buyNow

Industrial Gearbox Market

Industrial Gearbox Market Size, Share, Growth & Industry Analysis, By Type (Helical Gearbox, Bevel Gearbox, Worm Gearbox, Planetary Gearbox, Others), By Design (Parallel Axis, Angled Axis, Others), By End-use Industry (Telecom, Oil & Gas, Military & Aerospace, BFSI), and Regional Analysis, 2025-2032

pages: 160 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

An industrial gearbox is used to transmit power and control speed and torque in heavy-duty machinery in industrial applications. The market focuses on the production and application of these systems in manufacturing, energy, and logistics sectors.

It supports automation, enhances efficiency, and ensures machinery performance in complex processes. This report outlines the primary drivers of market growth, emerging trends, and evolving regulations shaping the industry.

Industrial Gearbox Market Overview

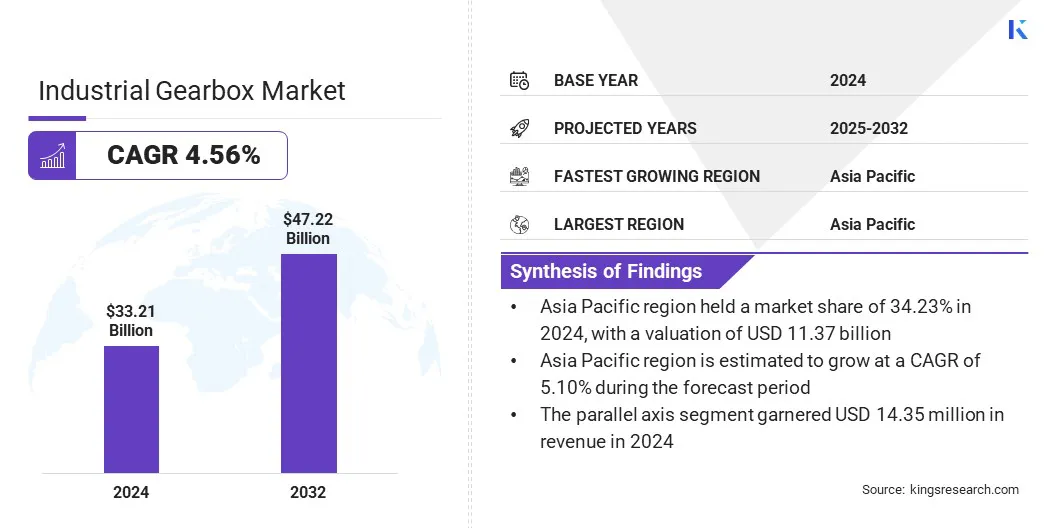

The global industrial gearbox market size was valued at USD 33.21 billion in 2024 and is projected to grow from USD 34.56 billion in 2025 to USD 47.22 billion by 2032, exhibiting a CAGR of 4.56% during the forecast period.

The market is growing with the growing demand for automation.Gearboxes play a crucial role in delivering accurate motion control and efficient power transmission. Technological advances are introducing smart gearboxes that enable real-time monitoring and predictive maintenance for enhanced reliability.

Key Highlights:

- The industrial gearbox industry size was recorded at USD 33.21 billion in 2024.

- The market is projected to grow at a CAGR of 4.56% from 2025 to 2032.

- Asia Pacific held a market share of 34.23% in 2024, with a valuation of USD 11.37 billion.

- The helical gearbox segment garnered USD 12.13 billion in revenue in 2024.

- The parallel axis segment is expected to reach USD 20.17 billion by 2032.

- The telecom segment is anticipated to witness the fastest CAGR of 5.37% during the forecast period.

- North America is anticipated to grow at a CAGR of 4.71% during the forecast period.

