buyNow

Employer of Record Market

Employer of Record Market Size, Share, Growth & Industry Analysis, By Service Type (Core EOR Services, Onboarding & Offboarding, HR Support & Employee Relations, Legal & Advisory Services, Others), By Enterprise Size, By End User Industry, and Regional Analysis, 2025-2032

pages: 170 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

Employer of Record (EOR) is a third-party organization that legally employs workers on behalf of another company, handling responsibilities such as payroll, tax compliance, benefits administration, and employment contracts. The market includes a wide range of services that help companies manage global and domestic workforces without setting up legal entities in each location.

The market is segmented by service type into core EOR services, onboarding & offboarding, HR support & employee relations, legal & advisory services, and others. It serves both small and medium-sized enterprises and large enterprises. Key end-user industries include IT & technology, healthcare, retail & e-commerce, BFSI, and others.

Employer of Record Market Overview

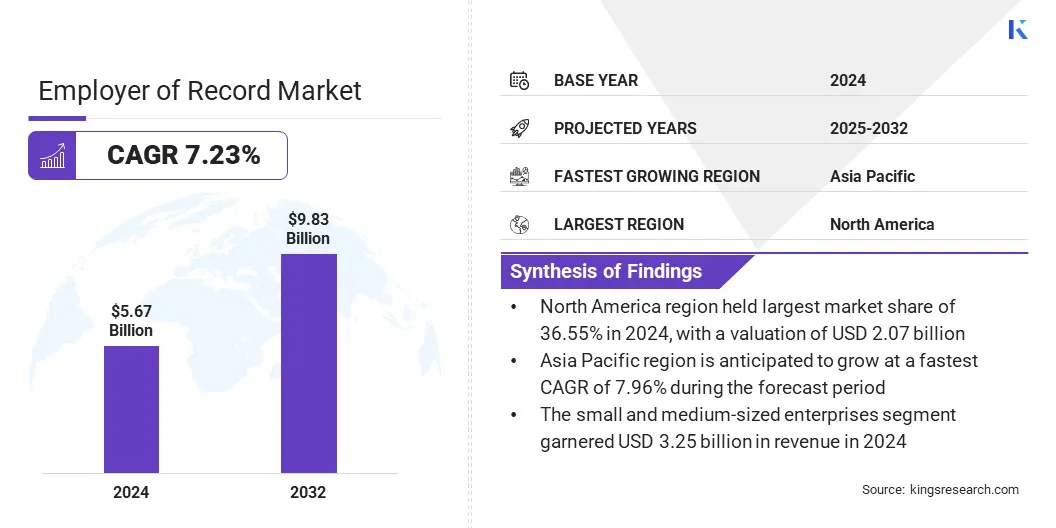

The global employer of record market size was valued at USD 5.67 billion in 2024 and is projected to grow from USD 6.03 billion in 2025 to USD 9.83 billion by 2032, exhibiting a CAGR of 7.23% during the forecast period.

This growth is attributed to the growing demand for a seamless hiring process, as companies look to onboard international talent quickly without establishing local entities. The market trend of integrating AI technology into EOR platforms is transforming how providers manage compliance, payroll, and onboarding with greater speed and accuracy.

Key Highlights:

- The employer of record industry size was valued at USD 5.67 billion in 2024.

- The market is projected to grow at a CAGR of 7.23% from 2025 to 2032.

- North America held a market share of 36.55% in 2024, with a valuation of USD 2.07 billion.

- The core EOR services segment garnered USD 2.01 billion in revenue in 2024.

- The small and medium-sized enterprises segment is expected to reach USD 6.00 billion by 2032.

- The IT & technology segment is expected to reach USD 3.67 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 7.96% during the forecast period.

Major companies operating in the employer of record market are Horizons, Oyster HR, Inc, Hire with Near, Remote Technology, Inc., Atlas Technology Solutions, Inc., RemotePass, Deel, Agile HRO, Rippling People Center Inc., Borderless AI, papaya global, Justworks, Inc., RemoFirst, Inc., Multiplier, and Safeguard Global.

