buyNow

Health Insurance Exchange Market

Health Insurance Exchange Market Size, Share, Growth & Industry Analysis, By Type (Individual, Family, Group), By Distribution Channel (Online, Offline), By End User (Children, Adults, Senior Citizens), and Regional Analysis, 2025-2032

pages: 160 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

The market refers to a digital marketplace where individuals, families, and small businesses can compare, purchase, and enroll in health insurance plans. These platforms, established under healthcare reforms such as the Affordable Care Act (ACA), facilitate access to standardized and subsidized insurance options through private providers or government programs.

The market encompasses public and private exchanges, eligibility and enrollment systems, plan comparison tools, premium management, and ancillary services such as data integration and analytics.

It covers individual and group plans, medicaid and medicare expansion services, and technology providers enabling exchange operations. The report provides a comprehensive analysis of key drivers, emerging trends, and the competitive landscape expected to influence the market over the forecast period.

Health Insurance Exchange Market Overview

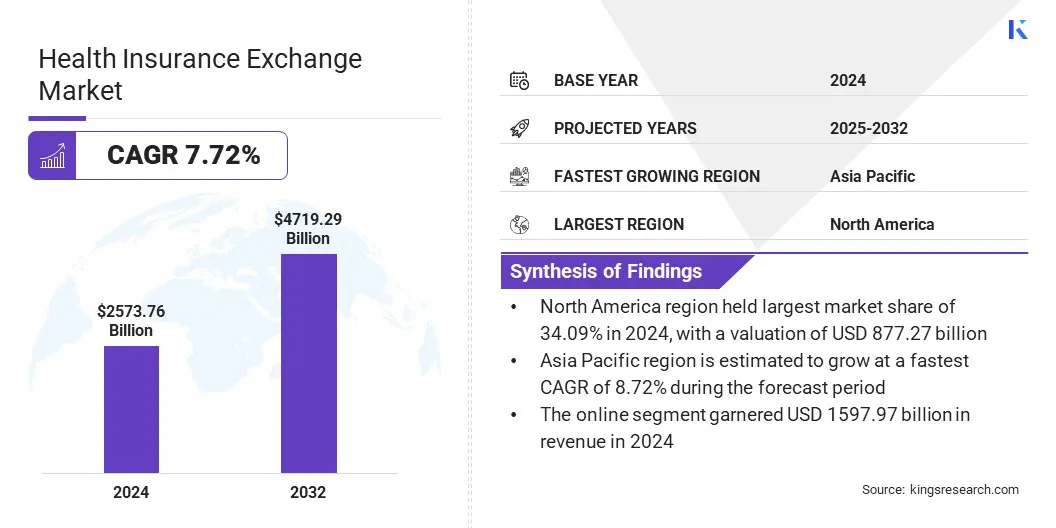

The global health insurance exchange market size was valued at USD 2573.76 billion in 2024 and is projected to grow from USD 2755.72 billion in 2025 to USD 4719.29 billion by 2032, exhibiting a CAGR of 7.72% during the forecast period.

Market growth is drive by an aging population and increasing chronic disease burden, highlighting the need for insurance solutions. Generative AI is advancing advisory capabilities and enhancing customer engagement.

Key Highlights:

- The health insurance exchange industry size was recorded at USD 2573.76 billion in 2024.

- The market is projected to grow at a CAGR of 7.72% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 877.27 billion.

- The individual segment garnered USD 1085.29 billion in revenue in 2024.

- The online segment is expected to reach USD 2873.57 billion by 2032.

- The adults segment is anticipated to witness the fastest CAGR of 7.97% over the forecast period.

- Asia Pacific is anticipated to grow at a CAGR of 8.72% through the projection period.

Major companies operating in the health insurance exchange industry are United Healthcare Services, Inc., Aetna Inc., Anthem Insurance Companies, Inc., Oscar Insurance, Cigna Healthcare., Centene Corporation, Blue Cross Blue Shield Association, AMERIHEALTH CARITAS., GetInsured, Softheon, Conduent Incorporated, Oracle, Kaiser Foundation Health Plan, Inc., EmblemHealth., and MetroPlusHealth.

The expansion of private health insurance offerings on state and federal exchanges is fueling market expansion by increasing consumer access to tailored plans, enhancing competition, and improving price transparency. This includes the entry of new insurers, customized plan structures, and tiered benefit options addressing diverse income and health needs.

The growing presence of private carriers on public platforms improves plan portability, accelerates enrollment, and strengthens consumer choice within regulated environments.

Private insurers are strategically aligning with state and federal exchange frameworks to broaden market presence and diversify their product portfolios. They are investing in digital enrollment systems, dynamic pricing models, and customer engagement strategies to attract and retain members.

Leading providers are also collaborating with technology vendors to streamline plan comparison tools and enhance transparency. These developments are collectively reinforcing the scalability of health exchanges, contributing to sustained market growth and an evolving ecosystem centered on consumer centric, value-based insurance solutions.

