buyNow

CCUS Absorption Market

CCUS Absorption Market Size, Share, Growth & Industry Analysis, By Type (Chemical, Physical), By End Use (Oil & Gas, Power Generation, Cement, Others), and Regional Analysis, 2025-2032

pages: 140 | baseYear: 2024 | release: July 2025 | author: Sharmishtha M.

Market Definition

Carbon Capture, Utilisation, and Storage (CCUS) absorption refers to capturing CO₂ from emissions using chemical solvents or materials that absorb CO₂. The market consists of the technologies, services, and commercial activities involved in developing, deploying, and operating absorption-based CO₂ capture systems.

This report identifies the principal factors contributing to market expansion, along with an analysis of the competitive landscape influencing its growth trajectory.

CCUS Absorption Market Overview

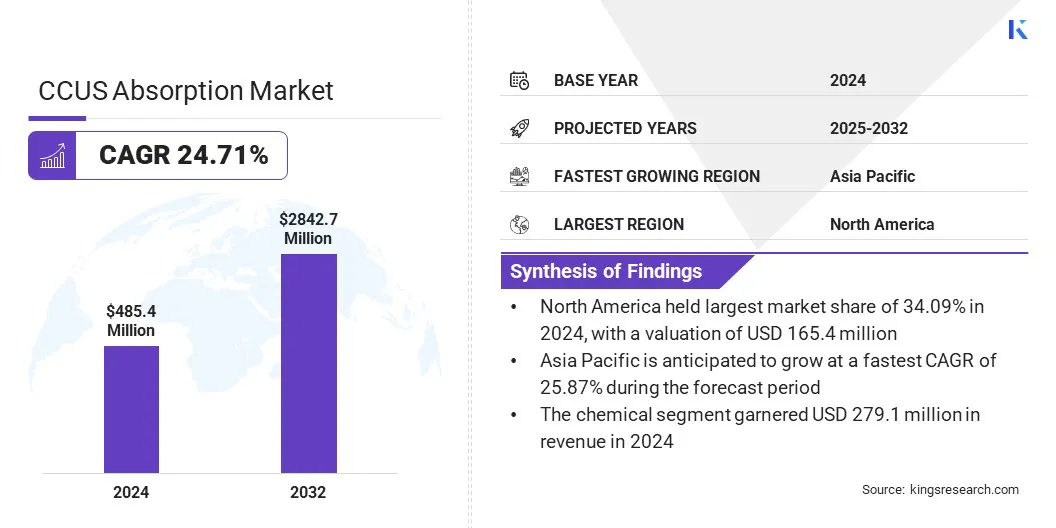

The global CCUS absorption market size was valued at USD 485.4 million in 2024, which is estimated to be valued at USD 604.9 million in 2025 and reach USD 2842.7 million by 2032, growing at a CAGR of 24.71% from 2025 to 2032. The market is gaining momentum through the increasing scalability and flexibility of modular systems.

These compact solutions support deployment across various industries and locations, making them ideal for large-scale settings as well as smaller, space-constrained facilities.

Key Market Highlights:

- The CCUS absorption industry size was valued at USD 485.4 million in 2024.

- The market is projected to grow at a CAGR of 24.71% from 2025 to 2032.

- North America held a market share of 34.09% in 2024, with a valuation of USD 165.4 million.

- The chemical segment garnered USD 279.1 million in revenue in 2024.

- The oil & gas segment is expected to reach USD 1026.9 million by 2032.

- Asia Pacific is anticipated to grow at a CAGR of 25.87% during the forecast period.

Major companies operating in the CCUS absorption market are Exxon Mobil Corporation, Fluor Corporation, TotalEnergies, Schlumberger Limited, Equinor ASA, MITSUBISHI HEAVY INDUSTRIES, LTD., BASF, Aker Solutions, General Electric Company, Honeywell International Inc., Shell International B.V., JGC HOLDINGS CORPORATION, Siemens AG, Chevron Corporation., and Linde PLC.

The CCUS absorption market is experiencing steady growth as global efforts to reduce carbon emissions intensify. According to the International Energy Agency (IEA), the total energy-related CO₂ emissions hit a record high of 37.8 gigatonnes (Gt) in 2024 witnessing a 0.8% increase from 2023, pushing atmospheric CO₂ concentrations to 422.5 parts per million (ppm), around 3 ppm higher than 2023 and nearly 50% above pre-industrial levels.

