buyNow

Geographic Information System (GIS) Market

Geographic Information System Market Size, Share, Growth & Industry Analysis, By Component (Hardware, Software, Services), By Deployment Mode (On-Premise, Cloud-Based), By Function (Mapping, Spatial Analysis, Surveying, Geovisualization, Data Management), By End-use Industry (Government & Public Sector, Utilities), and Regional Analysis, 2024-2031

pages: 180 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Geographic information systems (GIS) are digital frameworks used to capture, manage, analyze, and visualize spatial data tied to specific locations on the Earth's surface. These systems combine maps with data to uncover patterns, relationships, and geographic context, supporting more informed decision-making.

Widely used in urban planning, environmental management, transportation, and emergency response, geographic information systems help organizations optimize resource allocation and monitor changes over time. The market also supports applications in agriculture, public health, utilities, and defense, where accurate geospatial insights are critical for operational efficiency and strategic planning.

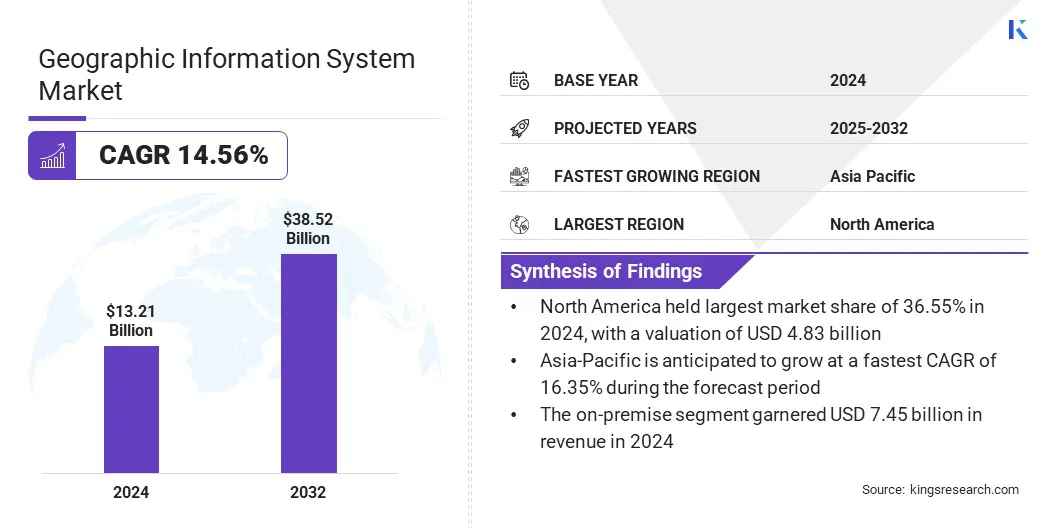

The global geographic information system market size was valued at USD 13.21 billion in 2024 and is projected to grow from USD 14.87 billion in 2025 to USD 38.52 billion by 2032, exhibiting a CAGR of 14.56% during the forecast period. The market is growing due to wider adoption across industries, advancements in AI and big data, increased spatial data availability, and government investments.

The rise of smart cities, cloud-based platforms, and location-based services further support this expansion. GIS's expanding applications in agriculture, urban planning, transportation, healthcare, and environmental management are fueling market expansion by enhancing resource management, predictive analytics, and decision-making.

- In November 2023, The World Health Organization inaugurated its first Geographic Information System Centre for Health in a country office, located in Mogadishu, Somalia. Supported by UNFPA, UNICEF, and the Bill & Melinda Gates Foundation, the center will enhance health planning by using geospatial data to monitor population movement, improve service access, and support outbreak response. It marks WHO’s broader effort to scale GIS capabilities globally.

Key Highlights

- The geographic information system industry size was recorded at USD 13.21 billion in 2024.

- The market is projected to grow at a CAGR of 14.56% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 4.83 billion.

- The hardware segment garnered USD 5.71 billion in revenue in 2024.

- The on-premise segment is expected to reach USD 20.40 billion by 2032.

