buyNow

Fluoroelastomer Market

Fluoroelastomer Market Size, Share, Growth & Industry Analysis, By Type [Fluorocarbon Elastomers (FKM), Fluorosilicone Elastomers (FVMQ), Perfluorocarbon Elastomers (FFKM)], By End Use (Automotive, Industrial, Aerospace, Oil & Gas), and Regional Analysis, 2025-2032

pages: 130 | baseYear: 2024 | release: July 2025 | author: Sharmishtha M.

Market Definition

A fluoroelastomer is a fluorocarbon-based synthetic rubber known for its superior heat, chemical, and fuel resistance. The market involves their production and application of fluoroelastomers across various sectors. The report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

Fluoroelastomer Market Overview

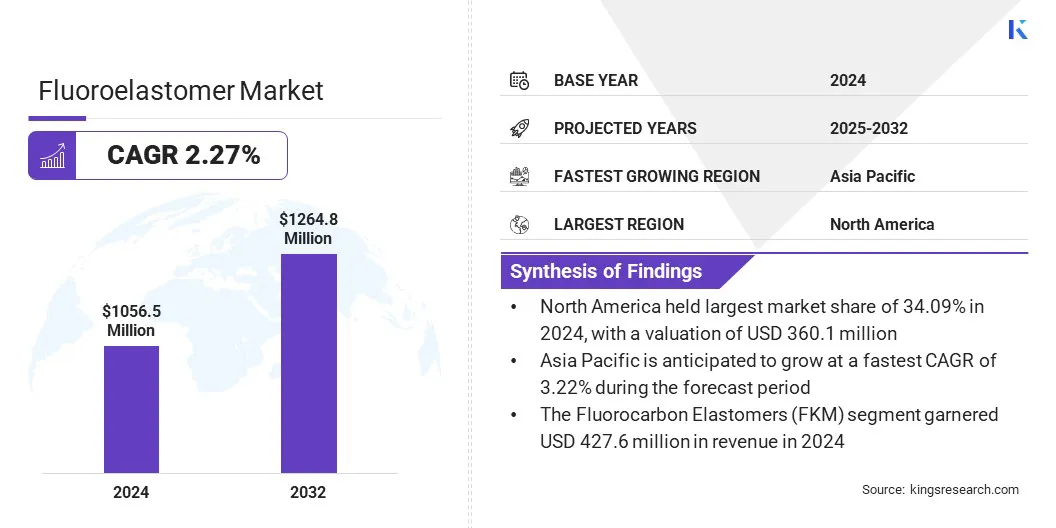

The global fluoroelastomer market size was valued at USD 1056.5 million in 2024, which is estimated to be valued at USD 1080.2 million in 2025 and reach USD 1264.8 million by 2032, growing at a CAGR of 2.27% from 2025 to 2032.

Market growth is driven by increasing adoption in the oil and gas industry for critical applications such as sealing, insulation, and sensor encapsulation in downhole equipment. Their superior resistance to heat, hydrocarbons, and corrosive fluids makes them ideal for extreme operating conditions.

Key Highlights:

- The fluoroelastomer industry size was recorded at USD 1,056.5 million in 2024.

- The market is projected to grow at a CAGR of 2.27% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 360.1 million.

- The fluorocarbon elastomers (FKM) segment garnered USD 427.6 million in revenue in 2024.

- The automotive segment is expected to reach USD 332.2 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 3.22% during the forecast period.

Major companies operating in the fluoroelastomer industry are The Chemours Company FC, LLC, DAIKIN INDUSTRIES, Ltd., Syensqo, 3M, Shin-Etsu Chemical Co., Ltd., AGC Inc., Gujarat Fluorochemicals Limited, Zhejiang Fluorine Chemical New Material Co., Ltd, HaloPolymer OJSC, James Walker Group, and CLWYD COMPOUNDERS LTD.

Market expansion is fueled by increasing demand from industries requiring high-performance materials resistant to heat, chemicals, and fuels. Key sectors such as automotive, aerospace, electronics, and chemical processing rely on fluoroelastomers for durable sealing solutions in harsh environments. Moreover, rising vehicle production, stricter emission regulations, and advancements in industrial equipment are supporting market expansion.

- According to the European Automobile Manufacturers' Association (ACEA), approximately 93.9 million motor vehicles are produced globally each year. Additionally, rapid industrialization and growing automotive manufacturing, along with continued R&D investments by major players, are contributing to enhanced product performance and sustainability.

Market Driver

Rising Demand in Oil & Gas Industry

The fluoroelastomer market is experiencing significant growth, propelled by increased demand from the oil and gas sector. In downhole applications, where equipment is exposed to high temperatures, aggressive hydrocarbons, and corrosive environments, fluoroelastomer offer unmatched performance in sealing, insulation, and sensor encapsulation.

Their chemical stability and thermal resistance make them indispensable for maintaining operational integrity and safety in deep-well and offshore drilling operations. As oil companies adopt advanced monitoring systems and operate in extreme environments, the demand for durable materials such as fluoroelastomer continues to grow.

