buyNow

Cloud Managed Services Market

Cloud Managed Services Market Size, Share, Growth & Industry Analysis, By Type (Business Services, Network Services, Security Services, Data Center Services, Mobility Services), By Deployment (Public, Private, Hybrid), By Organization (Large Enterprises, Small & Medium Enterprises), By Vertical and Regional Analysis, 2025-2032

pages: 220 | baseYear: 2024 | release: July 2025 | author: Versha V.

Market Definition

The market encompasses a broad range of outsourced IT functions delivered through cloud infrastructure, including network management, security services, data storage, application monitoring, and cloud migration support.

This market involves third-party providers managing and optimizing a company’s cloud-based operations, allowing organizations to streamline IT processes, reduce in-house complexities, and maintain continuous performance across public, private, and hybrid cloud environments.

Cloud Managed Services Market Overview

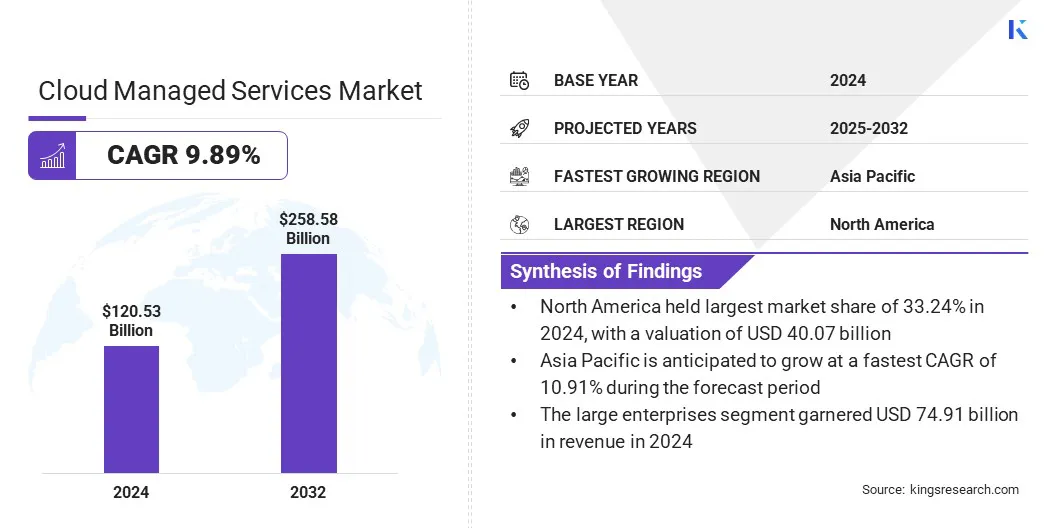

The global cloud managed services market size was valued at USD 120.53 billion in 2024 and is projected to grow from USD 131.70 billion in 2025 to USD 258.58 billion by 2032, exhibiting a CAGR of 9.89% during the forecast period.

The market is growing quickly as more businesses use cloud computing to run their operations. Companies want flexible, affordable IT solutions and often need help managing cloud systems that can be complex. By hiring expert service providers, they can save time and focus on their main work. Growth in remote work, digital tools, and the need for better security and data compliance are also driving this market.

Key Highlights

- The cloud managed services industry size was valued at USD 120.53 billion in 2024.

- The market is projected to grow at a CAGR of 9.89% from 2025 to 2032.

- North America held a market share of 33.24% in 2024, with a valuation of USD 40.07 billion.

- The network services segment garnered USD 33.07 billion in revenue in 2024.

- The public segment is expected to reach USD 107.89 billion by 2032.

- The large enterprises segment is expected to reach USD 159.16 billion by 2032.

- The BFSI segment is expected to reach USD 57.69 billion by 2032.

- The market in Asia Pacific is anticipated to grow at a CAGR of 10.91% during the forecast period.

Major companies operating in the cloud managed services market are Ollion, Accenture, AllCloud, Avanade Inc., Capgemini, Deloitte Touche Tohmatsu Limited, Rackspace Technology, Infosys Limited, Logicworks, Atos SE, NTT DATA, Inc., DXC Technology Company, Hitachi Vantara LLC, Mission Cloud Services Inc., and SMX Group.

