buyNow

Thermoelectric Modules Market

Thermoelectric Modules Market Size, Share, Growth & Industry Analysis, By Model (Single Stage, Multi Stage), By Type (Bulk, Micro, Thin Film), By Vertical (Consumer Electronics, Automotive, Automotive, Manufacturing & Industrial, IT & Telecommunications, Aerospace & Defense, Healthcare, Others) and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Thermoelectric modules are solid-state devices that facilitate the conversion of heat energy into electrical energy and vice versa. The market encompasses the design, production, and application of these modules across diverse sectors, including automotive, consumer electronics, industrial equipment, and medical technology.

It includes various types such as bulk, micro, and thin-film modules, each tailored to specific performance requirements. Additionally, the market covers advancements in thermoelectric materials and system integration aimed at enhancing energy conversion efficiency and precision in temperature control.

Thermoelectric Modules Market Overview

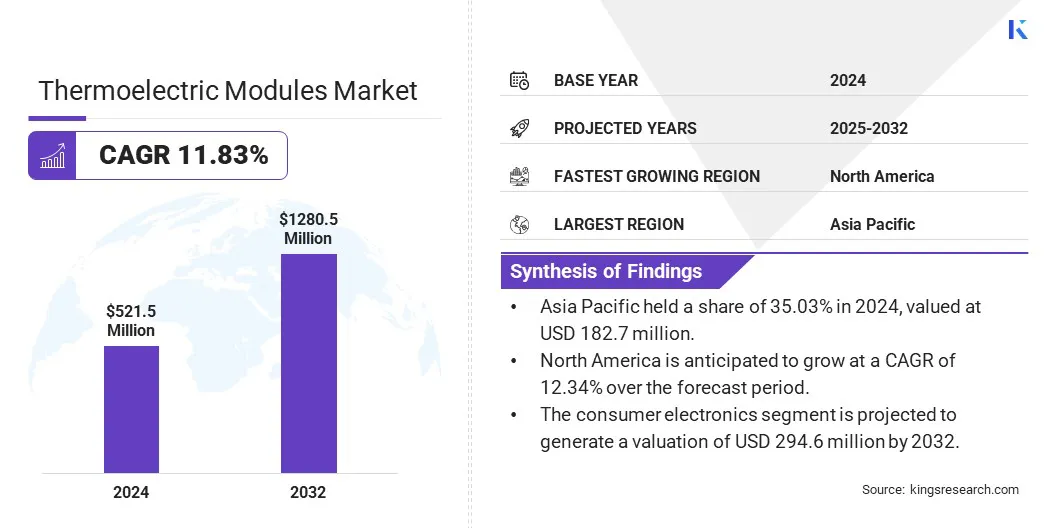

The global thermoelectric modules market size was valued at USD 521.5 million in 2024 and is projected to grow from USD 581.6 million in 2025 to USD 1,280.2 million by 2032, exhibiting a CAGR of 11.83% during the forecast period.

The market is experiencing steady growth, mainly due to increasing demand for compact, reliable, and energy-efficient temperature control solutions. Rising adoption in automotive applications, such as battery thermal management and seat climate control, is further contributing to this expansion.

Key Market Highlights

- The thermoelectric modules industry size was valued at USD 521.5 million in 2024.

- The market is projected to grow at a CAGR of 11.83% from 2025 to 2032.

- Asia Pacific held a share of 35.03% in 2024, valued at USD 182.7 million.

- The single stage segment garnered USD 300.9 million in revenue in 2024.

- The bulk segment is expected to reach USD 534.1 million by 2032.

- The consumer electronics segment is projected to generate a valuation of USD 294.6 million by 2032.

- North America is anticipated to grow at a CAGR of 12.34% over the forecast period.

Major companies operating in the thermoelectric modules industry are Ferrotec Holdings Corporation, Coherent Corp, Tark Thermal Solutions, TE Technology, Inc., Crystal Ltd., RMT Ltd., Same Sky, Thermo Electric Company, Inc., Z-MAX Co. Ltd., Guangdong Fuxin Technology Co., Ltd., AMS Technologies, Phononic, Gentherm, TEC Microsystems GmbH, and Hi-Z TECHNOLOGY.

The growing deployment of thermoelectric generators for converting waste heat into electrical energy is fueling market growth, as sectors such as manufacturing, oil and gas, power generation, and transportation adopt solutions to recover unused thermal energy and enhance overall energy efficiency.

With features such as compact form factors, high-temperature endurance, and increased power output, these modules are well-suited for integration into heat-intensive environments, supporting broader adoption in energy recovery and sustainability-focused applications. Advancements in interface materials and sealing techniques are enhancing system reliability and integration, reinforcing the role of thermoelectric modules in efficient heat utilization.

- In January 2025, Same Sky's Thermal Management Group launched a new line of thermoelectric generator modules. The SPG family offers 5.4 to 21.6 W output in compact sizes and is designed for waste heat recovery in industrial applications. The modules support up to 300°C, feature silicone sealing, and include graphite pad options for thermal interface.

