buyNow

Hydraulic Cylinder Market

Hydraulic Cylinder Market Size, Share, Growth & Industry Analysis, By Product Type (Welded Cylinders, Tie-Rod Cylinders, Telescopic Cylinders, Others), By Bore Size (< 50 mm, 50-150 mm, > 150 mm), By Application (Mobile Equipment, Industrial Equipment), By Function, and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

A hydraulic cylinder is a mechanical actuator that converts pressurized hydraulic fluid into linear motion and force. It consists of a cylindrical barrel, piston, and piston rod. Hydraulic cylinders are widely used in construction equipment, manufacturing systems and automotive applications due to their durability and high force output.

Hydraulic Cylinder Market Overview

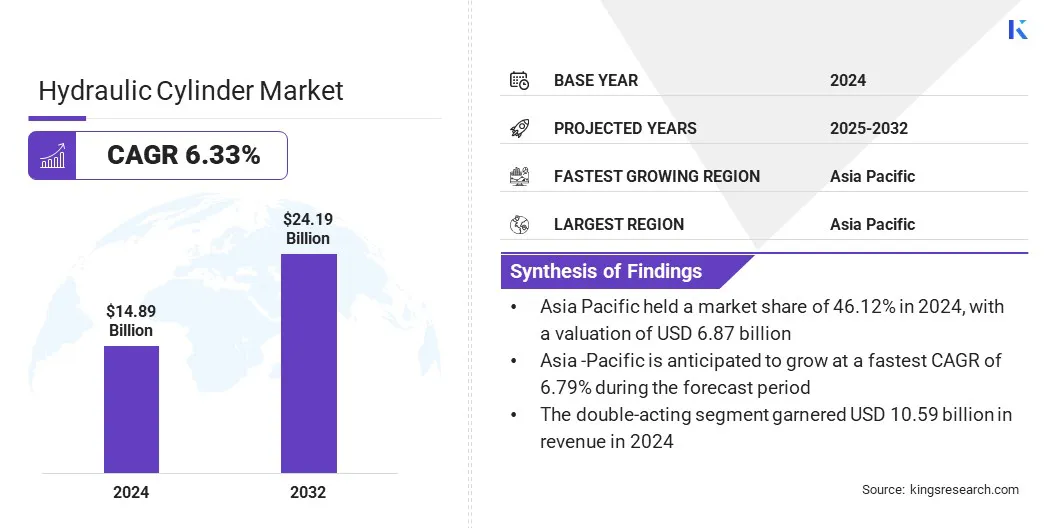

The global hydraulic cylinder market size was valued at USD 14.89 billion in 2024 and is projected to grow from USD 15.75 billion in 2025 to USD 24.19 billion by 2032, exhibiting a CAGR of 6.33% during the forecast period. This growth is attributed to the surge in construction activities, which is increasing demand for hydraulic cylinders used in heavy-duty equipment for lifting, pushing, and material handling operations.

This growth is further supported by the development of Customization and modular design of cylinders are helping meet diverse application needs across industries such as construction, agriculture, and material handling. These features enable greater operational efficiency and flexibility in equipment integration.

Major companies operating in the hydraulic cylinder industry are Eaton, Parker Hannifin Corp, Aggressive Hydraulics, Inc, HYDAC International GmbH, Bosch Rexroth AG, Ortman Fluid Power, Inc, Caterpillar, ENERPAC, KYB Americas Corporation, Wipro, Jiangsu Hengli Hydraulic Co., LTD, Perfection Hydraulics Inc, SMC Corporation, Texas Hydraulics, and Hydro Tech.

The surging adoption of industrial robots is dueling demand for hydraulic cylinders that deliver high-force, precise motion in robotic and material-handling systems. Market growth is further supported by the expanding automation in manufacturing, logistics and automotive industries.

- According to the International Federation of Robotics, 541,302 industrial robots were installed globally in 2023, increasing the global total to over 4.28 million units. This surge in automation is boosting demand for hydraulic cylinders used in heavy-duty robotic and material-handling systems with high force and precision.

Key Highlights:

- The hydraulic cylinder industry size was recorded at USD 14.89 billion in 2024.

- The market is projected to grow at a CAGR of 6.33% from 2025 to 2032.

- Asia-Pacific held a share of 46.12% in 2024, valued at USD 6.87 billion.

- The welded cylinders segment garnered USD 7.76 billion in revenue in 2024.

