buyNow

Personal Care Ingredients Market

Personal Care Ingredients Market Size, Share, Growth & Industry Analysis, By Source (Natural, Synthetic), By Type (Emollients, Surfactants, Emulsifiers, Rheology Modifiers, Conditioning Polymers, Others), By Application (Skin Care, Hair Care, Oral Care, Make-up, Others), and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Personal care ingredients are used in the formulation of skin care, hair care, oral hygiene, and cosmetic products. They include conditioning agents, emulsifiers, preservatives, surfactants, and active compounds that improve product performance and user experience. The market covers the development, manufacturing, and supply of these ingredients across a wide range of personal care products.

Personal Care Ingredients Market Overview

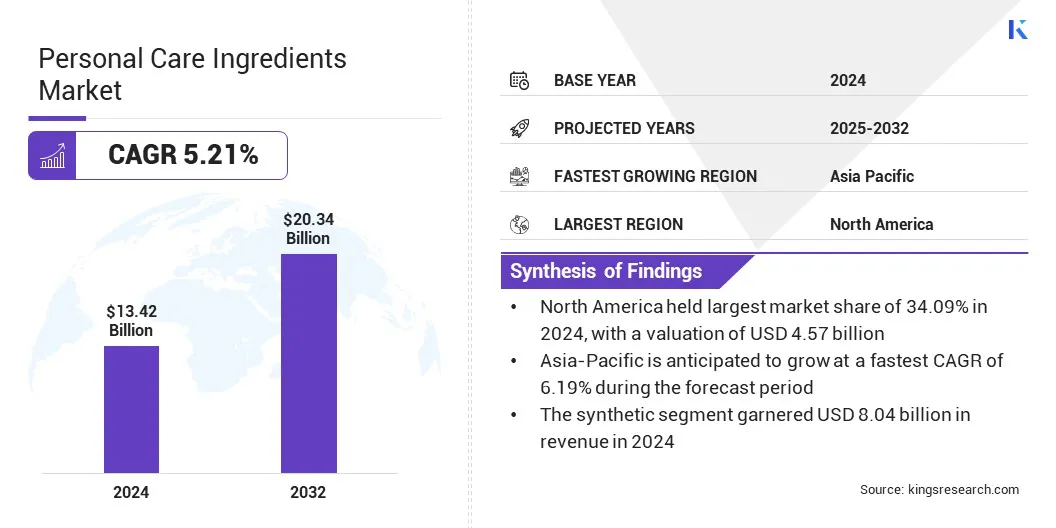

The global personal care ingredients market size was valued at USD 13.42 billion in 2024 and is projected to grow from USD 14.04 billion in 2025 to USD 20.34 billion by 2032, exhibiting a CAGR of 5.21% during the forecast period.

This growth is attributed to the rising consumer awareness of personal hygiene and the growing demand for effective and multifunctional ingredients in daily care routines. The increasing preference for natural, organic, and sustainable ingredients is fueling product innovation across skincare, haircare, and cosmetic applications.

Key Highlights

- The personal care ingredients market size was valued at USD 13.42 billion in 2024.

- The market is projected to grow at a CAGR of 5.21% from 2025 to 2032.

- North America held a share of 34.09% in 2024, valued at USD 4.57 billion.

- The synthetic segment garnered USD 8.04 billion in revenue in 2024.

- The Emollients segment is expected to reach USD 6.09 billion by 2032.

- The hair care segment is anticipated to witness the fastest CAGR of 5.73% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 6.19% through the projection period.

Major companies operating in the global personal care ingredients market are BASF, Croda International Plc, Clariant, Dow, Solvay, The Lubrizol Corporation, Nouryon, J.M. Huber Corporation, Wacker Chemie AG, Akzo Nobel N.V., Evonik, Symrise, Lonza, ADEKA CORPORATION, and Kemira.

Advancements in formulation technologies, the expansion of urban populations, and the influence of social media trends are accelerating product development and consumer engagement. Additionally, supportive regulatory frameworks promoting ingredient safety and sustainability are prompting manufacturers to invest in R&D and diversify their product offerings.

- In April 2025, BASF unveiled three new bio-based personal care ingredients, Verdessence Maize, Lamesoft OP Plus, and Dehyton PK45 GA/RA at in-cosmetics Global 2025. These ingredients address the growing demand for sustainable and high-performing formulations, supporting skin and hair health while reinforcing BASF’s commitment to longevity and environmental responsibility.

Market Driver

Surging Demand for Multi-Functional Ingredients

The growth of the personal care ingredients market is propelled by rising demand for high-performance ingredients that deliver multiple benefits in a single formulation. Increasing consumer demand for convenience, efficiency, and visible results is prompting manufacturers to adopt multifunctional ingredients that support hydration, protection, repair, and aesthetic enhancement.