Major companies operating in the cloud managed services market are Ollion, Accenture, AllCloud, Avanade Inc., Capgemini, Deloitte Touche Tohmatsu Limited, Rackspace Technology, Infosys Limited, Logicworks, Atos SE, NTT DATA, Inc., DXC Technology Company, Hitachi Vantara LLC, Mission Cloud Services Inc., and SMX Group.

In addition, new technologies like artificial intelligence and automation are making cloud services more efficient and reliable, encouraging more organizations to adopt them and helping the market expand steadily.

- In February 2025, Fujitsu Limited launched the Fujitsu Cloud Service Generative AI Platform, designed to offer secure and flexible enterprise data management through cloud-based generative AI. The service provides private cloud areas for sensitive data, shared GPU infrastructure for cost-effective AI processing, and end-to-end support, enabling businesses to securely adopt AI while ensuring compliance and maximizing operational efficiency.

Market Driver

Increasing Adoption of Cloud-Based Infrastructure

The cloud managed services market is being significantly driven by the rising adoption of cloud-based infrastructure across various industries. Organizations are increasingly shifting from traditional on-premises IT setups to cloud environments to capitalize on enhanced scalability, reduced IT overhead, and improved operational efficiency.

Cloud infrastructure allows enterprises to scale resources on demand, supporting dynamic workloads and business growth without the need for large capital investments in hardware and maintenance. Additionally, outsourcing IT management to cloud service providers minimizes the burden on internal teams, enabling companies to focus on core business activities while maintaining robust and secure IT operations.

- In October 2024, CommScope launched its cloud-managed RUCKUS Edge platform, extending the AI-driven RUCKUS One network assurance and business intelligence platform to the network edge. The platform enables centralized control and performance management for networking, security, and productivity services, supporting low-latency service deployment and scalable multi-site cloud-managed operations.

Market Challenge

Data Security Challenge

A significant challenge in the cloud managed services market is ensuring robust data security. As businesses increasingly migrate their operations to the cloud, they expose themselves to heightened risks such as unauthorized access, data breaches, and cyberattacks. With sensitive and critical business data stored in cloud environments, it becomes a prime target for malicious actors. These threats can result in financial losses, reputational damage, and regulatory penalties.

To address these risks, companies can adopt a combination of advanced security protocols such as end-to-end encryption, multi-factor authentication (MFA), and continuous monitoring of cloud environments.

Market Trend

Shift Towards Multicloud and Hybrid Cloud Solutions

The cloud managed services market is witnessing a significant shift driven by the growing adoption of multicloud and hybrid cloud strategies. Enterprises are increasingly deploying a combination of public and private cloud infrastructures, along with services from multiple providers, to achieve greater operational agility, cost optimization, and strategic risk mitigation.

This trend reflects a broader effort to avoid over-reliance on a single vendor while enhancing workload portability and resilience. By leveraging diverse cloud environments, organizations are able to align IT resources more effectively with business objectives and regional performance demands.

As a result, managed service providers are updating their services to make it easier for businesses to manage and connect different cloud systems, ensuring smooth operations and supporting their digital transformation goals.

- In September 2024, Oracle expanded its multicloud capabilities by deploying Oracle Database services running on Oracle Cloud Infrastructure (OCI) directly in the data centers of AWS, Google Cloud, and Microsoft Azure. This collaboration enables customers to access fully managed Oracle Database services across multiple cloud environments, simplifying application migration, multicloud deployment, and ongoing database management.

Cloud Managed Services Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Business Services, Network Services, Security Services, Data Center Services, Mobility Services |

|

By Deployment |

Public, Private, Hybrid |

|

By Organization |

Large Enterprises, Small & Medium Enterprises |

|

By Vertical |

BFSI, Retail, Healthcare, IT & Telecommunications, Manufacturing, Automotive, Government & Public Sector, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, U.K., Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation

- By Type (Business Services, Network Services, Security Services, Data Center Services, and Mobility Services): The network services segment earned USD 33.07 billion in 2024 due to the growing need for reliable connectivity and continuous cloud access across distributed business environments.

