buyNow

Life Science Instrumentation Market

Life Science Instrumentation Market Size, Share, Growth & Industry Analysis, By Technology (Spectroscopy, Chromatography, Flow Cytometry, Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Microscopy, Liquid Handling, Electrophoresis, Cell Counting, Others), By Application, By End User & Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

The market comprises analytical and measurement technologies used to support research, diagnostics, and industrial applications in life sciences.

It includes a wide range of instruments categorized by technology such as spectroscopy, chromatography, flow cytometry, next generation sequencing (NGS), polymerase chain reaction (PCR), microscopy, liquid handling systems, electrophoresis, cell counting tools, and other specialized systems. The market serves multiple applications, primarily research and clinical

Life Science Instrumentation Market Overview

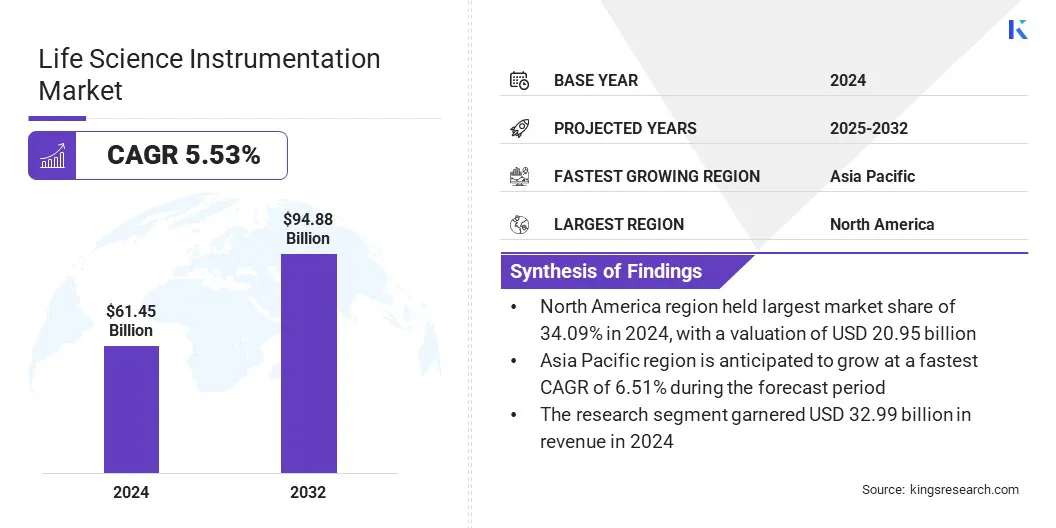

The global life science instrumentation market size was valued at USD 61.45 billion in 2024 and is projected to grow from USD 64.71 billion in 2025 to USD 94.88 billion by 2032, exhibiting a CAGR of 5.53% during the forecast period.

Growth is driven by the rising demand for advanced technologies, such as ultra-high-resolution optical coherence tomography (OCT) spectrometers, which enable deeper and more accurate imaging for advanced clinical and research applications.

There is also a notable shift toward the integration of spectrometers into smartphones, allowing portable diagnostics and expanding the scope of real-time, point-of-care testing.

Key Market Highlights:

- The life science instrumentation industry size was valued at USD 61.45 billion in 2024.

- The market is projected to grow at a CAGR of 5.53% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 20.95 billion.

- The spectroscopy segment garnered USD 7.69 billion in revenue in 2024.

- The research segment is expected to reach USD 49.13 billion by 2032.

- The pharma & biotech companies segment is expected to reach USD 31.24 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 6.51% during the forecast period.

Major companies operating in the life science instrumentation market are METTLER TOLEDO, Sartorius AG, Illumina, Inc., Shimadzu Corporation, Bruker, JEOL Ltd., Thermo Fisher Scientific Inc., HORIBA, Ltd., Agilent Technologies, Inc., Siemens, Bio-Rad Laboratories, Inc., DH Life Sciences, LLC., Tecan Trading AG, PerkinElmer, F. and Hoffmann-La Roche Ltd.

Manufacturers are introducing automated, integrated, and standardized workflows to reduce manual processes and improve consistency.

