buyNow

Spray Drying Equipment Market

Spray Drying Equipment Market Size, Share, Growth & Industry Analysis, By Product (Rotary Atomizer, Nozzle Atomizer, Fluidized, Centrifugal, Others), By Cycle (Open, Closed), By Stage (Single-stage, Two-stage, Multi-stage), By Application (Food & Beverages, Pharmaceuticals, Chemicals, Animal Feed, Others) and Regional Analysis, 2025-2032

pages: 210 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Spray drying equipment converts liquid or slurry feed into dry powder by dispersing it into a hot drying chamber, enabling rapid moisture evaporation while preserving product stability and particle control.

It is widely used in food processing, pharmaceuticals, chemicals, and ceramics to produce shelf-stable powders with specific functional properties. The technology also finds application in nutraceuticals, detergents, and industrial materials, where uniformity and extended storage life are essential.

Spray Drying Equipment Market Overview

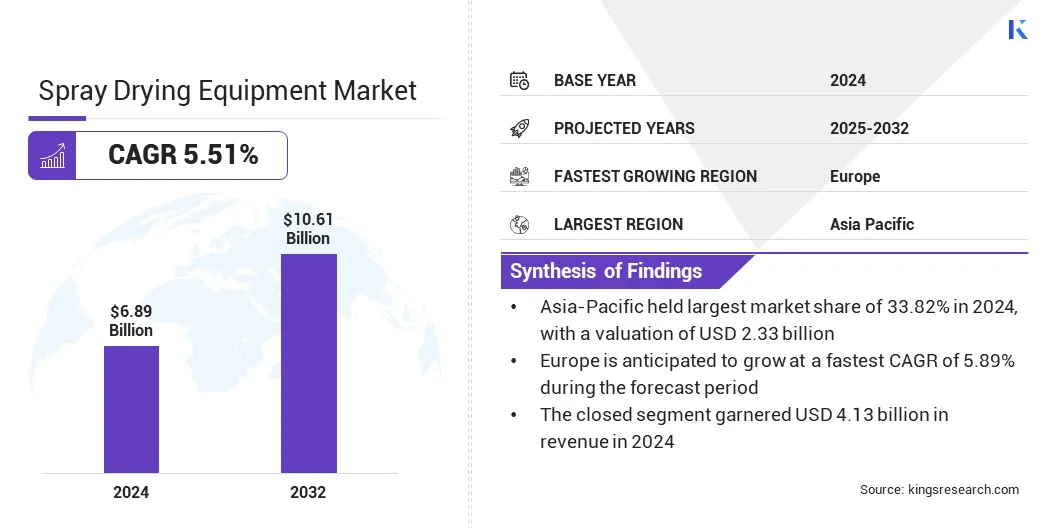

The global spray drying equipment market size was valued at USD 6.89 billion in 2024 and is projected to grow from USD 7.26 billion in 2025 to USD 10.61 billion by 2032, exhibiting a CAGR of 5.51% during the forecast period. This growth is attributed to the rising adoption of spray drying equipment across key industries such as food and beverage, pharmaceuticals, and chemicals.

Increasing demand for shelf-stable, functional powders and the need for efficient moisture removal processes are driving equipment installations in dairy processing, drug formulation, and specialty chemical production.

Key Highlights

- The spray drying equipment industry size was valued at USD 6.89 billion in 2024.

- The market is projected to grow at a CAGR of 5.51% from 2025 to 2032.

