, By Type (Electric Line, Slick Line), By Hole (Open, Cased), By Deployment (Onshore, Offshore), By Application (Completion, Intervention, Logging) and Regional Analysis, 2025-2032

pages: 210 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Wireline services involve the use of electrical or slick line cables to lower tools and equipment into oil and gas wells for data acquisition, intervention, and maintenance. These services support critical downhole operations such as reservoir evaluation, well integrity monitoring, pipe recovery, and perforation.

The market includes open-hole and cased-hole applications across onshore and offshore environments. Widely used throughout the well lifecycle, wireline services enable efficient diagnostics, enhance production optimization, and support decision-making in exploration and production activities.

Wireline Services Market Overview

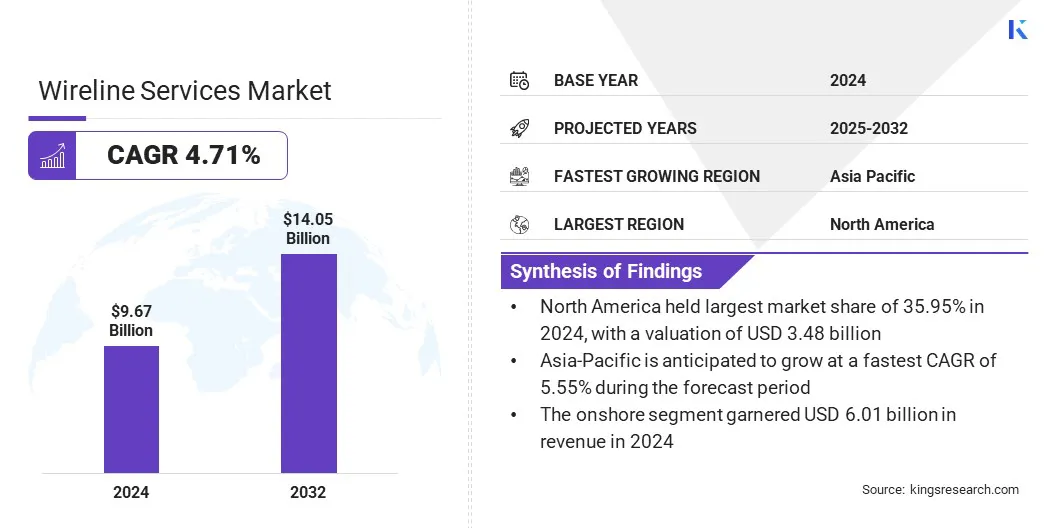

The global wireline services market size was valued at USD 9.67 billion in 2024 and is projected to grow from USD 10.10 billion in 2025 to USD 14.05 billion by 2032, exhibiting a CAGR of 4.71% during the forecast period.

This growth is attributed to the rising adoption of wireline services across critical stages of the oil and gas well lifecycle, including drilling, completion, and production. Increasing demand for real-time reservoir data, enhanced well intervention, and efficient production optimization is fueling the use of these services in conventional and unconventional fields.

Key Highlights

- The wireline services industry size was valued at USD 9.67 billion in 2024.

- The market is projected to grow at a CAGR of 4.71% from 2025 to 2032.

- North America held a share of 35.95% in 2024, valued at USD 3.48 billion.

- The electric line segment garnered USD 5.58 billion in revenue in 2024.

- The open segment is expected to reach USD 7.40 billion by 2032.

- The offshore segment is anticipated to witness the fastest CAGR of 4.92% over the forecast period.

- The completion segment garnered USD 3.91 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 5.55% through the projection period.

Major companies operating in the wireline services market are SLB, Baker Hughes Company, Weatherford, Expro Group, Halliburton Energy Services, Inc., Superior Energy Services, Archer, Pioneer Energy Services, SGS, NOV., General Electric Company, OiLSERV, China Oilfield Services Limited, Oceaneering International, Inc., and RPC, Inc.

The growing emphasis on maximizing recovery from mature wells and maintaining well integrity is fueling market expansion. Additionally, advancements in digital logging tools, increased offshore exploration activity, and rising global energy demand are further accelerating this development.

- In December 2024, Halliburton launched its Intelli portfolio, a suite of wireline-conveyed diagnostic well intervention services aimed at enhancing downhole insights and optimizing production. The portfolio includes tools for reservoir logging, production profiling, corrosion detection, and leak diagnostics, enabling faster, more efficient operations and improved asset performance.

