buyNow

Vibration Control Systems Market

Vibration Control Systems Market Size, Share, Growth & Industry Analysis, By Type (Motion Control, Vibration Control), By Application (Automotive, Aerospace & Defense, Manufacturing, Electrical & Electronics, Healthcare, Oil & Gas, Others), and Regional Analysis, 2025-2032

pages: 140 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Vibration control systems are designed to reduce or manage unwanted mechanical vibrations in structures, machinery, or vehicles to improve stability and performance. The market includes dampers, isolators, and actuators, which are used across various sectors.

These systems are widely deployed in automotive, aerospace, industrial machinery, and construction to enhance safety, extend equipment life, and ensure precise operation by minimizing vibration-induced wear, noise, and structural fatigue.

Vibration Control Systems Market Overview

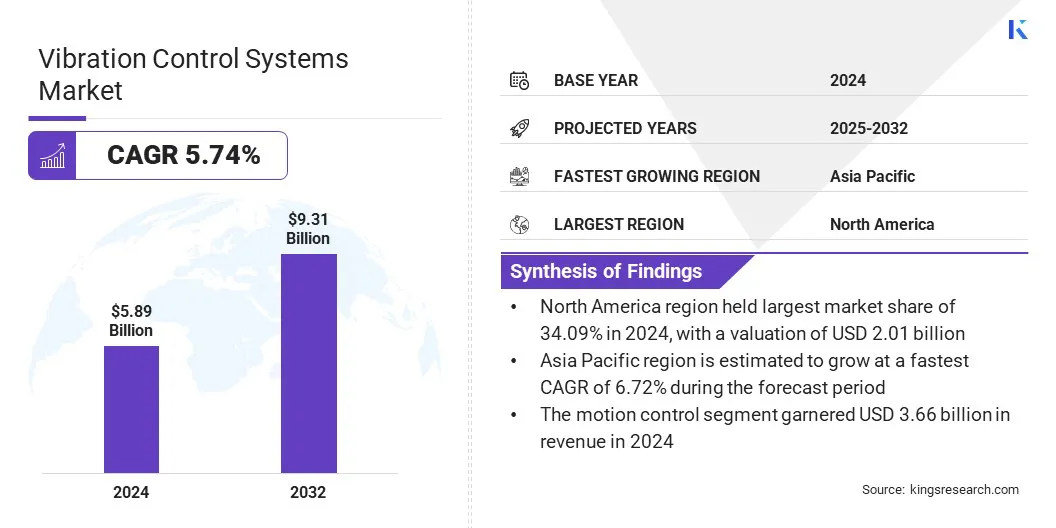

The global vibration control systems market size was valued at USD 5.89 billion in 2024 and is projected to grow from USD 6.19 billion in 2025 to USD 9.31 billion by 2032, exhibiting a CAGR of 5.74% during the forecast period.

The market is growing due to industrial expansion and the increased use of precision machinery that requires effective vibration mitigation. Additionally, the integration of wireless sensors for real-time monitoring enables improved diagnostics and long-term structural health insights..

Major companies operating in the vibration control systems industry are Kinetics Noise Control, Inc., Sentek Dynamics Incorporated, ContiTech Deutschland GmbH, HUTCHINSON, Isolation Technology Inc., MITSUBISHI HEAVY INDUSTRIES, LTD., Resistoflex, Trelleborg Marine and Infrastructure, Elesa S.p.A., Fabreeka, Emerson Electric Co., SKF, Baker Hughes Company, Schaeffler AG, and Parker Hannifin Corp.

The market is driven by the growing demand for comfort and safety in the automotive and aerospace industries. In vehicles and aircraft, minimizing vibration enhances passenger comfort, reduces noise, and protects sensitive components.

Manufacturers incorporate advanced suspension systems, active dampers, and vibration isolators to meet consumer and regulatory expectations. Enhanced ride quality and structural integrity are becoming essential, prompting original equipment manufacturers (OEMs) to invest in sophisticated vibration control technologies that improve performance, durability, and overall user experience.

Key Highlights:

- The vibration control systems market size was valued at USD 5.89 billion in 2024.

- The market is projected to grow at a CAGR of 5.74% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 2.01 billion.

- The motion control segment garnered USD 3.66 billion in revenue in 2024.

- The automotive segment is expected to reach USD 2.26 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.72% during the forecast period.

Market Driver

Rapid Industrialization and Expansion of Manufacturing Facilities

The market is driven by rapid industrialization and the expansion of manufacturing facilities within emerging and developed economies. As industries scale operations and deploy high-precision machinery, the need to minimize vibration-induced wear, misalignment, and operational inefficiencies becomes critical.

Vibration control solutions enhance equipment longevity, ensure process stability, and support uninterrupted production. The growing installation of automated and heavy-duty machinery in automotive, electronics, and metal processing segments further drives the demand for effective vibration mitigation systems.

Market Challenge

Environmental and Operational Limitations

The vibration control systems market faces environmental and operational limitations that hinder its performance. Extreme temperatures such as humidity, dust, and corrosive environments can degrade system components and reduce effectiveness.

