buyNow

Horticulture Lighting Market

Horticulture Lighting Market Size, Share, Growth & Industry Analysis, By Technology (Fluorescent, High-Intensity Discharge, Light Emitting Diodes), By Cultivation Type (Fruits & Vegetables, Cannabis, Floriculture), By Lighting Type (Toplighting, Interlighting), By Application, and Regional Analysis, 2025-2032

pages: 180 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Horticulture lighting refers to artificial lighting systems engineered to support plant growth by delivering light spectra suitable for photosynthesis and plant development, utilizing light emitting diodes (LEDs), high-pressure sodium (HPS), or compact fluorescent lamps (CFLs).

The market includes lighting fixtures, spectrum control technologies, automation systems, and related installation & maintenance services used in Controlled Environment Agriculture (CEA). The services include greenhouses, indoor farms, and vertical farming setups.

This market encompasses dynamic spectrum lighting, energy-optimized luminaires, and intelligent lighting controls, catering to diverse crop requirements. These solutions are widely adopted by commercial growers, research facilities, and agritech operations to improve productivity, crop quality, and sustainability.

Horticulture Lighting Market Overview

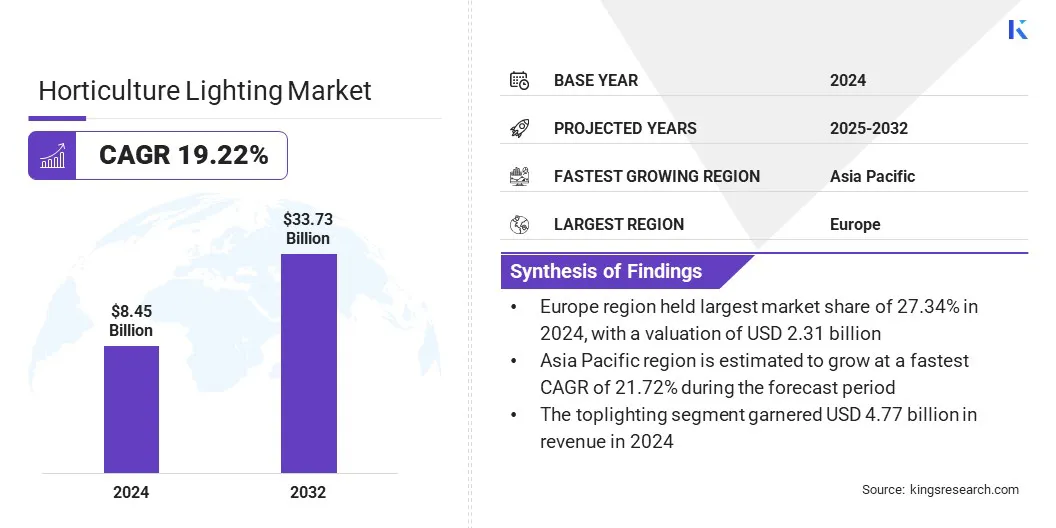

The global horticulture lighting market size was valued at USD 8.45 billion in 2024 and is projected to grow from USD 9.85 billion in 2025 to USD 33.73 billion by 2032, exhibiting a CAGR of 19.22% during the forecast period. This growth is attributed to rising corporate investments and strategic initiatives in controlled-environment agriculture, coupled with an increasing shift toward LED lighting solutions to enhance energy efficiency, crop productivity, and sustainability.

Rising awareness of precision farming and smart agriculture techniques is significantly accelerating the adoption of horticulture lighting solutions. These modern farming approaches rely on real-time data, automated systems, and sensor-based monitoring to optimize plant growth conditions, where advanced lighting technologies serve as a critical input.

Key Highlights:

- The horticulture lighting industry size was valued at USD 8.45 billion in 2024.

- The market is projected to grow at a CAGR of 19.22% from 2025 to 2032.

- Europe held a market share of 37.23% in 2024, with a valuation of USD 3.15 billion.

- The light emitting diodes segment garnered USD 3.39 billion in revenue in 2024.

- The interlighting segment is expected to reach USD 17.94 billion by 2032.

- The toplighting segment secured the largest revenue share of 56.43% in 2024.

- The vertical farming segment is poised for a robust CAGR of 21.04% through the forecast period.

- The market in Asia Pacific is anticipated to grow at a CAGR of 21.72% during the forecast period.

Major companies operating in the Horticulture Lighting industry are Signify Holding, Scotts, Heliospectra, ams-OSRAM AG, California LightWorks, Valoya, Hortilux Schréder, ILUMINAR Lighting LLC., Savant Technologies LLC., Acuity Inc., Lumileds Holding B.V.,Cree LED, TCP Lighting, Oreon Holding BV, and Black Dog Horticulture Technologies & Consulting.