Major companies operating in the global industrial gearbox market are Siemens AG, Bonfiglioli Mechatronic Research S.p.A., Bondioli & Pavesi S.p.A., Dana Incorporated, Sumitomo Heavy Industries, Ltd., ZF Friedrichshafen AG, Emerson Electric Co., Kumera Corporation, Johnson Electric Holdings Limited, Rotork Digital Services, Renold, Triveni Engineering & Industries Ltd., P G Drive, GearTec, and Elecon Engineering Company Limited.

The market is experiencing growth due to increasing investments in renewable energy, particularly wind power. The expansion of wind energy capacity to meet sustainability goals is driving the demand for high-performance gearboxes in wind turbines.

These gearboxes convert wind energy into electrical power. Therefore, with wind power becoming one of the leading sources of renewable electricity, sustained investment in this sector is driving the need for industrial gearboxs.

- The International Energy Agency reported that in 2023, wind power investment grew by 20%, reaching a record USD 180 billion, the second highest among all power generation technologies. Wind electricity generation rose by 216 TWh to exceed 2,330 TWh. To meet Net Zero targets, annual capacity additions increased from 115 GW in 2023 to 340 GW by 2030, demanding enhanced policy and private-sector efforts.

Market Driver

Rising Demand for Automation in High-Tech Industries

The industrial gearbox market is driven by the rising demand for automation across manufacturing, logistics, and processing industries. With the shift toward smart factories and autonomous systems, industries are seeking accurate motion control and dependable power transmission.

Industrial gearboxes fulfill this need by providing efficient torque management and precise speed regulation, which are vital for the performance of automated machinery. The integration of robotics, conveyor systems, and CNC machines further amplifies product demand, supporting continuous production, reducing downtime, and enhancing overall operational efficiency in automated industrial environments.

- In June 2023, Schaeffler showcased its comprehensive range of precision bearings, strain wave gears, planetary gearboxes, and modular drives for robotics and industrial automation at automatica 2023. Highlights included PSC planetary gearboxes for higher torque applications.

Market Challenge

High Initial Cost of Advanced Gearbox Systems

The industrial gearbox market faces a significant challenge due to the high initial cost of advanced gearbox systems. These systems often incorporate precision engineering, high-performance materials, and smart monitoring technologies, which increases their upfront cost. This hinders adoption for small and mid-sized enterprises.To address this, companies are offering modular gearbox designs that reduce production complexity and cost.

Some manufacturers are also coming up with leasing models or flexible financing options to ease the financial burden on buyers. Investments in local manufacturing and automation are also helping reduce production expenses, making advanced gearboxes more accessible to a broader market.

Market Trend

Integration of Smart Gearbox

The industrial gearbox market is experiencing a significant trend: Smart gearboxes featuring advanced sensors and real-time monitoring systems. Smart gearboxes use predictive maintenance to minimize unplanned downtime and enhance overall efficiency.

As industries adopt more automated and connected systems, smart gearboxes play a crucial role in delivering data on torque, temperature, and vibration. This enables better asset management, improved equipment reliability, and reduced lifecycle costs, aligning with the broader shift toward intelligent, performance-driven industrial operations.

- For instance, in April 2025, Schaeffler showcased a new co-axial gearbox with an integrated bevel gear differential, offering up to 98.7% efficiency, reduced installation space, and lower weight. The hybrid engine exhibit will highlight advanced components relevant to the market, including a spoke damper and electric cam phasing unit designed to enhance system performance and integration.

Industrial Gearbox Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Helical Gearbox, Bevel Gearbox, Worm Gearbox, Planetary Gearbox, Others |

|

By Design |

Parallel Axis, Angled Axis, Others |

|

By End-use Industry |

Telecom, Oil & Gas, Military & Aerospace, BFSI, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Helical Gearbox, Bevel Gearbox, Worm Gearbox, Planetary Gearbox, and Others): The helical gearbox segment earned USD 12.13 billion in 2024, due to its high efficiency, smooth operation, and widespread adoption in heavy-duty industrial applications.