These systems combine sample preparation, analysis, and data handling which enables uniform performance across labs. This shift supports reliable and high-throughput testing for applications such as therapeutic drug monitoring and clinical biomarker analysis.

- In December 2024, Roche secured the CE mark certification for its Cobas Mass Spec solution, which includes the Ionify reagent pack and Cobas i 601 analyser. The platform offers an automated, standardized, and integrated workflow designed for clinical mass spectrometry testing using IVDR-compliant assays.

Market Driver

Rising Demand for Ultra High-resolution Optical Coherence Tomography (OCT) Spectrometers

The market is driven by the rising demand for ultrahigh-resolution Optical Coherence Tomography (OCT) spectrometers. Theseinstruments offer exceptional imaging depth and resolution, essential for detailed visualization of biological tissues.

Their ability to deliver non-invasive and cross-sectional imaging with micrometer-level precision supports their widespread use in ophthalmology, oncology, and advanced research applications.

As research institutions and clinical centers demand enhanced imaging capabilities, ultrahigh-resolution OCT spectrometers are becoming a key factor shaping research expansion.

- In June 2025, Wasatch Photonics introduced the Cobra-D, an ultrahigh-resolution OCT spectrometer for extended imaging depths, using the 800 nm spectral domain OCT. The compact system features a configurable optomechanical bench for volume manufacturing and delivers imaging depths over 14 mm without costly InGaAs detectors.

Market Challenge

High Equipment Costs

A major challenge in the life science instrumentation market is the high cost of advanced instruments particularly systems used for next-generation sequencing, high-resolution spectroscopy, and automated liquid handling.

These technologies require significant capital investment, which limits access for smaller research labs, academic institutions, and healthcare facilities in emerging markets. The high upfront and maintenance costs can delay procurement and adoption, limiting market expansion.

To address this, manufacturers are offering modular instrument designs, leasing options, and collaborative purchase programs. These approaches help reduce financial burden and expand accessibility, supporting broader market penetration across varying customer segments.

Market Trend

Shift Toward the Integration of Spectrometers into Smartphones

The market is experiencing a shift toward the integration of spectrometers into smartphones, enabling real-time and portable diagnostics outside traditional laboratory settings.

This allows users to conduct on-site analysis for clinical diagnostics, environmental monitoring, and food safety. Miniaturized spectrometers are also being developed to deliver precise and real-time results by capitalizing on smartphone hardware and connectivity upgrades.

This shift supports decentralized testing, enhances accessibility in remote areas, and aligns with the industry's move toward compact, point-of-care instrumentation.

- In October 2023, trinamiX GmbH launched its first consumer spectroscopy solution for smartphones powered by the Snapdragon 8 Gen 3 platform. The near-infrared (NIR) spectrometer, covering the 1–3 µm wavelength range, enables non-invasive biomarker measurement directly through mobile devices.

Life Science Instrumentation Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Spectroscopy, Chromatography, Flow Cytometry, Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Microscopy, Liquid Handling, Electrophoresis, Cell Counting, Others |

|

By Application |

Research, Clinical |

|

By End User |

Pharma & Biotech companies, Agri and Food Industry, Diagnostic Labs, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Technology (Spectroscopy, Chromatography, Flow Cytometry, Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), Microscopy, Liquid Handling, Electrophoresis, Cell Counting, and Others): The spectroscopy segment earned USD 7.69 billion in 2024, due to its wide use in molecular analysis and drug development.

- By Application (Research, and Clinical): The research segment held 53.68% of the market in 2024, due to the rising investments in drug discovery and academic research.

- By End User (Pharma & Biotech companies, Agri and Food Industry, Diagnostic Labs, and Others): The pharma & biotech companies segment is projected to reach USD 31.24 billion by 2032, owing to increased R&D activities and demand for precision instruments.

Life Science Instrumentation Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America life science instrumentation market share stood at 34.09% in 2024, with a valuation of USD 20.95 billion. This dominance is due to the strong presence of companies offering advanced technology platforms, particularly in NGS. U.S. based manufacturers have developed high-performance benchtop sequencing systems with faster run times and streamlined workflows.