This alarming rise is accelerating the demand for efficient carbon capture solutions. Absorption-based technologies are widely used due to their scalability and effectiveness. Regulatory pressures, carbon pricing, and clean energy investments are driving market expansion, especially in the power, cement, and steel sectors.

Ongoing innovations in solvent performance and cost reduction continue to enhance the competitiveness of absorption technologies, positioning them as vital tools in global decarbonization strategies.

Market Driver

Modular Scalability and Operational Flexibility

Scalability and flexibility have emerged as key growth drivers in the market. Modular systems allow for easy adaptation of different emission sources and facility sizes, enabling broader use across power generation, manufacturing, and waste management applications.

Their compact design reduces space requirements and simplifies installation, making them suitable for retrofitting existing infrastructure.

Additionally, the ability to adjust capture capacity based on operational needs enhances cost efficiency. This supports decentralized and scalable carbon capture efforts and accelerates the adoption of CCUS technologies across sectors and geographies.

- In January 2024, Toshiba Energy Systems & Solutions Corporation delivered a compact carbon capture system to Tokyo Gas Co., Ltd. for a demonstration project at Tokyo Gas Senju Techno Station in Tokyo’s Arakawa Ward. Designed to capture up to 10 kilograms of CO₂ daily from a gas cogeneration system, it utilizes Toshiba’s efficient amine-based solvent. The system’s standardized and transportable design enables scalable and flexible CO₂ capture, supporting the broader adoption of CCUS technologies across diverse applications.

Market Challenge

Solvent Degradation and Management

Solvent degradation is a significant challenge in the CCUS absorption market, as chemical solvents that are used to capture CO₂ deteriorate over time, leading to decreased efficiency and increased operational costs due to frequent replacement or regeneration.

This complicates the carbon capture process and impacts overall system performance. To address this, companies are focusing on improving solvent formulations to reduce degradation rates and lower energy consumption during regeneration.

They are also implementing advanced monitoring and maintenance systems to optimize solvent use and predict replacement needs, minimizing downtime and costs. Additionally, firms are undertaking collaborations to scale up innovations and provide training, ensuring reliable, cost-effective, and environmentally friendly CCUS solutions for their clients.

Market Trend

Biological Desorption Technologies

A key trend in the market is the growing adoption of biological desorption technologies, which use specialized microorganisms to release and convert captured CO₂ at low temperatures, significantly reducing energy consumption compared to traditional thermal methods.

Biological desorption involves microbes, such as hydrogenotrophic methanogens, which break down the chemical bonds between CO₂ and capture agents, enabling efficient CO₂ release and conversion into valuable products like methane.

This eco-friendly approach enhances energy efficiency and lowers operational costs, driving wider CCUS deployment across industries.

- In August 2024, researchers from Aarhus University, Denmark, developed the Bio-Inspired Carbon Capture and Utilization (BICCU) process, which biologically desorbs and converts carbon dioxide (CO₂) into methane (CH₄) using hydrogenotrophic methanogens. BICCU eliminates the need for thermal energy by employing renewable hydrogen (H₂) from water electrolysis. This approach improves energy efficiency by 17–29% compared to traditional methods and regenerates capture agents, enabling continuous CO₂ absorption and conversion at lower temperatures.

CCUS Absorption Market Report Snapshot

|

Segmentation |

Details |

|

By Type |

Chemical, Physical |

|

By End Use |

Oil & Gas, Power Generation, Cement, Others |

|

By Region |

North America: U.S., Canada, Mexico |

|

Europe: France, UK, Spain, Germany, Italy, Russia, Rest of Europe | |

|

Asia-Pacific: China, Japan, India, Australia, ASEAN, South Korea, Rest of Asia-Pacific | |

|

Middle East & Africa: Turkey, U.A.E., Saudi Arabia, South Africa, Rest of Middle East & Africa | |

|

South America: Brazil, Argentina, Rest of South America |

Market Segmentation:

- By Type (Chemical, and Physical): The chemical segment earned USD 279.1 million in 2024, driven by the increasing demand for efficient CO₂ capture technologies in chemical manufacturing processes.

- By End Use (Oil & Gas, Power Generation, Cement, and Others): The oil & gas segment held 36.22% of the market in 2024, propelled by strict emission regulations and rising investments in carbon capture infrastructure.

CCUS Absorption Market Regional Analysis

Based on region, the global market has been classified into North America, Europe, Asia Pacific, the Middle East & Africa, and South America.

