buyNow

Transportation Composites Market

Transportation Composites Market Size, Share, Growth & Industry Analysis, By Resin (Thermoplastic, Thermoset), By Fiber (Glass, Carbon, Natural), By Mode of Transportation (Airways, Railways, Waterways, Roadways), and Regional Analysis, 2025-2032

pages: 140 | baseYear: 2024 | release: July 2025 | author: Sharmishtha M.

Market Definition

Transportation composites are advanced materials made by combining two or more substances to enhance strength, reduce weight, and improve durability in vehicles and infrastructure. The market is focused on the research, innovation and production of these materials.

The report explores key drivers of market development, offering detailed regional analysis and a comprehensive overview of the competitive landscape shaping future opportunities.

Transportation Composites Market Overview

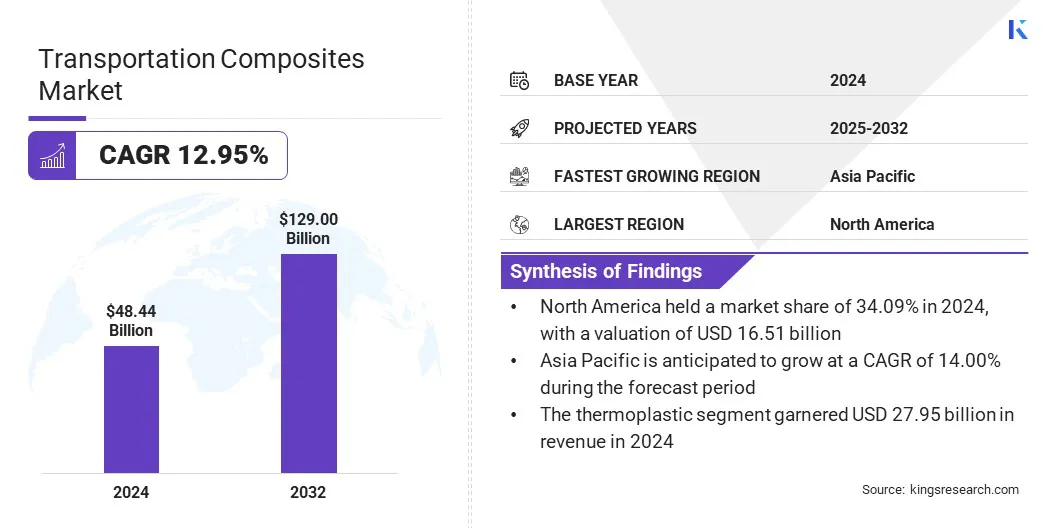

The global transportation composites market size was valued at USD 48.44 billion in 2024, which is estimated to be USD 54.56 billion in 2025 and reach USD 129.00 billion by 2032, growing at a CAGR of 12.95% from 2025 to 2032.

Market growth is driven by improved thermal management in vehicles, which enhances engine efficiency, component lifespan, and passenger comfort. This boosts demand for advanced composites with integrated thermoelectric materials in the automotive and aerospace sectors.

Key Market Highlights:

- The transportation composites industry size was recorded at USD 48.44 billion in 2024.

- The market is projected to grow at a CAGR of 12.95% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 51 billion.

- The thermoplastic segment garnered USD 27.95 billion in revenue in 2024.

- The glass segment is expected to reach USD 53.82 billion by 2032.

- The waterways segment is anticipated to witness the fastest CAGR of 13.31% over the forecast period

- Asia Pacific is anticipated to grow at a CAGR of 14.00% through the projection period.

Major companies operating in the transportation composites market are Owens Corning, Mitsubishi Chemical Group Corporation, Syensqo, Toray Composite Materials Inc., Hexcel Corporation, TEIJIN LIMITED, SGL Carbon, PPG Industries, Inc., Huntsman International LLC, DuPont, Solvay, Kineco Limited, Schweiter Technologies, Exel Composites, and Microtex Composites s.r.l.

Market expansion is fueled by rising demand for lightweight and high-performance materials in the automotive, aerospace, marine, and rail industries. These composites help manufacturers meet stringent fuel efficiency, emission, and safety standards by reducing vehicle weight without compromising strength or durability.

Technological advancements, increased use of electric vehicles, and supportive government regulations are further boosting market expansion. Additionally, the growing emphasis on sustainable transportation and reduced carbon emissions is promoting the adoption of innovative composite solutions.

Market Driver

Rising Need for Improved Thermal Management

The growth of the market is propelled by the need for improved thermal management in vehicles. Advanced composites with thermoelectric materials enhance heat regulation, boost engine efficiency, extend component lifespan, and improve passenger comfort.

As the automotive and aerospace industries focus on performance and sustainability, the demand for these composites rises, making them crucial for future innovations and energy-efficient designs.

- In March 2025, researchers from NIMS Japan, the Institute of Solid State Physics Austria, the Institute of Materials Research Germany, and the University of Vienna developed a breakthrough Fe₂VAl-based Heusler thermoelectric material. By adding Bi₁₋ₓSbₓ at grain boundaries, they doubled its efficiency near room temperature. This low-cost, earth-abundant material can integrate with lightweight transportation composites, enhancing vehicle performance through improved energy recovery and thermal management, advancing sustainability in transportation without altering composite properties.

Market Challenge

Material Durability Concerns

Material durability remains a key challenge in the transportation composites market, as these materials must withstand harsh environmental and mechanical stresses. Degradation can affect safety and performance, limiting broader adoption.

To address this, companies are investing in advanced testing protocols and developing enhanced composite formulations with improved resistance to fatigue, corrosion, and temperature extremes.

Additionally, protective coatings and reinforcing fibers are being used to extend service life while preserving the lightweight benefits critical for automotive and aerospace applications.