- The spatial analysis segment is anticipated to witness the fastest CAGR of 16.03% over the forecast period.

- The government & public sector segment garnered USD 4.71 billion in revenue in 2024.

- Asia Pacific is anticipated to grow at a CAGR of 16.35% during the forecast period.

Major companies operating in the geographic information system market are Hexagon AB, Bentley Systems, Incorporated, Esri, Pitney Bowes Inc., Autodesk Inc., Caliper Corporation, SuperMap Software Co., Ltd., Trimble Inc., Maxar Technologies, GE Vernova, Cadcorp Limited, L3Harris Technologies, Inc., TOPCON CORPORATION, Fugro, and Garmin Ltd.

Major companies operating in the geographic information system market are Hexagon AB, Bentley Systems, Incorporated, Esri, Pitney Bowes Inc., Autodesk Inc., Caliper Corporation, SuperMap Software Co., Ltd., Trimble Inc., Maxar Technologies, GE Vernova, Cadcorp Limited, L3Harris Technologies, Inc., TOPCON CORPORATION, Fugro, and Garmin Ltd.

Geographic Information System Market Report Scope

|

Segmentation |

Details |

|

By Component |

Hardware, Software, and Services |

|

By Deployment Mode |

On-Premise, and Cloud-Based |

|

By Function |

Mapping, Spatial Analysis, Surveying, Geovisualization, and Data Management |

|

By End-use Industry |

Government & Public Sector, Utilities, Agriculture & Forestry, Transportation & Logistics, and Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Geographic Information System Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America geographic information system market share stood at around 36.55% in 2024, valued at USD 4.83 billion. The dominance is reinforced by the region’s strong adoption of advanced geographic information system technologies across industries such as government, transportation, utilities, and agriculture.

This growth is further supported by the presence of leading geographic information system solution providers, ongoing investments in smart cities and infrastructure, and advancements in AI and machine learning integration.

Countries such as the U.S. and Canada lead this growth, supported by strong technological infrastructure, early adoption of geospatial technologies, and substantial investments in sectors such as government, urban planning, transportation, and environmental management.

- In February 2024, L3Harris Technologies in the USA offers TrueTerrain Visual Simulation Products, providing high-quality geospatial data such as satellite and aerial imagery, elevation data, vector features, 3D models, and material-classified maps. These products create realistic virtual training environments and are widely used by military, government, and commercial sectors.

The integration of GIS with cloud platforms like Microsoft Azure, along with smart city initiatives, underscores the growing reliance on geospatial technologies across critical sectors. Backed by ongoing investments in infrastructure, AI, and machine learning, the North America market is poised to sustain its leading position in the years to come.

The Asia-Pacific geographic information system industry is set to grow at a CAGR of 16.35% over the forecast period. China and India are contributing significantly to this growth, propelled by rapid urbanization, increased government investments in infrastructure, and the growing adoption of GIS technologies across various industries such as agriculture, transportation, and defense.

The Asia-Pacific geographic information system industry is set to grow at a CAGR of 16.35% over the forecast period. China and India are contributing significantly to this growth, propelled by rapid urbanization, increased government investments in infrastructure, and the growing adoption of GIS technologies across various industries such as agriculture, transportation, and defense.

The growth of the regional market is further fueled by technological advancements and strong governmental support. As countries such as China and India prioritize infrastructure development and smart city initiatives, the adoption of GIS technologies across various sectors is anticipated to grow, supporting urbanization and sustainability in the region.

Geographic Information System Market Overview

The market is poised for significant expansion, fueled by technological advancements and increasing industry adoption. As businesses and governments continue to recognize the value of geospatial data, GIS solutions are expected to become more sophisticated and widely integrated into various sectors. This ongoing evolution will not only enhance operational efficiency but also contribute to more informed decision-making and sustainable development worldwide.

- In March 2024, A study published by the National Center for Biotechnology Information (NCBI) emphasized the expanding role of geographic information systems in public health. It highlighted how GIS supports disease mapping, environmental risk assessment, and data-driven health planning by integrating spatial data with health records for improved surveillance and decision-making.

