buyNow

Polycarbonate Resin Market

Polycarbonate Resin Market Size, Share, Growth & Industry Analysis, By Application (Automotive, Construction, Electrical & Electronics, Optical Media, Medical, Packaging, Others), and Regional Analysis, 2025-2032

pages: 140 | baseYear: 2024 | release: July 2025 | author: Sunanda G.

Market Definition

Polycarbonate resin is a high-performance thermoplastic known for its exceptional strength, optical clarity, and impact resistance. It is lightweight, moldable, and offers enhanced thermal stability, making it suitable for demanding engineering applications.

Used widely in molding and extrusion processes, polycarbonate resins are integral in manufacturing electronics, automotive parts, medical devices, construction materials, and optical media. Their versatility in forming durable, lightweight components makes them critical across multiple industries.

The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Polycarbonate Resin Market Overview

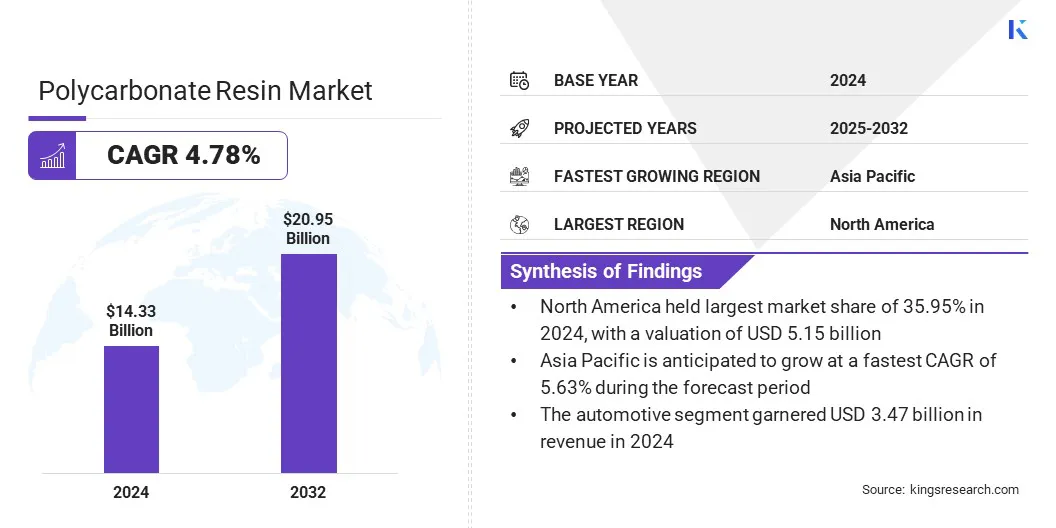

The global polycarbonate resin market size was valued at USD 14.33 billion in 2024 and is projected to grow from USD 14.97 billion in 2025 to USD 20.95 billion by 2032, exhibiting a CAGR of 4.78% during the forecast period.

The growth of the market is driven by the rapid expansion of consumer electronics production, where durable and lightweight materials are essential for device components. Additionally, the rising demand for medical-grade plastics, due to their strength, transparency, and biocompatibility, is supporting the broader use of polycarbonate in healthcare applications.

Key Market Highlights:

- The polycarbonate resin industry size was valued at USD 14.33 billion in 2024.

- The market is projected to grow at a CAGR of 4.78% from 2025 to 2032.

- North America held a market share of 35.95% in 2024, with a valuation of USD 5.15 billion.

- The automotive segment garnered USD 3.47 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 5.63% over the forecast period.

Major companies operating in the polycarbonate resin market are Covestro AG, SABIC, Teijin Limited, Mitsubishi Corporation, LG Chem, CHIMEI, Idemitsu Kosan Co., Ltd., Trinseo, Formosa Chemicals & Fibre Corp., Samyang Corporation, Asahi Kasei Corporation, Bayer AG, LOTTE Chemical CORPORATION., BASF, and Dow.

The shift toward lighter vehicles is accelerating market growth. Automakers are increasingly replacing metal parts with polycarbonate components to reduce weight and improve fuel efficiency. Applications in headlamp lenses, interior trims, and sunroof panels continue to expand due to the resin’s impact resistance and flexibility.