In oil and gas, mining, or offshore wind applications, harsh conditions demand highly durable and reliable solutions. Operational constraints such as limited installation space, complex load requirements, and frequent machinery movement also complicate system integration.

Therefore, companies are developing robust materials that are corrosion- and temperature-resistant, designing compact systems for tight spaces, and using simulation-based testing to ensure optimal performance. Some companies are also integrating adaptive technologies for dynamic environments.

Market Trend

Integration of Sensors for Real-Time Vibration Monitoring

The market is witnessing a growing trend of advanced sensors integration for real-time vibration monitoring. These sensors enables continuous data collection, improved diagnostics, and faster response to structural or equipment changes.

The use of wireless, low-power, and compliant sensors with an extended communication range enhances system reliability and usability. These advancements support better decision-making in maintenance and structural health. This is especially applicable in long-term monitoring applications across industrial and infrastructure environments.

- In November 2023, Worldsensing introduced the Vibration Meter, a wireless sensor designed for long-term vibration monitoring. It features a tri-axial MEMS accelerometer that offers extended battery life and broader communication range at low cost. Compliant with DIN 4140-3, BS 7385-2, and ISO 2631-2 standards, it supports engineering firms in meeting structural integrity and human vibration impact regulations.

Vibration Control Systems Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Motion Control (Springs, Hangers, Washers & Bushes, Mounts), Vibration Control (Isolating Pads, Isolators, Others) |

|

By Application |

Automotive, Aerospace & Defense, Manufacturing, Electrical & Electronics, Healthcare, Oil & Gas, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Motion Control, and Vibration Control): The motion control segment earned USD 3.66 billion in 2024, due to the rising demand for precision automation in manufacturing, robotics, and high-performance machinery.

- By Application (Automotive, Aerospace & Defense, Manufacturing, and Electrical & Electronics, Healthcare, Oil & Gas, and Others): The automotive segment held 24.20% of the market in 2024, owing to the increasing adoption of advanced suspension and noise reduction systems to enhance vehicle safety and ride comfort.

Vibration Control Systems Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

The North America vibration control systems market share stood at 34.09% in 2024, with a valuation of USD 2.01 billion. The region dominates the market due to the strong presence of advanced manufacturing, aerospace, and automotive industries that require high-performance vibration mitigation technologies.

North America benefits from significant investments in infrastructure, automation, and defense, where precision and equipment stability are essential. The presence of key industry players, ongoing R&D activities, and early adoption of smart sensing technologies further support market expansion.

Asia Pacific is poised for significant growth at a CAGR of 6.72% over the forecast period. The growth of the vibration control systems industry in Asia Pacific is driven by rapid urbanization and infrastructure development across China, India, and Southeast Asian countries.

These economies invest heavily in high-rise buildings, railways, and industrial parks, which boosts the demand for vibration isolation solutions to ensure structural safety and longevity. Additionally, the increasing adoption of smart manufacturing and automation technologies in regional production facilities reinforces the need for reliable vibration control systems maintain equipment precision and process efficiency.

Regulatory Frameworks

- In the U.S., vibration control systems are regulated by the Occupational Safety and Health Administration (OSHA) for workplace safety and the American National Standards Institute (ANSI), which sets performance and testing standards for vibration measurement and control equipment.

- In India, vibration control systems are primarily regulated by the Bureau of Indian Standards (BIS), which sets safety and performance standards for vibration monitoring and control equipment across various industries.

Competitive Landscape

Key players in the vibration control systems market are actively pursuing growth through strategic initiatives such as mergers and acquisitions, product launches, and partnerships. Companies are expanding their portfolios by introducing innovative solutions tailored for industrial, automotive, and infrastructure applications.

Collaborative ventures strengthen market presence in emerging regions, while acquisitions help consolidate capabilities and customers. Investments in R&D and technology integration reflect the competitive landscape, where firms enhance differentiation and sustain long-term market positioning.

- In September 2023, Kinetics Noise Control Inc. launched the enhanced KSR 3.0 Vibration Isolation Rail, for small-to-medium rooftop equipment. It features pre-installed restrained spring isolators and offers effective vibration isolation and resistance to wind or seismic forces while ensuring compatibility with most factory-provided roof curbs.

List of Key Companies in Vibration Control Systems Market:

- Kinetics Noise Control, Inc.

- Sentek Dynamics Incorporated

- ContiTech Deutschland GmbH

- HUTCHINSON

- Isolation Technology Inc.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Resistoflex

- Trelleborg Marine and Infrastructure

- Elesa S.p.A.

- Fabreeka

- Emerson Electric Co.

- SKF

- Baker Hughes Company

- Schaeffler AG

- Parker Hannifin Corp

Recent Developments (Product Launch)

- In October 2023, MachineAstro launched VIBit-BP, the first vibration sensor offering wired and battery-powered options for industrial asset maintenance. Designed for environments with limited power access or wiring constraints, VIBit-BP enhances predictive maintenance flexibility. With advancements in battery technology and low-power wireless networks, it delivers up to 10 years of battery life, supporting long-term, cost-effective monitoring.