buyNow

Home Healthcare Software Market

Home Healthcare Software Market Size, Share, Growth & Industry Analysis, By Component (Equipment, Services), By Indication (Cardiovascular Disorder & Hypertension, Diabetes & Kidney Disorders, Neurological & Mental Disorders, Respiratory Disease & COPD), and Regional Analysis, 2025-2032

pages: 140 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

The market comprises digital solutions engineered to support the planning, delivery, and management of in-home care services. It includes components such as electronic visit verification, scheduling systems, clinical documentation modules, telehealth platforms, and billing/invoicing tools.

The market supports deployment across home care agencies, hospice providers, and private caregiver operations to improve care coordination, regulatory compliance, clinical outcomes, and operational efficiency. The report examines industry trends, regional developments, and regulatory frameworks impacting market growth through the projection period.

Home Healthcare Software Market Overview

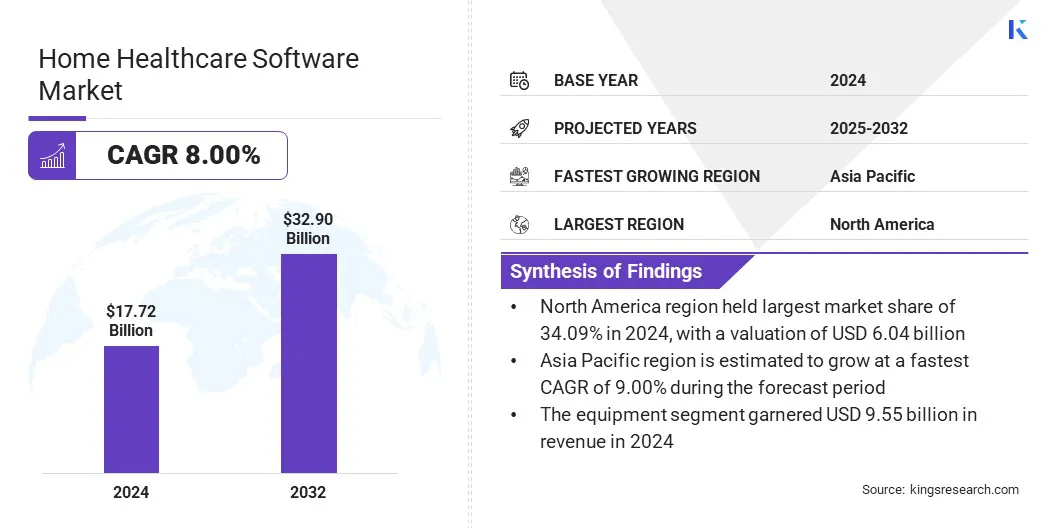

The global home healthcare software market size was valued at USD 17.72 billion in 2024 and is projected to grow from USD 19.11 billion in 2025 to USD 32.90 billion by 2032, exhibiting a CAGR of 8.00% during the forecast period.

The growth in the market is largely influenced by the rising incidence of chronic diseases leading to a greater demand for home-based care solutions. Furthermore, the expansion of AI-powered virtual assistants is becoming more prominent, enhancing patient engagement and support.

Key Highlights:

- The home healthcare software industry size was recorded at USD 17.72 billion in 2024.

- The market is projected to grow at a CAGR of 8.00% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 6.04 billion.

- The equipment segment garnered USD 9.55 billion in revenue in 2024.

- The cardiovascular disorder & hypertension segment is expected to reach USD 5.39 billion by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 9.00% during the forecast period.

Major companies operating in the Home Healthcare Software industry are Alora Healthcare Systems, LLC., Axxess, WellSky, Netsmart Technologies, Inc., Brightree, Homecare Homebase, LLC., Teladoc Health, Inc., Aaniie, Inc., Enlite Care, HealthViewX., LMC Software Ltd., Mountain Health Technologies, Kindred Home Care, Addus HomeCare, and Extendicare.

The increased use of mobile and cloud technologies is significantly contributing to the growth of the market. These technologies enhance operational efficiency by enabling real-time access to patient data, improving communication between caregivers, and enhancng remote monitoring.

Home healthcare providers are increasingly adopting cloud-based platforms and mobile applications to streamline scheduling, documentation, and care coordination. This is enabling organizations to meet regulatory requirements and patient expectations more effectively, thereby accelerating adoption across the home care ecosystem and driving market expansion.

- For instance, in March 2025, GE HealthCare unveiled its Genesis portfolio of cloud-based enterprise imaging SaaS solutions to advance efficiency and precision in healthcare delivery. Genesis aims to streamline workflows optimize IT and capital resources, and enhance decision-making for radiologists and caregivers in home healthcare settings.

Market Driver

Rising Prevalence of Chronic Conditions Accelerating Adoption of Home-Based Care Solutions

The rising incidence of chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders is a key factor driving demand for home healthcare software. These software offer remote patient monitoring, electronic health records integration, and care coordination essential for managing long-term treatment outside traditional clinical settings.

Chronic care is increasingly shifting toward home-based models, telehealth platforms, and assisted living environments. In response, providers are adopting software tools to improve clinical outcomes, reduce hospital readmissions, and streamline care workflows. This transition is fueling broader adoption of home healthcare software across healthcare providers.

- In April 2025, the National Institute for Health Care Management (NIHCM) reported that the U.S. spent USD 4,500 billion on healthcare in 2022, with a significant portion directed toward managing chronic physical and mental health conditions. This substantial expenditure underscores the rising prevalence and burden of chronic diseases, highlighting their critical role in driving overall healthcare costs and shaping market growth.

Market Challenge

Data Security and Compliance Risks

A key challenge limiting growth in the home healthcare software market is the risk to data security and patient privacy. The shift toward cloud-based systems and remote access increases exposure to cyber threats and unauthorized access. Failure to comply with healthcare regulations such as HIPAA can result in legal and financial consequences, making data protection a critical concern for home healthcare software providers.