As growers increasingly shift toward controlled environment agriculture, the demand for tailored lighting systems capable of regulating light spectra, intensity, and duration has grown, thereby driving consistent yield improvement and resource efficiency.

Horticulture lighting providers are focusing on integrating smart technologies into LED systems, enabling precise control and remote operability. Moreover, manufacturers are developing AI-enabled lighting platforms and adaptive systems that align with crop-specific requirements, enhancing productivity and reducing energy costs.

This alignment, along with evolving agricultural practices, is reinforcing product relevance and expanding market opportunities across commercial greenhouses and vertical farming facilities.

Market Driver

Surging Corporate Investment and Strategic Growth Initiatives

Increasing corporate investments, including funding for infrastructure and research & development by agri-tech companies in greenhouse projects, is significantly driving the horticulture lighting market. These initiatives are accelerating the deployment of high-efficiency lighting technologies, intelligent environmental controls, and climate-resilient farming infrastructures, thereby maintaining steady demand for advanced lighting solutions in controlled-environment agricultural systems.

Lighting solution providers are actively launching crop-specific LED platforms, forming strategic partnerships, and expanding their production & distribution footprints across high-growth regions. These efforts are advancing technology access, enabling sustainable farming, and accelerating the growth of the market.

- In February 2025, Heliospectra AB released its 2024 Year-End Report highlighting strategic investments in greenhouse lighting technology, including custom optics and high-wattage MITRA X solutions, with trial installations at Tomato World (Netherlands) and Nature Fresh (U.S.). These initiatives represent rising investments in greenhouse-focused agri-tech, propelling the adoption of horticulture lighting.

Market Challenge

Absence of Standardized Performance Metrics and Testing Protocols

The lack of standardization in product performance and testing protocols poses significant challenges in the horticulture lighting market. Variations in metrics such as photosynthetic photon flux (PPF), spectral output, and energy efficiency across manufacturers create confusion among end users and complicate purchasing decisions.

This inconsistency affects buyer confidence, reduces transparency in product comparison, and delays large-scale procurement, especially in commercial farming operations.

Manufacturers are aligning their products with globally recognized horticultural lighting standards such as those established by the American Society of Agricultural and Biological Engineers (ASABE) and DesignLights Consortium (DLC).

Companies are focusing on increasing transparency by providing detailed performance data, third-party certifications, and standardized testing documentation. Producers aim to build credibility, improve comparability across product offerings, and accelerate customer decision-making in the competitive market.

Market Trend

Shift Toward LED Lighting Solutions

The horticulture lighting market is registering a significant shift toward LED technology, as growers are increasingly replacing traditional high-pressure sodium (HPS) and fluorescent systems with energy-efficient LED solutions. This transition is driven by superior energy performance, longer operational lifespan, and customizable spectral output of LEDs, which enable precise control over plant growth environments.

LED lighting reduces electricity consumption while enhancing crop quality and yield consistency. This shift supports cost optimization, improving sustainability metrics, and encouraging large-scale adoption across commercial greenhouses and vertical farms. This transition continues to define a key trend in the market, shaping product innovation and influencing lighting system preferences across advanced cultivation environments.

- In June 2025, Bloemteknik launched Top Crop, a fully adjustable multi-channel LED platform for high-wire crop cultivation that offeris real-time spectral control and maximised PAR efficiency. It enables enhanced crop uniformity and reduced energy use. This demonstrates the accelerating shift toward advanced, precision controlled LED technology in horticulture.

Horticulture Lighting Market Report Snapshot

|

Segmentation |

Details |

|

By Technology |

Fluorescent, High-Intensity Discharge, Light Emitting Diodes |

|

By Cultivation Type |

Fruits & Vegetables, Cannabis, Floriculture |

|

By Lighting Type |

Toplighting, Interlighting |

|

By Application |

Greenhouses, Vertical Farming, Indoor Farming |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Technology (Fluorescent, High-Intensity Discharge, and Light Emitting Diodes): The light emitting diodes segment earned USD 3.39 billion in 2024, due to its high energy efficiency, targeted spectral control, and extended lifespan, which collectively supports lower operational costs and improved crop performance.

- By Cultivation Type (Fruits & Vegetables, Cannabis, and Floriculture): The fruits & vegetables segment held 43.22% share of the market in 2024, owing to the increasing demand for year-round, high-quality produce and the growing adoption of controlled-environment agriculture by commercial growers.