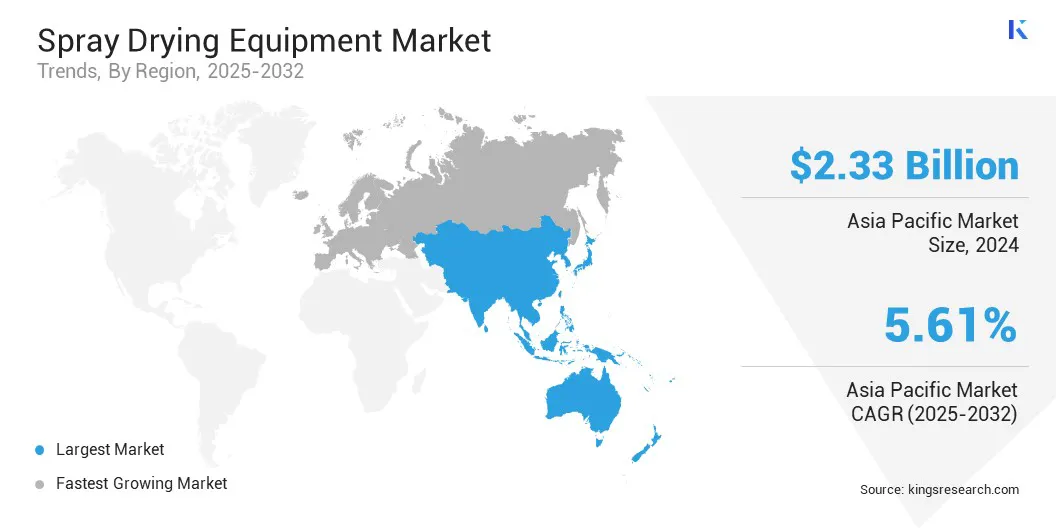

- Asia-Pacific held a share of 33.82% in 2024, valued at USD 2.33 billion.

- The rotary atomizer segment garnered USD 1.93 billion in revenue in 2024.

- The closed segment is expected to reach USD 6.26 billion by 2032.

- The two-stage segment is anticipated to witness the fastest CAGR of 5.62% over the forecast period.

- The food & beverages segment garnered USD 1.81 billion in revenue in 2024.

- Europe is anticipated to grow at a CAGR of 5.89% through the projection period.

Major companies operating in the spray drying equipment industry are GEA Group, SPX FLOW, Inc., Tetra Pak International S.A., Büchi Labortechnik AG, Dedert Corporation, Yamato Scientific co., ltd., European SprayDry Technologies., Swenson Technology, Inc., FREUND, G. Larsson Starch Technology AB, Shandong Tianli Energy Co., Ltd, Labplant, ystral gmbh, Bühler AG, and Spraying Systems Co.

The growing emphasis on product consistency, extended shelf life, and scalable manufacturing is fueling market expansion. Additionally, technological advancements in energy-efficient designs, multi-stage drying systems, and the handling of heat-sensitive materials are accelerating market development.

- In May 2024, GEA Group introduced the AsepticSD, a new spray dryer specifically designed for aseptic pharmaceutical production. It enables sterile, closed-process drying of sensitive ingredients such as probiotics and biological materials, ensuring high purity and product stability while meeting stringent contamination control standards.

Market Driver

Surging Demand for Processed and Functional Foods

The growth of the spray drying equipment market is fueled by the surging demand for processed and functional foods that offer convenience, extended shelf life, and added nutritional value. Consumers are increasingly opting for powdered products such as instant dairy, protein supplements, flavor enhancers, and functional beverages that require precise drying techniques to retain quality and stability.

Food manufacturers are leveraging spray drying to meet these needs through efficient moisture removal and controlled particle formation.

This shift is further supported by the rising focus on clean-label formulations, fortified food products, and plant-based alternatives, which rely on advanced drying methods to maintain ingredient integrity. The shift toward scalable, hygienic, and energy-efficient food processing solutions is leading to increased investments in modern spray drying systems, contributing significantly to sustained market expansion.

- In January 2024, GEA installed a heat recovery system at Nestlé’s Nunspeet facility in the Netherlands for its spray dryer. The system reduces steam consumption by 75% by capturing exhaust heat to generate 80 °C hot water, which supports both drying and wet-processing operations. This aligns with Nestlé’s broader sustainability targets, including its goal of net-zero emissions by 2050.

Market Challenge

Energy-Intensive Drying Process

The spray drying process is inherently energy-intensive, requiring significant thermal input to rapidly evaporate moisture and convert liquid feed into powder. This results in high operational costs, particularly for manufacturers operating in energy-restricted or cost-sensitive regions.

Dependence on fossil fuels for heat generation further raises concerns regarding environmental impact and carbon emissions, challenging the economic and environmental sustainability of the process, particularly for small and mid-sized enterprises.

To overcome these obstacles, equipment manufacturers are developing energy-efficient designs featuring multi-stage drying, advanced atomizers, and integrated heat recovery systems that reduce overall energy demand.