- The 50–150 mm segment is expected to reach USD 15.01 billion by 2032.

- The industrial equipment segment is anticipated to grow at a CAGR of 6.84% over the forecast period.

- The double-acting segment held a share of 71.09% in 2024.

- North America is anticipated to grow at a CAGR of 6.19% through the projection period.

Market Driver

Surge in Construction Activities

The hydraulic cylinder market is experiencing strong growth with the increasing construction spending in infrastructure and commercial projects. This investment is prompting contractors to upgrade to advanced hydraulic cylinders that offer enhanced durability, load capacity, and control.

Hydraulic cylinders are valued for their high force output and reliability, and are vital components in excavators, bulldozers, and cranes. Demand continues to rise for robust and precise actuation solutions across residential, commercial, and industrial construction segments.

- According to the U.S. Census Bureau, construction spending in April 2025 reached a seasonally adjusted annual rate of USD 2,152.4 billion. The rising use of hydraulic cylinders in heavy machinery such as excavators, loaders, and cranes is boosting demand.

Market Challenge

High Maintenance Costs

High maintenance costs are limiting the adoption of hydraulic cylinders in clean or sensitive environments such as food processing and pharmaceutical manufacturing.

These systems require regular servicing, which affects operational flow and leads to increased downtime, making them unsuitable for applications requiring consistency and minimal intervention. Precision-focused industries are shifting toward alternative actuation technologies that offer lower maintenance and more reliable performance.

To address this challenge, market players are developing hydraulic cylinders with improved sealing technologies and wear-resistant materials to extend service life and reduce maintenance frequency. They are also integrating condition monitoring sensors that enable predictive maintenance to help users identify issues before failures occur.

Additionally, manufacturers are designing compact and modular cylinders that simplify servicing and replacement to improve overall system uptime and make hydraulic solutions more suitable for sensitive, performance-critical environments.

Market Trend

Demand for Customization and Modular Design

Customization and modular design are gaining traction as industries demand hydraulic cylinders tailored to specific operational needs. Manufacturers are developing flexible cylinder systems that allow quick adaptation across applications without the need for complete redesign. These approaches reduce production time, improve compatibility, and meet diverse industry requirements, from agriculture to construction.

Market players are offering modular components and custom features to improve product versatility, support varied conditions, and simplify inventory and maintenance.

- In September 2024, Idroteck Srl launched a digital product catalog for hydraulic cylinders on the CADENAS platform to improve accessibility for design engineers. The catalog features compact short-stroke cylinders, double-acting rod cylinders, and custom hydraulic solutions, enabling streamlined selection and integration of components into industrial applications while supporting digital transformation in hydraulic system design.

Hydraulic Cylinder Market Report Snapshot

|

Segmentation |

Details |

|

By Product Type |

Welded Cylinders, Tie-Rod Cylinders, Telescopic Cylinders, Others |

|

By Bore Size |

< 50 mm, 50–150 mm, > 150 mm |

|

By Application |

Mobile Equipment, Industrial Equipment |

|

By Function |

Double-Acting, Single-Acting |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Product Type (Welded Cylinders, Tie-Rod Cylinders, Telescopic Cylinders, and Others): The welded cylinders segment earned USD 7.76 billion in 2024, mainly due to their high strength, compact design, and suitability for heavy-duty mobile applications.

- By Bore Size (< 50 mm, 50–150 mm, and > 150 mm): The 50–150 mm segment held a share of 62.07% in 2024, fueled by its widespread usage across construction, agriculture, and material-handling equipment.

- By Application (Mobile Equipment and Industrial Equipment): The mobile equipment segment is projected to reach USD 13.36 billion by 2032, owing to the rising deployment of hydraulic cylinders in excavators, loaders and lifting machinery.

- By Function (Double-Acting and Single-Acting): The single-acting segment is anticipated to grow at a CAGR of 6.81% over the forecast period, propelled by its cost-effectiveness and suitability for simple lifting or pressing operations.

Hydraulic Cylinder Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The Asia-Pacific hydraulic cylinder market accounted for a share of 46.12% in 2024, valued at USD 6.87 billion. This dominance is reinforced by the region’s growing industrialization and the rapid expansion of manufacturing and construction activities. Companies are increasing regional production capacity and technological capabilities through strategic acquisitions.

A strong supplier base and rising demand for customized hydraulic solutions are further prompting international players to invest in the regional market. Additionally, regional manufacturers are building integrated capabilities that cover design, testing, and distribution processes. This supports the production of complex and application-specific hydraulic systems.