Market Driver

Aging Demographics and Chronic Disease

The global increase in the aging population, along with the rising prevalence of chronic conditions such as diabetes, hypertension, cancer, and cardiovascular diseases, is boosting the expansion of the health insurance exchange market. This growth is mainly attributed to the rising need for financial protection and continuous access to care. In response, exchange platforms are offering standardized, affordable plans tailored to older adults and patients with chronic illnesses.

Moreover, insurers are developing specialized policies through both state and federal exchanges, offering benefits such as preventive care, ongoing treatment coverage, and condition-specific support.

Additionally , providers are incorporating digital engagement tools to enhance accessibility, improve user experience, and allow for greater plan personalization. This integration of technology and customized coverage is reinforcing participation in health insurance exchanges and supporting market expansion through more adaptive and patient-focused insurance solutions.

- According to the National Institute for Health Care Management (NIHCM) Foundation, nearly 60% of Americans are affected by, many managing multiple conditions. In 2022, 90% of the USD 4.5 trillion spent on U.S. healthcare was allocated to treating chronic physical and mental health issues. This growing burden of chronic illness is boosting demand for accessible, comprehensive coverage and accelerating the adoption of Health Insurance Exchanges .

Market Challenge

Complexity of Plan Selection and Low Consumer Awareness

A significant challenge hindering the expansion of the health insurance exchange market is the complexity of plan selection and limited consumer awareness. This hampers user engagement and results in suboptimal plan choices or lack of coverage , particularly among low-income and underserved populations. Additionally, the diversity in plan structures and coverage tiers further hinders effective comparison, impacting exchange participation and market growth.

To address this challenge, insurers and exchange platform operators are investing in enhanced decision-support tools, personalized recommendation engines, and multilingual outreach programs. These initiatives aim to simplify the enrollment experience, improve plan transparency, and increase consumer education.

By integrating digital solutions and targeted communication strategies, stakeholders seek to streamline plan selection and build consumer confidence in exchange-based insurance purchasing.

Market Trend

Growing Adoption of Generative AI

The rising adoption of generative artificial intelligence (AI) is emerging as a notable trend in the health insurance exchange market, equipping advisors with advanced tools for personalized plan recommendations and streamlined decision-making. This enhances customer engagement through real-time interactions, automated responses, and data-driven insights tailored to individual healthcare needs.

The integration of AI-driven solutions is enabling platforms to deliver a more intuitive and efficient user experience, minimizing friction in plan selection and accelerating enrollment. This is enhancing market progress by improving consumer trust, operational flexibility, and accessibility in digital insurance exchanges.

- In March 2025, Singlife launched an AI-powered insurance assistant using Oracle Cloud Infrastructure to provide advisors with real-time product insights. This innovation marks a growing trend in health insurance exchanges , where AI enhances advisor efficiency and customer engagement.

Health Insurance Exchange Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Individual, Family, Group |

|

By Distribution Channel |

Online, Offline |

|

By End User |

Children, Adults, Senior Citizens |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Individual and Family): The individual segment earned USD 1085.29 billion in 2024, owing to rising demand for personalized and flexible coverage among self-employed and uninsured individuals .

- By Distribution Channel (Online and Offline): The online segment held a share of 62.09% in 2024, on account of the increased digital adoption and consumer preference for convenient, transparent, and real-time policy comparison and enrollment platforms.

- By End User (Children, Adults, and Senior Citizens): The senior citizens segment is projected to reach USD 2139.25 billion by 2032, due to a growing aging population and increased prevalence of age-related health conditions.

Health Insurance Exchange Market Regional Analysis

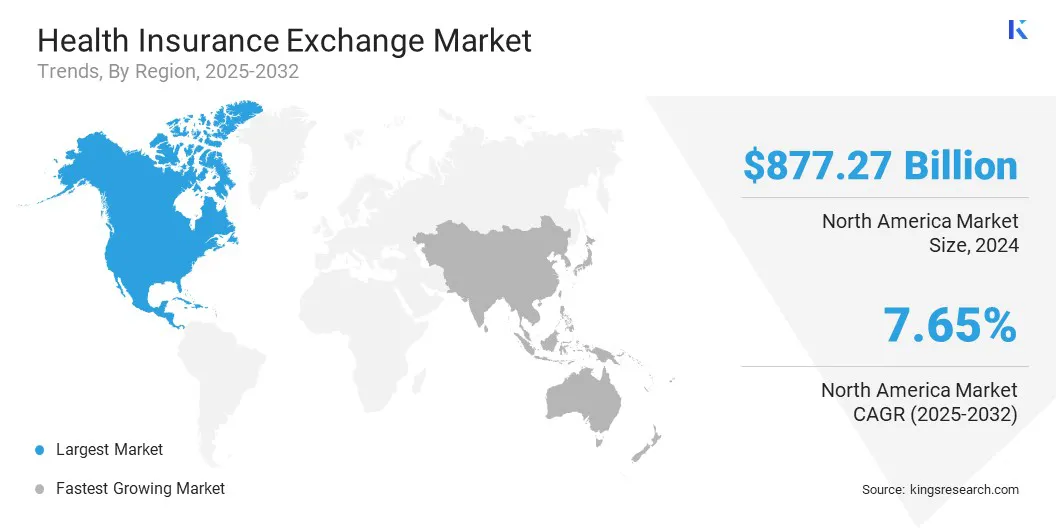

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

The North America health insurance exchange market share stood at around 34.09% in 2024, valued at USD 877.27 billion. This dominance is attributed to substantial per capita healthcare expenditure, which increases demand for structured insurance frameworks offering financial transparency.