These technologies are being widely adopted across academic, clinical, and commercial research labs, supporting large-scale genomic studies, personalized medicine, and diagnostics. The presence of well-established research institutions and consistent funding for life sciences further help the North American market.

- In October 2024, Illumina, Inc. launched the MiSeq i100 Series, a new line of benchtop sequencing systems designed to simplify and accelerate next-generation sequencing (NGS) for laboratories. The MiSeq i100 and MiSeq i100 Plus systems offer affordable, easy-to-use solutions with room-temperature kit storage and same-day sample-to-analysis capability.

Asia Pacific is poised to grow at a CAGR of 6.51% over the forecast period. Growth is driven by rising government investments in scientific research and healthcare infrastructure.

China, India, and South Korea are expanding their genomic research programs and upgrading laboratory capabilities to meet global standards. The push toward domestic biotechnology development and the growing demand for diagnostic technologies are fueling the product adoption.

The rapid expansion of biopharma manufacturing hubs in countries such as India and China is also supporting demand across both research and clinical segments.

- In March 2024, Wipro GE Healthcare announced a strategic investment exceeding USD 935.5 million for the next 5 years to enhance local manufacturing and R&D capabilities. With India’s hospital sector comprising 80% of the healthcare market and attracting robust global and domestic investment, this move strengthens Wipro GE’s supply chain resilience and addresses rising MedTech demand.

Regulatory Frameworks

- In the U.S., life science instruments are regulated by the Food and Drug Administration (FDA) under Title 21 CFR Part 820 (Quality System Regulation). Diagnostic instruments must comply with the Clinical Laboratory Improvement Amendments (CLIA) and may require 510(k) clearance or Premarket Approval (PMA).

- In Europe, instruments used for diagnostics fall under the In Vitro Diagnostic Medical Devices Regulation (IVDR) (EU) 2017/746, which mandates CE marking and compliance based on a risk-classification system.

- In Japan, the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour and Welfare (MHLW) regulate instruments under the Pharmaceutical and Medical Device Act (PMD Act), based on risk classification and conformity to Japanese standards.

Competitive Landscape

Key players in the life science instrumentation market are focusing on the development and commercialization of advanced Molecular Rotational Resonance (MRR) instruments to strengthen their market position.

Companies are investing to expand molecular rotational resonance technology to analytical workflows for pharmaceutical and biopharmaceutical applications, targeting its potential in chiral analysis and molecular structure identification.

Strategic efforts include integrating MRR systems with existing spectroscopy platforms and enhancing automation to improve throughput and data accuracy. These strategies aim to position MRR as a complementary or alternative solution to traditional methods like Nuclear Magnetic Resonance (NMR) and mass spectrometry in complex molecular analysis.

- In March 2025, BrightSpec launched the BrightSpec-MRR product suite at PittCon 2025, marking the first commercial release of Molecular Rotational Resonance instruments in over 50 years. The suite includes the isoMRR, spectraMRR, and nanoMRR systems, offering high molecular specificity without complex sample preparation.

Key Companies in Life Science Instrumentation Market:

- METTLER TOLEDO

- Sartorius AG

- Illumina, Inc.

- Shimadzu Corporation

- Bruker

- JEOL Ltd.

- Thermo Fisher Scientific Inc.

- HORIBA, Ltd.

- Agilent Technologies, Inc.

- Siemens

- Bio-Rad Laboratories, Inc.

- DH Life Sciences, LLC.

- Tecan Trading AG

- PerkinElmer

- F. Hoffmann-La Roche Ltd.

Recent Developments (Product Launch)

- In January 2025, Bruker Corporation launched the LUMOS II ILIM, a QCL-based infrared imaging microscope. The system enables rapid,high-resolution IR imaging for pharma and life science research. It includes AI-driven data evaluation and a coherence reduction method, supporting multimodal tissue imaging and automated pharmaceutical inspections.

- In May 2024, Agilent Technologies Inc. launched the NovoCyte Opteon Spectral Flow Cytometer. The system supports up to 73 detectors and enables high-dimensional flow cytometry with simplified workflows, enhancing applications in research, drug discovery, and therapy development.