- By Deployment (Public, Private, and Hybrid): The public segment held 42.17% of the market in 2024, due to its cost-effectiveness, scalability, and ease of deployment for businesses of all sizes.

- By Organization (Large Enterprises, and Small & Medium Enterprises): The large enterprises segment is projected to reach USD 159.16 billion by 2032, owing to increasing investments in digital transformation and the need to manage complex multi-cloud infrastructures.

- By Vertical (BFSI, Retail, Healthcare, IT & Telecommunications, Manufacturing, Automotive, Government & Public Sector, and Others): The BFSI segment is estimated to reach USD 57.69 billion by 2032, owing to the rising demand for secure, compliant, and always-on cloud services to support critical financial operations.

Cloud Managed Services Market Regional Analysis

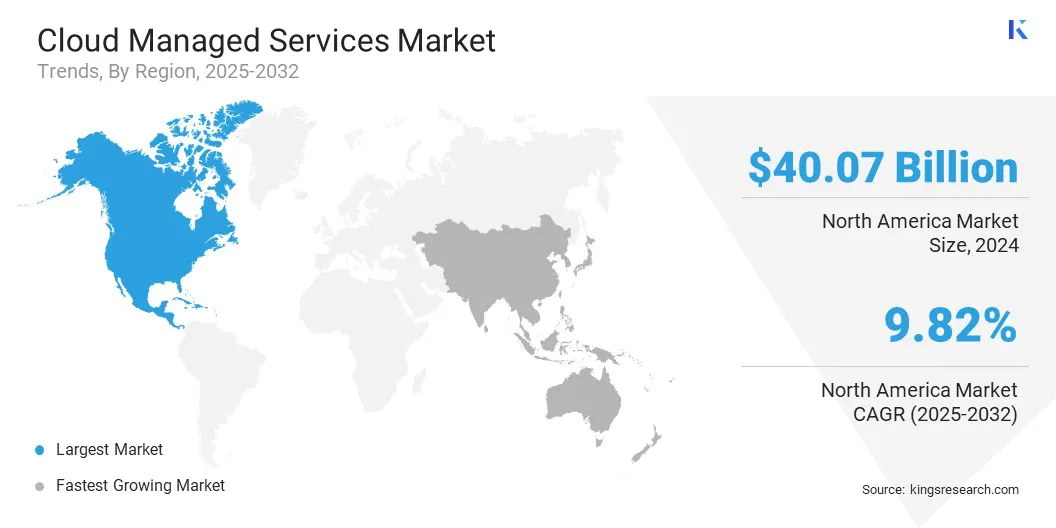

Based on region, the market has been classified into North America, Europe, Asia Pacific, Middle East & Africa, and South America.

North America accounted for a substantial market share of 33.24% in 2024 in the global market, with a valuation of USD 40.07 billion. The region’s dominance is primarily driven by the presence of major cloud service providers which have extensive infrastructure and managed service offerings in the U.S. and Canada.

North America accounted for a substantial market share of 33.24% in 2024 in the global market, with a valuation of USD 40.07 billion. The region’s dominance is primarily driven by the presence of major cloud service providers which have extensive infrastructure and managed service offerings in the U.S. and Canada.

High cloud maturity across industries, widespread enterprise adoption of advanced technologies like AI and big data, and strong demand for outsourced IT support from large corporations have further strengthened the market in this region. Additionally, a well-established ecosystem of managed service providers and system integrators supports on-going growth.

- In April 2025, the U.S. Army’s Enterprise Cloud Management Agency (ECMA) expanded its Oracle Defense Cloud services through a firm-fixed price task order under the Department of Defense’s Joint Warfighting Cloud Capability (JWCC) contract. The agreement enables Oracle to provide managed cloud compute and storage services across multiple security levels, supporting ECMA’s mission to deliver a secure multicloud environment and drive digital transformation across Army operations.

