buyNow

Source to Pay Market

Source to Pay Market Size, Share, Growth & Industry Analysis, By Organization (Large Enterprises, Small & Medium Enterprises), By Vertical (BFSI, Retail, Healthcare, Manufacturing), and Regional Analysis, 2025-2032

pages: 140 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

The source to pay process is an integrated procurement workflow that covers all stages from sourcing suppliers to making final payments. It includes activities such as spend analysis, supplier selection, contract negotiation, procurement, invoicing, and payment processing.

It includes key verticals such as banking, financial services and insurance (BFSI), retail, healthcare, manufacturing, automotive, IT and telecommunications, and energy and utilities, where efficient procurement operations are critical for cost savings and compliance.

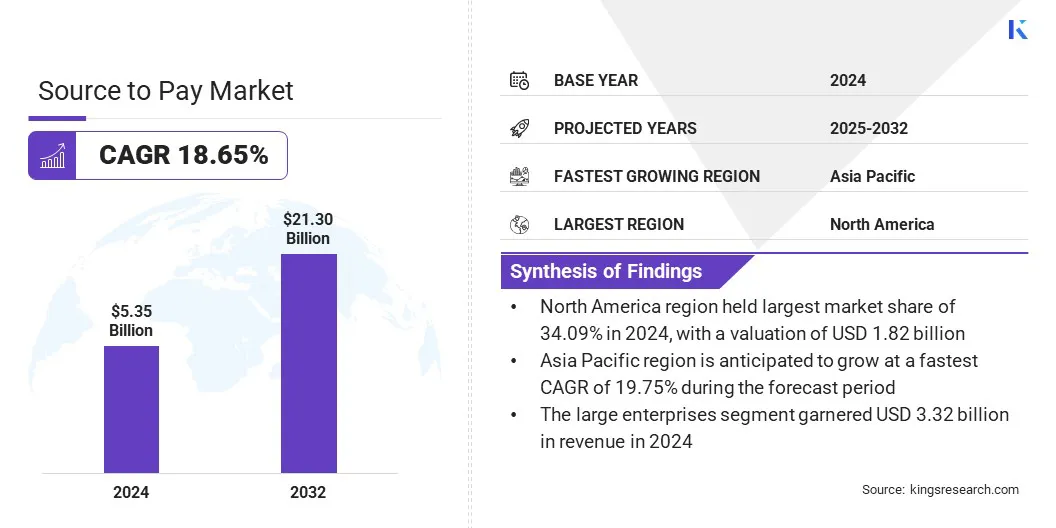

The global source to pay market size was valued at USD 5.35 billion in 2024 and is projected to grow from USD 6.30 billion in 2025 to USD 21.30 billion by 2032, exhibiting a CAGR of 18.65% during the forecast period. The growth is driven by the rising demand for end-to-end procurement visibility and control.

Organizations require structured oversight across sourcing, purchasing, invoicing, and payment to support compliance and efficiency. Integration with AI for intake management solutions allows automated classification, validation, and routing of procurement requests. This enhances process accuracy and reduces cycle times across procurement functions.

Key Market Highlights:

- The source to pay industry size was recorded at USD 5.35 billion in 2024.

- The market is projected to grow at a CAGR of 18.65% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 1.82 billion.

- The large enterprises segment garnered USD 3.32 billion in revenue in 2024.

- The BFSI segment is expected to reach USD 4.90 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 19.75% during the forecast period.

Major companies operating in the source to pay market are Zycus Inc., Medius, JAGGAER, LLC., Aavenir, Econocom Group., Coupa Software Inc., Zip, Oracle, Esker, SAP SE, Corcentric, Inc., Proactis Holdings Limited, Ivalua Inc., RealPage, Inc., and GEP.

Source to Pay Market Report Scope

|

Segmentation |

Details |

|

By Organization |

Large Enterprises, Small & Medium Enterprises |

|

By Vertical |

BFSI, Retail, Healthcare, Manufacturing, Automotive, IT & Telecommunications, Energy & Utilities, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Source to Pay Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America source to pay market share stood at 34.09% in 2024 in the global market, with a valuation of USD 1.82 billion. The dominance is due to the expansion of major companies into the source-to-pay category as part of their broader digital transformation strategies.

Large enterprises across the U.S., and Canada are increasingly adopting comprehensive source to pay platforms to consolidate procurement operations, improve financial transparency, and automate end-to-end workflows.

Additionally, a mature enterprise software ecosystem in North America and the presence of key vendors investing in cloud-based and AI-enabled procurement solutions are driving market growth.

- In November 2023, Zip expanded into the source to pay category with the launch of Zip Sourcing at its inaugural user conference. The new solution enables sourcing teams to manage RFX events, identify and track savings, and streamline sourcing operations through AI-powered automation. Integrated with Zip’s intake to procure platform, the solution provides an end-to-end source to pay experience with features such as autonomous sourcing, real-time collaboration, savings insights, and zero-training deployment.

Asia Pacific is poised to grow at a significant CAGR of 19.75% over the forecast period. The growth is driven by the rising adoption of digital procurement technologies among companies in the manufacturing, retail, and automotive sectors.

Rapid industrial expansion and supply chain diversification in China, India, Japan, and South Korea are prompting businesses to invest in scalable source-to-pay platforms. These platforms enable cost reduction, improve supplier collaboration, and provide real-time visibility across procurement cycles.

The market growth is further supported by increasing IT infrastructure development and a growing number of small and medium-sized enterprises transitioning to digital procurement models.