Market Driver

Expansion of Drilling & Field Development Activities

The expansion of drilling and field development activities is boosting demand for wireline services to support critical operations throughout the well lifecycle. Exploration and production companies are intensifying efforts in conventional and unconventional reservoirs to meet rising global energy needs and offset production declines in mature fields. These initiatives require reliable wireline solutions for formation evaluation, reservoir monitoring, and well completion to optimize output and ensure well integrity.

This shift is further supported by the growing complexity of well designs, including horizontal and deep-water drilling, which demand advanced data acquisition and intervention capabilities. The focus on improving recovery rates, reducing downtime, and enhancing real-time decision-making is compelling operators to adopt high-performance wireline technologies, supporting market expansion.

Market Challenge

High Operational and Equipment Costs

High operational and equipment costs present a significant challenge to the growth of the wireline services market, particularly in regions with low-margin drilling operations. The need for advanced downhole tools, durable cable systems, and skilled field personnel significantly increases service delivery expenses.

These high costs can deter smaller service providers from expanding their capabilities and limit adoption in cost-sensitive markets. Operational inefficiencies, frequent equipment maintenance, and logistical complexities in remote or offshore locations further strain budgets and reduce profitability.

To address these challenges, companies are focusing on digital integration, automation, and remote monitoring to streamline operations and reduce field personnel requirements. Investments in tool standardization, modular designs, and real-time data analytics are helping minimizing downtime and extending equipment life.

Service providers are also engaging in strategic collaborations and adopting bundled service models to improve economies of scale and offer cost-effective solutions without compromising performance.

Market Trend

Integration of Digital Technologies and Real-Time Data Analytics

Digitalization and real-time data integration are influencing the wireline services market by improving operational efficiency, accuracy, and decision-making across the well lifecycle. The adoption of intelligent sensors, cloud-based platforms, and edge computing is enabling the real-time monitoring of downhole conditions and faster data transmission to surface teams.

These technologies support high-resolution formation evaluation, precise intervention planning, and predictive maintenance, leading to reduced downtime and improved well productivity.

The use of artificial intelligence and machine learning for data interpretation enhances reservoir characterization and optimizes field development strategies. Remote operations and automation are also minimizing crew requirements and increasing safety, particularly in offshore and high-risk environments.

As digital infrastructure becomes integral to upstream workflows, wireline services are evolving into data-driven solutions that deliver enhanced value and long-term performance insights to operators.

- In March 2025, SLB secured a major contract from Woodside Energy for the ultra-deep-water Trion project offshore Mexico. The scope includes drilling 18 wells using an integrated services model covering wireline, AI-driven drilling, logging-while-drilling, cementing, and completions. Operations will begin in early 2026 and be supported through SLB’s Performance Live digital service centers.

Wireline Services Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Electric Line, and Slick Line |

|

By Hole |

Open, and Cased |

|

By Deployment |

Onshore, and Offshore |

|

By Application |

Completion, Intervention, and Logging |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Electric Line and Slick Line): The electric line segment earned USD 5.58 billion in 2024, due to its widespread use in logging, perforation, and real-time data acquisition across complex well environments.

- By Hole (Open and Cased): The open segment held a share of 53.87% in 2024, attributed to its critical role in providing accurate formation evaluation and reservoir characterization before casing installation.

- By Deployment (Onshore and Offshore): The onshore segment is projected to reach USD 8.65 billion by 2032, owing to the high volume of drilling activities, easier accessibility, and lower operational costs compared to offshore operations.

- By Application (Completion, Intervention, and Logging): The intervention segment is anticipated to grow at a CAGR of 4.82% through the projection period, propelled by the increasing need for well maintenance, enhanced oil recovery, and production optimization in mature fields.

Wireline Services Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America wireline services market share stood at 35.95% in 2024, valued at USD 3.48 billion. This dominance is reinforced by North America’s extensive upstream oil and gas infrastructure, widespread adoption of advanced wireline technologies, and the presence of major service providers with strong technical capabilities.

Furthermore, increased investments in unconventional resource development, frequent well intervention programs, and a robust regulatory environment supporting energy exploration boost demand for wireline services across onshore and offshore operations.