- In August 2024, PMC Hydraulics Group acquired the remaining shares of Hydroquip Hydraulics, a Bangalore-based company specializing in hydraulic components and customized manifold solutions. This acquisition aims to strengthen PMC’s market presence by leveraging Hydroquip’s regional expertise and manufacturing capabilities, while enhancing service delivery and product innovation across South Asia.

The North America hydraulic cylinder industry is set to grow at a CAGR of 6.19% over the forecast period. This growth is propelled by the region’s expanding construction and waste management sectors, which are increasingly adopting hydraulic-powered equipment.

The regional market is further benefiting from rising investments in manufacturing infrastructure as market players are acquiring regional hydraulic cylinder producers to ensure component availability and enhance production control. Manufacturers are scaling operations to meet application-specific performance needs amid rising demand for specialized heavy-duty vehicles.

Moreover, the domestic market is experiencing continued expansion as companies focus on regional growth strategies to minimize supply chain disruptions and accelerate delivery timelines. The establishment of new production facilities across the region is further supporting growth by enabling quicker responses to local demand and supporting the integration of hydraulic systems into advanced vehicle and equipment platforms.

- In June 2025, Wastequip acquired Foster Hydraulics, a Kentucky-based hydraulic cylinder manufacturer, to expand operations on the U.S. East Coast. The acquisition boosts Wastequip’s in-house cylinder production capabilities, reduces lead times, and supports the launch of a new collection body plant.

Regulatory Frameworks

- In the U.S., the Occupational Safety and Health Administration (OSHA) regulates the safety standards of hydraulic systems, including cylinders used in industrial and construction equipment. It oversees equipment installation, pressure ratings, fluid compatibility, and worker safety.

- In China, the State Administration for Market Regulation (SAMR) governs hydraulic cylinder manufacturing under equipment safety and product quality laws. It regulates standards for structural integrity, material use, and performance certification. The authority oversees inspections, enforces recall policies, and ensures manufacturers meet technical benchmarks for domestic use and international export, promoting reliability and industrial safety.

- In India, the Bureau of Indian Standards (BIS) regulates hydraulic cylinders under the Indian Standards framework, ensuring conformance to safety, pressure tolerance, and material specifications. It certifies manufacturers, monitors quality control, and enforces labeling norms. BIS aims to maintain performance consistency, enable export readiness, and protect users through stringent compliance in the hydraulic equipment segment.

- In the UK, the Health and Safety Executive (HSE) oversees safety regulations related to hydraulic cylinders under the Pressure Systems Safety Regulations (PSSR). It mandates regular inspection, safe installation, and maintenance protocols.

Competitive Landscape

Major players in the hydraulic cylinder industry are acquiring regional manufacturers to strengthen their presence in key international markets and expand their global presence. They are focusing on enhancing production capabilities to support growing demand from the industrial and construction sectors.

By integrating localized expertise and infrastructure, firms are improving operational efficiency and reducing supply chain dependencies, which enhances their ability to meet regional demand with faster delivery and customized solutions. These strategies are focused on increasing competitiveness, broadening application areas, and addressing evolving customer requirements across diverse markets.

- In August 2024, Wipro Infrastructure Engineering acquired full ownership of U.S.-based Columbus Hydraulics to strengthen its presence in North America and expand its global footprint in hydraulic cylinder production for industrial and construction applications.

List of Key Companies in Hydraulic Cylinder Market:

- Eaton

- Parker Hannifin Corp

- Aggressive Hydraulics, Inc

- HYDAC International GmbH

- Bosch Rexroth AG

- Ortman Fluid Power, Inc

- Caterpillar

- ENERPAC

- KYB Americas Corporation

- Wipro

- Jiangsu Hengli Hydraulic Co., LTD

- Perfection Hydraulics Inc

- SMC Corporation

- Texas Hydraulics

- Hydro Tech

Recent Developments (M&A/Expansion)

- In October 2024, Motion Industries acquired Canada-based Stoney Creek Hydraulics to enhance its service offerings in the region. The acquisition adds custom hydraulic and pneumatic cylinder manufacturing and repair services, supporting OEM production and MRO demands across industrial sectors.

- In August 2024, Wipro Hydraulics opened its sixth manufacturing facility in Jaipur to expand production capacity and strengthen regional operations. The company aims to meet growing demand from the industrial and construction sectors while improving supply efficiency and reducing lead times across North India.