Source to Pay Market Overview

Companies are integrating workforce management capabilities into source to pay platforms to oversee external labor in coordination with overall supplier expenditures. These tools help track and manage contract-based workers, temporary staff, and service providers within the same system used for sourcing and payments.

This approach improves cost control, ensures policy compliance, and provides unified visibility across both workforce and supplier engagements. As a result, organizations can align workforce planning with procurement goals and streamline vendor-related processes across categories.

- In June 2024, Ivalua launched its External Workforce Management solution as part of its unified Source-to-Pay platform. The solution enables organizations to manage all aspects of their external workforce with overall supplier spend. It supports efficient engagement, performance tracking, and regulatory compliance by offering complete visibility into workforce value, costs, and associated risks.

Market Driver

Rising Demand for End-To-End Procurement Visibility and Control

The market is driven by the growing need for complete visibility and control across the procurement lifecycle. Enterprises require integrated systems that connect sourcing, contracting, purchasing, invoicing, and payment functions within a single framework.

This allows procurement teams to monitor compliance, manage spendng effectively, and ensure process consistency. Comprehensive oversight across all procurement activities supports risk mitigation, cost control, and improved governance. These capabilities are critical for large organizations operating across multiple business units and regions.

Market Challenge

Data Security and Compliance Risks in Source to Pay Processes

A major challenge in the source to pay market is ensuring data security and regulatory compliance throughout the procurement cycle. Source to pay platforms handle sensitive financial and supplier information, making them targets for cyber threats and data breaches.

Additionally, global enterprises face added complexity due to differing regional compliance frameworks. Gaps in adherence can lead to financial losses, legal liabilities, and damage to organizational reputation.

To address this, organizations are implementing secure cloud infrastructure, encryption protocols, and access controls. Vendors are also embedding compliance management tools within S2P platforms to help businesses adhere to regional data protection laws and industry regulations.

Market Trend

Adoption of AI-enabled intake management solutions

The market is experiencing a notable shift with the integration of AI into intake management solutions. Organizations are deploying AI-enabled systems to manage the initial intake of procurement requests by automating classification, validation, and routing.

This use of AI improves accuracy, shortens processing times, and reduces administrative workload. The technology identifies request types, assesses urgency or relevance, and directs them to the correct approval paths or sourcing workflows. This supports consistent process execution and enhances procurement cycle efficiency.

- In December 2024, Ivalua launched its AI-powered Intake Management solution through its Source to Pay platform. The solution features a conversational AI interface to guide employees in submitting procurement and cross-departmental requests efficiently while ensuring policy compliance. It includes orchestration capabilities, real-time tracking, and seamless integration with third-party systems to enhance collaboration, transparency, and process scalability across enterprise functions.

Market Segmentation:

- By Organization (Large Enterprises, and Small & Medium Enterprises): The large enterprises segment earned USD 3.32 billion in 2024 due to high procurement volumes, complex supplier networks, and greater investment capacity in integrated Source to Pay platforms.

- By Vertical (BFSI, Retail, Healthcare, Manufacturing, Automotive, IT & Telecommunications, Energy & Utilities, and Others): The BFSI segment held 23.13% of the market in 2024, due to the sector’s strong focus on regulatory compliance, vendor risk management, and digital transformation of procurement operations.

Regulatory Frameworks

- In the U.S., the Federal Acquisition Regulation (FAR) governs procurement processes for federal agencies and sets standards for sourcing, contract management, and vendor selection, directly impacting source to pay systems used in public sector contracts.

- In Europe, the EU Public Procurement Directive (2014/24/EU) establishes legal requirements for transparency, fair competition, and electronic procurement, driving the adoption of compliant source to pay solutions across member states.

Competitive Landscape

Key players in the source to pay market are focusing on strategic collaborations and automation to strengthen their market position.

Many vendors are entering partnerships with financial institutions, ERP providers, and technology firms to expand integration capabilities and deliver end-to-end procurement solutions. These collaborations aim to enhance interoperability between sourcing, contract management, and payment systems.

A major focus among leading players is the implementation of automated payment processing within source to pay platforms. Companies are integrating AI and machine learning to streamline invoice matching, reduce payment errors, and enable dynamic discounting.

This automation helps enterprises accelerate cash flow management and improve supplier relationships. These strategies reflect a shift toward unified, intelligent procurement ecosystems that support compliance, scalability, and operational efficiency.

- In September 2024, JAGGAER and Bottomline announced their partnership to integrate the Paymode business payments network into JAGGAER Pay. The collaboration aimed to enhance JAGGAER’s procure to pay solution by automating payment processes, improving fraud prevention, and increasing rebate opportunities.

Key Companies in Source to Pay Market:

- Zycus Inc.

- Medius

- JAGGAER, LLC.

- Aavenir

- Econocom Group.

- Coupa Software Inc.

- Zip

- Oracle

- Esker

- SAP SE

- Corcentric, Inc.

- Proactis Holdings Limited

- Ivalua Inc.

- RealPage, Inc.

- GEP

Recent Developments (Product Launch)

- In May 2024, GEP launched its AI-driven Total Orchestration Solution to enhance enterprise procurement and supply chain operations. The solution simplifies workflows through guided intake, supplier recommendations, automated contract management, and dynamic reporting. Built on the GEP QUANTUM platform, it leverages AI, low-code capabilities, and data harmonization to streamline the source-to-pay cycle and strengthen collaboration, visibility, and decision-making across enterprise functions.