- By Design (Parallel Axis, Angled Axis, and Others): The parallel axis segment held 43.21% of the market in 2024, owing to its compact design, high load-carrying capacity, and suitability for a wide range of industrial machinery.

- By End-use Industry (Telecom, Oil & Gas, Military & Aerospace, and BFSI): The telecom segment is projected to reach USD 17.17 billion by 2032, due to increasing demand for high-performance gear systems in network infrastructure and data center equipment.

Industrial Gearbox Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

Asia Pacific industrial gearbox industry share stood at 34.23% in 2024 in the global market, with a valuation of USD 11.37 billion. Asia Pacific dominates the market primarily due to rapid industrialization and the expansion of manufacturing sectors across China, India, and Japan.

Additionally, significant investments in infrastructure development and automation technologies are accelerating demand for efficient power transmission systems. These factors, combined with the presence of major production hubs and favorable policies supporting industrial growth, position the region as a key contributor to global market growth.

North America Industrial gearbox market is poised to grow at a significant CAGR of 4.71% over the forecast period. The growth is driven by the rapid adoption of advanced automation technologies in manufacturing and heavy industries. Additionally, the increasing demand for energy-efficient and high-performance transmission systems across mining, oil and gas, and renewable energy is accelerating market growth.

The presence of well-established industry players and consistent investment in upgrading industrial infrastructure further supports the region’s leadership in innovation and deployment of modern gearbox solutions across diverse industrial applications.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) regulates industrial gearboxes by enforcing safety standards related to machinery operation, maintenance, and worker protection, ensuring that equipment, including gear systems, complies with industrial safety regulations and protocols.

- In India, the Bureau of Indian Standards (BIS) regulates quality and safety standards for industrial gearboxes, while the Ministry of Heavy Industries oversees policy formulation and promotes growth and compliance within the heavy engineering and industrial equipment sector.

Competitive Landscape

Companies in the industrial gearbox industry are actively pursuing growth through strategic initiatives such as mergers, acquisitions, and product launches. Key players are expanding their portfolios by introducing next-generation gearboxes and precision systems for various industrial applications. Additionally, partnerships and geographic expansions are being implemented to strengthen global presence and manufacturing capabilities.

These actions reflect a competitive landscape focused on innovation, consolidation, and portfolio diversification to enhance market positioning and respond to evolving industrial automation demands.

- In March 2023, ZF Witten launched its next-generation Redulus4F industrial gearbox series, featuring a compact, flexible design that enhances load capacity and performance for mining and construction applications. The launch includes advanced serviceability solutions enabled by the ProVID Condition Monitoring System, offering rapid maintenance response.

List of Key Companies in Industrial Gearbox Market:

- Siemens AG

- Bonfiglioli Mechatronic Research S.p.A.

- Bondioli & Pavesi S.p.A.

- Dana Incorporated

- Sumitomo Heavy Industries, Ltd.

- ZF Friedrichshafen AG

- Emerson Electric Co.

- Kumera Corporation

- Johnson Electric Holdings Limited

- Rotork Digital Services

- Renold

- Triveni Engineering & Industries Ltd.

- P G Drive

- GearTec

- Elecon Engineering Company Limited

Recent Developments (Product Launch)

- In December 2023, Mill Gears Pvt. Ltd. launched the world’s largest gearbox for sugar mills, marking a major advancement in industrial engineering. Installed at Jaranandeshwar Sugar Mill in Maharashtra, the gearbox enhances operational capacity to 24,000 tons of sugarcane per day. This innovation sets a new industry benchmark, delivering exceptional efficiency, durability, and performance for large-scale sugar mill operations globally.

- In September 2023, Schaeffler expanded its machine tool portfolio by introducing precision strain wave gear series RT1 and RT2, along with PSC precision planetary gearboxes. These gear units support torque ranges from 28 to 5000 Nm, offering flexibility for applications in C and A axes of milling heads, rotary tables, and swiveling units.