The material’s ability to meet safety standards while supporting lightweight construction is boosting its adoption across both electric and conventional vehicle segments.

- In April 2025, Covestro introduced TÜV Rheinland–certified post‑consumer recycled (PCR) polycarbonate grades with 50% recycled content, sourced from end‑of‑life automotive headlamps. Developed with GIZ, Volkswagen, and NIO, the material supports circularity and meets strict automotive standards. Its commercial availability allows global automakers to reduce weight while improving sustainability.

Market Driver

Expansion of Consumer Electronics Production

The rapid expansion of global consumer electronics production increases the demand for durable and lightweight materials, fueling the growth of the market.

These resins are widely used in manufacturing housings for smartphones, laptops, and other personal gadgets due to their optical clarity, electrical insulation, and toughness. The need for compact, high-performance devices is prompting manufacturers to adopt polycarbonates.

- In June 2024, Mitsubishi Chemical Group’s high-performance polycarbonate resin, XANTAR K series, was selected for the back panel casing of the Nothing Phone (2a), developed by the digital brand NOTHING. Offering superior surface hardness and enhanced scratch resistance over standard polycarbonate, XANTAR K is increasingly used in smartphone casings and automotive interiors.

Market Challenge

Regulatory Pressure on BPA Usage

A key challenge limiting the growth of the polycarbonate resin market is the increasing regulatory scrutiny over the use of bisphenol A (BPA), a primary raw material in polycarbonate production. Concerns about BPA’s potential health and environmental impact have led to stricter regulations, particularly in food-contact and medical applications.

In response, key players are investing in R&D to develop BPA-free polycarbonate alternatives and bio-based resins. Strategic collaborations and advancements in chemical recycling are also being explored to improve sustainability and reduce dependency on traditional fossil-based feedstocks, supporting continued market growth amid rising environmental concerns.

Market Trend

Increasing Preference for Medical-Grade Plastics

The market is expanding due to higher usage in medical devices and diagnostics equipment. Polycarbonate resins meet stringent safety and hygiene standards required in healthcare applications.

Their biocompatibility, impact resistance, and sterilizability support make them ideal for blood reservoirs, IV components, and surgical instruments. The shift toward durable, transparent plastics that withstand repeated cleaning is highlighting the importance of polycarbonate in the global healthcare sector.

- In June 2025, Covestro launched Apec 2045, a heat-resistant, medical-grade co-polycarbonate designed for devices requiring hot-air sterilization up to 180°C, such as respiratory masks with molded-in seals. This innovation enables manufacturers to reduce production time and cost by eliminating the need for overmolding with liquid silicone rubbe, while maintaining high performance and aesthetics.

Polycarbonate Resin Market Report Snapshot

|

Segmentation |

Details |

|

By Application |

Automotive, Construction, Electrical & Electronics, Optical Media, Medical, Packaging, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Application (Automotive, Construction, Electrical & Electronics, Optical Media, and Medical): The automotive segment earned USD 3.47 billion in 2024 due to its growing use in lightweight, impact-resistant components that help manufacturers meet fuel efficiency and emissions regulations.

Polycarbonate Resin Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America polycarbonate resin market share stood at around 35.95% in 2024, valued at USD 5.15 billion. The North American medical sector emphasizes innovation and precision manufacturing. Growth in healthcare infrastructure, outpatient care, and home-based diagnostics is leading to increased polycarbonate resin usage in medical applications.

Moreover, the region is witnessing a substantial rise in the adoption of energy-efficient lighting solutions, particularly LED systems. The growing number of commercial and industrial LED retrofitting projects is significantly boosting regional market growth.

- In November 2024, the U.S. Department of Energy allocated USD 11.5 million for the installation of LED lighting across various public spaces, including parks, police stations, airport runways, baseball fields, and municipal buildings to enhance energy efficiency. This funding is part of a broader USD 17.7 million initiative under the Energy Efficiency and Conservation Block Grant Program, supporting 61 projects to help local governments, states, and Tribal communities reduce energy consumption and emissions.

