buyNow

Peritoneal Dialysis Market

Peritoneal Dialysis Market Size, Share, Growth & Industry Analysis, By Modality (Continuous Ambulatory Peritoneal Dialysis (CAPD), Automated Peritoneal Dialysis (APD)), By Product (Solution Bags, Machines, Catheters, Transfer Sets, Others), By End User (Home Care Settings, Hospitals, Others) and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Peritoneal dialysis is a treatment for end-stage renal disease that uses the peritoneal membrane to remove metabolic waste, excess fluids, and toxins from the bloodstream. The market encompasses equipment, consumables, and services utilized in continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD).

It comprises manufacturers of dialysis machines, dialysate solutions, catheters, and associated supplies, along with providers of home-based care and patient training services.

Peritoneal Dialysis Market Overview

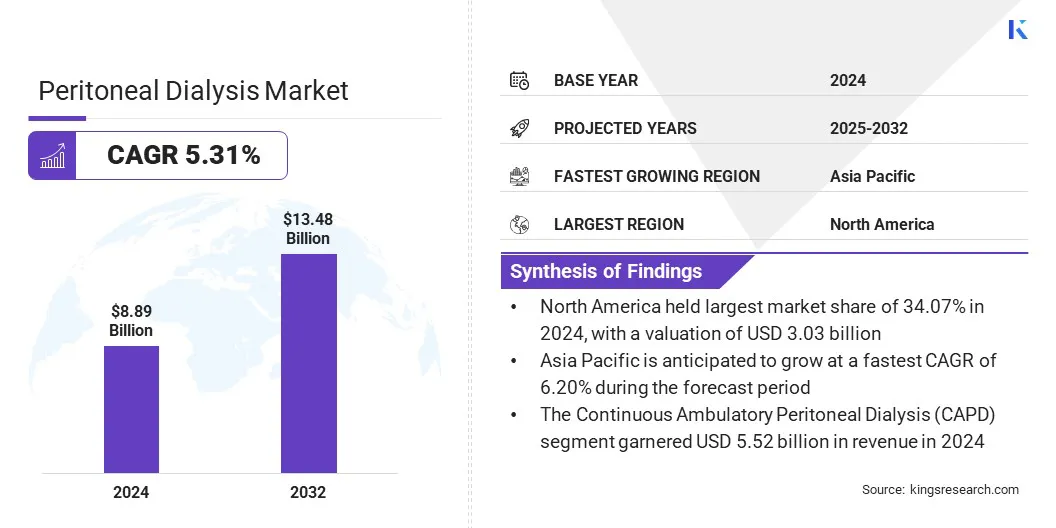

The global peritoneal dialysis market size was valued at USD 8.89 billion in 2024 and is projected to grow from USD 9.35 billion in 2025 to USD 13.48 billion by 2032, exhibiting a CAGR of 5.31% during the forecast period.

The market is experiencing steady growth, mainly due to the increasing prevalence of end-stage renal disease and the rising preference for home-based dialysis treatments. Advancements in automated peritoneal dialysis systems and the growing adoption of wearable and portable dialysis devices are contributing to improved patient outcomes and greater convenience.

Key Market Highlights:

- The peritoneal dialysis industry size was valued at USD 8.89 billion in 2024.

- The market is projected to grow at a CAGR of 5.31% from 2025 to 2032.

- North America held a share of 34.07% in 2024, valued at USD 3.03 billion.

- The continuous ambulatory peritoneal dialysis (CAPD) segment garnered USD 5.52 billion in revenue in 2024.

- The solution bags segment is expected to reach USD 3.79 billion by 2032.

- The home care settings segment is projected to generate a revenue of USD 4.99 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.20% over the forecast period.

Major companies operating in the peritoneal dialysis market are Baxter, Fresenius Medical Care AG, B. Braun SE, NIPRO, Medtronic, Terumo Corporation, DaVita Inc., JMS Co.Ltd., Infomed SA, Polymedicure, Renax Biomedical Technology Co., Ltd., Newsol Technologies Inc., Mitra Peritoneal Dialysis System, Vivance, and CloudCath.

The growing emphasis on personalized treatment regimens and the integration of digital health tools in therapy management are significantly enhancing clinical outcomes.

These advancements enable tailored dialysis protocols based on individual patient needs, improving treatment efficacy, adherence, and quality of life. Digital platforms such as remote monitoring systems allow real-time data exchange between patients and clinicians, facilitating timely interventions and proactive care adjustments.