Automation and real-time monitoring technologies are also helping optimize process parameters to minimize energy waste. The adoption of renewable energy sources for heating and enhanced insulation materials is further contributing to operational cost reductions and improved sustainability performance.

- In June 2023, SiccaDania introduced a heat-recovery system for spray dryers, designed to reduce energy consumption by 30–50% and lower CO₂ and NOₓ emissions. Featuring CIP-cleanable heat exchangers and efficient cyclones, the system supports automation and sustainability, with a typical payback period of 2–6 years.

Market Trend

Growing Focus on Customized Spray Drying for Heat-sensitive Products

Growing focus on customized spray drying for heat-sensitive products is reshaping formulation and processing in pharmaceuticals, nutraceuticals, and specialty foods. To preserve the stability and functionality of delicate ingredients such as probiotics, enzymes, and natural extracts, there is rising demand for systems that operate at lower temperatures and offer precise control over drying parameters.

Advanced atomization techniques, closed-loop drying systems, and modular configurations are enabling efficient, gentle drying of sensitive compounds.

These tailored solutions enable the production of high-value formulations by preserving ingredient integrity critical to performance and efficacy. Manufacturers are integrating real-time monitoring and automation to ensure consistency, reduce thermal degradation, and minimize product loss.

As the demand for clean-label, bioactive, and fortified products grows, customized spray drying technologies are becoming essential to meeting regulatory, quality, and innovation standards. This trend is expected to drive future investments and expansion in premium segments.

Spray Drying Equipment Market Report Snapshot

|

Segmentation |

Details |

|

By Product |

Rotary Atomizer, Nozzle Atomizer, Fluidized, Centrifugal, and Others |

|

By Cycle |

Open, and Closed |

|

By Stage |

Single-stage, Two-stage, and Multi-stage |

|

By Application |

Food & Beverages, Pharmaceuticals, Chemicals, and Animal Feed |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Product (Rotary Atomizer, Nozzle Atomizer, Fluidized, Centrifugal, and Others): The rotary atomizer segment earned USD 1.93 billion in 2024, primarily due to its high efficiency in producing uniform particle sizes and its widespread use in large-scale food and chemical processing applications.

- By Cycle (Open and Closed): The closed segment held a share of 59.94% in 2024, largely attributed to its suitability for processing heat-sensitive and hazardous materials while ensuring solvent recovery and enhanced safety.

- By Stage (Single-stage, Two-stage, and Multi-stage): The multi-stage segment is projected to reach USD 4.62 billion by 2032, owing to its ability to improve drying efficiency, reduce energy consumption, and enhance product quality in complex and moisture-sensitive formulations.

- By Application (Food & Beverages, Pharmaceuticals, Chemicals, and Animal Feed): The pharmaceuticals segment is anticipated to grow at a CAGR of 6.03% through the projection period, propelled by increasing demand for spray-dried drug formulations that offer enhanced bioavailability, controlled release, and improved stability of active pharmaceutical ingredients.

Spray Drying Equipment Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Asia Pacific spray drying equipment market share stood at 33.82% in 2024, valued at USD 2.33 billion. This market position is reinforced by the region's expanding industrial base, rising investment in food and pharmaceutical processing infrastructure, and the presence of major spray drying equipment manufacturers.

Additionally, supportive government policies, growing demand for value-added consumer products, and a shift toward automation in manufacturing processes are accelerating equipment adoption across key industries.

The region’s emphasis on high-efficiency production, product innovation, and export-oriented food and pharmaceutical manufacturing supports regional market expansion. Rising demand for functional ingredients, specialty chemicals, and heat-sensitive formulations, combined with ongoing technological advancements in spray drying systems, is expected to support regional market growth through the forecast period.

- In May 2025, Galactic expanded its Guzhen facility in China by installing a new spray-drying line, aimed at boosting production of preservative powders such as Galimax ACE‑N‑50 and DIACE‑N. The USD 5.4 million investment enhances product quality and handling while supporting rising demand in the Asian market. The upgrade advances sustainability goals by replacing plastic packaging with recyclable aluminum, reflecting regional preferences for eco-friendly solutions.

The Europe spray drying equipment industry is set to grow at a CAGR of 5.89% over the forecast period. This growth is propelled by rising demand for high-performance processing solutions across the food, pharmaceutical, and specialty chemical sectors. The region’s emphasis on quality standards, product safety, and compliance with strict environmental regulations is promoting the adoption of advanced spray drying technologies.