The market is propelled by the growing use of EOR solutions that help businesses navigate complex local employment laws without establishing legal entities. EOR providers offer end-to-end support for payroll, tax filing, benefits administration, and employee contracts in line with local regulations.

These solutions reduce legal risk, lower administrative burden, and allow companies to enter new markets faster. Businesses rely on EOR platforms to maintain full compliance while focusing on operational growth and workforce expansion across borders.

- In June 2025, BambooHR and Remote announced their partnership through the launch of BambooHR Employer of Record, powered by Remote. The collaboration aims to simplify global hiring for small and mid-sized businesses by providing a fast and compliant path to international expansion. The new solution offers access to Remote’s in-country legal entities, allowing companies to hire, onboard, and pay international employees within days without establishing local entities or navigating complex legal frameworks.

Market Driver

Growing Demand for a Seamless Hiring Process

The employer of record market is driven by the rising demand for a seamless hiring process across global operations. Organizations are under pressure to onboard talent quickly without disrupting internal workflows.

EOR providers address this need by offering streamlined platforms that manage end-to-end hiring with minimal manual intervention. These systems reduce delays, eliminate fragmented communication, and enable faster integration of new employees into the workforce. The ability to maintain speed and consistency in hiring is becoming a critical driver for adopting EOR solutions as companies scale across borders.

- In March 2025, Personio and Remote announced their partnership through the launch of an embedded EOR service. The collaboration focuses on enabling small and medium-sized businesses to hire, manage, and pay international employees by outsourcing compliance and eliminating the need to establish local legal entities.

Market Challenge

Limited Awareness of EOR Solutions Among Small Businesses

A key challenge in the employer of record market is the limited awareness of EOR services among small and medium-sized enterprises. Many smaller companies are unfamiliar with how EOR solutions work or how they can support global hiring without setting up local entities. This lack of understanding slows adoption and prevents businesses from accessing cost-effective and compliant employment models.

Providers are focusing on targeted education campaigns and simplified service models tailored to smaller firms. They are offering clear pricing, step-by-step onboarding support, and localized resources to build trust and drive engagement. These efforts are helping to increase awareness and expand the customer base in the SME segment.

Market Trend

Integration of AI technology into EOR platforms

The employer of record market is registering the trend of integrating AI technology into service platforms. EOR providers are using AI to automate core functions such as onboarding, payroll processing, document verification, and compliance monitoring. This reduces manual errors, speeds up administrative tasks, and improves the overall employee experience.

AI-driven analytics are also helping companies gain insights into workforce data, allowing better decision-making across regions. As global employment becomes more complex, the use of AI enables providers to deliver faster, more accurate, and scalable EOR solutions.

- In February 2025, G-P announced AI advancements through the integration of Generative AI and Agentic AI across its global employment products. The initiative focuses on enhancing G-P Employer of Record, G-P Contractor, and G-P Gia by embedding advanced AI capabilities to streamline global hiring, onboarding, and workforce management.

Employer of Record Market Report Snapshot

|

Segmentation |

Details |

|

By Service Type |

Core EOR Services, Onboarding & Offboarding, HR Support & Employee Relations, Legal & Advisory Services, Others |

|

By Enterprise Size |

Small and Medium-sized Enterprises, Large Enterprises |

|

By End User Industry |

IT & Technology, Healthcare, Retail & E-commerce, BFSI, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Service Type (Core EOR Services, Onboarding & Offboarding, HR Support & Employee Relations, Legal & Advisory Services, and Others): The core EOR services segment earned USD 2.01 billion in 2024, due to the growing demand for streamlined global hiring and compliance support.

- By Enterprise Size (Small and Medium-sized Enterprises, and Large Enterprises): The small and medium-sized enterprises segment held 57.32% share of the market in 2024, due to increasing reliance on EOR providers to manage international employment without setting up local entities.