This reduces the need for complex formulations while improving product appeal and cost-efficiency for producers. The shift toward multi-functional ingredient systems is further supported by advancements in formulation technologies and growing pressure to streamline product development. The rising demand for versatile and effective ingredients is fueling market expansion.

- In March 2025, Vantage Personal Care launched four new natural ingredients at in-cosmetics Global, including Angel-Eye EFX, Lipovol Origin Cacay, Distinctive Sunbooster, and Tucum-HA EFX, aimed at enhancing hydration, SPF performance, and skin health. These additions reflect Vantage’s focus on multifunctional, sustainable solutions that align with evolving consumer demands in the personal care industry.

Market Challenge

Rising Consumer Skepticism and Demand for Transparency

Rising consumer skepticism and demand for transparency are posing notable challenges to the expansion of the personal care ingredients market, as individuals become more informed and selective about the products they use. Shoppers are increasingly questioning ingredient safety, sourcing practices, and potential long-term health effects, particularly in skincare, haircare, and cosmetics.

This growing scrutiny is prompting companies to disclose detailed ingredient information, including origin, functionality, and regulatory status, across product labels and digital platforms. Fulfilling these transparency expectations often requires investment in traceable supply chains, third-party certifications, and enhanced consumer education.

Industry players are responding by adopting clean-label strategies, reformulating products, and implementing digital tools that provide clear and accessible ingredient data to build trust and brand loyalty.

- In April 2024, BASF launched “Ingredients Revealed,” a new feature within its D’lite platform, to provide more transparent information on cosmetic formulations. The tool delivers real-time insights into sustainability, regulatory standards, and labeling, helping developers make informed decisions quickly and efficiently.

Market Trend

Growing Emphasis on Sustainable and Ethically Sourced Ingredients

The growing emphasis on sustainable and ethically sourced ingredients is influencing the personal care ingredients market by supporting a shift toward environmentally responsible and socially conscious production practices.

Manufacturers are increasingly adopting biodegradable raw materials, renewable feedstocks, and green chemistry processes to reduce environmental impact and comply with evolving regulatory frameworks. Unlike conventional synthetic inputs, sustainably sourced ingredients offer benefits such as lower carbon footprints, reduced toxicity, and improved biodegradability, making them ideal for brands targeting eco-conscious consumers.

Ethical sourcing practices, including fair trade and supply chain transparency, are becoming critical for maintaining consumer trust and meeting global sustainability standards. Moreover, advancements in sustainable extraction technologies, life cycle assessment tools, and traceability systems are enabling ingredient suppliers to deliver high-performance solutions that align with both environmental goals and market demands.

- In October 2023, Dow launched three sustainable personal care technologies at in-cosmetics Asia 2023, including EcoSense APP-1000, EcoSense APP-5000, and DEXCARE CD-1 Polymer. The new ingredients focus on natural-origin content, biodegradability, and multifunctional performance. This launch reflects Dow’s continued commitment to eco-innovation and addressing evolving consumer demands in the beauty and personal care sector.

Personal Care Ingredients Market Report Snapshot

|

Segmentation |

Details |

|

By Source |

Natural, and Synthetic |

|

By Type |

Emollients, Surfactants, Emulsifiers, Rheology Modifiers, Conditioning Polymers, and Others |

|

By Application |

Skin Care, Hair Care, Oral Care, Make-up, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Source (Natural and Synthetic): The synthetic segment earned USD 8.04 billion in 2024, mainly due to its widespread use in high-performance formulations, cost efficiency, and longer shelf life.

- By Type (Emollients, Surfactants, Emulsifiers, Rheology Modifiers, Conditioning Polymers, and Others): The emollients segment held a share of 29.90% in 2024, largely attributed to their essential role in moisturizing formulations and their widespread use across skincare and cosmetic products.

- By Application (Skin Care, Hair Care, Oral Care, Make-up, and Others): The skin care segment is projected to reach USD 5.72 billion by 2032, owing to increasing consumer focus on hydration, anti-aging, and sun protection, along with growing demand for advanced and multifunctional skin care products.

Personal Care Ingredients Market Regional Analysis

Based on region, the global personal care ingredients market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America personal care ingredients market share stood at 34.09% in 2024, valued at USD 4.57 billion. This dominance is reinforced by the strong presence of global cosmetic brands, advanced formulation capabilities, and consistent consumer demand for high-performance personal care products.

The region’s early adoption of specialty ingredients, along with a focus on dermatologically tested and multifunctional formulations, is fueling product innovation and meeting evolving consumer expectations.

Additionally, increasing investment in research and development, supported by strategic partnerships between manufacturers and ingredient suppliers, is accelerating the development of novel ingredient technologies across skincare, haircare, and cosmetic segments. The growing emphasis on regulatory compliance, ingredient transparency, and sustainability is further strengthening North America's position in the global market.