North America CCUS absorption market share stood at 34.09% in 2024, with a valuation of USD 165.4 million. North America continues to dominate the market due to its well-established infrastructure, strong government support, and significant investments in carbon capture technologies.

The region benefits from policies promoting reduction in emissions andregulatory frameworks that incentivize CCUS adoption across multiple industries, which include oil & gas, chemicals, and power generation.

Ongoing technological advancements and extensive pilot projects also contribute to North America’s leadership, driving substantial market growth and positioning it as a key player in the transition to low-carbon energy solutions.

Asia Pacific is poised for significant growth at a robust CAGR of 25.87% over the forecast period. The region is witnessing rapid growth in the CCUS market, driven by accelerated industrialization and increasing energy demand.

Governments across the region are implementing stringent regulations and ambitious net-zero emission targets, encouraging investments in advanced CCUS technologies. The rising awareness about climate change and supportive policy frameworks are also fueling the expansion of CCUS projects in the region.

Additionally, the deployment of advanced CO2 capture technologies supported by clean energy initiatives in India, China and Japan has established Asia Pacific as the fastest-growing region in the CCUS market.

- In February 2023, BASF announced that its high-pressure regenerative CO2 capture technology, HiPACT, will be used in Japan’s first blue hydrogen and ammonia demonstration project. The technology aims to reduce CO2 capture and compression costs by up to 35%, supporting cleaner energy production and Japan’s carbon neutrality goals.

Regulatory Frameworks

- In India, the Ministry of Environment, Forest and Climate Change (MoEFCC) enforces environmental clearances for CCUS projects, aligned with the Long-Term Low Emission Development Strategy (LT-LEDS), which focuses on CCUS as a critical tool for achieving net-zero goals.

- In the U.S., the Department of Energy (DOE) funds R&D and demonstration projects for CCUS technologies, supporting carbon capture from major sources and safe storage in geologic formations through advanced modeling and site assessment tools to ensure long-term reliability.

- In the EU, Industrial Carbon Management (ICM) is vital for achieving climate neutrality by 2050, as mandated by the European Climate Law, which requires deep emission cuts and removal of residual CO₂ from the atmosphere.

Competitive Landscape

Companies operating in the CCUS absorption market are investing in advanced capture technologies, strategic collaborations, and pilot projects to reduce emissions and improve process efficiency.

Many are focusing on modular and compact systems to retrofit existing infrastructure and developing high-performance solvents to reduce energy consumption. Additionally, firms are exploring new CO₂ utilization pathways to generate revenue and offset capture costs.

These efforts reflect a growing commitment to align with global decarbonization targets and remain competitive in a carbon-regulated future.

- In November 2024, JSW Steel collaborated with BHP and Carbon Clean to launch India’s largest demonstration-stage CCUS project in the blast furnace-based steel sector, which targets 300 tonnes per day (TPD) CO₂ capture. The project will deploy Carbon Clean’s compact CDRMax technology, known for lower space requirements and cost-effective CO₂ separation. This initiative marks a significant step toward deep decarbonization in steelmaking, with plans to liquefy and utilize the captured CO₂ locally, paving the way for broader industrial adoption in India.

Key Companies in CCUS Absorption Market:

- Exxon Mobil Corporation

- Fluor Corporation

- TotalEnergies

- Schlumberger Limited

- Equinor ASA

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- BASF

- Aker Solutions

- General Electric Company

- Honeywell International Inc.

- Shell International B.V.

- JGC HOLDINGS CORPORATION

- Siemens AG

- Chevron Corporation.

- Linde PLC

Recent Developments (MoUs/Agreement)

- In June 2024, Enerflex and BASF signed a Memorandum of Understanding to advance commercial-scale CCUS projects. The partnership combines Enerflex’s gas processing expertise with BASF’s OASE blue technology, aiming to deliver energy-efficient CO₂ capture solutions and support global industrial decarbonization efforts.

- In July 2023, Fluor Corporation and Carbfix signed a Memorandum of Understanding to provide integrated CCS solutions. The collaboration combines Fluor’s capture technology with Carbfix’s underground mineralization process to help decarbonize hard-to-abate sectors like steel, cement, and aluminum through permanent CO₂ storage.

- In April 2023, Fluor Corporation agreed with Federated Co-Operatives Limited to deploy its Econamine FG PlusSM carbon capture technology at FCL’s Co-op Renewable Diesel Complex in Canada, supporting FCL’s goal to cut greenhouse gas emissions by 40% by 2030.