- By Lighting Type (Toplighting, and Interlighting): The interlighting segment is projected to reach USD 17.94 billion by 2032, owing to its ability to deliver targeted light within plant canopies, enhancing photosynthesis efficiency and promoting uniform crop growth in high-density cultivation systems.

- By Application (Greenhouses, Vertical Farming, and Indoor Farming): The greenhouses segment earned USD 3.39 billion in 2024, due to the increasing deployment of advanced lighting systems to optimize plant growth conditions, improve yield consistency, and extend growing seasons in controlled environments.

Horticulture Lighting Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

Europe horticulture lighting market share stood at around 37.23% in 2024, with a valuation of USD 3.15 billion. This dominance is attributed to the presence of major lighting manufacturers and well-established research and development facilities across Europe. This drives continuous innovation in horticulture lighting technologies and facilitates the rollout of high-efficiency and spectrum-tuned solutions.

Companies across the region sustain market leadership through specialized product portfolios and innovation strategies aligned with the needs of greenhouse and vertical farming operations. This integrated framework of technological advancement, strategic development, and institutional support is propelling the regional market by fueling adoption, improving distribution capabilities, and enabling the broad implementation of next-generation horticulture lighting systems.

- In May 2025, ams OSRAM unveiled cutting-edge LED and sensor-based plant-growth systems at the GreenTech fair in Amsterdam. It showcased how next-gen lighting can optimize energy use, sustainability, and crop yields. This highlights the region’s strength in using cutting-edge manufacturing and R&D to drive innovation.

The horticulture lighting industry in Asia Pacific is poised for significant growth at a CAGR of 21.72% over the forecast period. This growth is attributed to significant investments by government bodies and private sector enterprises in commercial greenhouse infrastructure across countries such as China, Japan, and South Korea.

The region is allocating substantial funding to enhance domestic food production capabilities and reduce reliance on imports. These investments are part of broader agricultural modernization programs such as China’s smart agriculture development plan, Japan’s green food system strategy, and South Korea’s smart farm expansion project that prioritizes technology integration and sustainable practices.

Additionally, private agribusinesses, venture capital firms, and agri-tech startups are channeling capital into large-scale greenhouse projects to meet the rising demand for high-quality and locally grown produce, including tomatoes, leafy greens, berries, and herbs, grown under controlled conditions for year-round supply. This is creating a strong foundation for advanced horticulture systems across the region.

Regulatory Frameworks

- In Europe, the European Commission regulates the market through binding directives such as the Ecodesign Directive and the Restriction of Hazardous Substances (RoHS) Directive, which mandates energy efficiency, environmental safety, and compliance in designing and manufacturing lighting systems across EU member states.

- In China, the Ministry of Agriculture and Rural Affairs (MARA) regulates the application of horticulture lighting in controlled-environment agriculture, and the State Administration for Market Regulation (SAMR) enforces product safety, LED compliance, and certification under the China Compulsory Certification (CCC) scheme, ensuring regulatory conformity for market entry and commercialization.

Competitive Landscape

The horticulture lighting industry exhibits a dynamic competitive landscape, as key participants accelerate product launches in response to evolving cultivation needs. These launches focus on spectrum-specific solutions, enhanced thermal efficiency, and adaptable intensity control.

Companies tailor innovations to meet the operational requirements of commercial greenhouses as well as precision farming systems. New systems integrate with automated platforms to improve crop productivity. Therefore, the increase in product deployment reflects intensified competition and strategic portfolio diversification.

- In March 2024, Oreon Holding BV introduced the Oreon Monarch 3-Channel LED toplight, featuring a maximum input of 1260W and integrated water-cooling technology to ensure high output and energy efficiency. The system enables spectrum adjustment during cultivation, allowing growers to deliver customized lighting for different plant growth stages, thereby supporting optimized crop performance and reduced energy costs.

Key Companies in Horticulture Lighting Market:

- Signify Holding

- Scotts

- Heliospectra

- ams-OSRAM AG

- California LightWorks

- Valoya

- Hortilux Schréder

- ILUMINAR Lighting LLC.

- Savant Technologies LLC.

- Acuity Inc.

- Lumileds Holding B.V.

- Cree LED

- TCP Lighting

- Oreon Holding BV

- Black Dog Horticulture Technologies & Consulting

Recent Developments (Launch)

- In June 2024, Signify Holding launched the Philips GreenPower LED Toplighting Force 2.0, developed to advance horticultural grow lighting solutions. The system delivers increased light output, dynamic color control, high energy efficiency, and uniform light distribution. It is engineered to help professional growers enhance crop yield and quality while effectively managing energy consumption, aligning with the operational demands of modern controlled-environment agriculture.