Government-backed initiatives supporting sustainable production and energy efficiency are also fueling equipment upgrades across key industries. Moreover, increased investment in research and innovation, particularly in the development of functional and clean-label ingredients, is accelerating regional market expansion.

- In February 2023, EUROAPI installed a new GMP-capable Procept SD1 spray dryer at its Haverhill site in the UK to support early-phase molecule development. Designed for small batches, the unit enhances scale-up and data collection, enhancing EUROAPI’s development capabilities in Europe and serving both regional and global clients.

Regulatory Frameworks

- In the U.S., spray drying equipment must comply with the Current Good Manufacturing Practice (CGMP) regulations under 21 CFR Part 110 and 117, regulated by the U.S. Food and Drug Administration (FDA). These regulations ensure hygienic design, operation, and maintenance to prevent contamination and maintain product safety and quality.

- In the European Union, the EU Machinery Directive 2006/42/EC regulates the safety and compliance of spray drying equipment used in food, pharmaceutical, and chemical processing. It establishes essential health and safety requirements for equipment design, covering mechanical integrity, cleaning procedures, and risk mitigation during operation.

- In China, the GB 16798-2010 National Food Safety Standard for Hygienic Specifications of Food Machinery regulates the design and construction of spray drying and related equipment. It mandates the use of non-toxic, corrosion-resistant materials and requires easy-to-clean structures to ensure food safety in line with national hygiene practices.

Competitive Landscape

Companies operating in the spray drying equipment industry are actively expanding their market presence through technological advancements, product customization, and strategic partnerships. Key players are investing in research and development to improve energy efficiency, process control, and the ability to handle heat-sensitive and complex formulations across diverse applications.

They are also introducing modular and compact systems, low-temperature drying solutions, and automation-enabled equipment to meet the evolving needs of the food, pharmaceutical, and chemical sectors. Additionally, manufacturers are collaborating with end-use industries, research institutions, and regional distributors to enhance customer reach, secure long-term supply agreements, and strengthen their competitive positions in both developed and emerging markets.

- In September 2024, Evonik inaugurated a spray drying facility in Darmstadt for the production of EUDRAGIT polymer dispersions used in oral pharmaceutical applications. Compliant with IPEC-GMP (International Pharmaceutical Excipients Council – Good Manufacturing Practices) standards, the facility aims to improve supply chain efficiency and address growing demand for advanced drug delivery solutions. Powered by renewable energy, it is expected to reduce CO₂ emissions by over 1,000 tons annually.

List of Key Companies in Spray Drying Equipment Market:

- GEA Group

- SPX FLOW, Inc.

- Tetra Pak International S.A.

- Büchi Labortechnik AG

- Dedert Corporation

- Yamato Scientific co., ltd.

- European SprayDry Technologies.

- Swenson Technology, Inc.

- FREUND

- Larsson Starch Technology AB

- Shandong Tianli Energy Co., Ltd

- Labplant

- ystral gmbh

- Bühler AG

- Spraying Systems Co.

Recent Developments (M&A/Partnerships/Expansion)

- In June 2025, Particle Dynamics acquired EUROAPI UK Ltd.’s spray drying facility in Haverhill, UK, strengthening its global contract development and manufacturing organization (CDMO) capabilities for spray-dried pharmaceutical products. The site is designed to enhance drug solubility and bioavailability.

- In January 2025, Fluid Air partnered with Sinopep Biotech to deploy its PolarDry electrostatic spray drying technology in China for peptide and oligonucleotide production. The low-temperature process preserves biological activity and improves powder uniformity, offering a scalable alternative to freeze-drying.

- In November 2024, Hovione expanded its spray drying capacity at it U.S. and Ireland sites to meet the rising demand for pharmaceutical formulations. The investment supports long-term capacity growth.

- In August 2023, Spray-Tek, backed by Aurora Capital, acquired TRuCapSol, a provider of biodegradable microencapsulation. The acquisition strengthens Spray-Tek’s position in eco-friendly spray drying solutions for the personal care and pharmaceutical sectors, aligning with its strategy to expand high-performance ingredient processing capabilities.