The rising demand for home-based and patient-centric dialysis solutions is poised to enhance care delivery standards and support sustained market growth.

- In June 2025, Vantive announced USD 1 billion over five years to expand R&D and manufacturing of digitally-enabled kidney and organ support therapies. The company will showcase its innovations, including the Sharesource platform for at-home automated peritoneal dialysis, at the 62nd European Renal Association (ERA) Congress in Vienna, Austria.

Market Driver

Growing Chronic Kidney Disease Burden Driving Peritoneal Dialysis Adoption

The market is expanding due to the rising global burden of chronic kidney disease (CKD), which is pushing more patients toward long-term renal replacement therapies.

- In 2024, the Institute for Health Metrics and Evaluation reported that chronic kidney disease (CKD) accounted for 44.5 million disability-adjusted life years (DALYs) globally in 2021. The burden includes patients with end-stage kidney disease on dialysis or with transplants, underscoring CKD as a major global health concern.

As CKD progresses to ESKD, the demand for effective and accessible treatment options such as peritoneal dialysis continues to grow. The therapy is gaining traction as a less invasive alternative to hemodialysis and offers advantages such as flexibility, improved quality of life, and compatibility with home-based care.

Moreover, the increasing prevalence of diabetes and hypertension—key risk factors for CKD—is contributing to the expanding dialysis-dependent population. These factors are reinforcing the role of peritoneal dialysis as a scalable and patient-centric solution that supports long-term disease management and aligns with evolving healthcare delivery models.

Market Challenge

Lack of Skilled Workforce and Patient Training

A significant challenge limiting the expansion of the peritoneal dialysis market is the shortage of trained healthcare professionals and limited patient education for managing home-based dialysis.

Many patients, particularly in low- and middle-income regions, face difficulties in initiating and maintaining therapy due to insufficient clinical support and inadequate training in aseptic techniques, which increases the risk of complications such as peritonitis.

To address this challenge, companies are investing in structured training programs and deploying digital platforms that offer guided tutorials, multilingual resources, and virtual nurse support. These efforts aim to address skill gaps, expand therapy access, and enhance patient safety and outcomes in peritoneal dialysis.

Market Trend

Rising Adoption of Remote Monitoring and Digital Solutions

The global market is witnessing a significant trend toward the integration of remote patient monitoring and digital health tools. These technologies support real-time data collection, improve treatment adherence, and enable early intervention by healthcare providers.

Digital platforms allow for continuous assessment of patient health status outside traditional clinical settings, enhancing care personalization and reducing hospitalizations.

As healthcare systems increasingly prioritize cost-effective, home-based care models, the incorporation of connected technologies is expected to enhance operational efficiencies and improve clinical outcomes. This shift is reinforcing peritoneal dialysis as a scalable, patient-centered solution within modern renal care frameworks.

Peritoneal Dialysis Market Report Snapshot

|

Segmentation |

Details |

|

By Modality |

Continuous Ambulatory Peritoneal Dialysis (CAPD), Automated Peritoneal Dialysis (APD) |

|

By Product |

Solution Bags, Machines, Catheters, Transfer Sets, Others |

|

By End User |

Home Care Settings, Hospitals, Independent Dialysis Centers, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Modality (Continuous Ambulatory Peritoneal Dialysis (CAPD) and Automated Peritoneal Dialysis (APD)): The continuous ambulatory peritoneal dialysis (CAPD) segment earned USD 5.52 billion in 2024, mainly due to its lower cost, minimal equipment requirements, and suitability for low-resource settings.

- By Product (Solution Bags, Machines, Catheters, Transfer Sets, and Others): The solution bags segment held a share of 28.08% in 2024, fueled by their high consumption rate and routine usage in every dialysis cycle.

- By End User (Home Care Settings, Hospitals, Independent Dialysis Centers, and Others): The home care settings segment is projected to reach USD 4.99 billion by 2032, owing to the rising preference for home-based dialysis and supportive remote patient management technologies.

Peritoneal Dialysis Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America peritoneal dialysis market accounted for a substantial share of 34.07% in 2024, valued at USD 3.03 billion. This dominance is largely attributed to the widespread adoption of patient-centric care models and a strong shift toward home-based dialysis in the United States and Canada.

The regional market further benefits from an established healthcare ecosystem that prioritizes early-stage kidney disease management, enabling smoother transitions to peritoneal dialysis for eligible patients.