- By End User Industry (IT & Technology, Healthcare, Retail & E-commerce, BFSI, and Others): The IT & technology segment is projected to reach USD 3.67 billion by 2032, owing to rising cross-border talent acquisition and the need for fast onboarding in global tech operations.

Employer of Record Market Regional Analysis

Based on region, the market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America employer of record market share stood at around 36.55% in 2024, with a valuation of USD 2.07 billion. The market dominance is attributed to a high volume of strategic acquisitions by key players focused on expanding service depth and geographic reach.

Providers in the region are actively integrating acquired capabilities to enhance global compliance, payroll automation, and workforce deployment. These acquisitions have accelerated the development of unified EOR platforms tailored to the operational needs of large enterprises. This ongoing consolidation and investment in scalable infrastructure have enabled North America to maintain its dominant position in the market.

- In June 2025, Beeline announced the acquisition of MBO Partners through a strategic deal aimed at expanding its extended workforce platform. The partnership focuses on integrating high-value independent talent into Beeline’s ecosystem, creating a unified solution to manage all types of external workers, including contingent labor, independent contractors, consultants, gig workers, and payroll professionals.

The employer of record industry in Asia Pacific is poised to grow at a significant CAGR of 7.96% over the forecast period. The growth is attributed to the rising demand for EOR solutions from global companies entering fast-growing markets like India, Indonesia, and the Philippines.

These companies use EOR services to handle local compliance and hire talent quickly without setting up legal entities. The need for flexible workforce management and strong regulatory support has made Asia Pacific the fastest-growing region in the market.

Regulatory Frameworks

- In the U.S., EOR providers must comply with federal and state employment laws, including the Fair Labor Standards Act (FLSA), Internal Revenue Code (IRC), and Equal Employment Opportunity (EEO) regulations. They are recognized as the legal employer for tax, payroll, and benefits administration and must file Form W-2 for each employee.

- In Europe, EOR operations are subject to the EU Agency Work Directive (2008/104/EC), which governs temporary agency work and mandates equal treatment in pay and working conditions. Each member state has its own implementation of this directive, requiring EORs to align with national labor laws, including GDPR compliance for employee data.

Competitive Landscape

Key players in the employer of record industry are focusing on acquisitions and geographic expansion to strengthen their position. Several providers are acquiring local firms to increase compliance capabilities and extend service coverage across critical markets. These moves allow them to deliver consistent and scalable EOR solutions across regions.

Many companies are expanding their presence through the setup of local entities or partnerships with in-country experts. This enables them to manage employment, payroll, and legal requirements more efficiently while meeting local regulatory standards.

Investment in regional operations and alignment with national labor laws have helped providers offer faster, compliant workforce deployment. These strategies reflect the ongoing efforts of market participants to enhance competitiveness and meet growing cross-border demand.

- In February 2025, Ascentium acquired Links International through a strategic expansion initiative aimed at strengthening its HR and payroll services across Asia Pacific. The partnership focused on enhancing Ascentium’s capabilities in EOR, recruitment, and unified HR platforms, while expanding its operational footprint into Macau SAR, Japan, South Korea, and Thailand.

Key Companies in Employer of Record Market:

- Horizons

- Oyster HR, Inc

- Hire with Near

- Remote Technology, Inc.

- Atlas Technology Solutions, Inc.

- RemotePass

- Deel

- Agile HRO

- Rippling People Center Inc.

- Borderless AI

- papaya global

- Justworks, Inc.

- RemoFirst, Inc.

- Multiplier

- Safeguard Global

Recent Developments (M&A/Expansion)

- In April 2025, Rippling expanded its EOR services to 80 countries as part of its global workforce platform strategy. This initiative aimed to unify global HR, payroll, and compliance operations within one system, allowing organizations to manage employees and contractors across borders.

- In August 2024, Payoneer acquired Singapore-based HR and payroll platform Skuad for USD 61 million. The partnership focused on expanding Payoneer’s global offering by integrating workforce management capabilities such as payroll, EOR, and contractor management.