The region’s focus on maximizing production efficiency and extending the life of mature fields reinforces its market leadership. The growing adoption of real-time data acquisition, digital well monitoring, and high-performance intervention tools, along with ongoing exploration activity in key basins, further fosters regional market expansion.

The Asia-Pacific wireline services industry is set to grow at a CAGR of 5.55% over the forecast period. This growth is propelled by rising energy consumption, growing upstream investment, and the strategic development of domestic oil and gas resources across key Asia-Pacific economies. The region’s increasing focus on reducing reliance on imports and expanding exploration in both conventional and unconventional reserves is driving the demand for wireline services.

Government-backed initiatives to boost production efficiency and enhance subsurface data acquisition are further supporting regional market expansion. Moreover, advancements in drilling technologies and the rising adoption of digital well intervention tools are accelerating the deployment of wireline services across onshore and offshore fields in the region.

- In May 2025, Unity collaborated with Reservoir Link to deliver advanced well integrity and performance solutions across Southeast Asia. Announced during the Offshore Well Intervention Asia Pacific Conference, the partnership combines Unity’s technology with Reservoir Link’s regional expertise to support upstream operations, including wireline and well intervention services.

Regulatory Frameworks

- In the U.S., 30 CFR Part 250, administered by the Bureau of Safety and Environmental Enforcement (BSEE), regulates oil and gas operations on the Outer Continental Shelf. It establishes safety, operational, and environmental standards for well operations, including wireline activities such as logging, perforation, and well intervention.

- In Canada, the Drilling and Production Regulations (SOR/2009-315) under the Canada Oil and Gas Operations Act govern wireline and other well operations. These regulations require detailed risk assessments, operational planning, and reporting for well interventions, including electric and slickline services.

- In the UK, Offshore Installations (Offshore Safety Directive) (Safety Case etc.) Regulations 2015 (SCR 2015) regulate well operations, including wireline services, under the broader Offshore Safety Directive. It mandates safety cases, risk management, and operational control for any wireline work on offshore installations, ensuring compliance with EU-derived safety requirements.

- In Australia, Offshore Petroleum and Greenhouse Gas Storage (Resource Management and Administration) Regulations 2011 govern wireline operations as part of well management. It requires operators to maintain well integrity, submit activity notifications, and ensure that intervention operations such as wireline logging comply with approved safety and environmental standards.

Competitive Landscape

Companies operating in the wireline services industry are actively strengthening their competitive positions through technological innovation, service diversification, and strategic partnerships. Leading players are investing in advanced wireline tools, real-time data analytics, and digital well intervention technologies to enhance operational efficiency, accuracy, and downhole diagnostics in increasingly complex well environments.

They are also developing integrated service platforms that combine electric line and slickline capabilities, enabling greater flexibility across exploration, logging, and intervention operations. Additionally, firms are collaborating with exploration and production companies, national oil corporations, and technology providers to secure long-term contracts, expand geographic reach, and reinforce their presence in both established and high-growth energy markets.

- In April 2025, RPC, Inc. acquired Pintail Alternative Energy, L.L.C. for approximately USD 245 million, expanding its wireline presence in the Permian Basin. The acquisition added over 30 wireline fleets and strengthened customer relationships in key shale regions, contributing to improved earnings and cash flow in 2025.

Key Companies in Wireline Services Market:

- SLB

- Baker Hughes Company

- Weatherford

- Expro Group

- Halliburton Energy Services, Inc.

- Superior Energy Services

- Archer

- Pioneer Energy Services

- SGS

- NOV.

- General Electric Company

- OiLSERV

- China Oilfield Services Limited

- Oceaneering International, Inc.

- RPC, Inc.

Recent Developments (Partnerships)

- In September 2024, Welltec partnered with Axter to deliver advanced robotic wireline intervention solutions for plug-and-abandonment and enhanced oil recovery. The collaboration combines Welltec’s robotic systems with Axter’s acoustic and electro-mechanical technologies, enabling multiple intervention functions in a single run and streamlining global operations.

- In May 2023, Sparro, a WCI subsidiary, partnered with AT&T Partner Exchange to deliver wireline and IT services across the energy, healthcare, logistics, mining, and manufacturing sectors. Through this collaboration, Sparro will leverage AT&T’s secure, scalable network and advanced technologies such as artificial intelligence, machine learning, and IoT to offer integrated connectivity, virtualization, and managed service solutions.