Market Driver

Growth of GIS Innovation Hubs & Startup

The expansion of incubation networks and domain accelerators, particularly in research and academia, is fostering innovation in the geospatial sector. Venture capitalists and private equity are increasingly investing in space and geospatial startups, while industry collaborations with research institutions facilitate funding, technical support, and mentorship for emerging businesses.

- In January 2025, Suzano signed a long-term commercial agreement with Marvin, a startup focused on AI-driven land use and supply chain management. This partnership follows a successful validation of Marvin's geospatial intelligence capabilities in the forestry sector. Suzano Ventures increased its strategic investment in Marvin, building on the initial funding from October 2023. The deal emphasizes the growing role of AI in enhancing supply chain and land management practices.

The rise in space technology and agricultural startups is largely attributed to national geospatial policies that promote investment and development in these sectors. These policies foster a supportive ecosystem for new ventures, contributing to the growth of the geographic information system market.

Increased support from venture capital, private equity, and research collaborations accelerates innovation, leading to the introduction of new GIS technologies. With governments and private investors prioritizing geospatial innovation, this market is set to witness notable expansion.

Market Challenge

High Data Acquisition Costs

High data acquisition costs pose a significant challenge to the growth of the geographic information system (GIS) market. Geospatial data, particularly high-resolution imagery and real-time data from satellite, drone, or remote sensing technologies, are often expensive. This financial burden limits access for small and medium-sized businesses. Additionally, integrating data from diverse sources requires different processing techniques, further increasing costs and complexity.

To overcome these obstacles, strategies like supporting open data initiatives such as USGS Earth Explorer and Copernicus Open Access Hub can make datasets more accessible at lower costs.

Cloud-based platforms like Google Earth Engine and Esri ArcGIS Online offer scalable pricing models, reducing the need for significant infrastructure investments. Data sharing and collaboration among industries, governments, and research institutions, along with crowdsourcing and citizen science efforts, can further reduce costs and improve accessibility.

Market Trend

Advancements in AI, ML, and Deep Learning

The increasing adoption of AI, ML, integrated with business intelligence and engineering workflows, is enhancing communication and operational efficiency. These technologies enhance, accuracy and decision-making while expanding the interoperability of geospatial technologies across industries, thus aiding the growth of the geographic information system market.

The deep learning techniques, such as convolutional neural networks (CNNs), are improving the processing of high-resolution satellite images, enhancing object detection and pattern recognition, further pushing the boundaries of GIS applications.

- In February 2024, Trimble Inc. introduced new AI-based feature extraction capabilities in its Trimble Business Center (TBC) platform, aimed at enhancing the efficiency and value of geospatial data processing. The update uses deep learning models to automatically identify stockpiles and classify objects from point clouds, reducing the need for manual intervention. These advancements help streamline workflows and support more accurate, consistent outcomes across mapping and surveying projects.

As AI and ML evolve, their ability to automate data processing and enhance predictive analytics is boosting the demand for advanced geospatial technologies. Integrating machine learning with geospatial data improves forecasting, resource management, and risk assessment. This adoption fosters cross-industry collaborations, positioning AI, ML, and GIS as key enablers of digital transformation and geospatial innovation.

Market Segmentation

- By Component (Hardware, Software, and Services): The hardware segment earned USD 5.71 billion in 2024 due to increased adoption of advanced sensors, GPS devices, and data collection equipment.

- By Deployment Mode (On-Premise, and Cloud-Based): The on-premise held 56.43% of the market in 2024, due to

- By Function (Mapping, Spatial Analysis, Surveying, Geovisualization, and Data Management): The mapping segment is projected to reach USD 13.71 billion by 2032, owing to greater data security, customization capabilities, and compliance with internal IT policies.

- By End-use Industry (Government & Public Sector, Utilities, Agriculture & Forestry, Transportation & Logistics, and Others): The transportation & logistics segment is anticipated to witness the fastest CAGR of 16.14% over the forecast period due to increasing use of geographic information systems for route optimization, real-time tracking, and infrastructure planning.