Rising medical costs further accelerate the shift toward digital exchanges, increasing consumer dependence on platforms that simplify enrollment and support informed decision making.

In response, insurers are enhancing exchange-based services to improve affordability and access. Ongoing investment in healthcare fosters technological advancement, strengthens operations, and expands market reach. This is solidifying North America's leading position by accelerating adoption, optimizing user engagement, and scaling insurance delivery.

- The American Medical Association reported a 7,5% rise in U.S. health spending in 2023, reaching USD 4.9 trillion or USD 14,570 per capita. This surge is prompting health exchange providers to expand digital solutions for improved plan accessibility and cost efficiency.

The Asia-Pacific health insurance exchange industry is set to grow at a CAGR of 8.72% over the forecast period. This growth is fueled by the expansion of telemedicine and e-health services integrated with insurance platforms. Rapid digitalization in emerging economies is accelerating the deployment of virtual healthcare solutions linked to insurance coverage.

The integration of real-time diagnostics, remote consultations, and digital health monitoring is streamlining policy issuance and claims management. Enhanced interoperability between healthcare providers and insurers is enabling seamless access to customized plans through digital exchanges.

- In July 2024, under the Ayushman Bharat Digital Mission, the Government of India introduced the National Health Claims Exchange (NHCX) to streamline and standardize health insurance claims. NHCX facilitates secure, interoperable, and machine-readable data exchange among insurers, auditors, and providers, enhancing operational efficiency, transparency, and trust while improving patient experience and accelerating claim settlements.

This is reshaping consumer engagement and enabling wider coverage penetration. The evolving digital infrastructure and strong policy support continue to reinforce Asia Pacific’s position as the fastest growing market for health insurance coverage.

Regulatory Frameworks

- In the U.S., the Department of Health and Human Services (HHS), in coordination with the Centers for Medicare & Medicaid Services (CMS), oversees health reform and regulates insurance exchanges, including essential health benefits and marketplace standards.

- In China, the National Healthcare Security Administration (NHSA) regulates the national medical insurance system, sets reimbursement policies, and aligns private and public exchanges with government healthcare standards.

- In Japan, the Ministry of Health, Labour and Welfare (MHLW) oversees the universal healthcare system, regulates public and private insurance, and formulates digital health policies to advance innovative insurance enrollment models.

Competitive Landscape

The health insurance exchange industry is witnessing intensified competition driven by strategic acquisitions, platform launches, and geographic expansions. Key players are enhancing scale and service integration through targeted mergers, while continued investment in digital platforms that supports market penetration.

Moreover, expansion into emerging markets improves accessibility and plan diversity. These initiatives collectively strengthen competitive positioning, stimulate innovation in plan offerings, and align with evolving regulatory standards and consumer demand for streamlined insurance solutions.

- In October 2024, Antidote Health, a digital-first ACA health plan payvider, expanded its footprint in Ohio’s market. The company extended its on-exchange offerings to additional 21 counties, bringing the total to 43. It also launched individual on-exchange plans in Arizona’s Maricopa and Pima counties, supporting its strategic growth across both on- and off-exchange markets.

Key Companies in Health Insurance Exchange Market:

- United HealthCare Services, Inc.

- Aetna Inc.

- Anthem Insurance Companies, Inc.

- Oscar Insurance

- Cigna Healthcare

- Centene Corporation

- Blue Cross Blue Shield Association

- AMERIHEALTH CARITAS.

- GetInsured

- Softheon

- Conduent Incorporated

- Oracle

- Kaiser Foundation Health Plan, Inc.

- EmblemHealth

- MetroPlusHealth

Recent Developments (Expansion)

- In November 2024, UnitedHealthcare expanded its Individual & Family ACA Marketplace offerings to 30 states, adding coverage in Indiana, Iowa, Nebraska, Wyoming, and new counties across 13 states. This strategic move enhances access to affordable health benefits for individuals ineligible for other coverage, with many qualifying for USD 0 premiums based on income, strengthening its position in the exchange market.

- In September 2024, GoHealth, Inc. entered into a purchase and subscription agreement to acquire e-TeleQuote Insurance, Inc.This acquisition strengthens GoHealth’s market position and supports its strategy to enhance consumer experiences through innovation, operational efficiency, and aligned values.

- In June 2024, Oracle launched its Health Insurance Data Exchange Cloud Service, providing a modern and secure platform that allows insurers to efficiently manage and adapt to evolving data formats.By supporting custom data mapping and validation, it accelerates processing, enhances integration with entities such as CMS, minimizes IT complexity and costs, and improves operational efficiency by streamlining data exchange across the health insurance ecosystem.