- In November 2023, researchers from the University of Massachusetts Amherst, Institute for Applied Life Sciences, Massachusetts Institute of Technology, and the Saudi Arabian Oil Company conducted a study on improving sensor reliability in vertically suspended, closed-suction hydrocarbon pumps used in the oil and gas industry. To withstand high-temperature and chemically aggressive environments, the sensors were encapsulated using fluoroelastomers (FKM), known for their superior resistance to heat, oil, and corrosive fluids. This work highlights a growing industrial application of fluoroelastomers, reinforcing their rising demand in extreme downhole conditions.

Market Challenge

Long Development and Testing Cycles

A major challenge limiting the expansion of the fluoroelastomer market is the prolonged development and testing cycles required to meet stringent industry-specific standards, which often delay product launches and hinder market penetration.

To overcome this challenge, companies are investing in advanced simulation technologies, accelerated testing methods, and collaborative R&D partnerships to shorten validation times. These efforts streamline product, enabling faster market entry while ensuring high performance and safety standards.

Market Trend

Focus on Sustainable and Eco-friendly Solutions

A significant trend in the fluoroelastomer market is the increasing focus on sustainable and eco-friendly solutions. As environmental concerns grow, manufacturers are investing in developing low-emission manufacturing processes to reduce the carbon footprint associated with fluoroelastomer production.

Additionally, there is rising interest in creating biodegradable or recyclable fluoroelastomer alternatives to address end-of-life disposal challenges. These innovations aim to balance the material’s exceptional performance with environmental responsibility, helping companies comply with stricter regulations and meet the growing demand for greener products across the automotive, electronics, and oil and gas industries.

Fluoroelastomer Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Fluorocarbon Elastomers (FKM), Fluorosilicone Elastomers (FVMQ), Perfluorocarbon Elastomers (FFKM) |

|

By End Use |

Automotive, Industrial, Aerospace, Oil & Gas, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type [Fluorocarbon Elastomers (FKM), Fluorosilicone Elastomers (FVMQ), and Perfluorocarbon Elastomers (FFKM)]: The fluorocarbon elastomers (FKM) segment earned USD 427.6 million in 2024, driven by its superior chemical resistance and widespread application in automotive and industrial sealing solutions.

- By End Use (Automotive, Industrial, Aerospace, Oil & Gas, and Others): The automotive segment held a share of 26.23% in 2024, fueled by increasing demand for durable fuel system components and heat-resistant seals in electric and combustion vehicles.

Fluoroelastomer Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America fluoroelastomer market share stood at around 34.09% in 2024, valued at USD 360.1 million. This dominance is reinforced by the region's well-established automotive, aerospace, and oil & gas industries demanding high-performance materials. Advanced manufacturing capabilities, strong R&D investments, and stringent regulatory standards promote the adoption of fluoroelastomer for sealing, insulation, and protective applications.

Additionally, the presence of key market players and growing emphasis on innovation and sustainability further reinforce North America’s leadership. Rising infrastructure development and increased use in electronic devices further bolster regional market growth.

The Asia-Pacific fluoroelastomer industry is set to grow at a CAGR of 3.22% over the forecast period, largely attributed to rapid industrialization and expanding end-use industries such as automotive, electronics, and oil & gas. Increasing infrastructure development and growing demand for durable, high-performance materials are further supporting this growth.

Countries such as China, India, and South Korea are investing heavily in advanced manufacturing technologies and research, fostering innovation in fluoroelastomer applications. Additionally, rising environmental awareness promotes the adoption of sustainable materials, fostering regional market growth.

Regulatory Frameworks

- In India, the Environment Protection Act (EPA) of 1986 regulates chemical safety and emissions, ensuring environmental protection through standards and guidelines for the handling, use, and disposal of hazardous substances.

- In the U.S., the Toxic Substances Control Act (TSCA) of 1976 grants the Environmental Protection Agency (EPA) authority to enforce reporting, testing, record-keeping, and impose restrictions on chemical substances and mixtures to ensure safety.

- In the EU, REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulates chemical substances to ensure safe production, use, and environmental protection through strict evaluation and authorization processes.

Competitive Landscape

Companies in the fluoroelastomer industry are developing advanced sealing solutions that offer enhanced chemical resistance and durability for harsh industrial environments. They are investing in research to improve material flexibility and temperature tolerance to meet the demanding needs of sectors such as oil and gas, chemical processing, and manufacturing.

Additionally, firms are prioritizing innovation in application methods, such as liquid caulks and adhesives, to provide easier installation and long-lasting performance under extreme conditions.

- In January 2023, Pelseal Technologies introduced Pelseal A1104, an AFLAS fluoroelastomer caulk designed to resist alkalis, aminos, and high pH chemicals. With excellent oil and fuel resistance, it performs reliably across a temperature range of -40 to 400°F. Ideal for industries such as oil and gas and chemical processing, it seals joints and cracks, providing flexibility, chemical resistance, and durability in harsh environments.

Key Companies in Fluoroelastomer Market:

- The Chemours Company FC, LLC

- DAIKIN INDUSTRIES, Ltd.

- Syensqo

- 3M

- Shin-Etsu Chemical Co., Ltd.

- AGC Inc.

- Gujarat Fluorochemicals Limited

- Zhejiang Fluorine Chemical New Material Co., Ltd

- HaloPolymer OJSC

- James Walker Group

- CLWYD COMPOUNDERS LTD.