The market in Asia Pacific is expected to register fastest growth in the market, with a projected CAGR of 10.91% over the forecast period. Growth in this region is being driven by rising use of digital technology in countries like India, China, and those in Southeast Asia. Many global cloud companies are building new data centers in the region, and local businesses are spending more on cloud services to modernize their IT.

Southeast Asia is seeing fast adoption of mobile apps and digital platforms, leading companies to rely more on managed services for cloud security, data backup, and network management. Global cloud providers are also investing in new data centers across the region, making it easier for local businesses to access advanced services. As more companies focus on digital tools, the demand for expert cloud management continues to rise across Asia Pacific.

Regulatory Frameworks

- In the United States, cloud services must comply with FedRAMP (Federal Risk and Authorization Management Program), which sets security standards for cloud services used by federal agencies, and HIPAA (Health Insurance Portability and Accountability Act), which mandates the protection of healthcare information for cloud services handling sensitive medical data.

- In the European Union, cloud services must adhere to GDPR (General Data Protection Regulation), which governs data privacy and security for individuals within the EU, and the EU Cybersecurity Act, which establishes a cybersecurity certification framework for cloud services.

- In China, cloud service providers are required to follow the Cybersecurity Law, which enforces strict data security and privacy practices, including data localization requirements for cloud services.

- In Japan, the cloud services industry is governed by APPI (Act on the Protection of Personal Information), which ensures data protection and privacy for personal data handled by cloud providers, and JCSA (Japan Cloud Service Association) guidelines, which provide standards for cloud services in terms of cybersecurity.

Competitive Landscape

The cloud managed services industry is characterized by active strategic development, with key players focusing on initiatives to expand their service portfolios and global presence.

A common strategy is the development of end-to-end managed service offerings that cover cloud migration, security, monitoring, and optimization to address diverse client needs. Companies are investing in automation, AI-based tools, and analytics to enhance service efficiency, reduce operational costs, and deliver more predictive support.

- In March 2025, DoiT established a USD 250 million fund to acquire companies specializing in autonomous cloud optimization, AI-driven CloudOps, and cloud reliability, performance, and security. The fund supports DoiT’s expansion strategy to integrate AI capabilities into its Cloud Intelligence platform.

Many firms are also acquiring specialized cloud and IT service providers to strengthen their expertise in niche areas such as hybrid cloud, containerization, and industry-specific cloud solutions.

Additionally, expanding service delivery centers in emerging markets is a key move to support global clients with localized support and faster response times. Strategic partnerships with cloud infrastructure providers are frequently used to gain access to new technologies and extend service capabilities.

- In October 2024, CoreStack and ConRes IT Solutions formed a strategic partnership to launch ConRes Insights, a cloud optimization service utilizing CoreStack's multi-cloud governance platform. The service provides in-depth analysis, cost optimization, and security capabilities across Azure, AWS, and Google Cloud, helping organizations manage their cloud investments more effectively and optimize their cloud environments.

Key Companies Cloud Managed Services Market:

- Ollion

- Accenture

- AllCloud

- Avanade Inc.

- Capgemini

- Deloitte Touche Tohmatsu Limited

- Rackspace Technology

- Infosys Limited

- Logicworks

- Atos SE

- NTT DATA, Inc.

- DXC Technology Company

- Hitachi Vantara LLC

- Mission Cloud Services Inc.

- SMX Group

Recent Developments (Acquisition/Collaboration)

- In March 2025, Intel and IBM collaborated to make Intel Gaudi 3 AI accelerators available on IBM Cloud. This initiative aims to enhance cost-performance for enterprise AI workloads, enabling clients to scale and deploy generative AI more effectively. The service is offered via IBM Cloud VPC, with integration options for Red Hat OpenShift and IBM watsonx.ai, supporting AI development and deployment in a cloud-managed environment.

- In August 2024, Hewlett Packard Enterprise (HPE) entered into a definitive agreement to acquire Morpheus Data, a hybrid cloud management and platform operations software provider. The acquisition aims to enhance HPE GreenLake by adding multicloud automation, orchestration, and FinOps capabilities, positioning HPE as the first vendor with a full suite of enterprise-grade services across the hybrid cloud stack.