To address this, manufacturers are investing in advanced cybersecurity frameworks, including end-to-end encryption, multi-factor authentication, and blockchain-based data management. These measures aim to ensure compliance, build stakeholder trust, and maintain the integrity of sensitive health information across decentralized care environments, thereby supporting sustained software adoption.

Market Trend

Expansion of AI-Powered Virtual Assistants for Patient Engagement

Advancements in artificial intelligence is accelerating the integration of virtual assistants into home healthcare software platforms. These intelligent tools offer capabilities such as real-time patient query handling, personalized medication, appointment reminders, symptom tracking, and adaptive care recommendations based on patient behavior and health data.

By enhancing communication between patients and providers, these AI-driven solutions are improving patient engagement, satisfaction, and compliance with treatment plans. Furthermore, these solutions are reducing administrative burden on healthcare staff, optimizing resource utilization, and enabling proactive and timely care interventions. These factors are is fueling broader adoption home healthcare software, thereby driving market growth.

- In November 2023, Artera partnered with Hyro to launch Artera Care Assist, an AI-powered virtual assistant designed to enhance communication workflows. This integrated solution streamlines provider-patient interactions, improves staff efficiency, and addresses workforce shortages supporting the growing demand for automation in the home healthcare software market.

Home Healthcare Software Market Report Snapshot

|

Segmentation |

Details |

|

By Component |

Equipment (Therapeutic, Diagnostic, Mobility assist), Services |

|

By Indication |

Cardiovascular Disorder & Hypertension, Diabetes & Kidney Disorders, Neurological & Mental Disorders, Respiratory Disease & COPD, Maternal Disorders, Mobility Disorders, Cancer, Wound Care |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Component (Equipment, and Services): The equipment segment earned USD 9.55 billion in 2024 due to the rising adoption of remote patient monitoring devices and diagnostic tools that require integrated software support for real-time data transmission and clinical decision-making.

- By Indication (Cardiovascular Disorder & Hypertension, Diabetes & Kidney Disorders, Neurological & Mental Disorders, Respiratory Disease & COPD, Maternal Disorders, Mobility Disorders, Cancer, and Wound Care): The cardiovascular disorder & hypertension segment held 16.77% of the market in 2024, owing to the rising prevalence of chronic heart conditions among aging populations, which drives sustained demand for remote monitoring and personalized care management.

Home Healthcare Software Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America home healthcare software market share stood at 34.09% in 2024 in the global market, with a valuation of USD 6.04 billion. The dominance is attributed to substantial investments in digital health infrastructure and personalized care delivery. The region’s advanced healthcare ecosystem supports the continuous development and integration of sophisticated software solutions tailored for remote monitoring, and patient engagement.

Moreover, the presence of major technology firms, robust reimbursement frameworks, and high adoption rates of telehealth services enable seamless deployment and frequent software upgrades. These factors are driving market growth across North America.

- According to the American Medical Association, U.S. health spending rose 7.5% in 2023, reaching USD 4.9 trillion, equivalent to USD 14,570 per capita. This surge can be attributed to significant investments in digital health infrastructure and personalized care delivery, which are essential for enhancing patient outcomes and meeting the growing demand for innovative healthcare solutions.

Asia Pacific home healthcare software industry is poised for a significant CAGR of 9.00% over the forecast period, driven by rising healthcare digitization, aging populations, and increasing prevalence of chronic diseases. Governments across countries like India, China, and Japan are investing in telehealth and remote patient monitoring infrastructure, thereby accelerating the adoption of healthcare solutions.

Moreover, growing smartphone penetration and internet accessibility in this region further support mobile health platforms, enabling personalized care delivery at home. Additionally, the region is witnessing a surge in startups developing advanced AI-enabled solutions, electronic health records (EHR), and patient engagement tools.

Regulatory Frameworks

- In the U.S., the Health Insurance Portability and Accountability Act (HIPAA) mandates strict standards to protect the confidentiality, integrity, and availability of patient health data. Home healthcare software solutions are required to adhere to HIPAA’s privacy and security regulations when handling, storing, or transmitting Protected Health Information (PHI).

- In China, the Personal Information Protection Law (PIPL) serves as the country’s primary data privacy framework, overseeing the collection, storage, processing, and disclosure of personal health information. Home healthcare software providers are required to secure explicit user consent and enforce robust data protection protocols, particularly when transferring sensitive health data across national borders.

Competitive Landscape

The home healthcare software industry is experiencing a series of strategic acquisitions as key players aim to strengthen their technological capabilities and expand service offerings.

Market players are acquiring specialized software firms focused on remote monitoring, patient engagement, and care coordination to enhance platform integration. These acquisitions are also facilitating entry into untapped regional markets, improving interoperability, and accelerating innovation in digital health ecosystems.

- In December 2024, Nourish Care acquired CarePlanner Home Care Software, integrating two established home care software platforms. The acquisition also combined their respective development teams to align resources for continued support of digital solutions in the social care sector.

Key Companies in Home Healthcare Software Market:

- Alora Healthcare Systems, LLC.

- Axxess

- WellSky

- Netsmart Technologies, Inc.

- Brightree

- Homecare Homebase, LLC.

- Teladoc Health, Inc.

- Aaniie, Inc.

- Enlite Care

- HealthViewX

- LMC Software Ltd.

- Mountain Health Technologies

- Kindred Home Care

- Addus HomeCare

- Extendicare

Recent Developments (M&A)

- In June 2024,. HHAeXchange acquired Cashé Software to enhance its service capabilities for homecare providers and payers in the United States. The acquisition supports improvements in compliance management, billing process efficiency, and workforce operation