Market Trend

Increased Focus on Closed-Loop Systems

The rising adoption of closed-loop recycling systems is emerging as a key trend in the market. These systems focus on recovering and reprocessing composite materials from end-of-life vehicles and manufacturing waste to create new components.

By minimizing material loss and waste, closed-loop processes support circular economy models, reducing environmental impact and raw material dependency.

This trend is further supported by growing sustainability goals and regulatory pressures, prompting manufacturers to develop innovative recycling techniques that maintain material quality while promoting resource efficiency and cost savings across the transportation industry.

- In June 2025, Toray Advanced Composites, Daher, and TARMAC Aerosave launched a joint End-of-Life Aerospace Recycling Program with Airbus to recycle continuous fiber-reinforced thermoplastic composites from retired A380 aircraft. This initiative aims to create a closed-loop recycling system, reduce waste, and enhance sustainability in aerospace manufacturing.

Transportation Composites Market Report Snapshot

|

Segmentation |

Details |

|

By Resin |

Thermoplastic, Thermoset |

|

By Fiber |

Glass, Carbon, Natural |

|

By Mode of Transportation |

Airways, Railways, Waterways, Roadways |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Resin (Thermoplastic and Thermoset): The thermoplastic segment earned USD 27.95 billion in 2024, mainly due to its lightweight, high durability, and recyclability, which support growing demand in automotive and aerospace composites.

- By Fiber (Glass, Carbon, and Natural): The glass segment held a share of 42.17% in 2024, fueled by its cost-effectiveness, strong mechanical properties, and wide use in transportation composite structures.

- By Mode of Transportation (Airways, Railways, Waterways, and Roadways): The airways segment is projected to reach USD 46.60 billion by 2032, propelled by increased adoption of composite materials for improved fuel efficiency and lightweight aircraft design.

Transportation Composites Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America transportation composites market share stood at around 34.09% in 2024, valued at USD 16.51 billion. This dominance is reinforced by the region's advanced manufacturing infrastructure, strong aerospace and automotive industries, and continuous innovation in lightweight, high-performance materials.

The region’s focus on sustainability and stringent regulations to reduce vehicle emissions further boost the adoption of composites.

Additionally, major companies and research institutions in the U.S. and Canada are actively developing and implementing cutting-edge composite technologies. Robust investments in R&D and recycling initiatives further contribute to regional market growth.

The Asia-Pacific transportation composites industry is set to grow at a robust CAGR of 14.00% over the forecast period. This expansion is stimulated by rapid industrialization, increasing infrastructure development, and growing demand for lightweight, durable materials in the automotive and aerospace sectors.

As per IBEF, the Indian composite materials industry is set to grow at a projected compound annual growth rate (CAGR) of 7.8%, reaching USD 2.8 billion by 2030, propelled by increasing demand across transportation, construction, and aerospace sectors.

Expanding manufacturing capabilities, government initiatives promoting sustainable transportation, and rising investments in research and development are further accelerating regional market growth. Additionally, the region’s focus on innovation and adoption of advanced composite technologies positions it as a key market for transportation composites.

Regulatory Frameworks

- AS9100, introduced in 1999 by the Society of Automotive Engineers, is a globally recognized quality management standard incorporating ISO 9001:1994 with additional aerospace-specific requirements for design, production, and servicing.

- In the EU, Regulation (EU) 2018/1139 establishes a unified framework for civil aviation, supporting the role of the European Union Aviation Safety Agency (EASA) in maintaining consistent safety, environmental, and operational standards.

- In India, the Defence Procurement Procedure (DPP) promotes indigenous capability through MAKE Projects, which streamline the design, development, and upgrading of defence systems, promoting public and private sector participation.

- Globally, the ISO/TC 61/SC 12 subcommittee oversees standards for thermosetting materials in advanced composites, ensuring consistent characterization, testing, and application to enhance quality, performance, and safety.

Competitive Landscape

Companies in the transportation composites market are increasingly focusing on innovation to enhance material performance, sustainability, and manufacturing efficiency.

They are investing in developing lightweight, high-strength composites that improve fuel efficiency and reduce emissions. Furthermore, there is a growing emphasis on integrating advanced adhesives and thermoelectric materials to optimize energy recovery and thermal management.

- In March 2024, Syensqo introduced AeroPaste 1003, a new epoxy-based structural paste adhesive designed for efficient bonding of metallic and composite parts in aerospace applications. This adhesive supports rapid assembly and repair, ideal for advanced air mobility, commercial aerospace, and defense sectors. Offering excellent high-temperature strength and easy processing, AeroPaste 1003 enhances manufacturing efficiency through automated, out-of-autoclave processes.

Additionally, firms are advancing recycling technologies and closed-loop systems to promote circular economy models, ensuring eco-friendly production practices and meeting stringent environmental regulations within the transportation sector.

Key Companies in Transportation Composites Market:

- Owens Corning

- Mitsubishi Chemical Group Corporation

- Syensqo

- Toray Composite Materials Inc.

- Hexcel Corporation

- TEIJIN LIMITED

- SGL Carbon

- PPG Industries, Inc.

- Huntsman International LLC

- DuPont

- Solvay

- Kineco Limited

- Schweiter Technologies

- Exel Composites

- Microtex Composites s.r.l.

Recent Developments (Product Launch)

- In September 2024, Viva ACP launched its Busbody Series—advanced aluminium composite panels designed for bus interiors and exteriors. These lightweight, fire-retardant, and termite-resistant panels offer enhanced fuel efficiency, durability, and passenger comfort. Featuring easy installation, weather resistance, and sustainable recycled materials, the series aims to enhance bus manufacturing and public transportation efficiency in India and beyond.