Regulatory Frameworks

- In the U.S., the Geospatial Data Act of 2018 regulates the coordination, sharing, and standardization of geospatial data across federal agencies. It mandates the development of a National Spatial Data Infrastructure (NSDI) and ensures the use of common standards to improve interoperability, reduce duplication, and support data-driven decision-making.

- In the European Union, the Infrastructure for Spatial Information in the European Community (INSPIRE) Directive regulates the creation and use of interoperable spatial data infrastructures. It aims to support environmental policies and public sector activities by ensuring standardized access to geospatial datasets across member states.

- In India, the National Geospatial Policy, 2022 regulates the development, acquisition, and sharing of geospatial data. It promotes private-sector participation, establishes clear data governance standards, and encourages the use of GIS for national development, infrastructure planning, and disaster management.

Competitive Landscape

Companies operating in the geographic information system industry are actively expanding their footprint by integrating advanced technologies, enhancing platform capabilities, and pursuing strategic collaborations across industry verticals. Key players are investing heavily in artificial intelligence, machine learning, and cloud computing to improve spatial data accuracy, real-time analytics, and decision-support systems tailored for complex geospatial applications.

They are also introducing solutions that support 3D mapping, remote sensing integration, and automated feature extraction to meet the growing demand for high-resolution, dynamic geographic insights across sectors such as transportation, healthcare, agriculture, and urban planning.

Additionally, firms are partnering with government agencies, infrastructure developers, and utility providers to secure large-scale contracts, accelerate deployment, and strengthen their presence in both developed and emerging geospatial markets.

- In June 2023, Autodesk and Esri expanded their partnership to integrate Autodesk’s design tools with Esri’s GIS platform. This collaboration enhances connectivity between design and geospatial data, supporting improved decision-making in infrastructure and construction projects, and fostering greater collaboration and efficiency in planning, design, and execution.

Key Companies in Geographic Information System Market:

- Hexagon AB

- Bentley Systems, Incorporated

- Esri

- Pitney Bowes Inc.

- Autodesk Inc.

- Caliper Corporation

- SuperMap Software Co., Ltd.

- Trimble Inc.

- Maxar Technologies

- GE Vernova

- Cadcorp Limited

- L3Harris Technologies, Inc.

- TOPCON CORPORATION

- Fugro

- Garmin Ltd.

Recent Developments (Partnerships/Agreements/Launch)

- In March 2025, DATAMARK Technologies launched its Location Platform, an integrated GIS solution designed to streamline public safety data workflows for Next Generation 9-1-1 systems. The platform simplifies address creation, data validation, and emergency call routing, while reducing maintenance redundancies and ensuring data accuracy across systems.

- In February 2025, Esri introduced the Content Store for ArcGIS, a web-based tool designed to make it easier for users to access and integrate commercial satellite imagery. Created in partnership with SkyWatch, the platform allows direct purchase of high-resolution imagery from providers like Maxar within ArcGIS, helping users streamline workflows in areas such as urban planning, infrastructure, and emergency response.

- In June 2024, CENTEGIX announced a strategic partnership with GeoComm to strengthen school safety by enabling seamless two-way integration of indoor and outdoor mapping data. The collaboration ensures that schools maintain control over their facility maps and asset details while enhancing emergency response coordination through improved public safety system interoperability.

- In September 2023, Precisely released MapInfo Pro v2023, introducing new 3D visualization tools that allow simultaneous 2D and 3D views, enhanced integration with enterprise spatial analytics via Spectrum Spatial, and user-requested custom workspace and UI improvements. These upgrades aim to help users better interpret complex spatial relationships and make faster, more informed decisions.

- In June 2023, Procore Technologies announced its integration of GIS mapping and AI tools into its construction technology platform. This initiative aims to enhance project management by providing real-time geospatial data, improving decision-making, and increasing site efficiency, while streamlining workflows and optimizing resource allocation.