The Asia-Pacific polycarbonate resin industry is poised to grow at a CAGR of 5.63% over the forecast period. This growth is propelled by the expansion of the automotive sector, with several global and regional manufacturers increasing local production.

The growing focus on fuel efficiency and cost-effective materials is strengthening the role of polycarbonates in automotive applications across the region.

Furthermore, the region's position as a global hub for electronics manufacturing, supported by a dense network of OEMs and component suppliers, is contributing significantly to regional market growth.

Regulatory Frameworks

- In the U.S., polycarbonate resins containing bisphenol A (BPA) must be registered and reported to the Environmental Protection Agency (EPA) under the Toxic Substances Control Act (TSCA). BPA is subject to specific risk evaluations, labeling requirements, and exposure monitoring. Additionally, the Food and Drug Administration (FDA) regulates polycarbonate for food-contact use under Title 21, part 177.1580 of the Code of Federal Regulations, enforcing strict migration limits for food safety.

- In the European Union, regulation under Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) mandates registration of polycarbonate resins and associated monomers such as BPA above one tonne per year. REACH restricts BPA in food‑contact applications to very low migration levels. Producers must submit safety dossiers to the European Chemicals Agency, with ongoing monitoring and updated risk assessments for continued market access.

- In China, Polycarbonate resins fall under the chemical management system, requiring registration with the Ministry of Ecology and Environment. China classifies BPA as a priority control chemical, particularly in food-contact materials. National standards (GB) impose migration limits and require certification from the China National Center for Food Safety Risk Assessment.

- Japan’s Food Sanitation Act regulates polycarbonate resins in food-contact applications, defining migration limits for BPA and requiring testing by accredited laboratories. Polycarbonate use must meet the Ministry of Health, Labour and Welfare standards. Additionally, chemical substances are monitored under the Chemical Substances Control Law, which mandates notification and risk assessments for BPA and similar chemicals prior to industrial use.

Competitive Landscape

Key players in the polycarbonate resin market are increasingly adopting strategies such as joint research and development agreements, product innovation, and the use of bio-based raw materials to enhance the performance and sustainability of polycarbonate resin applications.

Companies are focusing on developing high-performance, eco-friendly materials tailored to specific industries such as renewable energy.

- In May 2024, the Mitsubishi Chemical Group announced that its biomass-based polycarbonatediol, BENEBiOL, has been selected as a raw material for AROLEP 940 series, a polyurethane coating developed by AEROX for wind turbine blade protection. This development follows a Joint Research and Development Agreement (JRDA) between the two companies and represents the first-ever application of BENEBiOL in coatings for wind turbine blades.

Key Companies in Polycarbonate Resin Market:

- Covestro AG

- SABIC

- Teijin Limited

- Mitsubishi Corporation

- LG Chem

- CHIMEI

- Idemitsu Kosan Co., Ltd.

- Trinseo

- Formosa Chemicals & Fibre Corp.

- Samyang Corporation

- Asahi Kasei Corporation

- Bayer AG

- LOTTE Chemical CORPORATION.

- BASF

- Dow

Recent Developments (Agreements/Product Launches)

- In December 2024, SABIC launched its LNP ELCRES CXL polycarbonate (PC) copolymer resins, engineered for outstanding chemical resistance. These materials are tailored for mobility, electronics, industrial, and infrastructure applications, offering enhanced durability, reduced environmental stress cracking, and extended product lifespan under harsh conditions.

- In May 2024, the Mitsubishi Chemical Group announced that BENEBiOL, its biomass-based polycarbonatediol, has been chosen for the interior finish coating of the Lawson Aomori Chiyuuou Koukou-Mae store in Aomori Prefecture, Japan. This marks the second Lawson outlet to incorporate coatings formulated with BENEBiOL, following its earlier use at the Lawson Obihiro Nishi 21-Jo Minami 4-chome stores.

- In January 2024, the Mitsubishi Chemical Group initiated verification testing for a program aimed at collecting polycarbonate (PC) resin from end-of-life vehicle headlamps in Japan's Kanto region. This testing is being carried out in partnership with Tokio Marine & Nichido Fire Insurance Co., Ltd., as part of a broader effort to advance sustainable material recovery.