Market Driver

Ongoing Expansion in Global EV Production

The thermoelectric modules market is significantly influenced by the continued growth in electric vehicle (EV) production worldwide. As automakers expand their EV portfolios to meet rising consumer demand and sustainability targets, the need for advanced thermal management systems becomes more critical.

- In March 2025, Hyundai Motor Türkiye announced plans to begin electric vehicle production at its İzmit plant by 2026. The initiative supports Hyundai’s goal of offering zero-tailpipe emission vehicles in Europe by 2035 and reinforces its commitment to sustainability, local sourcing, and strengthening its role in the European automotive market.

Thermoelectric modules offer compact, solid-state solutions for managing battery temperatures, cabin comfort, and electronic component cooling without relying on fluid-based systems. Their ability to provide precise, efficient, and maintenance-free temperature control is particularly valuable in EVs, where energy optimization and space constraints are key considerations.

Additionally, these modules contribute to extending battery life and improving vehicle efficiency. The increasing integration of thermoelectric technologies in next-generation EV platforms supports the expansion of the thermoelectric modules market, enabling enhanced performance and reliability in electric mobility.

- In July 2024, Kyocera Corporation introduced a new Peltier thermoelectric module with a 21% higher maximum heat absorption rate compared to its previous products. Designed for automotive battery and seat temperature control, the module offers enhanced cooling performance, high responsiveness, and reliability. Kyocera has shipped 32 million units for automotive applications as of June 2024.

Market Challenge

High Material Costs and Supply Constraints

A major challenge limiting the progress of the thermoelectric modules market is the high cost and limited availability of critical raw materials such as bismuth, tellurium, and other rare elements used in conventional thermoelectric compounds.

These materials are both expensive and scarce, and are subject to geopolitical and supply chain risks that can disrupt production and limit the scalability of thermoelectric solutions across high-demand sectors such as automotive, industrial, and electronics.

To address this issue, manufacturers and research institutions are focusing on material innovation and substitution. New hybrid materials are being developed that offer improved thermoelectric performance, greater thermal stability, and reduced reliance on scarce elements. These alternatives help lower production costs and enhance long-term supply security, enabling broader and more sustainable adoption of thermoelectric modules across diverse applications.

- In March 2025, Fabian Garmroudi developed new hybrid thermoelectric materials that achieved over 100% efficiency improvement. The materials decouple heat and charge transport, offering greater stability and lower cost compared to conventional bismuth telluride-based compounds.

Market Trend

Miniaturization and Material Advancements Fueling Next-Gen Thermal Management Solutions

The thermoelectric modules market is witnessing a notable shift toward miniaturization, supported by the increasing demand for compact and high-efficiency thermal management solutions across industries such as consumer electronics, healthcare, and automotive.

As end-use devices continue to reduce in size, there is a growing requirement for thermoelectric modules that can operate effectively within limited space while delivering precise temperature control. Miniaturized modules, particularly those utilizing thin-film and nano-engineered materials, offer enhanced thermal performance and integration flexibility for applications including wearable technology, implantable medical devices, and semiconductor components.

Furthermore, advancements in material science and fabrication techniques are enabling scalable, cost-efficient production of these compact modules. This is enhancing their functionality and strengthening their role in next-generation electronic systems focused on space efficiency and thermal reliability.

- In May 2025, Samsung Electronics and Johns Hopkins APL developed a high-performance thin-film Peltier refrigerator using nano-engineered thermoelectric materials. The device achieved a 75% efficiency improvement over traditional systems, reduced material use by 1/1,000, and enabled scalable, refrigerant-free cooling for applications in home appliances, semiconductors, medical devices, automotive electronics, and data centers.

Thermoelectric Modules Market Report Snapshot

|

Segmentation |

Details |

|

By Model |

Single Stage, Multi Stage |

|

By Type |

Bulk, Micro, Thin Film |

|

By Vertical |

Consumer Electronics, Automotive, Manufacturing & Industrial, IT & Telecommunications, Aerospace & Defense, Healthcare, Oil & Gas, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Model (Single Stage and Multi Stage): The single stage segment earned USD 300.9 million in 2024, mainly due to its cost-effectiveness and suitability for standard temperature differential applications.

- By Type (Bulk, Micro, and Thin Film): The bulk segment held a share of 42.17% in 2024, largely attributed to its high power output and widespread use in industrial and automotive applications.

- By Vertical (Consumer Electronics, Automotive, Manufacturing & Industrial, IT & Telecommunications, Aerospace & Defense, Healthcare, Oil & Gas, and Others): The consumer electronics segment is projected to reach USD 294.6 million by 2032, owing to the increasing demand for compact thermal management solutions in portable and wearable devices.