Moreover, advancements in bio-based ingredients, digital formulation tools, and clean-label trends are enhancing product quality, supporting brand differentiation, and contributing to long-term market growth.

- In April 2024, U.S.-based Ashland introduced new sustainable personal care technologies, including a natural peptide-hyaluronic hybrid, a biodegradable texture agent, and a multifunctional natural additive. The launch highlights the company’s commitment to green chemistry and high-performance innovation.

The Asia-Pacific personal care ingredients market is set to grow at a CAGR of 6.19% over the forecast period. This growth is attributed to increasing consumer spending, evolving beauty standards, and increased demand for customized personal care products across diverse demographic segments.

The region's thriving beauty and personal care industry, fueled by the rising youth population and social media influence, is boosting the demand for innovative and functional ingredient formulations.

Government support for domestic manufacturing, combined with expanding retail and e-commerce networks, is enabling broader product accessibility and promoting local sourcing of ingredients. Additionally, partnerships between global ingredient suppliers and regional manufacturers, along with advancements in formulation technologies and scalable production capabilities, are strengthening supply chains and fostering regional market expansion.

- In November 2024, Switzerland-based Clariant launched minimalist beauty ingredients at in-cosmetics Asia, including Hostacerin CCT, Eclipsogen CAP, and Genadvance, along with new actives from Lucas Meyer Cosmetics. The launches highlight Clariant’s focus on high-efficacy, simplified formulations aligned with minimalist beauty trends.

Regulatory Frameworks

- In the U.S., the Federal Food, Drug, and Cosmetic Act (FD&C Act) regulates the formulation, safety, and labeling of personal care ingredients. It ensures that cosmetic products do not contain harmful substances and mandates accurate labeling to protect consumer health and prevent misleading claims.

- In the EU, Regulation (EC) No. 1223/2009 on Cosmetic Products regulates the use of personal care ingredients. It mandates comprehensive safety assessments, prohibits hazardous substances, and enforces labeling transparency to ensure consumer safety and product compliance across member states.

- In China, the Cosmetic Supervision and Administration Regulation (CSAR) regulates the approval, safety, and classification of personal care ingredients. It introduces stricter controls for ingredient registration, including safety documentation and pre-market evaluation, to enhance oversight of domestic and imported cosmetic products.

Competitive Landscape

Companies operating in the global personal care ingredients market are actively expanding their product portfolios through technological advancements, ingredient innovation, and strategic acquisitions. Leading players are investing significantly in research and development to formulate high-performance, multifunctional, and compliant ingredients that address evolving consumer preferences and regulatory requirements.

They are also focusing on the development of sustainable, skin-compatible, and bioactive ingredients that enhance product functionality across skincare, haircare, and cosmetic applications. Additionally, firms are entering partnerships with personal care brands, contract manufacturers, and regional distributors to strengthen their global reach, improve supply chain efficiency, and accelerate product commercialization across both established and emerging markets.

- In February 2024, Evonik launched a biotech-derived vegan collagen ingredient targeted at the personal care industry. This animal-free collagen mimetic supports skin elasticity and hydration, offering a sustainable alternative to traditional animal-sourced collagen with consistent quality and traceability.

List of Key Companies in Personal Care Ingredients Market:

- BASF

- Croda International Plc

- Clariant

- Dow

- Solvay

- The Lubrizol Corporation

- Nouryon

- M. Huber Corporation

- Wacker Chemie AG

- Akzo Nobel N.V.

- Evonik

- Symrise

- Lonza

- ADEKA CORPORATION

- Kemira

Recent Developments (M&A/ Product Launches)

- In April 2025, Unilever acquired UK-based personal care brand Wild, known for its refillable, plastic-free deodorants and body care products. The initiative supports Unilever’s Growth Action Plan 2030 by expanding its sustainable, premium portfolio and strengthening its digital-first, direct-to-consumer capabilities.

- In March 2024, IMCD Benelux acquired Gova Ingredients to strengthen its product portfolio and technical support capabilities in the personal care segment. The acquisition enhances IMCD’s presence in the Benelux region and supports its strategy to expand value-added distribution across Europe.

- In October 2023, Clariant acquired Lucas Meyer Cosmetics from IFF for USD 810 million to expand its portfolio of high-value personal care ingredients. The acquisition enhanced Clariant’s innovation capabilities, extended its global reach, and set a target of reaching USD 180 million in annual sales by 2028.

- In July 2023, Elementis Personal Care launched two sustainable ingredients at in-cosmetics Asia: BENTONE HYDROCLAY 700, a natural texture stabilizer, and BENTONE® PLUS GLOW, a glow-enhancing hectorite gel. The launches reflect the company’s focus on clean-label, eco-conscious innovation.