- In March 2025, Strive Health expanded its partnership with Zing Health to deliver value-based kidney care to eligible members across six U.S. states. The collaboration aims to improve outcomes for chronic kidney disease and end-stage kidney disease patients through coordinated care, predictive analytics, and tailored Medicare Advantage benefits.

This collaboration underscores the region’s emphasis on integrated, outcome-driven care approaches that support early intervention and continuity of treatment. The high level of digital literacy, coupled with a robust healthcare infrastructure, supports the adoption of these technologies.

Additionally, the growing emphasis on value-based care is promoting a shift from traditional in-center hemodialysis to more flexible and patient-centered peritoneal dialysis solutions. Regional market expansion is further bolstered by continuous innovation, strong industry presence, and a growing preference for home-based, technology-enabled renal care solutions.

The Asia-Pacific peritoneal dialysis industry is expected to register the fastest CAGR of 6.20% over the forecast period. This growth is primarily driven by the increasing elderly population in densely populated countries, where the prevalence of non-communicable diseases such as diabetes and hypertension is rising.

These conditions significantly elevate the risk of chronic kidney disease and end-stage renal disease, both of which commonly require dialysis treatment.

- In February 2025, the World Health Organization reported that the global population aged 60 and over is projected to double by 2050. In Southeast Asia, this demographic is expected to rise from 77.4 million in 2020 to 173.3 million, marking one of the fastest demographic transitions worldwide.

This demographic shift is fueling demand for peritoneal dialysis as a preferred modality, particularly for elderly patients seeking less invasive and home-based treatment options.

The flexibility and convenience of peritoneal dialysis allow older adults to manage therapy at home, minimizing frequent hospital visits and reducing cardiovascular stress. As awareness increases and infrastructure expands, Asia Pacific is well-positioned to meet the growing demand for elderly-centric renal care solutions.

Regulatory Frameworks

- In the U.S., the Food and Drug Administration (FDA) is the primary regulatory authority for peritoneal dialysis systems and related devices. The FDA ensures the safety and effectiveness of these devices through various regulations and guidelines.

- In Japan, the regulation of peritoneal dialysis, including devices and solutions, falls under the purview of the Ministry of Health, Labour and Welfare (MHLW) and the Pharmaceuticals and Medical Devices Agency (PMDA). The MHLW is responsible for the administrative aspects, including guidance and approvals, while the PMDA focuses on the review of medical products and post-market surveillance.

- In India, the Central Drugs Standard Control Organization (CDSCO) is the regulatory authority for medical devices, including those used in peritoneal dialysis (PD).

Competitive Landscape

The peritoneal dialysis market is characterized by accelerated innovation and increased collaboration among medical device manufacturers and clinical research organizations.

Companies are focusing on developing advanced automated peritoneal dialysis systems that improve ease of use, enhance patient outcomes, and support the shift toward home-based care. To accelerate product development and reduce time-to-market, market players are increasingly engaging in strategic outsourcing partnerships that offer integrated clinical, regulatory, and testing services.

These collaborations streamline development processes and enable faster commercialization of new dialysis technologies. This evolving landscape highlights the industry’s commitment to expanding access, improving therapy delivery, and addressing the rising burden of chronic kidney disease.

- In October 2024, NAMSA and Terumo entered into a strategic outsourcing partnership to accelerate regulatory approval and commercialization of Terumo’s global medical device portfolio, including peritoneal dialysis treatments. NAMSA will provide clinical research, testing, and consulting services to support end-to-end development and faster market access.

- In May 2025, Byonyks received 510(k) clearance from the FDA for its X1 automated peritoneal dialysis (APD) cycler, becoming the third company to obtain such clearance. The device is designed to improve clinical outcomes and expand access to peritoneal dialysis, which offers higher survival rates compared to in-center hemodialysis.

Key Companies in Peritoneal Dialysis Market:

- Baxter

- Fresenius Medical Care AG

- B. Braun SE

- NIPRO

- Medtronic

- Terumo Corporation

- DaVita Inc.

- JMS Co.Ltd.

- Infomed SA

- Polymedicure

- Renax Biomedical Technology Co., Ltd.

- Newsol Technologies Inc.

- Mitra Peritoneal Dialysis System

- Vivance

- CloudCath

Recent Developments (Acquisition)

- In February 2025, Baxter Kidney Care was rebranded as Vantive, an independent vital organ therapy company, following its acquisition by Carlyle. Vantive is committed to advancing home and in-clinic dialysis solutions, including remote patient monitoring technologies, to improve care accessibility, clinical outcomes, and patient experience across over 100 countries.