Thermoelectric Modules Market Regional Analysis

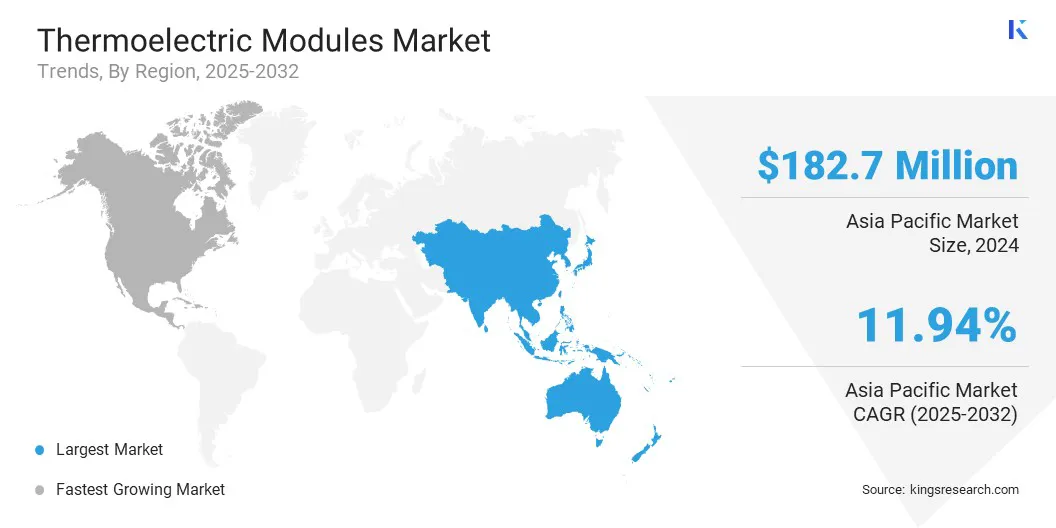

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific thermoelectric modules market accounted for a substantial share of 35.03% in 2024, valued at USD 182.7 million. This dominance is supported by the region’s expansive manufacturing ecosystem and strong presence of electronics and semiconductor industries. This growth is further aided by the increasing adoption of thermoelectric modules in automotive seat cooling and battery thermal management systems.

With rapid growth in electric vehicle (EV) production and increased demand for in-cabin thermal comfort, automakers in countries such as China, Japan, and South Korea are integrating compact, solid-state thermal solutions to enhance efficiency and passenger experience.

These modules offer silent operation, rapid response, and precise temperature control. The region’s continued automotive innovation reinforces Asia Pacific's position as a critical hub for thermoelectric module deployment.

The North America thermoelectric modules industry is expected to register the fastest CAGR of 12.34% over the forecast period. This growth is supported by increasing investment in next-generation thermoelectric materials aimed at converting waste heat into usable electricity. The region's focus on clean energy, energy efficiency, and grid resilience is creating a strong demand for solid-state power generation technologies.

Thermoelectric modules are increasingly adopted in defense, advanced electronics, and industrial systems due to their compact size, silent operation, and lack of moving parts. Additionally, the presence of leading research institutions and government-backed innovation programs is accelerating material development and scalability. These factors position North America as a major region for thermoelectric advancement in energy conversion applications.

- In June 2025, Morgan State University received a USD 1 million grant from the U.S. Department of Defense to develop next-generation thermoelectric materials for efficient heat-to-electricity conversion. The four-year project aims to produce cost-effective, eco-friendly materials and strengthen the university's role in clean energy research and national defense-related technological advancement.

Regulatory Frameworks

- In the U.S., thermoelectric modules used in energy recovery or cooling systems fall under the regulatory oversight of agencies such as the Department of Energy (DOE) and the Environmental Protection Agency (EPA).

Competitive Landscape

The thermoelectric modules industry is characterized by continuous innovation and strategic diversification as companies seek to enhance their competitive position. Manufacturers are focusing on the development of high-performance modules with improved thermal efficiency, durability, and integration flexibility to meet the evolving needs of industries such as automotive, electronics, medical, and industrial automation. These advancements are enabling reliable thermal management in compact systems and demanding environments.

Furthermore, companies are expanding into emerging application areas, including energy harvesting and precision cooling in data centers, particularly those supporting high-density AI and crypto mining operations. This shift reflects a broader market trend toward application-specific, solid-state thermal solutions that offer energy efficiency, scalability, and low maintenance.

- In January 2025, Coherent Corp. launched its CT-Series thermoelectric coolers, offering enhanced thermal performance and reliability for medical, life sciences, and industrial applications. Positioned between the XLT and RC product lines, the CT-Series supports up to 100,000 thermal cycles and ensures compatibility with existing Coherent coolers for seamless integration.

- In March 2025, PyroDelta Energy Inc. developed a thermoelectric radiator prototype designed to convert waste heat from AI and crypto mining data centers into electricity. The device utilizes hot liquid from immersion cooling systems and is scheduled for testing at a Canadian AI data center facility.

Key Companies in Thermoelectric Modules Market:

- Ferrotec Holdings Corporation

- Coherent Corp

- Tark Thermal Solutions

- TE Technology, Inc.

- Crystal Ltd.

- RMT Ltd.

- Same Sky

- Thermo Electric Company, Inc.

- Z-MAX Co. Ltd.

- Guangdong Fuxin Technology Co., Ltd.

- AMS Technologies

- Phononic

- Gentherm

- TEC Microsystems GmbH

- Hi-Z TECHNOLOGY